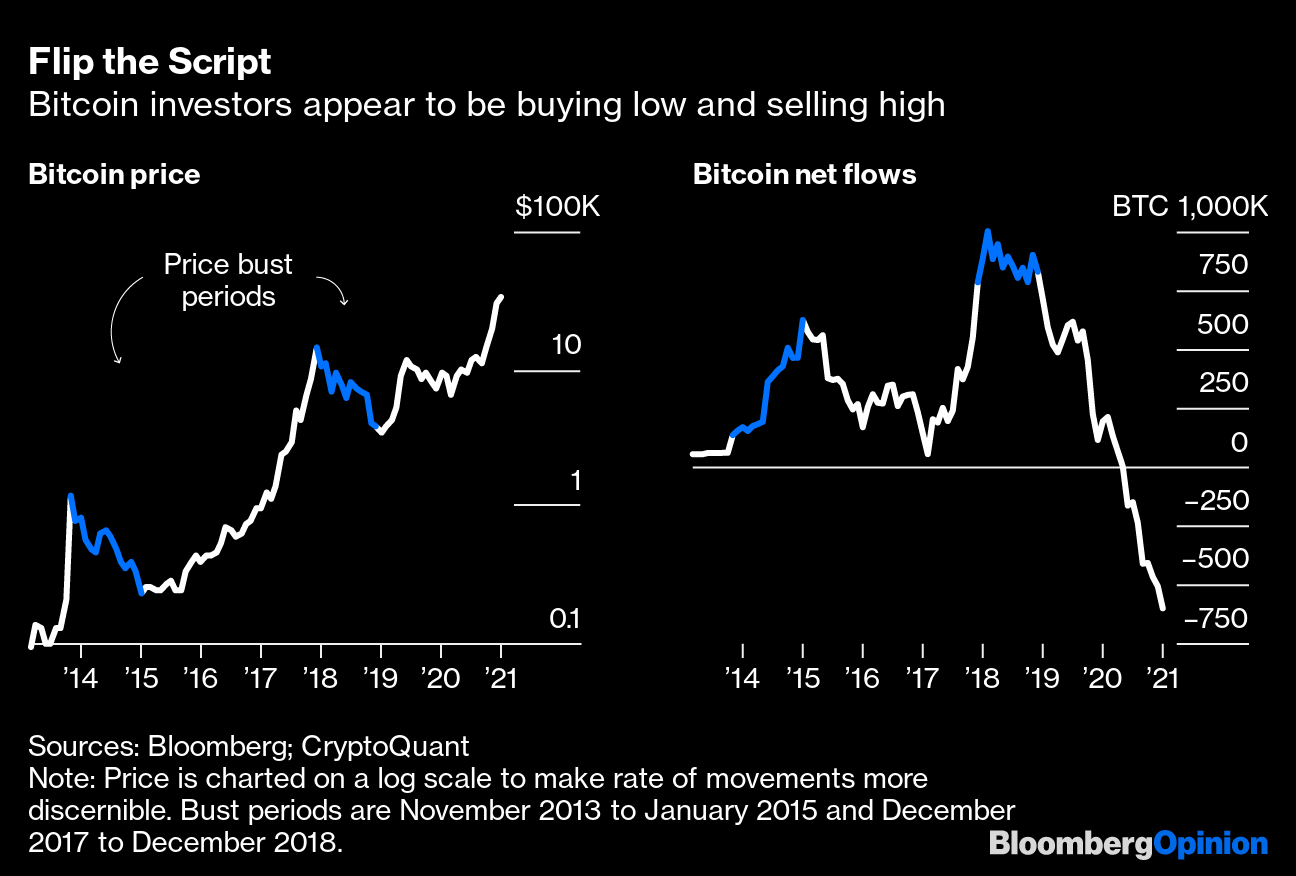

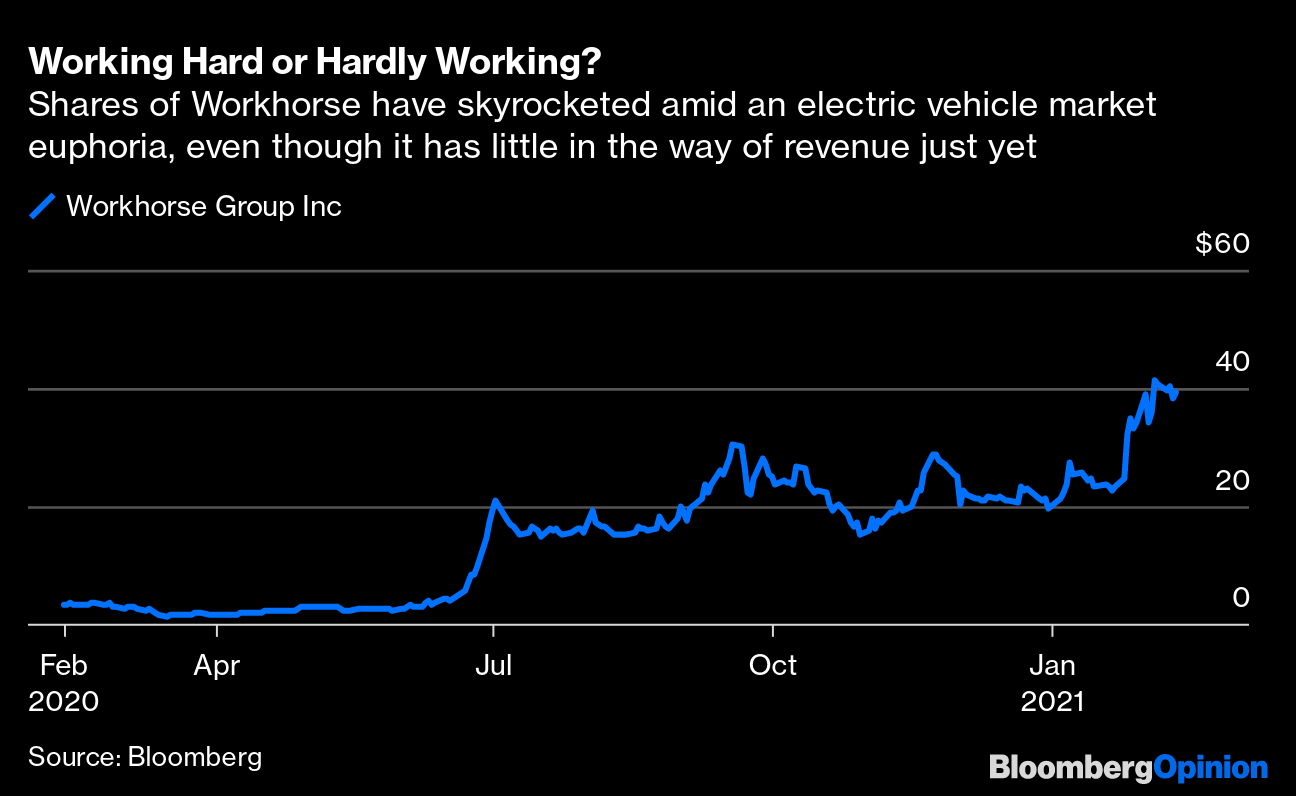

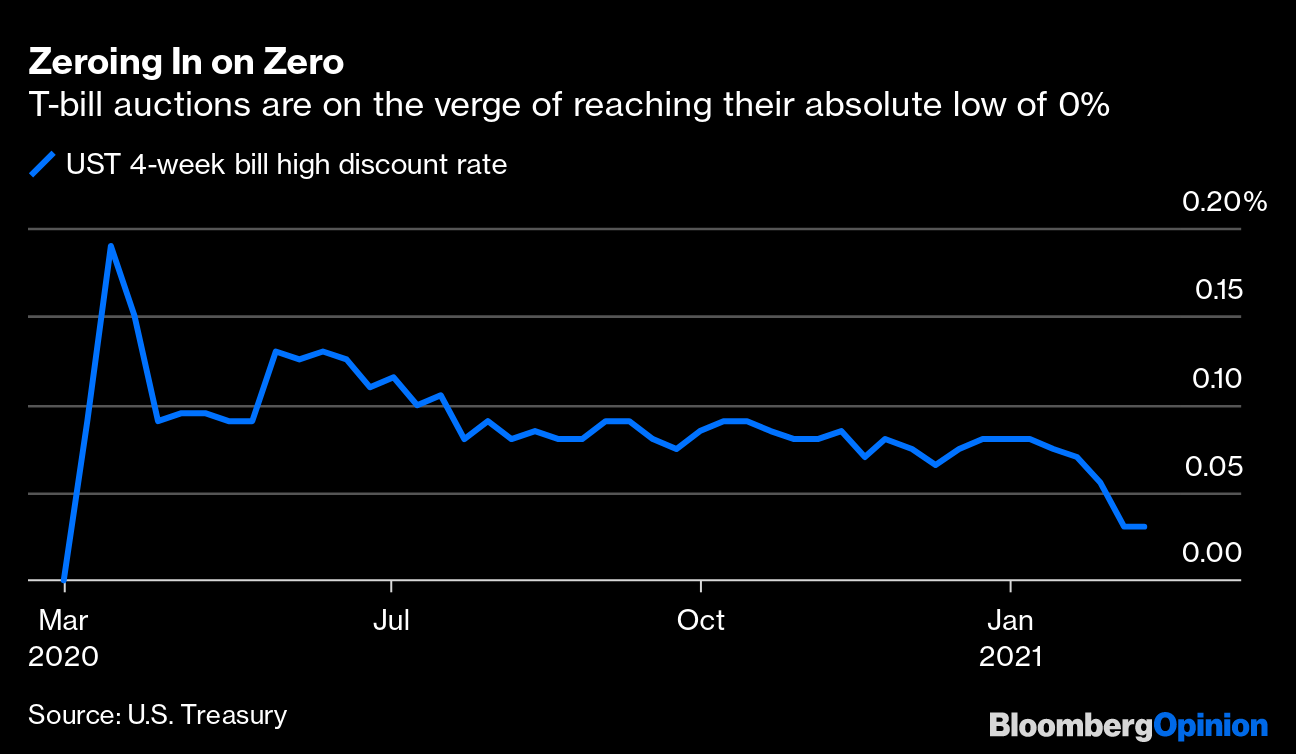

| This is Bloomberg Opinion Today, a power grid of Bloomberg Opinion's opinions. Sign up here. Today's AgendaExpect More Texas VortexesIn northern New Jersey, where this newsletter is lovingly hand-carved from a single block of wood each day, there has been roughly a foot of snow on the ground for the past two weeks, with temperatures dipping repeatedly into the teens, with no noticeable effect on background levels of New Jersey-ness. Meanwhile, Texas gets some cold weather and a little snow on the ground, and the state is laid out like Conor McGregor. Millions of Texans lack electricity after an overwhelmed system buckled beneath the weight of too many people turning up the heat just as icy weather froze all the stuff that makes the heat come on. The difference between New Jersey and Texas, at least on the limited issue of resilience to winter storms, is one of frequency: They just don't happen that often in Texas. Many Texans blamed frozen wind turbines, suggesting things would be better if we went back to powering everything with coal and gas. But fossil fuels froze up, too, and not that much wind capacity has shut down this week, Liam Denning notes. And cold weather hobbled Texas power back when wind was much less important. The real issue is an electrical system that's not up to the task of handling extreme weather events, Liam writes. This is true not only of Texas but also New Jersey, wildfire-wracked California and every state in between. Such once-per-generation weather crises are becoming annual events. The Jersey Shore faces rising sea levels and devastating hurricanes. California's wildfire season now runs from January to December. And the polar vortex gripping Texas could become a regular feature as global warming weakens the jet stream. It may cost us, but we need a power system that can handle the punishment without making the underlying problems worse. Read the whole thing. The Smart Money's in BitcoinGiven Bitcoin's hype, volatility and endorsement by Elon Musk, you might think its investment base is made up of the same extremely online people who buy stuff like Dogecoin and GameStop for the lulz or because of millenarian fanaticism or both. And you might be right. But these Bitcoin investors are also shockingly savvy, writes Nir Kaissar. Typically, volatility is poison for retail investors, causing them to sell when prices fall and buy when prices rise. Instead, Nir writes, Bitcoin investors have been doing the opposite — doubling down during busts and selling out during booms. Lulz are not only the best medicine, but they can also be profitable.  Further Hot Investment Reading: European VexationIt's been about a month and a half since Britain Brexited from the European Union. How's everybody getting along? Not great, to be honest. The EU has long positioned itself as a foil to anti-democratic sorts such as Donald Trump, but it hasn't exactly been living up to its own democratic ideals, writes Martin Ivens. For instance, it keeps pressing on with plans to import gas from Russia, looking the other way as the latter (allegedly) poisons and imprisons dissidents. And it mocked Boris Johnson's buffoonery and then watched him distribute vaccines with shocking competence, while dropping all of its own vaccines down an open well and then tripping and falling into said well (metaphorically). The U.K. has plenty of its own troubles, though. Between Brexit and Johnson's ham-fistedness, Northern Ireland and Scotland are more likely than ever to leave the U.K., writes Max Hastings. This will be good for the Irish but bad for the Scots and definitely diminishing for the English. Further Post-Brexit Reading: Telltale ChartsThe hot new thing in electric vehicles is package-delivery vans, write Brooke Sutherland and Chris Bryant. It's vacuuming investment dollars from Amazon to Wall Street, but it's already a crowded space.  Treasury Secretary Janet Yellen probably won't let short-term Treasury yields dip below 0%, which would cause all sorts of problems, Brian Chappatta writes.  Further ReadingThe pandemic exposed how vulnerable the financial system still is. Here's how to strengthen it. — Bloomberg's editorial board It makes no sense that Revlon's creditors won't have to repay money Citigroup accidentally gave them. — Noah Feldman Arguments about the size of Covid relief miss the point; what we need is temporary support, not long-lasting stimulus. — Mervyn King The good news on Covid variants is they seem limited; the virus may not keep mutating forever like the flu. — Faye Flam Here's how Toyota avoided the global chip shortage despite its just-in-time inventory approach. — Anjani Trivedi Corporate executives are more trusted by Americans than ever, and they've earned it lately. — Barry Ritholtz Here's the argument for prenuptial agreements. — Erin Lowry ICYMIWealthy workers are waiting for vaccines in luxury. Iceland's herd-immunity study falls victim to its Covid success. Traders are buying the wrong Clubhouse. KickersOh great, now there's a Grape-Nuts shortage. Archaeologists dig up a 5,000-year-old brewery. (h/t Ellen Kominers for the first two kickers) A fake New York town briefly became real. (h/t Scott Kominers) Maybe a comet, not an asteroid, killed the dinosaurs. Note: Please send Grape-Nuts and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment