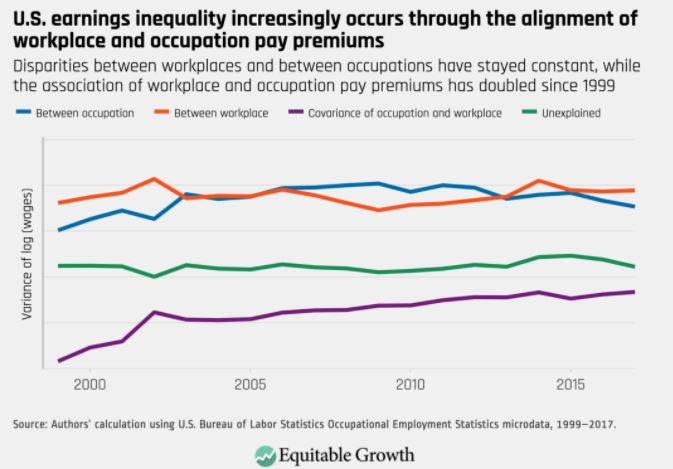

| Biden's stimulus package clears its final congressional hurdle. Credit Suisse managers are suspended amid a probe into the collapse of funds. Warren Buffett joins the $100 billion club. Here's what people in markets are talking about today. President Joe Biden's $1.9 trillion Covid-19 relief bill cleared its final congressional hurdle, with the House passing the bill on a 220-to-211 vote, sending it to the president for his signature. The final vote caps a nearly two-month sprint from the time the package was first unveiled. The bill is a major political victory for the new president, displaying his influence over a Democratic Party in control of Congress by the thinnest of margins. The bill provides new health-insurance subsidies and child-tax credits, while extending $300 per week supplemental unemployment benefits into September. There's also $360 billion for state and local governments, a bailout for troubled union pensions and funds to ramp up vaccinations and school re-openings. Here's how to qualify for the $1,400 stimulus check. Asia stocks are poised for a muted open following gains in U.S. equities as a tame inflation report helped the recovery in value stocks. Treasury yields dipped and the dollar weakened. The S&P 500 rose for a second day, led by financial firms and producers of raw materials. The Dow Jones Industrial Average closed above 32,000 for the first time. Futures signaled a higher open for equities in Japan and Australia, and were flat in Hong Kong. The yield on the 10-year Treasury note fell toward 1.50%, as bonds shrugged off a tepid government auction. Crude topped $64 a barrel in New York, while gold edged higher. Bitcoin briefly topped $57,000. Credit Suisse has started an internal probe into the collapse of a $10 billion group of supply chain finance funds and temporarily replaced three employees in its asset management unit who were tied to the strategy. The Swiss lender has reached out to external firms to deal with regulators' queries surrounding the collapse of the funds, which it ran with Australian financier Lex Greensill, people familiar with the matter said. Credit Suisse froze the funds last week after doubts emerged about the valuations of some of the assets, kicking off a chain of events that culminated in the collapse of Greensill Capital. U.S. Secretary of State Antony Blinken and National Security Advisor Jake Sullivan will meet with their Chinese counterparts in Alaska next week, the State Department announced. Blinken and Sullivan's meeting with Yang Jiechi, a member of the ruling Politburo, and Wang Yi, the foreign minister, will represent the highest-level in-person exchange between the two sides since President Joe Biden took office in January. Ties between the U.S. and China sank to their lowest level in decades under former President Donald Trump, with both nations ramping up sanctions and tariffs, expelling journalists and closing consulates. In recent years Warren Buffett's position in the world's wealth rankings has slipped as tech fortunes soared. But now, at the age of 90, his net worth has blown past $100 billion, making him the sixth member of the world's most prestigious club, which includes Jeff Bezos, Elon Musk and his friend Bill Gates. Berkshire Hathaway, the source of virtually all of Buffett's wealth, has had a good start to 2021. The firm's A shares are up 15% this year, outpacing the 3.8% gain of the S&P 500 Index. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayBe afraid, McKinsey. Be very afraid. One of the big economic issues in recent years has been increasing inequality. The explanation for this typically involves the labor market being buffeted by major technological and economic trends, with higher-skilled workers much more in demand than lower-skilled workers thanks to shifts towards automation and outsourcing. If you're an engineer, you're probably making a lot more money than if you're a factory worker putting together spigots, for instance. And if you're an engineer at a superstar firm like Google or Apple, you're probably making significantly more than an engineer working at a place no one has heard of. A fascinating new paper, however, suggests that one of the biggest contributors to inequality might be something else entirely. The paper, by Nathan Wilmers at MIT and Clem Aeppli at Harvard, uses granular data from the Bureau of Labor to calculate workplace and occupational premiums — or the additional money one might be expected to earn from a particular workplace or occupation. (In the above example, there's an occupational premium from being an engineer, but there's also a workplace premium for being employed by Google). Interestingly, the paper finds that both sets of premiums have been rather steady in recent years. That is, the difference in occupational and workplace premiums hasn't actually increased all that much.  Bloomberg Bloomberg What has increased, however, is the co-movement between workplace and occupational premiums. That has doubled over the past 20 years. In other words, highly-paid jobs (occupations) are much more likely to be located in highly-paid companies (workplaces) than previously. The same is true for low-paying jobs, which are increasingly found at low-paying workplaces. So it seems there's not just a problem with the inequality of wages, there's also a problem in the structure of corporate society. (One way of thinking about it is not only do you have to go to the right school to become the right thing, you also have to work at the right company). This has policy implications. For a start, it would suggest that a government looking to reduce inequality might want to target sectors where bifurcation between "high-paying" and "low-paying" has been most extreme. The paper, finds, for instance that services jobs have been particularly impacted by recent years, with the sector "dominated by low-paying workplaces employing primarily poorly-paid occupations on the one hand (think fast-food restaurants)." On the other hand, there are also "very high-paying workplaces employing mainly well-compensated occupations (think consulting firms)." These could in theory be the focus of more redistributive policies. One for the consultants to ponder, surely. For more inequality coverage, check out Bloomberg Businessweek's special issue on the topic, out this week. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment