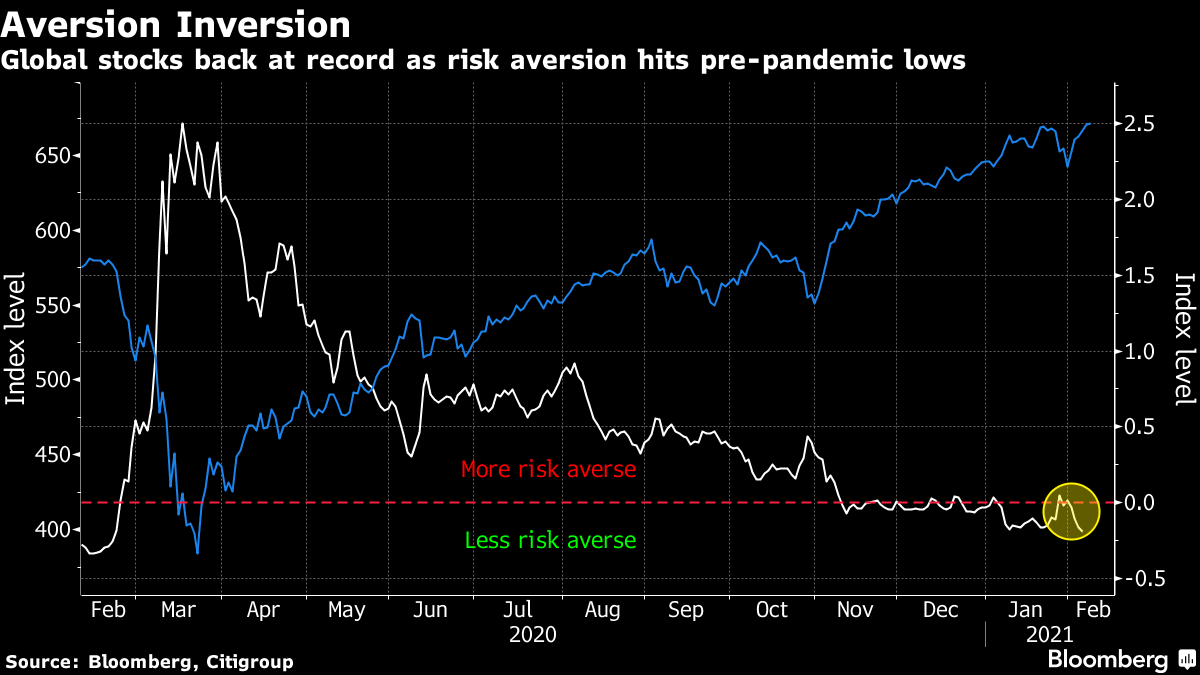

| Good morning. New variant vaccine, chipmaker deal talks, stocks edge higher. Here's what's moving markets. Astra Adapts VaccineAstraZeneca's Covid-19 vaccine showed limited efficacy against mild disease caused by the variant first identified in South Africa, according to early data. Protection against severe illness hasn't yet been determined, Astra said, with the Financial Times reporting the study will be published today. Work is already under way to adapt the shot and a new version is "very likely" to be available by autumn. The U.K. has predicted that annual vaccination drives may be needed. Elsewhere, France aims to vaccinate up to four million by the end of this month, and Germany may have to extend its lockdown when state and federal leaders meet on Wednesday, according to the Bavarian state premier. Dialog Deal TalksU.K. chipmaker Dialog Semiconductor is in advanced discussions to sell the company to Japan's Renesas Electronics for about 4.9 billion euros ($5.9 billion), with an offer price 20% above Friday's close. The company, whose shares trade in Germany, previously held discussions with Franco-Italian group STMicroelectronics, people familiar with the matter said. The volume of deals involving semiconductor companies more than doubled last year to $144 billion, according to data compiled by Bloomberg. In separate deal news, Veolia Environnement has gone hostile in its long-running attempt to buy French utility rival Suez. Markets PositiveThe euro is little changed after failing to see a big boost from news of Mario Draghi being linked up as Italian prime minister. Draghi will start a second round of talks with parties today and is expected to meet trade unions and business lobbies. Assuming the talks go well, Draghi could announce his cabinet picks this week before facing confidence votes in both houses of parliament. In stocks, an index tracking global bourses hit another record high and European futures are higher. Oil edges up again after hitting a one-year high last week. democraticU.S. President Joe Biden was questioned on why he has not spoken to Chinese President Xi Jinping since entering the White House. "We haven't had occasion to talk to one another yet," Biden said in an interview with CBS recorded Friday. Despite seeing no need for conflict, Biden said China's leader "doesn't have a democratic, small 'd,' bone in his body." China's top diplomat last week warned the U.S. not to cross the country's "red line," in a speech seen as pushing back against early moves by Biden to press Beijing on human rights. Coming Up…Today's earnings slate is light but there's a busy week ahead, with lender Societe Generale and brewer Heineken among the highlights. Watch shares of Rolls-Royce, too, as the aviation engineer proposes shutting down operations at its civil aerospace business for two weeks. Meanwhile, Tesco is leading calls for a higher online sales tax in the U.K. In data, we'll get industrial production from Germany after statistics Friday showed a drop in factory orders. Here's what else is coming up for the economy in the days ahead. Elsewhere, European Central Bank boss Christine Lagarde is participating in a debate about the institution's annual report at the European Parliament. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningThe January jitters are well and truly behind us, according to one global gauge of investor risk appetite. Citigroup Inc.'s Global Risk Aversion Index, a combination of market indicators across asset classes and geographies, has fallen to its lowest since the pandemic first roiled markets earlier this year. Its current reading below zero points to market stress now being below the long-term historical average as investors continue to bet on a return-to-normal for much of the global economy this year. The gauge popped briefly into positive territory late last month as the retail investor ruckus upset markets, but was quick to resume its march lower. With the MSCI AC World Index of global shares back at record highs it's easy to see why risk aversion is retreating. But with signs of excess continuing to pop up in a number of markets -- from cryptocurrencies to tech IPOs to SPAC launches -- it may not be the time for investors to be too brave.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment