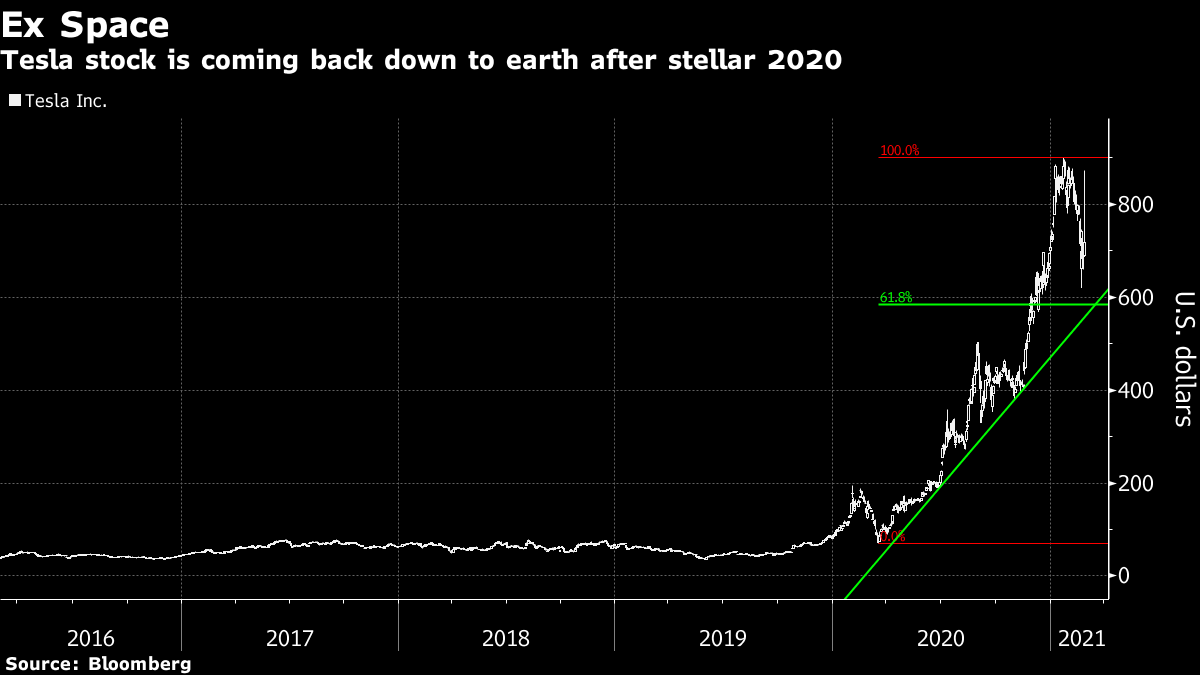

| Good morning. China bubble worries, Zoom's longevity, New York variant. Here's what's moving markets. China's Bubble WorriesAsia stocks and futures elsewhere slipped after China's top banking regulator sparked fresh concerns about further tightening in the world's second-biggest economy, saying he's "very worried" about bubble risks. The S&P 500 had just seen its biggest daily advance in almost nine months as investors jumped back into riskier assets following a recent rout triggered by concern the global economy could possibly overheat. For rates markets, the European Central Bank "must react" to any unwarranted rises in bond yields, a policy maker said. Meanwhile, Bitcoin is higher again, with Goldman Sachs said to be restarting a trading desk for cryptocurrencies and Citigroup laying out a case for the digital coin to play a bigger role in the financial system. Viva ZoomZoom Video Communications doesn't intend to fade away, according to its management, who gave a projection for annual revenue that topped analysts' estimates. The guidance suggests the service expects to remain a ubiquitous presence in daily life even as the pandemic recedes. Still, the annual revenue growth prediction of 43% for the fiscal year 2022 is far short of Zoom's 326% increase in the fiscal year ended Jan. 31. Zoom shares gained about 8% in extended trading. New York StrainAbout 735 cases of a coronavirus variant that emerged in New York City in November have now been identified in the U.S., including 585 in the last two weeks, a federal health official said. The mutation has traveled extensively through the metropolitan New York region, and cases have also been found in 14 other states. It is one of five concerning variants now being tracked nationally by health officials. As with other strains around the world, there are concerns over its potential ability to evade antibodies. "It's something we take very, very seriously," Anthony Fauci, a top medical adviser to President Joe Biden said. Elsewhere, U.K. Prime Minister Boris Johnson attempted to reassure the public over the emergence of a Brazilian variant in Britain, saying there is no reason to think vaccines will be ineffective against it. Russia Sanctions PlannedThe Biden administration is preparing to impose sanctions against Russia over the poisoning and jailing of opposition leader Alexey Navalny, according to three congressional aides briefed on the plans. The sanctions could be unveiled as early as Tuesday, though the aides offered no specifics. Navalny returned to Russia in January after being treated in Germany for a nerve agent attack. Western governments and Navalny have accused the Kremlin of being behind the attempted assassination. Russia denies that and has said that Navalny's imprisonment is an internal matter. The sanctions would be the first ordered by President Joe Biden against Russia and could set the tone for relations with his Russian counterpart, Vladimir Putin. Coming Up…Gambling group Flutter reports earnings after meal subscription firm HelloFresh beat quarterly profit estimates. Meanwhile, Activia yogurt-maker Danone bowed to pressure to separate the roles of chairman and chief executive officer, while booze retailer Virgin Wines begins trading in London, using the ticker VINO. Elsewhere, chipmaker Infineon will replace telecommunications equipment maker Nokia in the Euro Stoxx 50 equity benchmark later this month. Finally, we'll get data on euro area inflation and German unemployment, along with Nationwide house price statistics from the U.K. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe Euphoria trade is losing one of its founder members. No it's not lower-for-longer interest rates -- the jury is still out on those despite last week's mini bond tantrum -- but car superstar Tesla. The stock is flirting with bear-market territory and had turned negative for the year before Monday's rebound dragged it back above zero. The sheer scale of Tesla's rise in 2020 -- it surged 743% -- means there is a long way down even under a `normal' retracement scenario. It could fall almost 20% from here to a closely-watched Fibonacci support level and still remain in a technical uptrend. It's just that now the company is no longer an upstart but part of the establishment -- over 4% of the Nasdaq 100, almost 2% of the S&P 500 and about 10% of the hugely popular ARK Innovation ETF. Even the problems facing Tesla show how it is becoming more "mainstream" -- supply chain woes, reported price cuts, increasing competition. But of course its valuation remains anything but normal -- 165 times forward earnings compared to 17 times for the global sector. Tesla has become hugely important for market sentiment, especially among retail investors, who are most at risk of catching a falling knife if the stock does come back down to earth. And if Tesla cracks, other euphoria trades could quickly go with it.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment