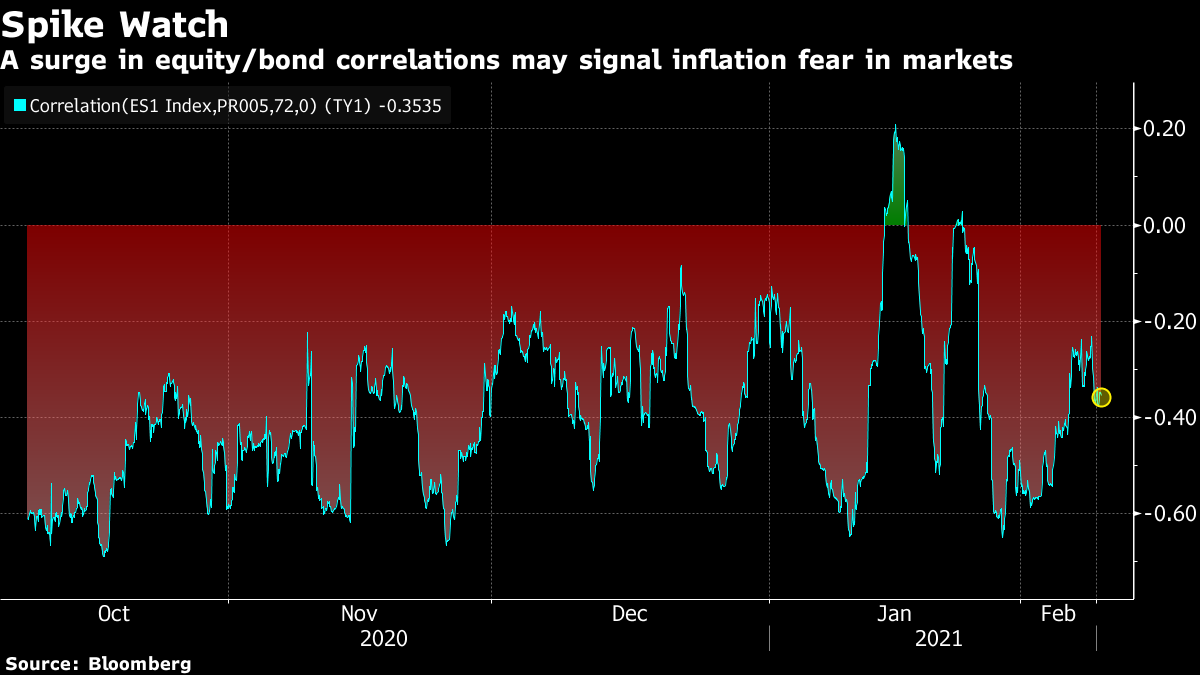

| Good morning. Bitcoin's Tesla rally, steady stocks, Trump's second impeachment. Here's what's moving markets. Tesla EffectDebate is rife over the long term consequences of Tesla's investment in Bitcoin. The cryptocurrency has soared almost 20% against the dollar since the electric carmaker revealed it had invested $1.5 billion and signaled an intent to begin accepting the cryptocurrency as a form of payment. Tesla becomes the second largest publicly-traded corporate holder of the digital currency, but the the question now is whether or not other big firms follow suit. One analyst reckons Apple should do so, while also considering launching a crypto exchange. The digital coin topped $47,000 overnight, and while some are now touting $100,000 by year-end, nothing with Bitcoin is ever certain. Calm MarketsStock markets feel remarkably calm as investors wait patiently for vaccine rollouts to progress. The Stoxx 600 gauge hasn't had a down day this month, though futures on some countries' indexes are lower this morning. In currencies, the pound is higher against the dollar even as the Bank of England's prediction of a rapid economic rebound is questioned amid concern around the impact of the South Africa virus mutant -- something that's already hurting retail sales in Britain. Italian assets, meanwhile, continue to be boosted by premier-designate Mario Draghi bringing together warring parties from across the political spectrum. How has he pulled it off? "He's Draghi," said one official. Brent crude oil remains above $60 a barrel. Round TwoGroundhog Day comes a week late in Washington as Donald Trump's second impeachment begins. The former president's lawyers argued in a brief filed Monday that the charge that he incited an insurrection at the U.S. Capitol last month should be dismissed as it violates his free speech and due process rights. Many Senate Republicans have argued that trying the former president after he's left office is unconstitutional, in a sign that Trump is all but assured of escaping conviction. Still, some are just happy for all the circumstances to be aired in public. Real WinnersHedge funds gained in January even as retail-driven short squeezes added to concern around virus infection spikes. While there were high profile losers, the industry rose 0.6%, according to preliminary figures from the Bloomberg Hedge Fund Indices. Meanwhile, the platform where the new short sellers organized, Reddit, says it raised $250 million from private investors, riding the recent publicity. Terms of the funding pushed its valuation to $6 billion. The company, which ran a Super Bowl ad, intends to spend the cash to develop its advertising business and expand internationally. What's still unclear is how the retail traders themselves fared, particularly given the huge slumps in stocks like Gamestop and AMC more recently. Coming Up…Oil giant Total and online grocer Ocado are on the earnings schedule, while Twitter reports after the close in New York. Watch shares of lender Natixis, too, with French financial group BPCE in advanced discussions about a potential offer to buy out minority shareholders, according to people with knowledge of the matter. Meanwhile, the London Stock Exchange's first medical marijuana stock, MGC Pharma, begins trading after the firm raised about 6.5 million pounds ($9 million) in an initial public offering last week. Elsewhere, economic statistics include German trade balance and Italian industrial production, while the European Central Bank's top economist, Philip Lane, speaks during a fiscal discussion hosted by Ireland. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWith investors seemingly cheering the "imminent'' return of inflation, they need to be careful what they wish for. A faster-than-expected surge in prices would bring forward the day central banks are forced to tighten policy, taking away the punch bowl that is lubricating the current risk rally. And the higher bond yields climb, the more there is an argument for an alternative to equities, undermining the TINA mantra. That makes monitoring the link between stocks and bonds crucial, to watch out for the trigger point that shows when inflation has flipped from being a positive to a negative for risk assets. JPMorgan strategists have suggested short-term equity-bond correlations will do the job, with the danger signal coming when there is rapid spike. A high-frequency measure of 72-hour correlation between S&P 500 futures and 10-year Treasury equivalents stood at about minus 0.34 on Tuesday, up from minus 0.57 at the end of January, data compiled by Bloomberg show. That shows a slow rise, but no spike and implies traders are not yet concerned about the negative impact of price rises. JPMorgan calls it the ``most important indicator'' in global markets right now, and it is one worth keeping an eye on.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment