| This is Bloomberg Opinion Today, a stuck container ship of Bloomberg Opinion's opinions. Sign up here. Today's AgendaShip HappensAfter the year we've all had, we needed a global crisis as hilarious as a container ship the size of the Empire State Building getting stuck sideways in the Suez Canal, bringing global shipping to a screeching (splashing? doggy paddling?) halt. Most catastrophes don't lend themselves well to memes, but this one, hoo boy.   Anyway, sorry to be a buzzkill, but once all the lulz have been had, there will still probably be a massive ship blocking global trade, which could get to be a bit of an economic problem, which is one of the last things we need right now. Tyler Cowen suggests it's the latest argument for reviving supply-side economics, a theory whose respectability was last seen buried alive under the Laffer curve. Supply Side 2.0 would focus less on relentless tax-cutting and more on, uh, the supply of stuff, which lately is threatened by more than just one funny boat. At the very least, such disruptions help the case for a massive North American railroad merger, writes Brooke Sutherland. Worse, this is just a taste of the kind of trade chaos the world could face in the growing cold war between the U.S. and China, write David Fickling and Anjani Trivedi. Their compelling case goes back millennia, to the time the Persians got a trireme stuck in the Bosphorus and triggered the Greco-Persian Wars, or something. Shipping still makes up 70% of global trade, and China is especially dependent on it, which helps account for its drive to control critical lanes. Future blockages could involve boats with much more firepower than memes. In the meantime:  Business Class Is Becoming ObsoleteIt's not great when container ships can't travel. On the other hand, it's kind of great when business people can't travel, as we're discovering in the Covid pandemic. All sorts of industries are realizing a couple of Zoom calls are much easier on people and budgets than expensive junkets for pointless face-to-face meetings, Joe Nocera writes. This is good for the people involved, who get to spend more time at home. It's also good for the planet, which has to deal with less wasteful traveling. It's not great, of course, for the airlines. They may have to face that this is their new normal. Extra Carbon CreditPop quiz: What's been the best investment since the start of 2018? - Bitcoin

