| Bond markets relax, stimulus bill heads to the Senate and Johnson & Johnson vaccine approved. Yields down Global bond markets are stabilizing after last week's rout as central banks across the world reassure investors that they will continue their accommodative policy measures. While officials at the Federal Reserve and Bank of England have said they see little cause for concern in the rapid run up in yields last week, Australia's monetary authority signaled it would stick with its yield target and the European Central Bank has said it will not tolerate higher yields that risk undermining the economy. Increasingly, investors are also reassessing the risk of a breakout in inflation, with some now thinking fears of a rapid increase in consumer prices are overblown. Stimulus President Joe Biden's $1.9 trillion stimulus bill, which was passed by the House on Saturday with no Republican support, moves to the Senate. Plans to penalize companies that don't raise the minimum wage have been shelved in order for the package to quickly progress, according to people familiar with the matter. With some unemployment support measures running out in two weeks, the focus for lawmakers is on getting the bill passed through the Senate and ready for Biden's signature as quickly as possible. VirusThe approval of the Johnson & Johnson single-shot vaccine by the U.S. Food and Drug Administration is a welcome addition to the armory in fighting the pandemic as officials become concerned about the circulation of new variants and the recent slowdown in the pace of cases declines. The FDA has also outlined a fast-track approval process for new vaccines or booster shots to combat new strains. In Europe, further curbs have been announced to combat local outbreaks in Italy and Norway, while the U.K. is trying to trace cases of the Brazil variant. Stocks rallyWith bond investors becoming less concerned about the risks from high inflation, risk appetite in equities is getting a boost. Overnight the MSCI Asia Pacific Index added 1.5% while Japan's Topix index closed 2% higher. In Europe, the Stoxx 600 Index had gained 1.6% by 5:50 a.m. Eastern Time with every industry sector in the green. S&P 500 futures pointed to a similar rise at the open, the 10-year Treasury yield was at 1.432% and both oil and gold were higher. Coming up... U.S. February manufacturing PMI is 9:45 a.m. with ISM Manufacturing at 10:00 a.m. New York Fed President John Williams and Fed Governor Lael Brainard speak later, and three regional presidents are on a panel on racism and the economy held by the Minneapolis Fed. Zoom Video Communications Inc., NIO Inc. and Novavax Inc. are among the companies reporting results. CERAWeek begins. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningSelloffs in the Treasury market are inherently more mysterious than stock market declines. Everyone gets their biases confirmed. Maybe it's good news, because investors are pricing in faster growth. Maybe it's bad news because the Fed is losing control of the yield curve. Maybe investors are starting to fret about inflation. Maybe it's the bond vigilantes rousing from their slumber, sending a message about big-time Washington D.C. spending plans. Choose-Your-Own-Bond-Market-Narrative. Last week, of course, we had this big selloff in the belly of the curve, with yields on five-year U.S. Treasuries soaring, before falling back a little bit.  Anyway, as we start the new week, here's four quick things to think about in terms of what it all means. 1. As my colleague Tracy Alloway wrote about in her newsletter (sign up here), much of the move should be understood as technical. Speculative positioning combined with trend-following strategies basically meant a bunch of different players all got sell signals at the same time, causing an extremely sloppy rush for the exits. Rather than reading too much into the move as some major economic signal, it should be at least in part understood as one of those things that happens in markets from time to time. Some of it is noise.

2. Of course there is a real policy tension that exists in the market. Friday on TV we talked to Jon Turek, who is the author of the excellent Cheap Convexity newsletter. As he laid it out, the basic issue is that growth in 2020 is expected to be blazing hot, with GDP perhaps even growing in the double digits. Normally you'd think the Fed would be in a tightening bias in such an environment.

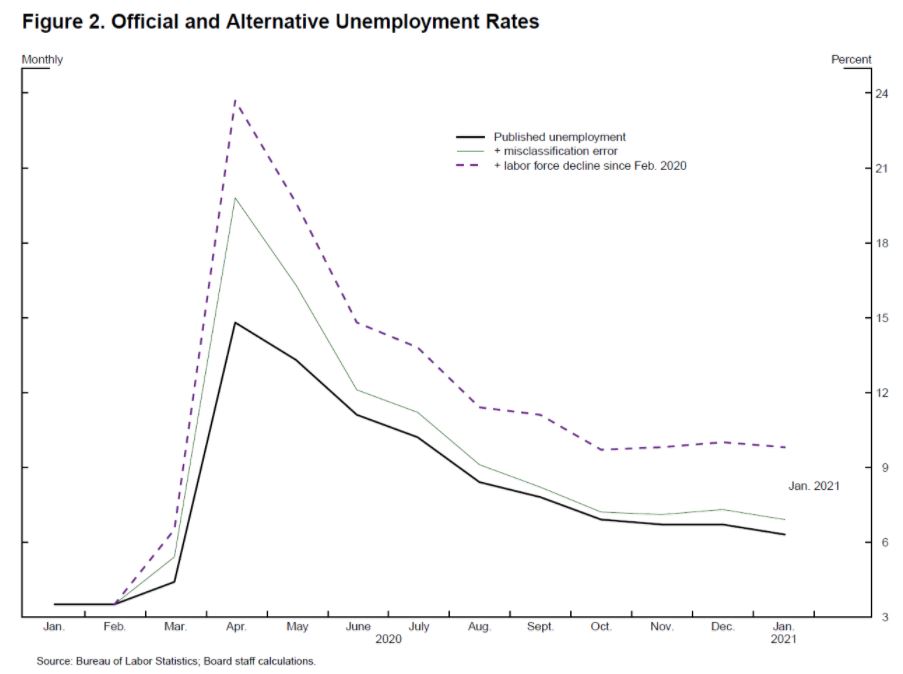

On the other hand, the Fed has made clear that it's not so much interested in the path, but rather the destination. It wants to get back to full employment and yet right now we're nowhere close to the Fed's goals. As Lael Brainard discussed last week, by one measure the unemployment rate is probably close to 10%. That's not a level where the Fed is even thinking about thinking about hiking rates.  Photographer: Weisenthal, Joe Photographer: Weisenthal, Joe 3. Despite all the talk of inflation, it's really not clear that the market is showing any actual concern. If you look at breakevens, the market is pricing in higher inflation over the next two years than it is over the next 10 years. In other words, there may be some broad-based rise in prices in the short term due to reopening and stimulus, but then nothing that would really be sustained or worrisome over the long term.  4. And finally, what we're seeing happening in the rates market has a corollary to what's going on in stocks. There's a reason why Exxon is already up 32% just this year, while Tesla is down 4%. From Goldman Sachs' latest Weekly Kickstart note:

Of course, shifting interest rates have major implications for rotations within the equity market, a dynamic made clear in recent weeks. In mid-2020, our equity valuation model showed that equity duration – the expectations of earnings growth far in the future – had become a more important contributor to multiples than ever before. One key reason for the importance that investors ascribed to expected future growth was the extremely low level of interest rates. As rates have risen, the contribution of equity duration to stock valuations has declined while near-term growth profiles have become more important. Practically, this means that both the improving growth outlook and rising rates have supported the outperformance of cyclicals and value stocks relative to stocks with the highest long-term growth.

Things are calmer on the rates front today, but it seems like a safe bet that this will be everyone's focus for awhile nonetheless. So these are a few thoughts to keep in mind.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment