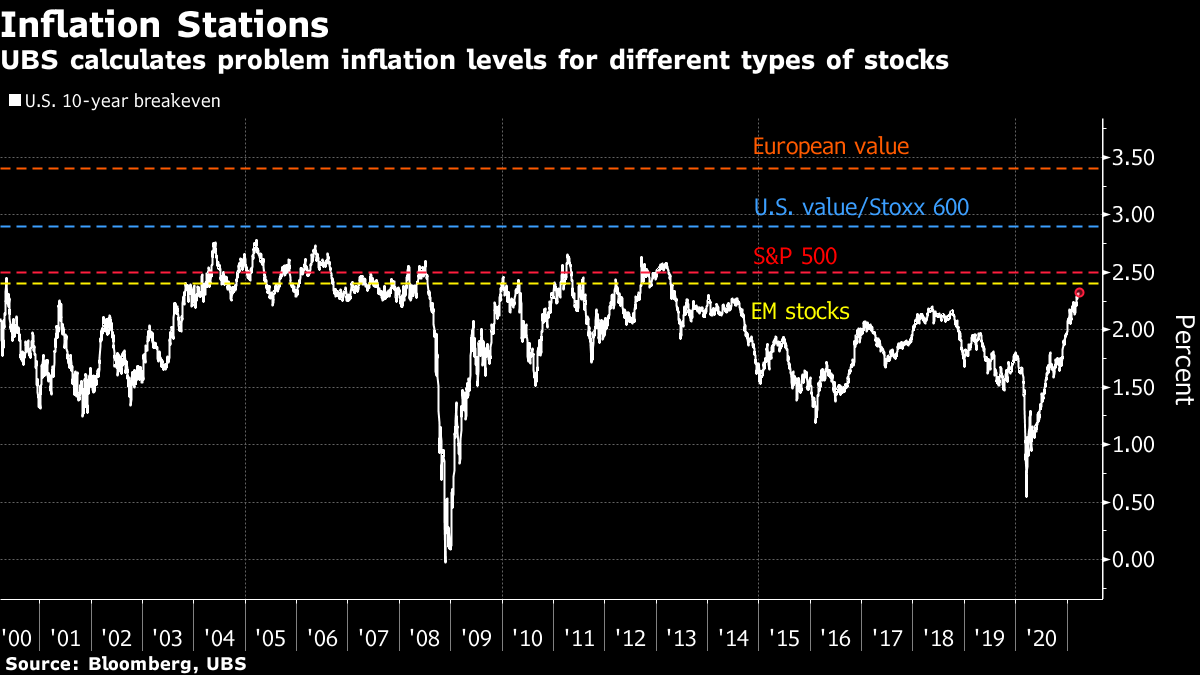

| Good morning. Tough German lockdown, Powell and Yellen in Congress, Israel election and a pricey tweet. Here's what's moving markets. Germany's Tough EasterChancellor Angela Merkel and regional leaders agreed to put Germany into a hash lockdown over Easter after the country's Covid-19 incidence rate nearly doubled in the past month, threatening to overwhelm hospitals. All stores will be shuttered for five days, except for a brief respite for food stores. "We are now in a very, very serious situation," Merkel said. Elsewhere, vaccine diplomacy is progressing, with Europe and the U.K. seeking to avoid an escalation that could see exports to Britain blocked from AstraZeneca's plant in the Netherlands, European Union officials have floated sharing the facility's output, Bloomberg reports. U.K.'s Boris Johnson says the EU does not want "blockades." Powell & YellenIt's all eyes on Washington later as U.S. Federal Reserve boss Jerome Powell and Treasury Secretary Janet Yellen speak on the pandemic response. Yellen is expected not only to highlight the improved economic outlook and dramatic expansion in help to households from the bill, but also highlight the need for more spending, partly paid for with higher taxes. The hearing comes as the Biden administration is reportedly considering as much as $3 trillion worth of new measures. Watch for Powell to repeat that the central bank won't act on forecasts of inflation, but only on harder data. In this region, the European Central Bank on Monday followed through on a pledge to boost the pace of emergency bond-buying to combat higher yields. Israel VotesIsraelis go to the polls in what's set to be a tightly-contested election as a successful vaccine rollout fails to give incumbent leader Benjamin Netanyahu a clear edge. Polls show neither Netanyahu -- who has faced corruption charges -- nor any of his rivals securely forming a coalition after the fourth election in two years. Joblessness is climbing at home while the national budget hasn't been updated since March 2019. Internationally, Israel has faced flaring tensions with Iran and is watching warily as U.S. President Joe Biden works to rejoin the Iran nuclear accord and reset relations with the Palestinians that foundered during Donald Trump's era. Here's a refresher on the state of play. Mona Lisa TweetTwitter co-founder Jack Dorsey's first tweet just sold for $2.9 million. Sina Estavi, chief executive officer of Malaysian blockchain service Bridge Oracle, paid for the non-fungible token in cryptocurrency Ether, according to Cent, the operator of auction website Valuables where it was sold. The 15-year-old post -- "just setting up my twttr" is the latest example of digital art gaining popularity, with non-fungible tokens, or NFTs, providing a certificate of authenticity that runs on blockchain technology. "I think years later people will realize the true value of this tweet," said Estavi, "like the Mona Lisa painting." Coming Up…European stock futures are slipping, while Turkey's lira steadied after Monday's chaos. Chinese shares dropped as much as 1.8%, extending losses from this year's peak to more than 14%. We'll get data on U.K. jobs and Hungary's main interest rate is expected to be unchanged. Elsewhere, Scottish First Minister Nicola Sturgeon is expected to survive a no confidence vote after being cleared of breaking the ministerial code. Finally, everyone's favorite meme stock, Gamestop, reports earnings after the close in New York. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningAt what level does a rise in inflation shift from being a tailwind to a headwind for equities is one of the key questions investors are pondering at the moment. The answer depends on a stock's sensitivity to inflation, which naturally varies across geographies and sectors. Handily, the strategy team at UBS has come up with a cheat-sheet of sorts, based on 10-year U.S. breakevens -- a gauge of inflation expectations. They currently trade at 2.3% and can be interpreted as what bond traders expect average inflation to be over the next 10 years. Emerging market equity investors should be most nervous right now, as a small rise to 2.4% in breakevens is the "pain threshold" beyond which returns suffer, according to the Swiss bank's calculations. At 2.5%, the S&P 500's returns should then come under pressure, the strategists suggested. European stock investors have a lot more leeway, with the trigger point in breakevens not coming until about 2.9% for the Stoxx 600. And investors in European value shares don't have to worry about inflation becoming a problem until 10-year breakevens hit 3.4%, according to UBS.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment