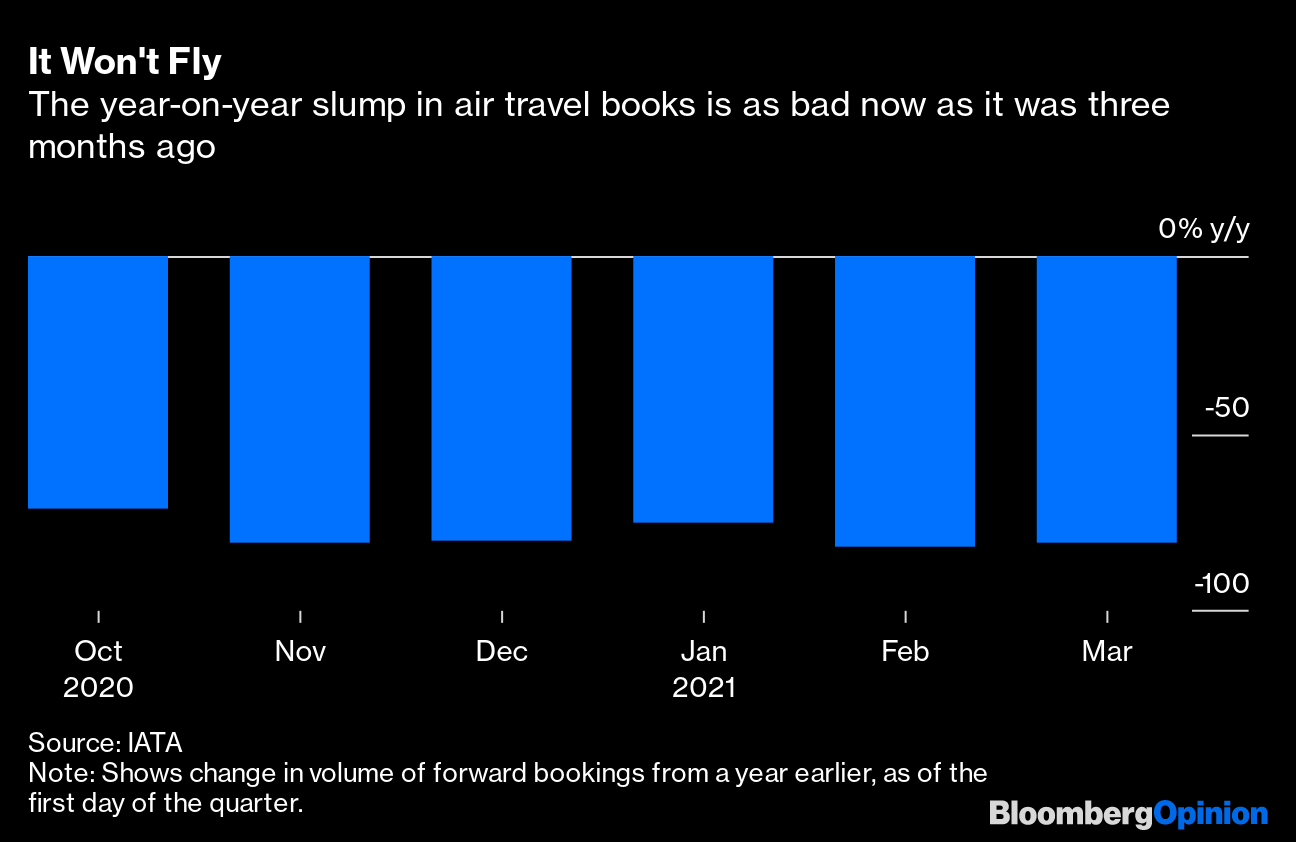

| This is Bloomberg Opinion Today, a reconciliation of Bloomberg Opinion's opinions. Sign up here. Today's Agenda Larry Summers in 2009. Photographer: Alex Wong/Getty Images North America Learning From Our Stimulus MistakesFor a second this morning, it seemed President Joe Biden might back down from his $1.9 trillion plan to help the pandemic-battered U.S. economy. Politico reported the White House was listening to warnings from former Treasury Secretary Larry Summers not to go too big. But then the January jobs report came out, and it was pretty bad, and big relief was back on the menu. Biden and many around him rushed to say they feared doing too little rather than too much, displaying a shocking degree of learning from the mistakes of President Barack Obama. These were also partly the mistakes of Larry Summers, who helped build Obama's inadequate stimulus package in 2009, notes Karl Smith. Summers says spending too much now will make it harder to spend more on infrastructure later, but Karl counters there's no basis for such fear. In fact, a strong economy could help us better afford to upgrade its foundations. And the $1.9 Trillion Express has already left the station anyway, notes Brian Chappatta, conducted by Vice President Kamala Harris. At the crack of dawn, after an all-night vote-a-rama, she cast the deciding vote for a budget that will become a relief package soon. Markets understandably are betting even harder on reflation, with stock prices and interest rates rising. Biden may have to pass his plan with zero Republican votes, though there are signs of elusive bipartisanship in Washington. Sixty senators shot down a Ted Cruz plan to curb immigration, and then maybe looked at each other in amazement, realizing they might have the votes for filibuster-proof immigration reform. Meanwhile, Mitt Romney, who as of this writing was still a Republican, proposed just straight-up paying people to have children and paying for it by cutting other welfare. His plan got the bipartisan stink eye today, but it has potential. And Ramesh Ponnuru calls it an example of what a post-Trump Republican Party can be, if it wants to be: a source of ideas to actually govern in fresh, conservative ways. If Democrats can learn from their mistakes, then maybe Republicans can, too. How Do You Solve a Problem Like MTG?Or then again, maybe not. Marjorie Taylor Greene, congressperson from Georgia, remains a beloved member of the House Republican caucus despite trafficking in toxic conspiracy theories, such as that Democrats eat babies and Jewish bankers burned California with space lasers. Her half-baked apologies weren't enough to keep Democrats from stripping her of committee assignments last night. Such extreme actions don't set a great precedent, writes Jonathan Bernstein, but then again something must be done to push back on the extremism growing on the other side of the aisle. Ideally, such policing would have been done by Republicans, writes Bloomberg's editorial board. Letting Greene and her ilk turn formerly consensus ideas such as "9/11 actually happened" and "maybe don't shoot Democrats" into partisan issues only corrodes the party and the government of which it's a part. Don't Stop GameStopAs of this writing, GameStop stock is worth less than $63 a share. A week ago it was worth $325. Somebody has lost some money, and maybe a lot. But these are the breaks, notes Nir "Kurtis Blow" Kaissar: People make and lose money on volatile stocks all the time. But because GameStop made headlines for a couple of weeks, regulators are busy figuring out how to prevent such horrors from happening again. It can't be done, and it shouldn't, Nir writes. Instead of trying to protect investors from themselves, regulators should make sure markets are open and fair and that investors are educated. If we really want to protect investors, then we should hurry up and de-list the Chinese stocks the Reddit crowd has recently discovered, writes Shuli Ren. Unlike GameStop, which has an understandable business model and accessible financials, these stocks are far less vetted and far riskier. And Aaron Brown wonders why day traders don't do more with stock futures, which offer less disruptive ways for people to gamble. Telltale ChartsBond yields are no longer low enough to make a compelling case for owning super-expensive stocks, writes Brian Chappatta.  Cash-starved airlines will keep offering option-like deals to pull money from consumers' wallets, writes David Fickling.  Further Reading Harley-Davidson is giving hourly workers stock to motivate them to help with its turnaround. — Brooke Sutherland Biden is going his own, surprisingly hawkish, way on Iran. — Bobby Ghosh He's also trying to make America's relationship with Saudi Arabia more balanced. — Eli Lake The best Super Bowl ad could be the NFL explaining how it fought Covid effectively. — Joe Nocera McKinsey's opioid settlement should be a wake-up call for consultants that they will be held to higher standards. — Chris Hughes SEC interest in Chamath Palihapitiya's Clover Health hints at a new era of closer scrutiny for SPACs. — Chris Bryant ICYMILong-haul travel might not resume until 2023. Crypto hedge-fund manager admits to crypto fraud. Shorting hedge funds are getting death threats. KickersArea man won't give police his Bitcoin password. (h/t Scott Kominers) Our long national Peep nightmare is over. (h/t Mike Smedley) Childhood diet has a lifelong impact. IBM quantum computers are getting faster. Note: Please send Peeps and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment