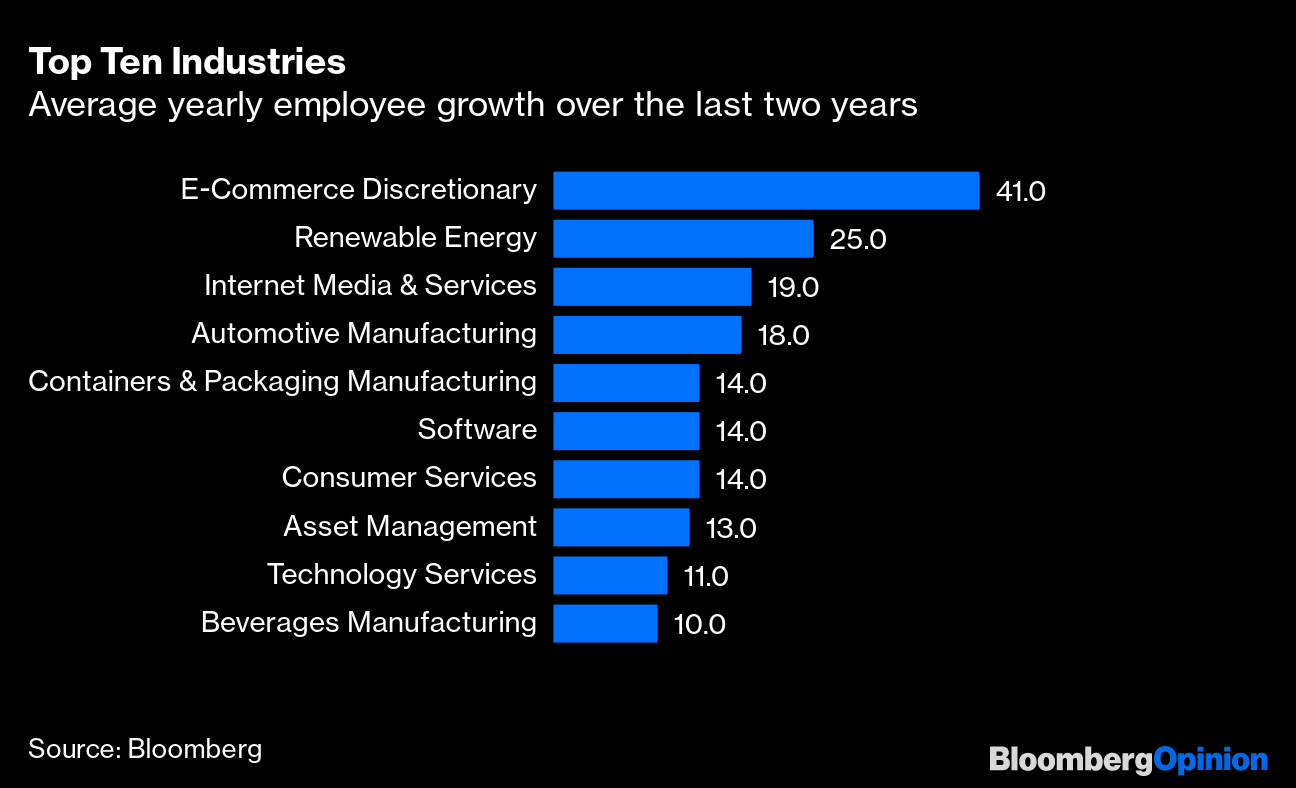

| This is Bloomberg Opinion Today, a black swan of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThese Are Not the Black Swans You're Looking ForNassim Taleb did himself and the rest of the world a big favor when he popularized the term "black swan" back in 2007, just before all the money caught on fire. Taleb became a renowned seer, and the rest of us had a convenient shorthand for when things went bananas. All the money is on fire? That's a black swan, baby. Donald Trump is president? Black swan time. Lady Gaga wears a meat dress? Black swan again. Black swan events, to roughly paraphrase Taleb, are things people don't see coming because of their limited human perception but have dramatic impact and seem inevitable in hindsight. Not everything fits this definition. If I forget to renew my home insurance and my house burns down, that's not a black swan event. Robinhood Markets CEO Vlad Tenev yesterday told Congress it was the black swan's fault when day traders nearly blew up his app by placing too many orders to buy meme stocks all at once. Like me with my ruined house, Tenev is really the one to blame, writes Tim O'Brien: It was possible to see such a thing coming and prepare for it. Congress is still hunting for black swans in the GameStop saga, but Nir Kaissar writes it's barking up the wrong, uh, pond. Weird stuff will happen (along with the laughs, Matt Levine notes) when you get a bunch of redditors together chasing tendies, but that is not a systemic crisis. Texas freezing over and losing power is another example of a false black swan, Tim notes. In fact, roughly the same thing happened just 10 years ago, and Texas gets cold and snowy more frequently than you might think. But the state acts as if there were nothing but white swans to the horizon, Bloomberg's editorial board writes, failing to winterize its equipment or accept that climate change makes freakish events more common. And it's not just Texas; much of the rest of the country's contingency planning for climate disasters amounts to pointing at the scape-swan. Adding layers of irony to the Texas story — sort of like how Ted Cruz leaving behind a dog named Snowflake when he flew to Cancun enriched his saga — many Texans wrongly blame clean energy for their power problems. But not only did wind turbines not fail as much as natural gas did, but clean energy also helps keep weather nightmares from getting worse. On top of that, it's creating jobs even as the fossil-fuel industry cuts them, Matthew Winkler writes.  That's a pleasant surprise. A green swan, you might call it. Lessons in Covid ManagementThe other thing you can't possibly call a black swan is the Covid-19 pandemic. Yes, it's been an awful event unlike anything we've experienced in 100 years, but people saw it coming. Governments around the world have nevertheless struggled to respond. Even some of those who are praised for their reactions hit their limits eventually. New York Governor Andrew Cuomo wrote an arguably premature book about his pandemic experience, but he is now besieged for under-reporting Covid deaths and generally being jerky. Justin Fox crunches the numbers and finds the state is persistently undercounting deaths, though he also finds some potentially exculpatory evidence suggesting this is less sinister than just weird and maybe jerky. Still, redemption is always possible. Boris Johnson made some big mistakes early in the pandemic, but lately the U.K. has been a model of vaccine distribution and scientific discovery, writes Sam Fazeli. There's hope even for the weird and the jerky. Lessons in Covid MarketsTraders could certainly be forgiven for seeing Covid as a black swan event, at least in the early days. Deeply swannish stuff happened to bond, oil and other markets as the financial world adjusted to the terrible new normal. John Authers looks back at the year in charts and finds one very comforting fact shined through: Throwing free money at everybody makes it all better. Less comforting: Someday all that free money might make it all worse again.  Another comforting revelation of the past year: Bond ETFs have proven much more resilient than expected, writes Brian Chappatta, and certainly more resilient than bond mutual funds. All of which adds to the inescapable sense the mutual fund concept itself is dying. Further ReadingPresident Joe Biden shouldn't reward Iran's latest shenanigans by jumping into a deal. — Bloomberg's editorial board Saudi Arabia and the UAE are allies now, but they will compete economically as they pivot from oil. — Bobby Ghosh Even the best master limited partnership really should stop being an MLP. — Liam Denning The SPAC planning to buy Lucid is soaring on high hopes and Reddit heat, which may be a mixed blessing. — Chris Bryant Uber's loss in U.K. court will complicate life for some in the gig economy. — Alex Webb It's time for social media to admit: Content moderation is impossible. — Cathy O'Neil ICYMIA Trump inaugural donor got 12 years in prison. Apple's working on magnetic battery packs for iPhones. A 26-year-old living with his parents built the world's best Covid model. Kominers's Conundrums HintBecause we LOVE our Conundrum solvers, we're extending the deadline for our Valentine's Day puzzle through noon New York time this Saturday, Feb. 20. And here's a hint to help you get started: If the problem of "marrying" different words sounds confusing, maybe first try to figure out what a couple of the clues could be pointing toward. Then ask yourself: To get there from the words in the two columns, what could be missing? — Scott Duke Kominers KickersFINALLY, science explains the rubber pencil illusion. (h/t Mike Smedley) Mars is a Linux planet now. Picture yourself there. How to be more productive without forcing it. It's a new golden age for sports cards. Note: Please send sports cards and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment