|

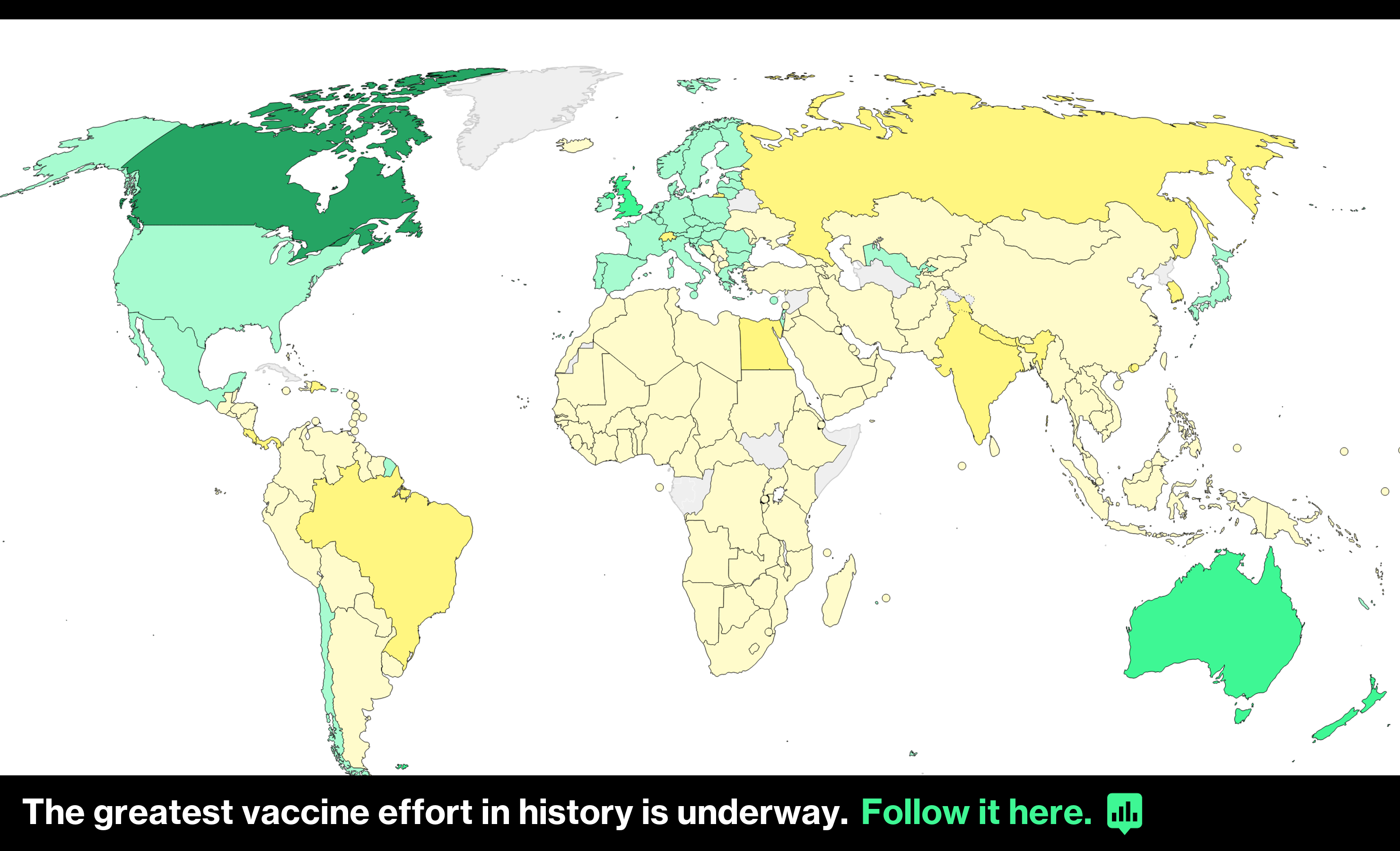

What's happening? Teething problems hurt at the border and cross-Channel jabs sting. The Brexit deal has already frayed at the Irish border. U.K. Cabinet Office Minister Michael Gove accused the European Commission of eroding trust by threatening border checks with Northern Ireland to control the flow of coronavirus vaccines. He's seeking a grace period past the end of March, when checks are due to kick in, as Joe Mayes and Alberto Nardelli report. The EU retreated within hours in last Friday's flare-up, but the incident risked undermining one of the most fragile parts of the trade agreement – the Northern Ireland Protocol – put in place to avoid checks at the Irish border. Look for more tension in the coming weeks. Joe Biden should step in to ease tensions, according to the leader of Northern Ireland's Democratic Unionist Party in London. The U.S. president could help prevent economic instability from sparking a return to violence in the region, Jeffrey Donaldson told Bloomberg's Kitty Donaldson in an interview.  Graffiti in the Village area of Belfast, U.K., Feb. 4. Photographer: Paul Faith/Bloomberg "We haven't seen anything yet" that would change how Brexit will impact the U.K. economy, Bank of England Governor Andrew Bailey said Thursday as the central bank held interest rates and asset purchases steady. That left intact the BOE projecting a new economic contraction and trade disruption that will "gradually, we hope, reduce over the first two quarters of this year." Trade flows now are almost back to normal, U.K. Transport Secretary Grant Shapps reckons, according to a story by Tim Ross. But high-frequency data from global logistics platform Transporeon show freight firms are still shunning the U.K., at least partly because truckers are put off by delays. The median time truckers spent in lines at Ashford, southeast England, was about 15 hours. The future of the City of London is at the mercy of political winds on both sides of the Channel. Harry Wilson and Neil Callanan ask whether Brexit marks the start of an irreversible demise for the Square Mile as thousands of cuts merge into a single bleeding wound. Strengthening that sense of doom was a warning this week from the Bank of England that financial institutions should lower their expectations for a quick deal on "equivalence," which would enable cross-border access for their business. Meanwhile, not everyone is pessimistic: Barclays Plc Chief Executive Officer Jes Staley thinks Brexit will benefit the financial hub. The Scots might not like Brexit, but separating from the U.K. would cost their economy up to three times as much as leaving the EU – and re-joining the bloc might even increase the damage, according to modelling by the London School of Economics Centre for Economic Performance. It found the cost of trading between the two nations would increase by almost a third if Scotland became independent. Finally, new freedoms on state aid mean the U.K. is studying ways to dish out subsidies. Prime Minister Boris Johnson is looking for a "more dynamic" way to use government money to spur business. Building on that theme, bidding is due to finish Friday on which cities can bid to become one of up to 12 "free ports" in the model of Dubai. It's part of the government's post-Brexit vision to boost trade by lowering taxes and regulation. — Lizzy Burden Beyond Brexit Click here for the latest on the global coronavirus vaccine rollout. Sign up here for our coronavirus newsletter, and subscribe to our podcast. Watch Bloomberg Quicktake, our new streaming news service with a global view and an informed take. Want to keep up with Brexit?You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share the Brexit Bulletin: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. Like getting the Brexit Bulletin? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. |

Post a Comment