- European carbon permits

- Supreme hoodies

- Palladium

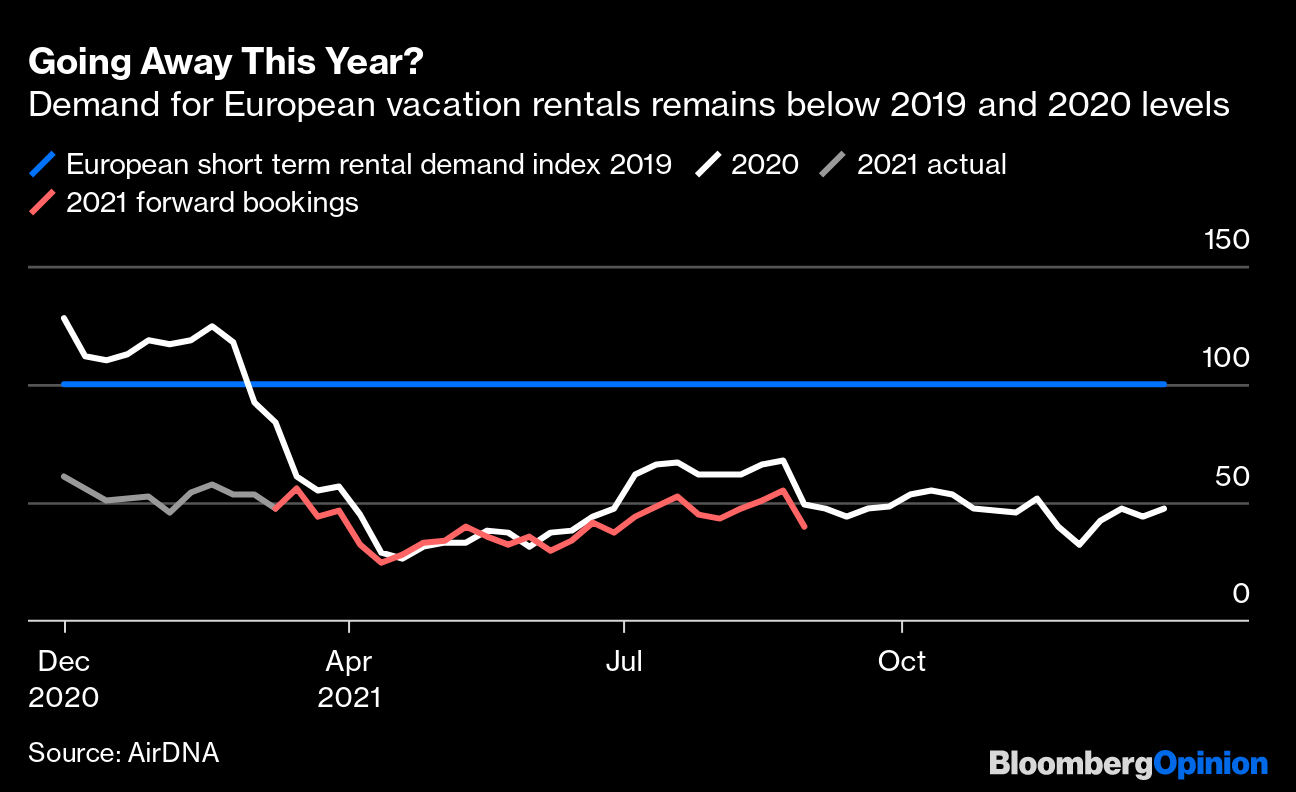

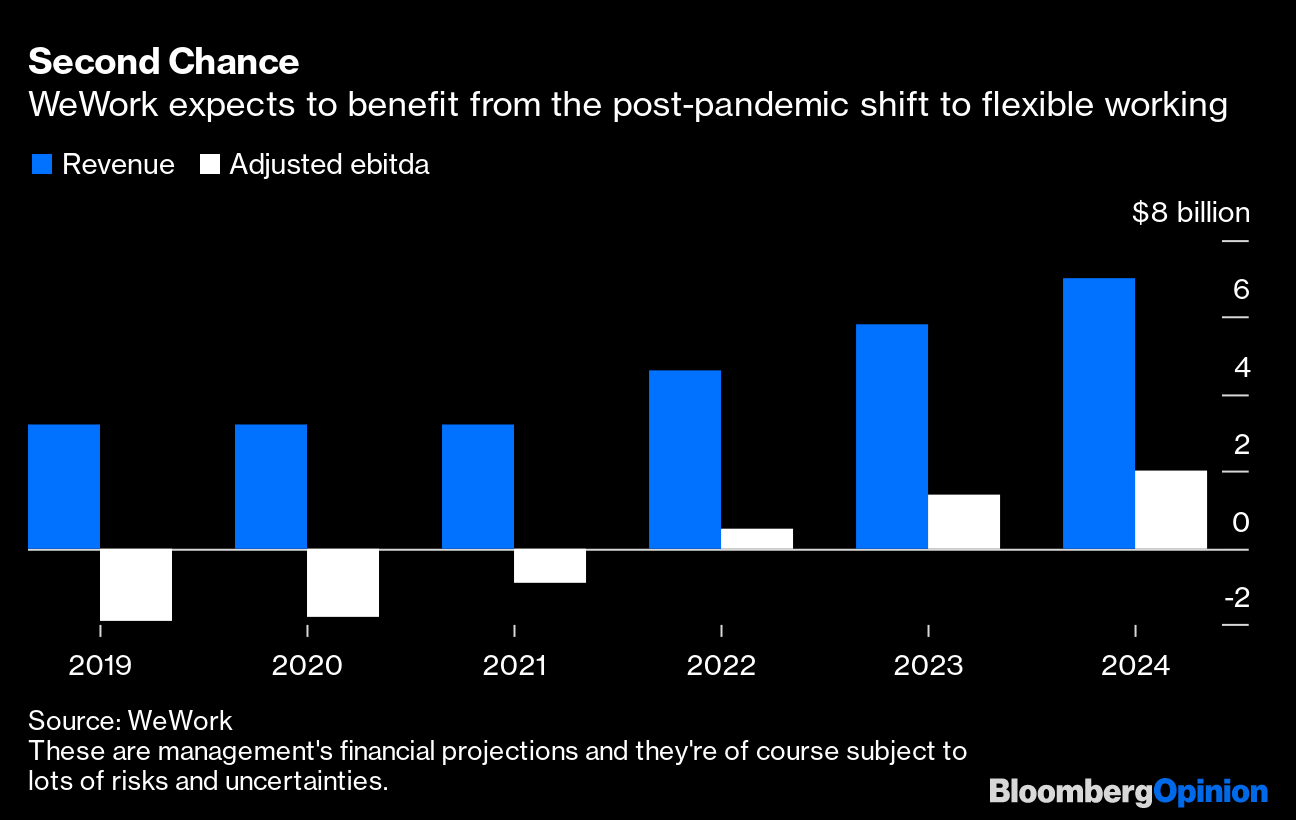

Some of you probably said "Bitcoin," or at least "Wait, European carbon permits are still a thing?" But you would be wrong. They not only still exist, but they also have trounced Bitcoin over the past three years, David Fickling writes, while being exponentially better for the planet. Once left for dead, they're now strong evidence carbon trading is a viable way to curb emissions. Along those lines, President Joe Biden's administration wants to start a bank to pay farmers for storing carbon in their soil and plants. Amanda Little suggests this bank is no business for the federal government, which she says would do more good funding research into planet-saving farming practices and letting private investors figure out the carbon-credit thing. Bonus ESG Investment Reading: New black-rhino bonds align everybody's interests: Investors get paid more when rhinos get saved. — Brian Chappatta Telltale ChartsOnce-high hopes of a European summer travel boom are starting to wither as cases rise and vaccinations keep not happening, writes Andrea Felsted.  With new leadership, some frugality and a growing flexible-work paradigm, WeWork could be a legitimate comeback story, writes Chris Bryant. Investors may still need some convincing.  Further ReadingWe can support bank lending without weakening capital requirements in difficult times. — Bloomberg's editorial board Banks are making a mint on SPACs and investors may not understand the costs. The SEC is right to investigate. — Elisa Martinuzzi Warren Buffett's Texas-grid rescue plan looks like his Goldman rescue plan. Texas may be less receptive. — Liam Denning Jimmy Dolan once again displeases investors, Knicks fans. — Tara Lachapelle Israel's election showed the surprising new strength of the Israeli center and left. — Daniel Gordis Brazilian capitalists are starting to regret backing Jair Bolsonaro. — Mac Margolis There's no good argument against D.C. statehood. — Jonathan Bernstein Here's how to lower your tax bill on your Bitcoin winnings. — Alexis Leondis ICYMITrump's former CDC chief says Covid came from a Wuhan lab. Pandemic wipes are creating more sewer fatbergs. Why so many people want to die with money in the bank. KickersMystery lights over Seattle and Portland were space trash. (h/t Ellen Kominers) The Sistine Chapel, now in life-size-photo-book form. (h/t Scott Kominers) How Afghans use mud and straw to keep grapes fresh for months. FINALLY: Peep soda. Notes: Please send Peep soda and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment