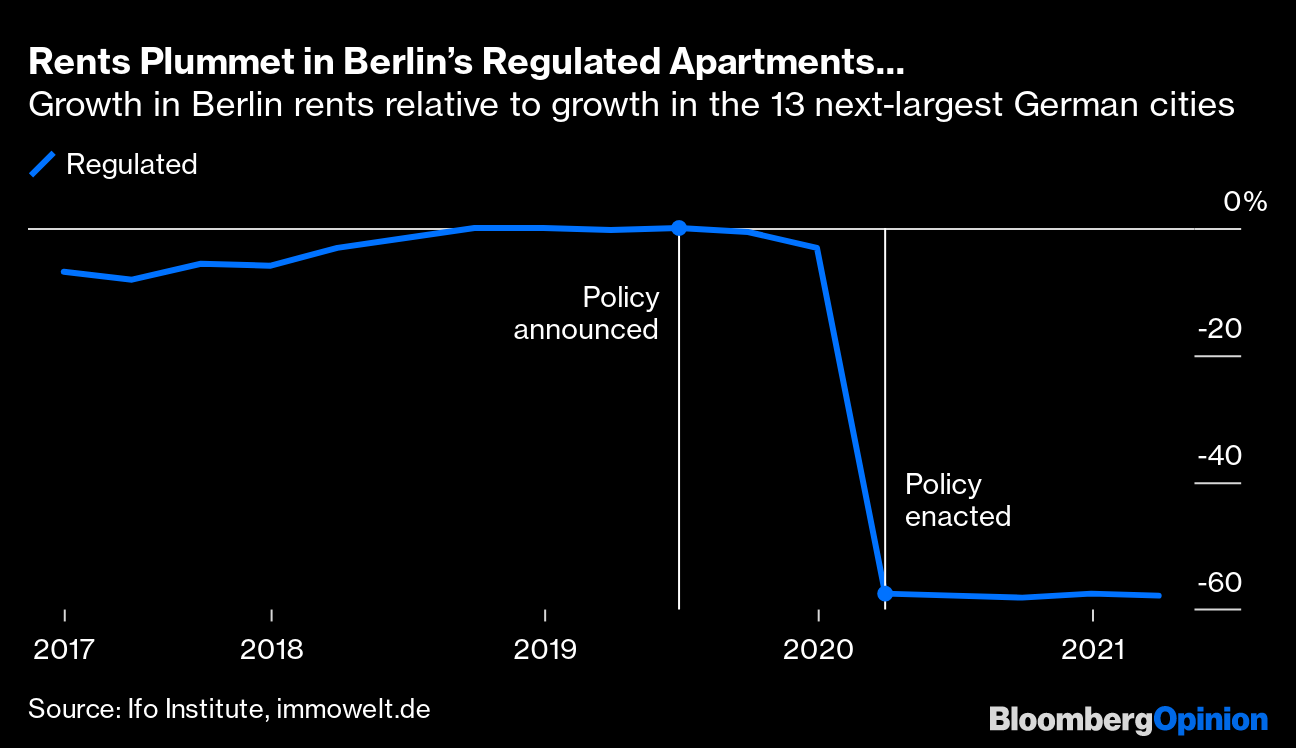

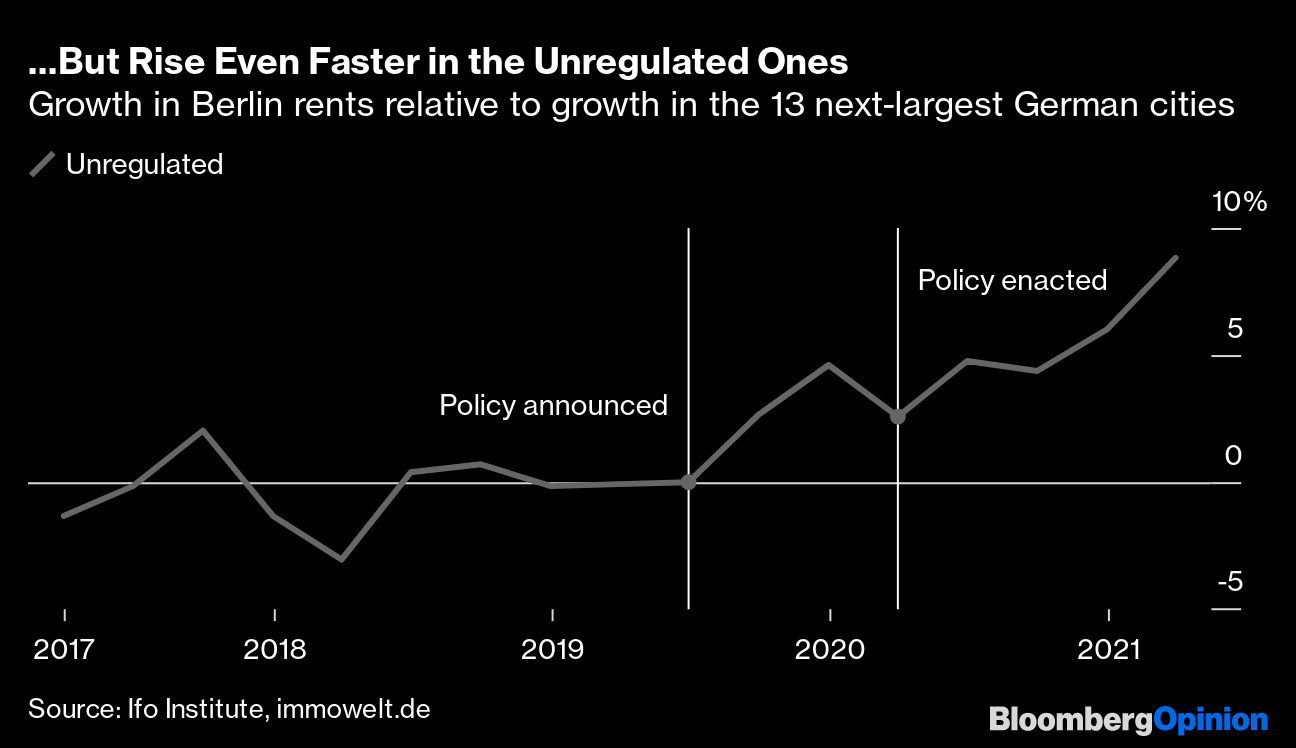

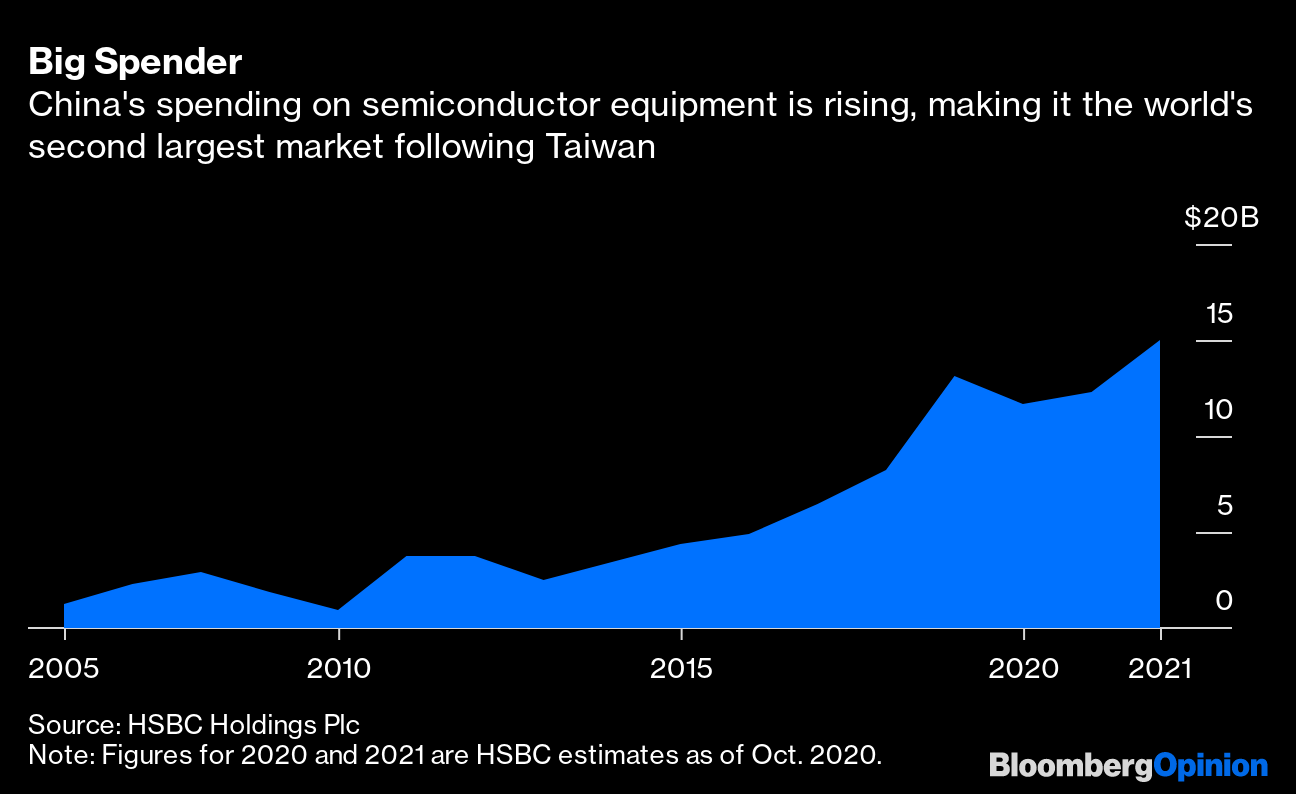

| This is Bloomberg Opinion Today, a cult of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Cult of BitcoinOne sign of how being trapped in an apocalyptic nightmare for the past year has broken our brains is that we can no longer simply invest in stuff like stocks or cryptocurrencies: We must shave our heads, give away our possessions and dedicate our lives to them. For instance, some people probably made a lot of money cashing in on the GameStonk revolution but were ashamed to admit it, because the only appropriate attitude toward any meme investment is unyielding devotion. If you aren't strapped in by your diamond hands for a trip to the moon, then you are a paper-hands boomer, which is essentially a non-person. And Jared Dillian writes of how he once made a tidy profit selling Bitcoin, tweeted about it, and then spent days being roasted online for his troubles. He's not alone. Bitcoin is no longer just another way to buy heroin or pizza, and it's no longer just an alternative store of value, one that happens to take "the same energy as 400 Ford F-150s idling for 11 years," as one Twitter comic put it. It is now a way of life that has many hallmarks of a cult, Jared writes, including the worship of a mysterious leader, Satoshi Nakamoto. Of course, cults can occasionally go legit. Wall Street's many boomers are getting religion. This adds to the pressure on the SEC to approve a Bitcoin ETF, which will complete its ascendancy and draw in the noobs, who will still have money left over after buying the new meme-stonk ETF. The SEC has good reason to resist, writes Nir Kaissar, but the longer it waits, the more painful its decision will become. And Elaine Ou wonders if the mainstreaming of Bitcoin will undermine some of the features that attracted cultists in the first place. But then they can always turn to the one true religion: Dogecoin. Bubble Watch!All of this foolishness could also just be a sign there's too much cash in the market and too little to spend it on. Footnoted.org's Michelle Leder spots one more: Iffy private companies are jumping back into the public market to rake in easy cash while the raking is good. Unless you can convince a whole subreddit to join you on some of these stocks, caveat emptor. It all has to end sometime, but then that time may not be nearly as soon as you think. On a price-to-typical-valuation-metrics basis, stocks are a 30-story Jenga tower constructed by an infant standing on phone books. But John Authers notes that, when you measure price by the sheer amount of garbage money available to all — "liquidity," if you will — they aren't nearly as bubbly as they could be. So fill your boots? Further Markets Reading: The recent surge in bond yields has pension-fund managers cheering. — Brian Chappatta How Not to Fight Climate ChangeAlan Weisman's "The World Without Us" is a portrait of how well and quickly the environment would fix itself if only humans would just go away and quit driving cars and visiting Disney and mining Bitcoin forever. We got a glimpse of this last year, when the pandemic abruptly shut down human economic activity, causing carbon emissions to plummet. Fortunately for us humans, we are still around, and getting back to the driving and eventually the Disneying (we never stopped the Bitcoin-mining). Unfortunately for future humans, carbon emissions bounced right back, notes Liam Denning. "Relying on worldwide pestilence, societal lockdowns and economic destruction isn't the preferred method of dealing with our emissions problem," he writes. Fortunately, longer-lasting positive trends also kept unfolding last year, with renewables getting cheaper and more popular. Someday we may be able to drive our kids to Disney without dooming our grandkids. Further Wrong-Way Greening Reading: It's self-defeating to try to offset the budget impact of green infrastructure investments. — Peter Orszag Telltale ChartsBerlin's rent-control experiment has been a predictable failure, writes Andreas Kluth.   China is spending gobs of money on its chipmaking capacity, but it still lacks the know-how and equipment to end the world's semiconductor shortage, writes Anjani Trivedi.  Further ReadingPresident Joe Biden needs to keep the Afghanistan war going a little longer to force the Taliban into a lasting peace. — Bloomberg's editorial board Biden can't completely break with Saudi Arabia, and not because the U.S. needs the oil. — Meghan O'Sullivan French snobbishness about vaccines has left it far behind its peers on getting shots in arms. — Lionel Laurent China's plans to become a football powerhouse are dying on the vine. — Clara Ferreira Marques A Fed focus on equitable employment could be a boon to cities with large minority populations. — Conor Sen ICYMIAndrew Cuomo's water keeps getting hotter. Elon Musk invited Vladimir Putin to Clubhouse. Four-day workweek. You hear it more and more. KickersCats may be too socially inept to be loyal to humans. (h/t Mike Smedley ) Just what we needed: space hurricanes. Nearly half of digital subscribers are "zombies." You can now buy Omaha's "most divorced" apartment. Or the Brooklyn Heights house from "Moonstruck." Note: Please send cats and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment