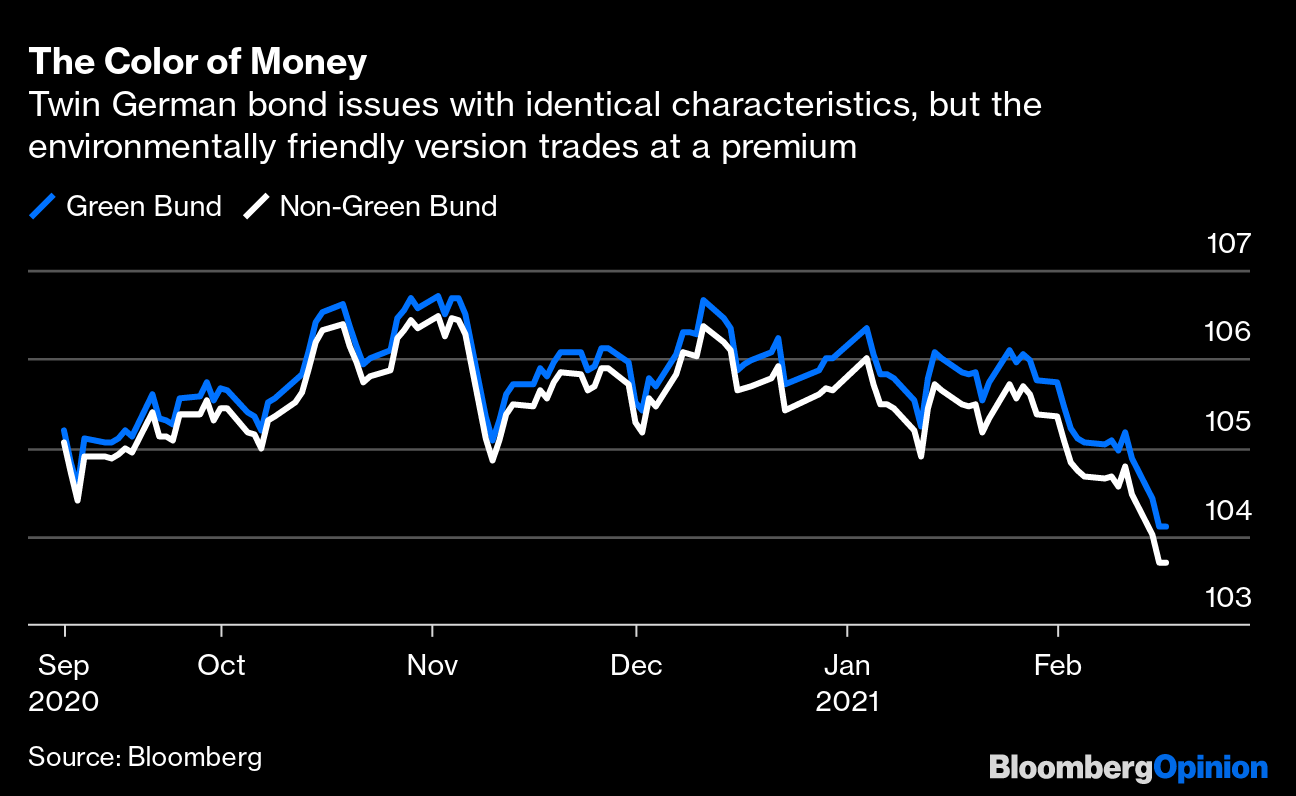

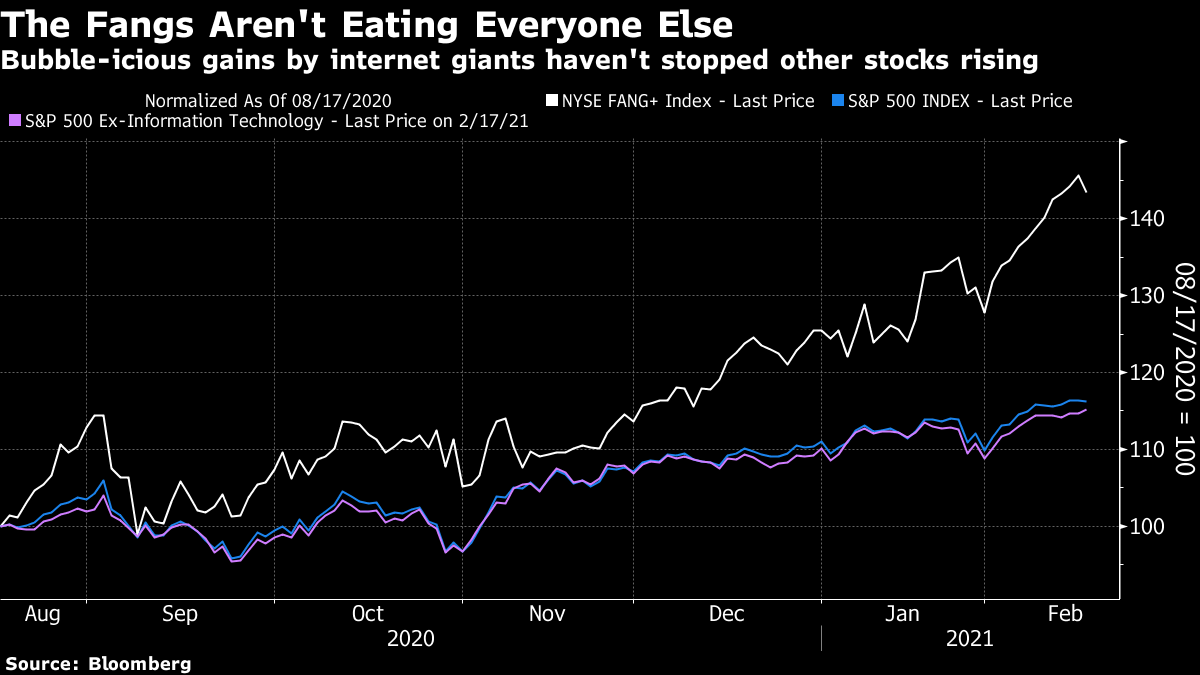

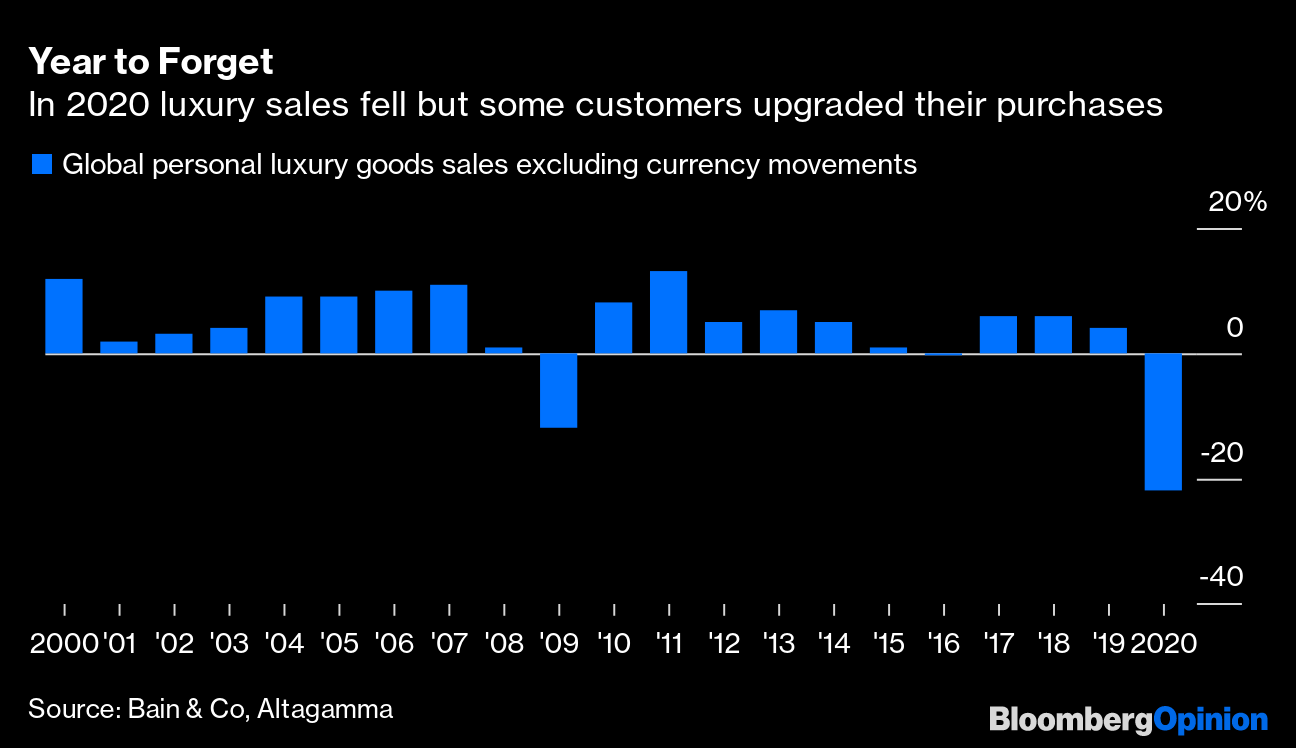

| This is Bloomberg Opinion Today, an ESG ETF of Bloomberg Opinion's opinions. Sign up here. Today's AgendaWhat If GameStop, But Green?Back in this newsletter's day, people bought stocks for good, wholesome reasons, such as making money, getting wealthy and becoming rich. Simple American values. Nowadays young whippersnappers buy stocks because of boredom or all their friends on the computer are buying them. Something must be done, so Congress had hearings today about what happened to GameStop stock that one time everybody on the computer got together and made it go up 11,000 percent for a few days. They will probably decide there's really nothing wrong with it and nothing needs doing about it, writes Matt Levine. Because no laws seem to have been broken, given there's no law against buying stocks because it seems fun. And plenty of people buy stocks for other nontraditional reasons these days without anybody holding hearings about it. Environmental, social and governance investing, or ESG, is theoretically about making money; the idea is that companies that don't actively destroy the environment or society or run themselves like Tony Soprano's crew will make more money in the long run. The trouble is these stocks haven't shown they can outperform the broader market, writes Nir Kaissar. On the one hand, this suggests these stocks aren't in a bubble. On the other hand, people may soon tire of buying them for virtue-signaling reasons if they keep not making any money. "Green" bonds, at least, don't seem to have this problem. Mark Gilbert compares two German bonds issued at the same time — one green, one sooty — and finds the green one is winning, by a bit:  And a few companies combine the best of both meme-investing worlds: Tesla is a Reddit hero but also a quintessential ESG stock. On the latter score, it could be doing better, David Fickling argues; its electric cars aren't completely green, given they often use dirty power to charge up. Tesla should open up to investors about this. Then again, as Tesla keeps proving again and again, nothing matters to the kids these days. Texas Keeps Hitting the Limits of Free MarketsIt's a free country, but it also frowns upon senators jetting off to sunny Cancun when their states are icy disaster zones, as Texas Senator Ted Cruz discovered today. Texas itself is learning the limits of its own supposed freedoms, as millions have been without power and water for days in a crisis that could have been avoided if the state had shed just a bit of its libertarian bent in favor of some central-government planning, writes Liam Denning. It's no stranger to such things anyway; just last year its oil producers begged for nanny-state protection against a cruel energy market. Cutting itself off from the rest of the country's grid, skipping the winter-proofing of its infrastructure, and running lean and mean were akin to driving a fast car without insurance, Liam writes. It's all fun and low prices until you skid on the ice, off the road and right into a tree. Women Need Extra Help Right NowThis recession has been a Bizarro World version of normal recessions in many ways. Manufacturing did fine, on account of people hoarding stuff to fend off shortages and madness. But leisure and hospitality industries were gutted by people not leaving their houses, while health-care workers were either on the front lines of the Covid fight or out of work for long stretches. This skewed the way recessions normally hit the genders, with men holding up better than usual but women, who are more represented in those hospitality and health-care industries, suffering unusually. This is why governments around the world need to design assistance for women, write Melinda Gates and David Malpass. This includes making sure they're not missed by relief programs, helping them participate in the economy, and better educating them for today's and tomorrow's jobs. This nightmare won't end for any of us until it ends for women. Telltale ChartsHistory suggests the out-of-control stock market may stay out of control for longer than you'd expect, writes John Authers.  Rihanna's luxury label fell victim to the pandemic, as consumers limited their purchases to known brands, writes Andrea Felsted.  Further ReadingThere's no reason to prop up NASA's failing Space Launch System when private alternatives abound. — Bloomberg's editorial board Joe Biden must pressure Ethiopia to end the bloodshed there and avoid a humanitarian disaster. — Bloomberg's editorial board Mitch McConnell's Trump strategy doesn't seem to be working out so far, but time will tell. — Karl Smith London's biggest worry isn't losing stock or derivatives trading; it's losing bankers. — Elisa Martinuzzi A VW spinoff of Porsche makes sense and might actually happen this time. — Chris Bryant While the U.S. grapples with its racist past, the U.K. and France keep pretending theirs don't exist. — Pankaj Mishra ICYMIA Covid vaccine surge is coming. The U.K. plans to deliberately infect volunteers. Ivanka Trump isn't running. NASA accomplished its trickiest rover landing yet, in a quest for signs of life. KickersMammoth DNA is the oldest ever sequenced. (h/t Ellen Kominers) Here's the most accurate flat map of Earth yet. People can answer questions while dreaming. Every superhero movie is a policy failure. Note: Please send dreams and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment