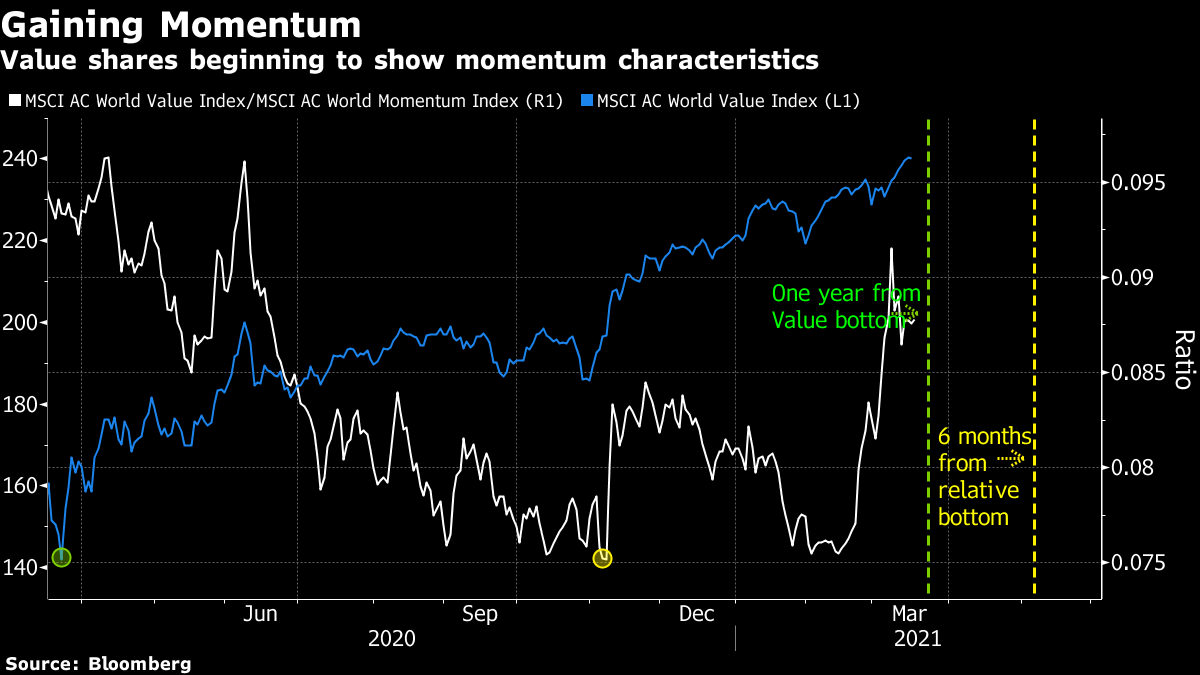

| Good morning. A verdict on AstraZeneca's vaccine is due, the Federal Reserve says monetary policy is appropriate and Europe's car industry is going electric. Here's what's moving markets. Vaccine VerdictThe European Medicines Agency will deliver its updated guidance on the AstraZeneca shot's safety on Thursday following a tumultuous few days for Europe's vaccine program. The company was criticized by European Commission President Ursula von der Leyen, who threatened to use emergency powers to seize vaccine production. Her intervention marked an escalation in the dispute between Europe and the U.K. over vaccine shipments, just as the latter warned of a slowdown to its inoculation program owing to a cut in supplies. Von der Leyen's threat also came before the World Health Organization then gave the Astra shot its backing, having previously warned on the threat vaccine nationalism poses to the global rollout. Appropriate PolicyFederal Reserve Chair Jerome Powell stuck firmly to a dovish message as the central bank announced its latest policy decision, repeatedly stressing interest rates won't rise until there's tangible evidence the U.S. economy has fully recovered from the hit delivered by Covid-19. The bank kept its projection of near-zero rates at least through 2023, despite upgrading the outlook for the U.S. economy and amid mounting inflation worries. Powell said current policy was appropriate and there is no reason to push back against the rise in Treasury yields, which hit pre-pandemic levels before the Fed's announcement. Stocks bounced and bond yields pared those rises after the decision, with Asian equities gaining and European and U.S. futures trending higher heading into Thursday. Speculative CornersAhead of the Fed's decision, the more speculative and expensive corners of the stock market took a hammering, with tech pain in the U.S. and a hit to renewable-energy stocks in Europe the most visible. The meme stock frenzy, however, appeared to calm, with a basket of retail-trader favorites now moving in line with the S&P 500, albeit accompanied by a number of new biotech penny stocks being touted on Reddit and surging higher. How long that relative calm remains the case will become clear soon, with stimulus checks being distributed across the U.S. and trading platform Robinhood offering users cash for new deposits. Going ElectricThe electric vehicle market has come roaring into view for Europe this week. German carmaker Volkswagen's embrace of the market has sent its share price soaring and made it the most valuable company in Germany, as the group once dismissed as a corporate dinosaur takes notes from the Tesla playbook to become a stock-market darling. Rival BMW also hit a three-year high as it laid out its EV ambitions. The optimism about future growth for EVs is also helping European automakers to shrug off currently weak sales as investors turn their attention to on the transition to electric, any developments in which are likely to attract plenty of attention from here on. Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. Coming Up…Dutch voters have handed a clear victory to Prime Minister Mark Rutte in the country's election, based on exit polls, setting the stage for negotiations to start on forming a coalition. Meanwhile, the Fed is not the only central bank game in town. The Bank of England's latest decision is coming up on Thursday, with expectations it will emphasize a high bar for tightening monetary policy. Norway's Norges Bank will make its latest announcement later too, and watch for any impact on Spanish lenders Santander and BBVA from Brazil's central bank hiking rates. Grocery delivery firm Ocado, online pharmacy Zur Rose and premium tonics firm Fevertree Drinks will all report earnings. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningGlobal value stocks are morphing into their once-feared momentum rivals, a shift that could accelerate in coming weeks and give their rally a fresh boost. Next Tuesday marks the 12-month anniversary of the MSCI AC World Value Index's eight-year low, a key timeframe that many quantitative models use to screen for momentum shares to buy. May 6 would be the six-month anniversary of the relative low for value stocks against their growth and momentum peers -- their outperformance began after the election of U.S. President Joe Biden. The global value stock gauge has jumped 22% since Nov. 6, while the equivalent growth index is up just 8%. The MSCI AC World Momentum Index -- which is up 5% over the same period -- chooses its members based on a combination of 12-month and 6-month performance, according to its factsheet. Momentum bets are popular within the roughly $2 trillion systematic community, which groups stocks together by their characteristics, an approach known as factor investing. Exchange-traded funds tied to momentum command $20 billion in the U.S. alone.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment