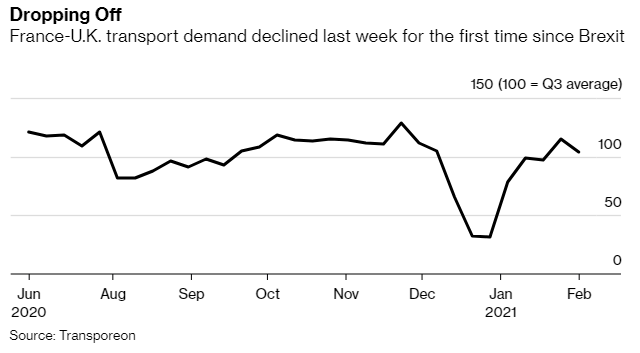

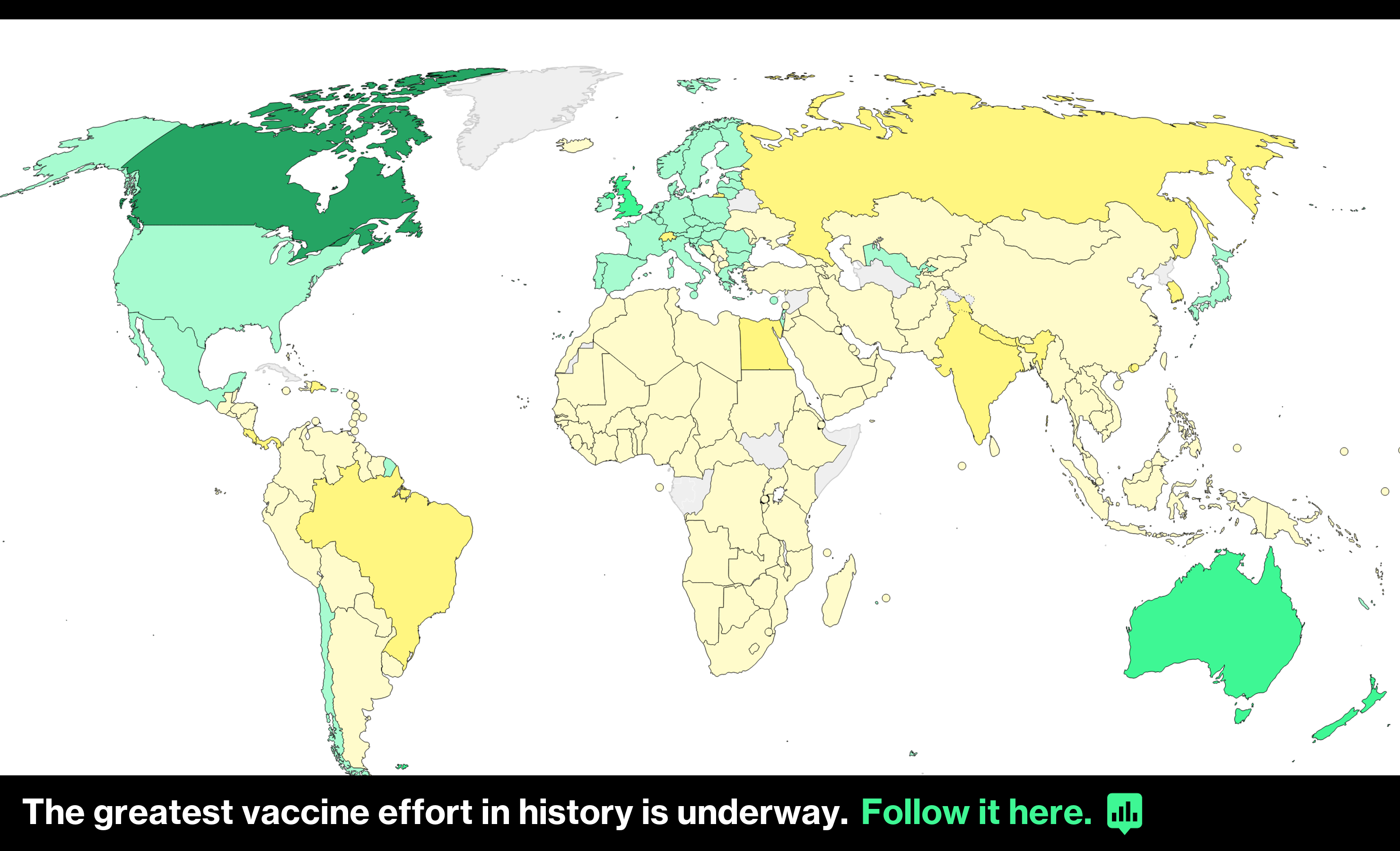

| What's happening? The divorce is getting uglier, with the European Union winning custody of more London financial services. Amsterdam has toppled London as Europe's biggest share-trading center. Six weeks into 2021, half the volumes that previously changed hands in the U.K. have migrated to the continent, with the Dutch capital the clear winner. Stock trading joins billions of dollars of derivatives and the carbon cap-and-trade system that have all exited London, highlighting the consequences of failing to secure a regulatory equivalence deal as part of the post-Brexit settlement.  But is it as bad as all that? The return of Swiss share trading to U.K. markets softens the blow, and, as William Wright of think tank New Financial tweeted, just a few dozen jobs at the exchanges have moved, while traders, hedge funds and asset managers have stayed put. Still, industry executives are pessimistic, as Silla Brush and Viren Vaghela report. They're worried Asian hubs and Wall Street could also eat into London's business. A trickle can also become a flood, argues Bloomberg Opinion columnist Lionel Laurent. The EU's demands on the U.K. are unrealistic and unworkable, according to Bank of England Governor Andrew Bailey. He said it's not worth Britain becoming a rule-taker just to land an equivalence deal – and that the EU shouldn't expect more from Britain than it does from the U.S. and other jurisdictions. Without a settlement, financial services will fragment across the continent, driving up complexity and costs for everyone, including the EU, the central banker said. Finance isn't alone in feeling the pinch. Data released on Friday show the U.K. economy grew slightly in the final quarter of 2020, but confirmed the toughest year for the economy since 1709. Half of U.K. exporters are facing post-Brexit difficulties that could threaten an economic recovery, according to a survey by the British Chambers of Commerce. Co-executive director Hannah Essex told Bloomberg TV small businesses are suffering the most with paperwork at the border. As Joe Mayes reports, those companies have less cash flow and organizational capacity to handle the changes, especially agricultural exporters. Real-time data underscore that Brexit and the pandemic's dent to trade isn't letting up. The Road Haulage Association said truck cargoes dropped off dramatically, and traffic-tracker Sixfold said weekly volumes were behind what's typical for five straight weeks. Cabinet Office Minister Michael Gove had disputed claims. Figures from the Office for National Statistics showed that the average number of daily ship visits to the U.K. was lower last week than a year ago.  The U.K. remains optimistic, with Gove comparing the friction to turbulence early in a flight: "We're not at the gin and tonic and peanuts stage yet." The EU added a chill to the relationship, with Ian Wishart reporting that European Commission Vice-President Maros Sefcovic rebuffed Gove's call for a reset in talks over Northern Ireland. Sefcovic wants Britain to honor its promises before moving ahead. New checks for some goods entering the province are set to go ahead without delay or the flexibility Gove wants. — Lizzy Burden This is a story we'll be reporting on for a long, long time. If Brexit's affecting you or your business, please get in touch. My email is eburden6@bloomberg.net Beyond Brexit Click here for the latest on the global coronavirus vaccine rollout. Sign up here for our coronavirus newsletter, and subscribe to our podcast. Watch Bloomberg Quicktake, our new streaming news service with a global view and an informed take. Want to keep up with Brexit?You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share the Brexit Bulletin: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. Like getting the Brexit Bulletin? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. |

Post a Comment