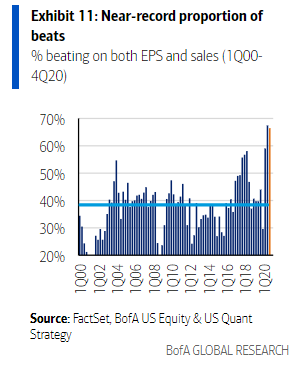

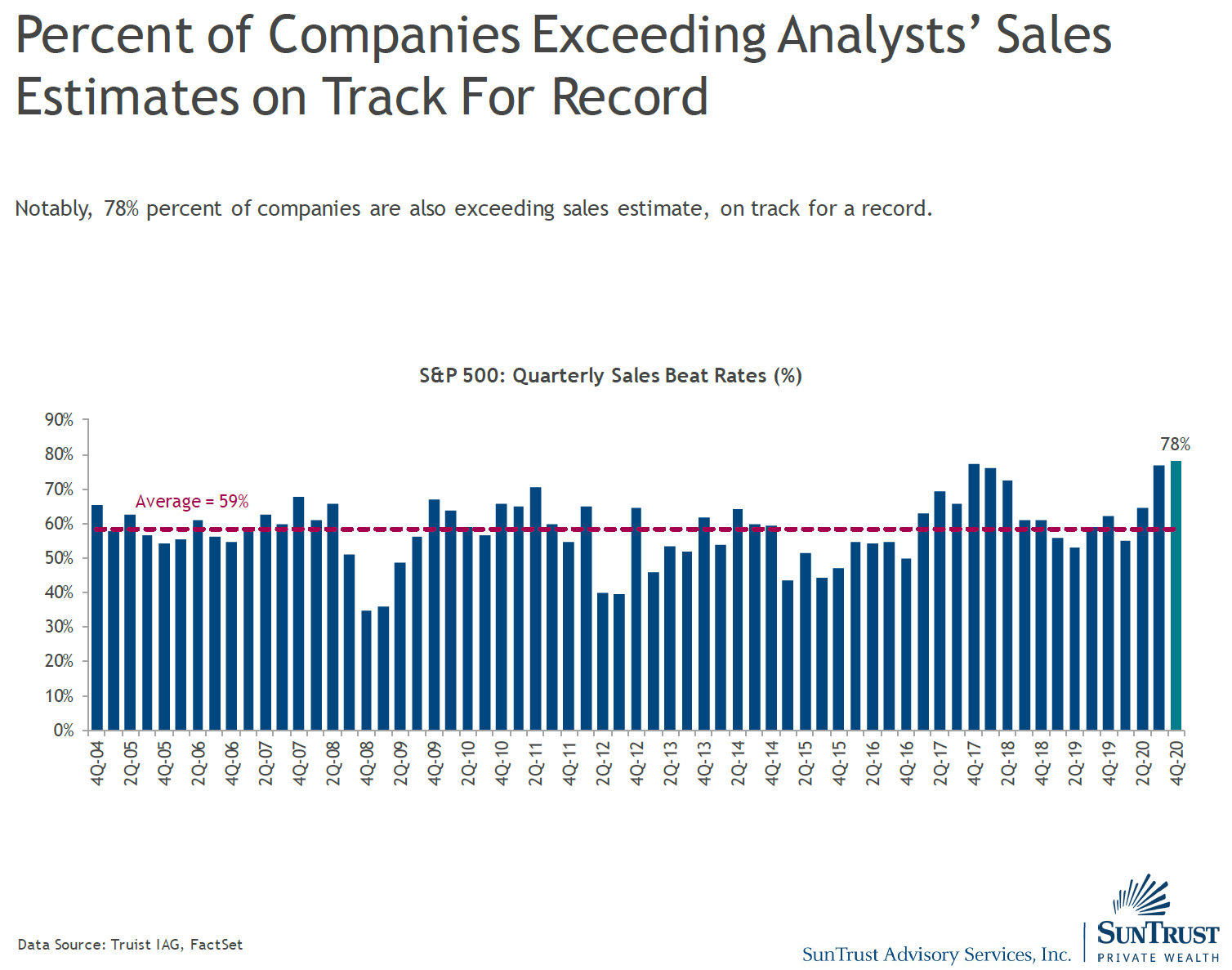

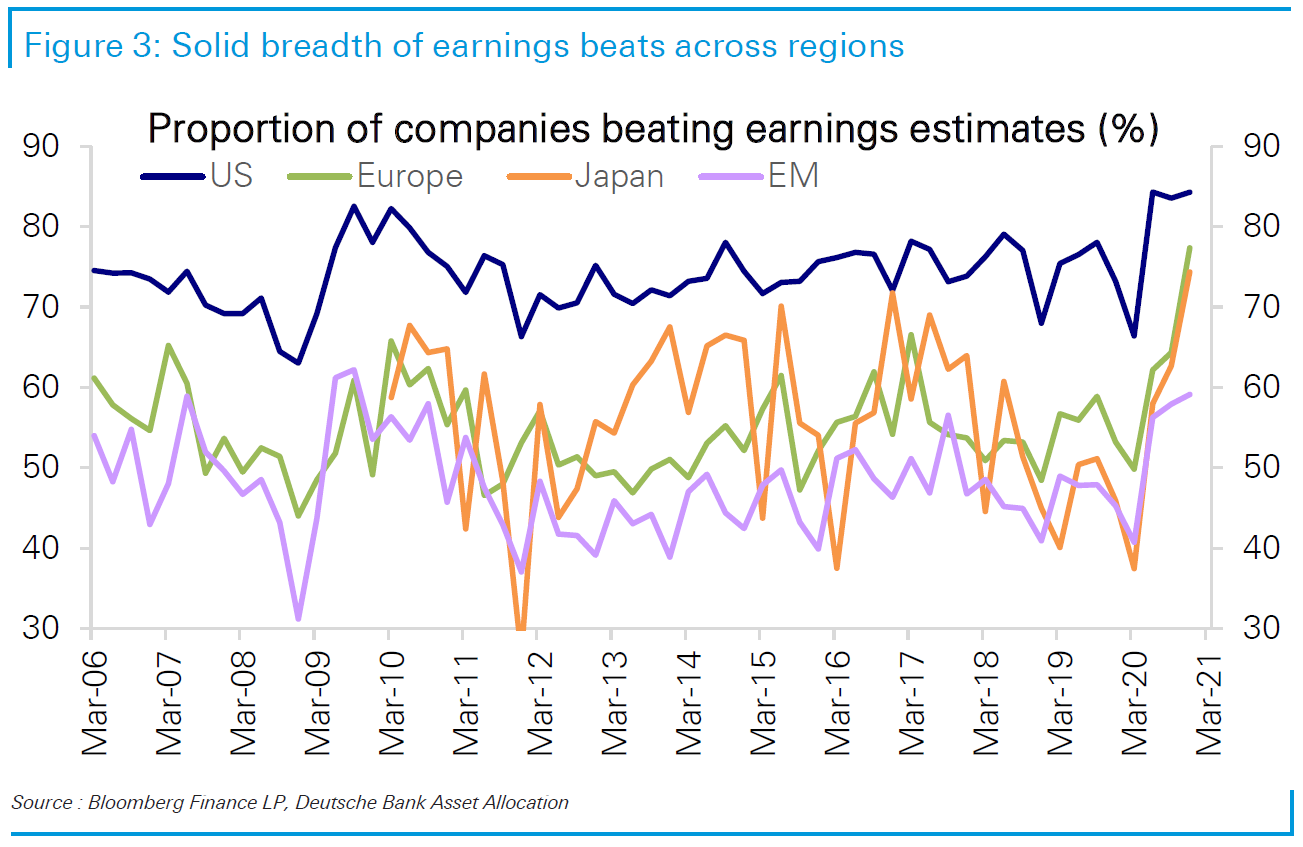

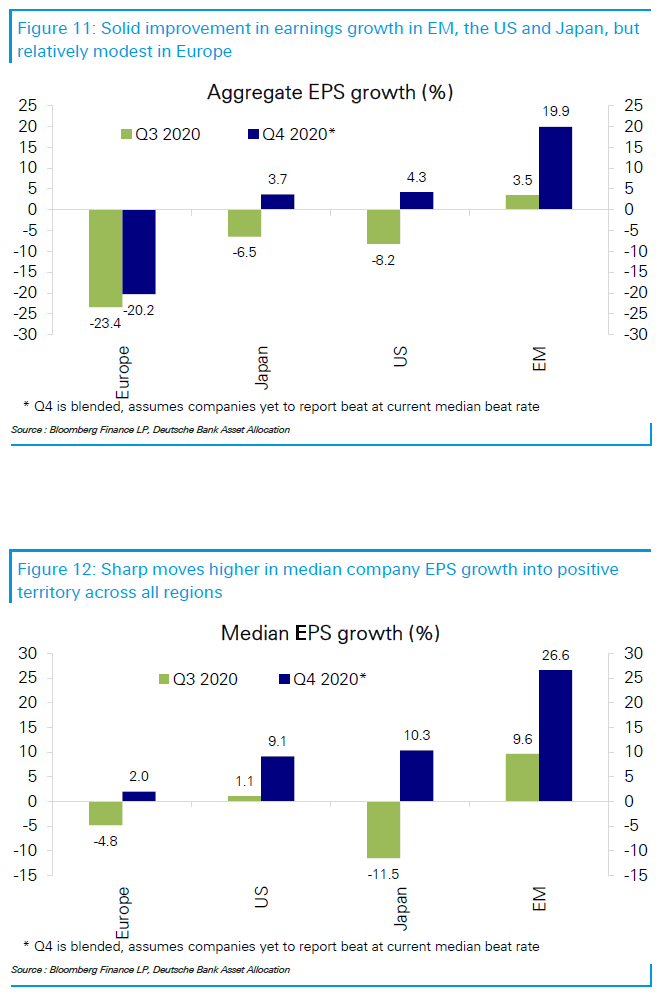

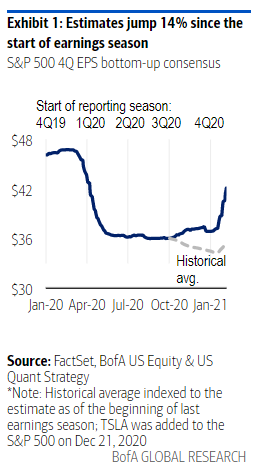

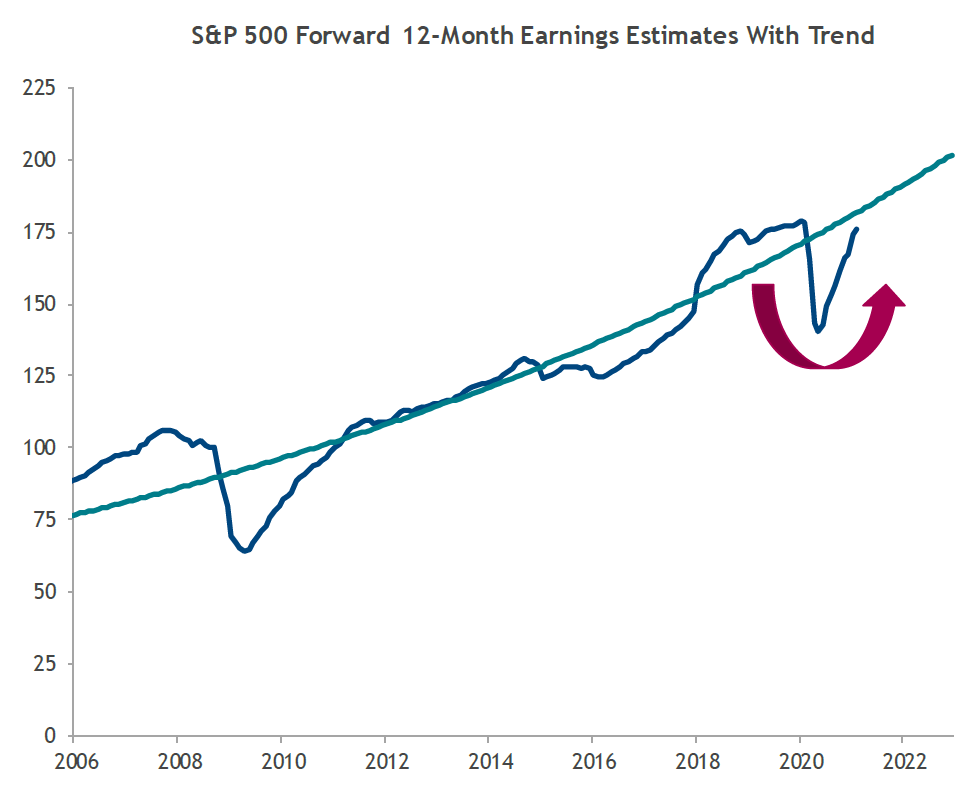

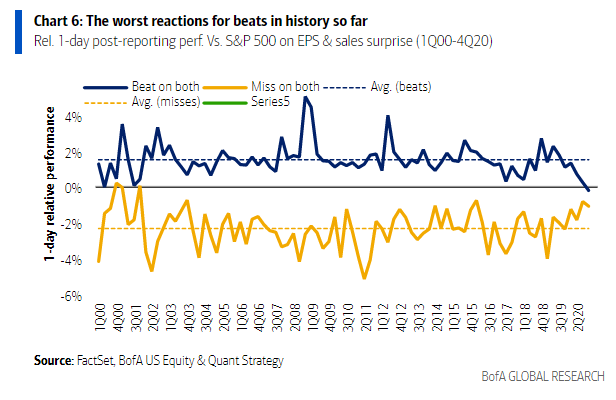

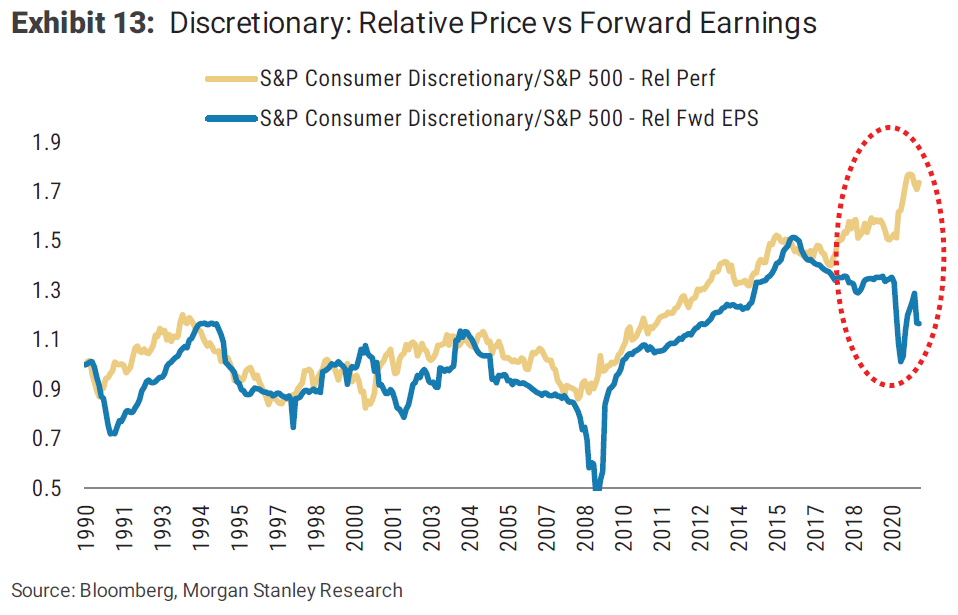

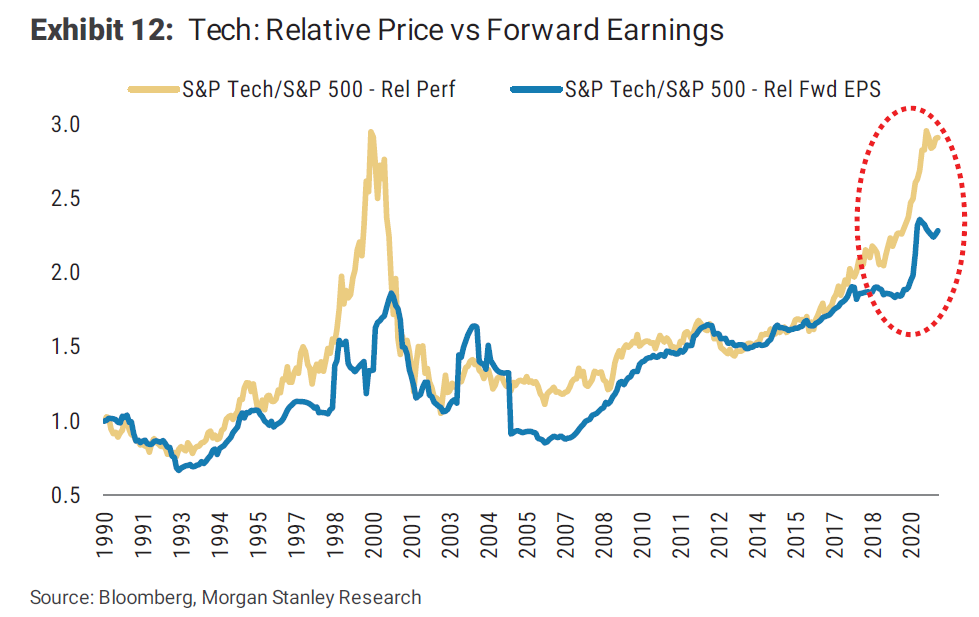

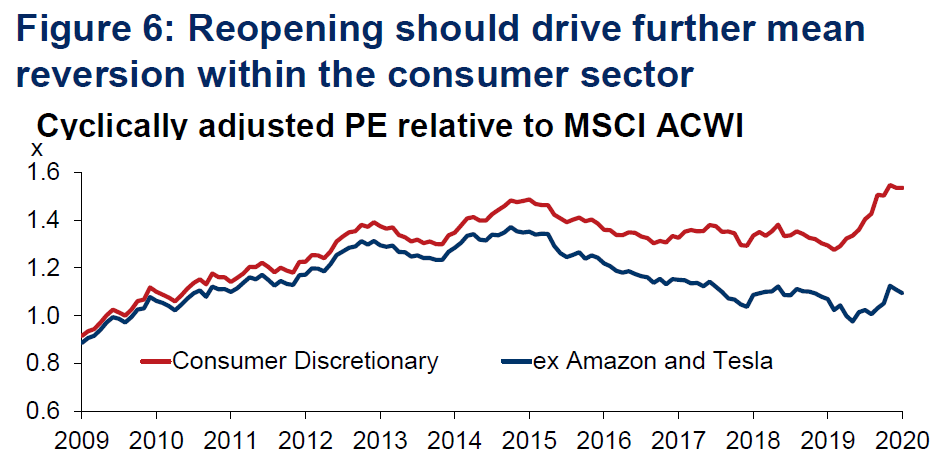

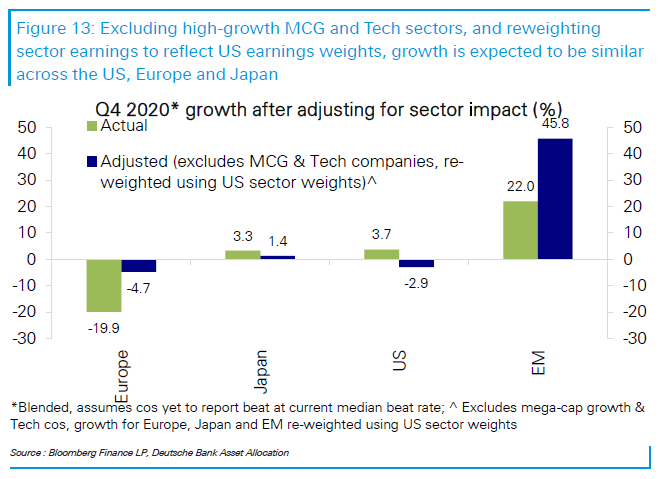

| Amid all the evidence of mad and irrational behavior in markets, we can at least be grateful that this has so far been an earnings season for the ages. The corporate sector — particularly in the U.S. and particularly in technology, but also in the rest of the world — is still recovering swiftly from last year's pandemic. What is worrying is that there is good evidence this has had almost nothing to do with the rocket-like performance of stocks. Let me tell the story with the aid of a lot of charts. Particularly in the U.S., people have long been conditioned to see whether companies have "beaten" their expectations. And as Savita Subramanian of BofA Securities Inc. demonstrates here, the percentage of S&P 500 companies beating estimates for both sales and profits is very nearly at the record set in the third quarter of last year:  Specifically on sales, the number most directly tied to the performance of the economy, more companies than ever before are outstripping forecasts, as shown here by SunTrust:  We should know by now that the earnings forecast game is a little silly. Particularly in the U.S., CFOs have grown adept at talking down expectations ahead of results, and then reaping the positive performance bump when they "beat" a lower bar. The following chart, from Bankim Chadha of Deutsche Bank AG, shows this beautifully. It compares the proportion of companies exceeding estimates in the U.S., Europe, Japan and the emerging markets. For 60 straight quarters, more U.S. companies have outpaced forecasts than in any of the other regions, and the proportion doing so stretches credulity. Whether this is because American investor relations departments are particularly unscrupulous, or because American brokers are particularly gullible, the numbers do suggest that we shouldn't taken the U.S. earnings game too seriously at the best of times:  However, there is more to the good corporate news than better-than-estimated earnings in an environment when few knew what to expect. If we look at actual aggregate growth in earnings per share, it has been positive everywhere but Europe, and spectacularly so in the emerging markets. Moreover, the pandemic continues to have a tail of serious losers. If we look at medians rather than averages, then most companies are back in growth mode, including in Europe. (The charts again come from Chadha of Deutsche Bank):  Meanwhile, predictions for the quarter, based in part on what CEOs have been choosing to say on earnings calls, have shot up remarkably. This is nothing like the normal massaging of expectations, as shown by this chart from Subramanian of BofA:  This has also had an effect on forward earnings estimates, which have almost completed a legitimate "V" shape. By the end of this year, they should be growing in line with the well-established trend after an interruption of only a year, at least as drawn in this chart from SunTrust:  All of this provides genuine reason for optimism and, all else equal, for stock prices to go up. And, of course, stock prices have indeed been going up. But these two things have almost nothing to do with each other. The following chart shows the performance on the first day after results announcements for all those companies that managed to beat expectations on both earnings and sales. This is the first quarter this century when such companies have on average endured a fall. They did slightly better than those that disappointed on both, as Subramanian of BofA shows here, but not by much:  Another worrying trend, revealed by research from Morgan Stanley, is that the sectors performing best with investors at present are doing so in spite of their forward earnings estimates, rather than because of them. The consumer discretionary sector, as shown here, is roaring forward, even though forecasts are diminishing relative to the rest of the market:  In the case of technology, forward estimates are positive, but not by anything like enough to justify tech companies' strong relative performance. (And yes, it does look quite a bit like the dot-com bubble of 1999 and 2000):  Both of these sectors have a FANG problem — they are distorted by the remarkable popularity of the dominant internet groups represented by the acronym. This is particularly true of the consumer discretionary sector. In the following chart, Oxford Economics took the cyclically adjusted price-earnings ratio for the MSCI all-country world index's consumer discretionary sector (which includes developed and emerging markets), without just two companies: Amazon.com Inc. and Tesla Inc. The difference is remarkable:  So there is a lot of excitement about a few companies boosting indexes. As all the most exciting companies are American, it is also interesting to see what earnings growth looks like when they are excluded. The following exercise was conducted by Chadha of Deutsche Bank. He excluded "mega-cap growth" and tech companies, and then reweighted the different regions in line with U.S. sector weights. On this basis the "Rest of the USA" is showing a slight fall in earnings. That's better than Europe, but behind Japan, where companies are showing a little growth. And all the excitement is in emerging markets:  Where does this exercise leave us? The main conclusions are: - Earnings and sales growth is genuinely strong, and the corporate recovery from the pandemic is going well;

- But that had been entirely priced in by the market before the releases started — speculative excitement is evidently driven by something else;

- The U.S. mega-tech/FANG complex is doing something truly special; the rest of corporate America, beholden to U.S. and world economic growth, are doing no better than developed counterparts;

- Something very impressive is happening in emerging markets.

Demographic ReversalOne final reminder: the Authers' Notes Bloomberg Book Club discussion of The Great Demographic Reversal by Charles Goodhart and Manoj Pradhan is only hours away. The book argues that inflation and rates are due to turn upward across the world, and inequality is poised to turn downward, thanks to the demographic shift that is under way. They see this as the consequence of the decline in the size of the working age population, looking after a growing portion of retirees. If you haven't read the book, it should still be worth following online.  The conversation will involve me, co-author Pradhan, my colleague Stephanie Flanders, and Blerina Uruci, senior U.S. economist at Barclays Plc. The live blog, which you can reach by going to TLIV <GO> on the terminal, will start at 4 p.m. in London/11 a.m. in New York. You can ask questions beforehand, or while the conversation is going on, by sending an email to authersnotes@bloomberg.net. You'll need access to the terminal to follow proceedings live, but we will have a transcript on the web for everyone to read by the end of the U.S. day. Judging by the submissions we have already received, it should be a fascinating discussion. Please take part if you can. Survival TipsLockdown conditions have been miserable, and many of us can barely stand Zoom any more. But occasionally it can bring joy. One such moment went viral today, and it was very funny. On the off chance that the phrase "I am not a cat" does not yet have any specific meaning for you, I suggest you watch this, and enjoy. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment