| Democrats wrangle over stimulus details, bubble warning, and Biden's regulatory picks testify. Democrat vs Democrat President Joe Biden will attend a virtual meeting of all Senate Democrats later today as he tries to keep the lawmakers united to pass stimulus legislation this week. Progressive members of the party in the House sent a letter to Biden and Vice President Kamala Harris demanding they set aside the ruling of the Senate Parliamentarian. The latter stated that legislating for a $15-an-hour minimum wage could not be passed under fast-track budget rules. Moderate Democratic Senators want a more targeted pandemic-relief bill and expect few changes from the package the House passed over the weekend. BubbleChina's top banking regulator said he's "very worried" about bubbles in European and U.S. markets as market rallies are heading in the opposite direction of underlying economies. He also expressed concern about price rises in the property market in China, something that the China Banking and Insurance Regulatory Commission has tried to calm by capping lending to the sector. Bank of America has also put out a warning about Wall Street bullishness, saying its measure of sentiment is near a level that has historically been bearish for stocks. Yesterday the S&P 500 Index closed 2.4% higher, its best day since June last year. New eraBiden's picks to head the Securities and Exchange Commission and the Consumer Financial Protection Bureau will face questions from the Senate Banking Committee at a hearing today. Gary Gensler, the former Commodity Futures Trading Commission Chairman, and Rohit Chopra, tapped for the CFPB, will be questioned on the boom in both GameStop Corp. and blank-check companies. Rally stalls Equity investors seem to be taking heed of the warnings of bubbles and excess bullishness. Overnight the MSCI Asia Pacific Index slipped 0.2% while Japan's Topix index closed 0.4% lower. In Europe the Stoxx 600 Index had gained 0.5% by 5:50 a.m. Eastern Time with consumer companies gaining as energy stocks slipped. S&P 500 futures pointed to a lower open, the 10-year Treasury yield was at 1.448%, oil slipped and gold was slightly higher. Coming up... Canadian fourth-quarter GDP is at 8:30 a.m. U.S. auto sales for February are published today. Fed Governor Lael Brainard and San Francisco Fed President Mary Daly speak later. Today's earnings are dominated by retailers with Target Corp., Kohl's Corp., Ross Stores Inc. and Nordstrom Inc. all reporting. CERAWeek and the Global Metals and Mining conference continue. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningMixing politics and investing has a very bad reputation. Go online and you'll find dozens and dozens of articles about how when you participate in the market, you should leave your politics at the door, or ignore politics altogether. But if instead of warning about the mixture of politics and investing, it would be better to warn about mixing partisanship and investing. In other words, not liking Obama would have been a terrible reason to stay out of the market. Same for Trump. Same for Biden. But as we're already seeing, politics itself is incredibly important.

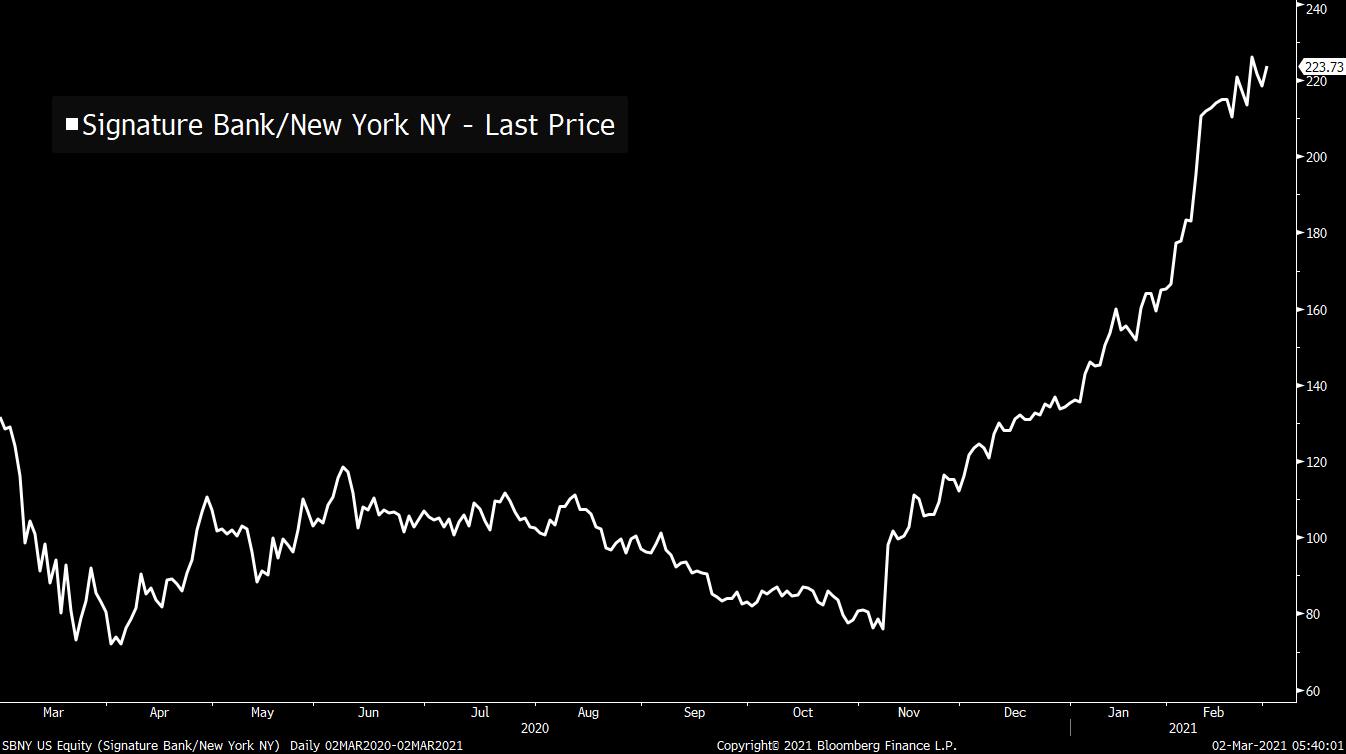

Here's a chart of Signature Bank -- heavily exposed to the fortunes of NYC -- which has been looking for financial support out of Washington D.C. Under Trump that was unlikely to be forthcoming. After Biden won, the stock immediately exploded higher. It then took another big leg higher starting in early January right after Democrats won both of the Georgia runoff elections.  In general, there's been a big change of stock market leadership since the election. Banks and energy companies have surged with the prospects of more stimulus. Growth companies have flagged. Interest rates have gathered upside steam, especially since the Georgia runoff cleared the way for more spending and faster growth. In a note, Goldman's top commodity strategist Jeff Currie maintained his bullish call on the asset class, citing environmental policies and increased demand through income redistribution. (Households with lower incomes tend to spend more, therefore income redistribution is growth positive.)

So much of what's thriving or slumping at any given time is a political choice, including whether we break out of this long, 40-year downtrend in interest rates. So ignore all that stuff about ignoring politics. It's worth paying attention to. It's partisanship and preferences that may be detrimental to good analysis.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment