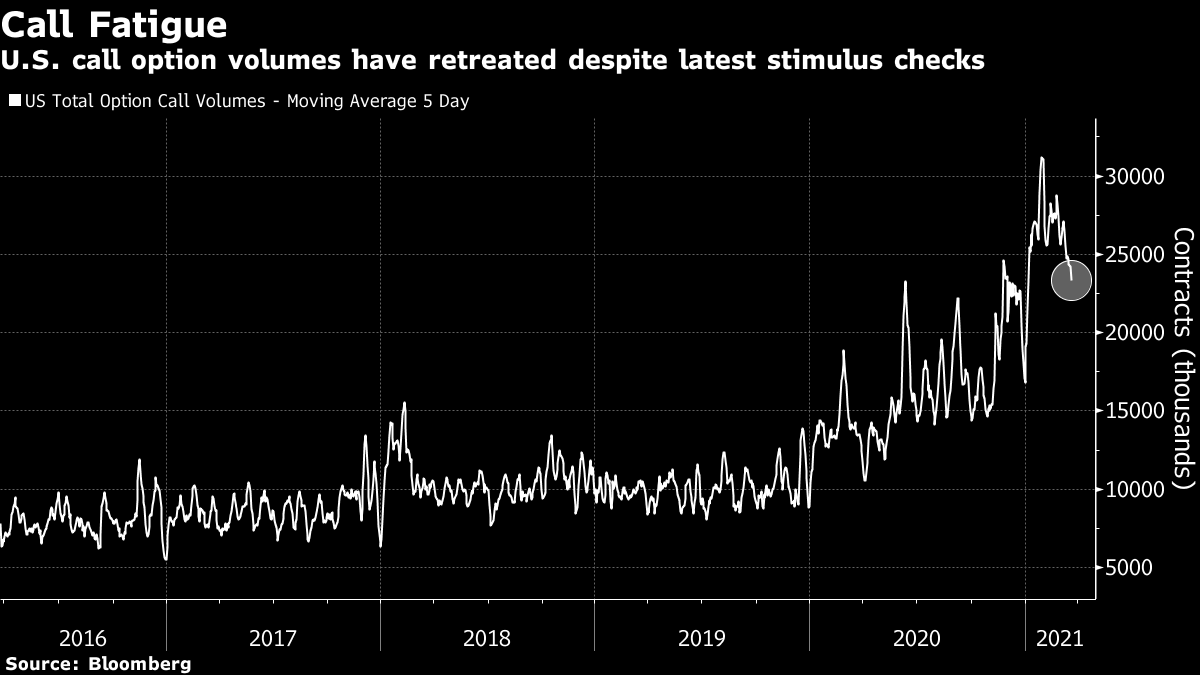

| Shipping stuck by Suez blockage, it's PMI day, and vaccine supplies remain a source of tension. Going nowhere The giant container ship Ever Given has run aground in the Suez canal, completely blocking off one of the world's busiest maritime trade routes. Attempts to refloat the vessel have so far proved unsuccessful, with experts suggesting it could be days before canal traffic gets back to normal. The blockage is already having ripple effects in global energy markets, with refiners likely to come under increasing pressure for supplies the longer the hold-up lasts. Rebound The latest purchasing manager survey data showed private-sector activity in the euro area unexpectedly grew for the first time in six months. Manufacturing in Germany was particularly strong coming in at 66.6 for the month, while factory activity was also higher than expected in France. The composite reading for the region was 52.5 as services activity remained subdued. Both manufacturing and services showed faster than forecast expansions in the U.K. PMI numbers for the U.S. economy are published at 9:45 a.m. Eastern Time. Not sharing The issue of vaccine supplies has become a political hot potato as global leaders attempt to ensure sufficient doses for their populations. President Joe Biden has continued the policies of President Trump which have ensured a de facto ban on the export of vaccines manufactured in the U.S. The European Union is set to unveil rules later today which may run along similar lines to current U.S. policy: Exports could be blocked if manufacturers have not met their European commitments. U.K. Prime Minister Boris Johnson risked inflaming tensions with the EU when he told a meeting of lawmakers that Britain's vaccine program was so successful "because of greed." Markets mixed Global stocks are caught between several forces at the moment, with the recovery trade still ongoing, the shadow of inflation not completely banished and risks from the pandemic remaining. Overnight the MSCI Asia Pacific Index dropped 1.5% while Japan's Topix index closed down 2.1%. In Europe, the Stoxx 600 Index had slipped 0.2% by 5:50 a.m. with technology shares the only real bright spot in the region. S&P futures pointed to a gain at the open, the 10-year Treasury yield was at 1.622%, oil held under $60 a barrel and gold gained. Coming up... U.S. February durable goods orders are at 8:30 a.m. Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen appear before the Senate from 10:00 a.m. Crude oil inventories are at 10:30 a.m. The sale of $61 billion of 5-year notes at 1:00 p.m. will be closely watched by markets. General Mills Inc. reports earnings. What we've been readingHere's what caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIs the furious, speculative YOLO trade that's dominated the markets for almost a year now starting to come to an end? Obviously it's hard to say, but there are perhaps signs of it coming off the boil. Here's a few things: -- As Yakob Peterseil and Vildana Hajric note, call options volumes in the U.S. have come off significantly since the beginning of February. There have been dips before, but this one is fairly notable.  -- The ARKK trade has cooled down. Not only has the popular ETF come off its highs, but volume is lower, as Eric Balchunas of Bloomberg Intelligence notes here.

-- Prices for NBA Top Shot online trading cards have been sliding in the last couple of weeks. -- Bitcoin is still holding up well. However other cryptos have been unimpressive. Ethereum peaked around $2000 in February, then ran up to nearly $1900 in mid-March, before dipping again. Meanwhile, the price of some crypto-linked equities has been wobbly. Here's the chart of Microstrategy, the software company that's been slowly pivoting into a Bitcoin play over the last year.  -- SPAC prices have been slipping. As SPAC investor and watcher Julian Klymochko noted yesterday, a number of new SPACs traded below their $10.00 offering prices. -- Robinhood's app store ranking has slid, according to Sensor Tower. It was at the very top of the free apps in the beginning of February. Now outside the top 100. (HT: @conorsen and Alex Good) -- Finally if you do a Google Trends search for various terms like "Bitcoin", "Buy Stock" or "Chamath" they've all come way down since their February highs. Could all be noise of course! But between higher U.S. yields and the ongoing reopening, it's possible that something has changed. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment