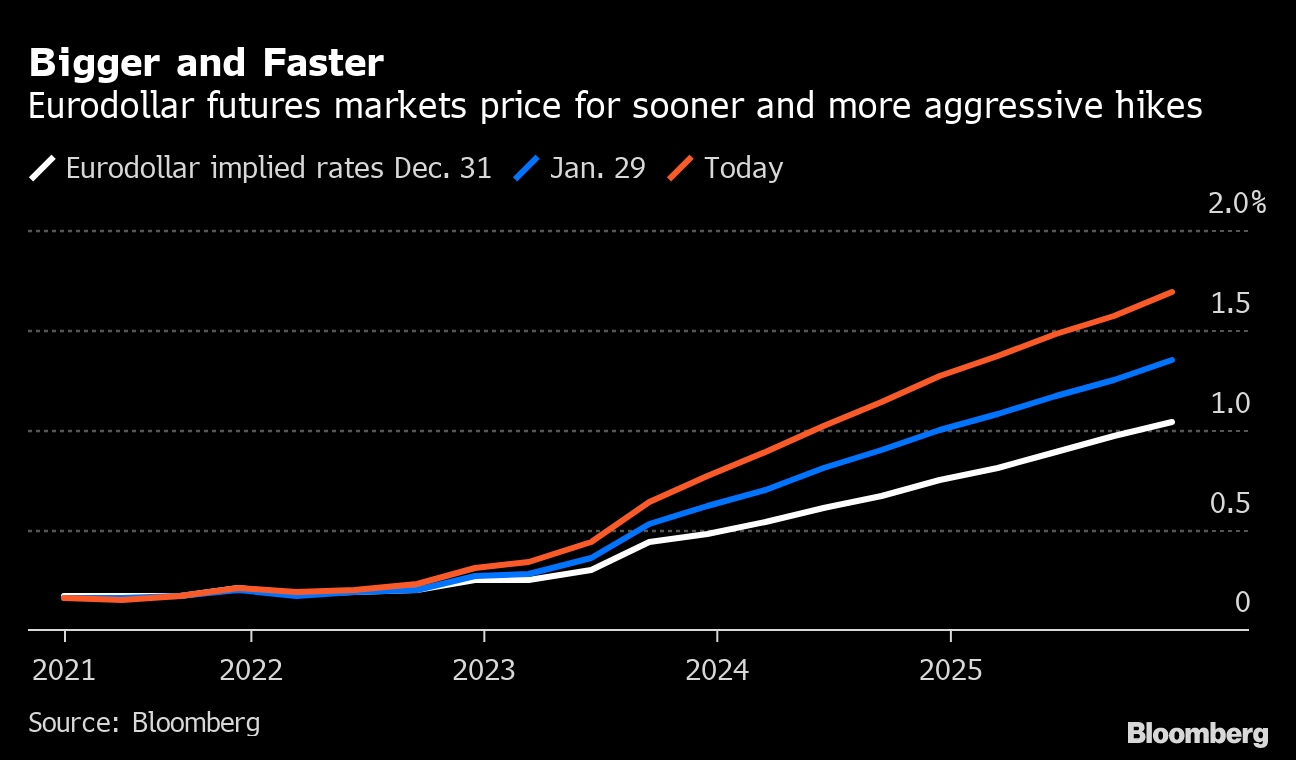

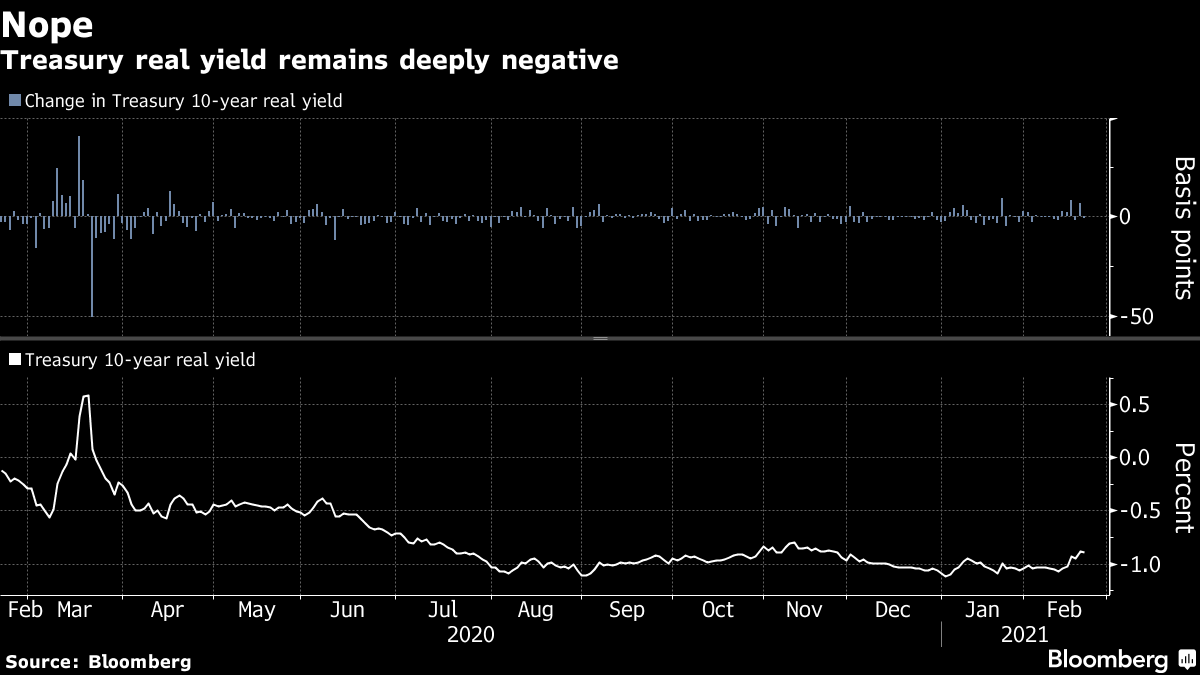

| Welcome to The Weekly Fix, the newsletter that is yet to devise a strategy - micro or macro - for Bitcoin. --Emily Barrett and Katie Greifeld, cross asset observers on either side of the world. Reflation... Are we there yet?At the start of this week, the U.S. 10-year yield jumped an extraordinary 11 basis points and the rest is history. (Well, maybe not quite but doesn't a week feel like forever these days?) This has only intensified the handwringing about an inflationary surge, premature Fed tightening and a potential stock market rout. (Larry Summers even ditched his secular stagnation theme). All of the above are possibilities in time. But for now, we can take a deep breath and await more evidence. By Wednesday, the world's largest bond market was steadying from losses that did, after all, happen in the midst of record-large auctions and holiday-thinned trade. These circumstances can temporarily weigh on the market and exaggerate moves, respectively. Here's the case for not panicking: 1) Inflationary surge.  Inflation in the U.S. is rising. But there's no sign that inflation is about to take off. The current rate is still below the Federal Reserve's target. It will look a fair bit higher in the next couple of months, as the change over a year starts to include the demand shock of the initial stages of the pandemic and global shutdowns -- but the underlying pressures are what count. And while the market's gauges of inflation expectations have increased significantly, they too imply a rate slightly below the 2% goal over the next decade. The path of inflation still looks higher, but a relatively benign course. 2) Premature Fed tightening. Traders have ramped up some pretty remarkable positioning for a Fed liftoff (aka the first interest-rate hike) as the reality of more-generous government stimulus has sunk in. The rate-hike premium built into money markets between this year and the end of 2023 has doubled since Jan. 5 -- the day of the Georgia runoff elections -- and now. And a first move in that period is now pretty much fully priced in. Here's my colleague Stephen Spratt's excellent chart:  The Fed may have something to say about this. The last set of projections from its open markets committee (albeit from December) showed most policymakers see interest rates stuck at rock-bottom for at least the next couple of years. None so far have offered strong signals that their views have changed. Fed Chair Jerome Powell said last week that the U.S. is "very far from a strong labor market whose benefits are broadly shared," noting there are still 10 million fewer jobs in the U.S. than before the pandemic struck. 3) Risk asset rout. Ok this one's really got everyone nervous. Stocks/stonks are at precipitous heights and there's a bit of high-jinx going on. Rising rates on super-safe assets should at some point start to pull demand from riskier markets, and JPMorgan's John Normand voiced concerns over emerging-market assets this week. But Pimco's Erin Browne is among those saying that we're not close to a broad shake out yet, judging by the still-deeply negative levels of inflation-adjusted yields. The benchmark 10-year real rate has risen roughly 20 basis points since the start of this year, but it's still in solidly negative territory.  The increase in benchmark yields has been driven primarily by rising inflation expectations, and that's the hallmark of recovery. "Typically it's a good environment for risk assets. Neither the pace nor the extent of the move so far has been unusual relative to other historical moves coming out of a recession," Browne said. "It would take a significant move in real yields in order to disrupt risk markets broadly." Goldman strategists took some time last week to consider what a sharper increase in real yields might look like, based on the last three experiences. (That's the 2013 Taper Tantrum, the 2015 Bund Tantrum -- both of which were sparked by fears of reduced central bank asset purchases -- and the post-U.S.-election growth boost of 2016). The main takeaway is that in each case, U.S. stocks rose, with the biggest gain in 2016, the U.S. dollar and oil strengthened, and gold fell. The second important takeaway is that the context of the increase mattered: "If growth expectations remain firm -- as was generally the case in recent episodes -- the impact on U.S. equities and credit is likely to be limited, even if the market experiences temporary anxiety. Shifts in real rates driven by expectations of more hawkish monetary policy, as occurred briefly within the 2013 taper tantrum, are apt to be more damaging." Still, judging by financial conditions showing U.S. markets in an historically laid back state, we're some way from worrying about that.  Bonds for BitcoinHi -- Katie Greifeld here. I couldn't resist stopping by to spill some ink on MicroStrategy's upsized convertible bond offering this week. For a bit of background, MicroStrategy is nominally a software maker, but made waves in August after revealing that it had purchased Bitcoin. In December, it sold $650 million of 0.75% coupon convertible notes to purchase more of the cryptocurrency -- bringing its total bet past $1 billion at the time. In fact, MicroStrategy has become so focused on speculating on cryptocurrency to boost its profits, it actually added a second pillar to its corporate strategy: "to acquire and hold Bitcoin." Well, MicroStrategy tapped the bond market again this week to further that specific goal. What was supposed to be a $600 million sale of convertible notes was boosted to $900 million, with an option for $150 million more within 13 days. The debt was priced with a 0% coupon -- you read that right -- and the company estimates total proceeds of about $1 billion, which will be used to purchase more of the world's largest cryptocurrency. What's fascinating about this phenomenon is that MicroStrategy is effectively providing an avenue for bond buyers to get a piece of Bitcoin's dizzying rally. Evidently, demand was strong. There's a monetary policy angle, too -- MicroStrategy's coupon marked the tenth 0% issue this year, which is in a large part a result of the Federal Reserve pinning short-term rates near zero.  In addition to the primary market demand, trading in MicroStrategy's existing December-issue notes are an interesting case study in convertible bonds. The yield-to-maturity on the 0.75% coupon 2025 notes currently stands at negative 17.7% -- a figure that was as low as negative 22.7% earlier this month. While that sounds nuts, it's not that uncommon to see negative yields in the land of convertible bonds. As ace Bloomberg News equity capital markets reporter Crystal Kim explains, the MicroStrategy notes are effectively trading as Bitcoin-linked bonds. As the token's price went parabolic, it dragged MicroStrategy's common shares along for the ride. The stock has skyrocketed since the debt was issued, pushing the notes -- which have a conversion price of about $398 -- deeply in-the-money. That basically tells you that these convertible notes are less bond, more stock at this point. But amazingly, no one appears to have converted them into common equity yet, according to data compiled by Bloomberg. Bonus PointsTexas's power disaster -- how to help, and don't blame green energy Don't blame the wind for Texas' power outages Wind turbines made of wood Perseverance pays off: See the Mars landing Krugman vs Summers on the risks of stimulus |

Post a Comment