| Biden preps go-it-alone stimulus strategy, Bitcoin surges, and Trump's second impeachment trial begins. Fast track President Joe Biden seems to be softening his desire to gain some Republican support for his $1.9 trillion stimulus bill. White House Press Secretary Jen Psaki said that the plan will probably advance under the budget procedure which means it will only need a simple majority in the Senate for approval. Biden is being won over by liberal Democrats who cite the reduction in the size of the 2009 bailout as the cost of reaching compromise with Republicans. On the current package, House Democrats are proposing limits to the next round of payments to households, which would fall to zero for those earning more than $200,000. Bitcoin While yesterday's newsletter said that cryptocurrencies were getting interesting again, we had no idea what Elon Musk had up his sleeve. While he had been extoling the virtues of Dogecoin on Twitter, the biggest market move was in Bitcoin which surged after Tesla Inc. announced that it had made a $1.5 billion investment in the cryptocurrency. In Asia trading the digital token moved above $48,000 for the first time, with fans of the currency saying that the adoption by the fourth-biggest company on the S&P 500 Index could be the start of more mainstream adoption. Impeachment The Senate begins former President Donald Trump's second impeachment trial today with a fight over whether it can proceed at all. Trump faces a single charge of inciting an insurrection relating to the Jan. 6 riots at the Capitol in Washington. His lawyers argue that the trial violates his free speech and due process rights as well as being "constitutionally flawed." The debate today over whether the trial can proceed will be settled in the Senate by a simple majority, meaning it's likely to properly get going tomorrow when Trump's defense team will begin up to 16 hours of presentations. Markets mixedThe run-up in stock prices is taking a pause today as investors digested another raft of earnings and weighed the impact of rising inflation expectations. Overnight the MSCI Asia Pacific Index added 0.4% while Japan's Topix index closed 0.1% higher. In Europe, the Stoxx 600 Index was 0.4% lower at 5:50 a.m. Eastern Time with energy companies among the few posting gains. S&P 500 futures pointed to a small drop at the open, the 10-year Treasury yield was at 1.146% and gold rose. Coming up... U.S. December JOLTS job openings data is at 10:00 a.m. Soft commodity investors will closely watch the U.S. Agriculture Department's monthly World Agricultural Supply and Demand Estimates at 12:00 p.m. for evidence of shrinking corn and soybean supplies. St. Louis Fed President James Bullard is today's only monetary policy speaker. Twitter Inc., Cisco Systems Inc., DuPont de Nemours Inc. and Lyft Inc. are among the many companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThis is the most interesting moment for the economy I've seen in my career. Now granted, I've only been following markets and the economy for about 17 years, and only about 12 as a reporter. Still, something feels different.

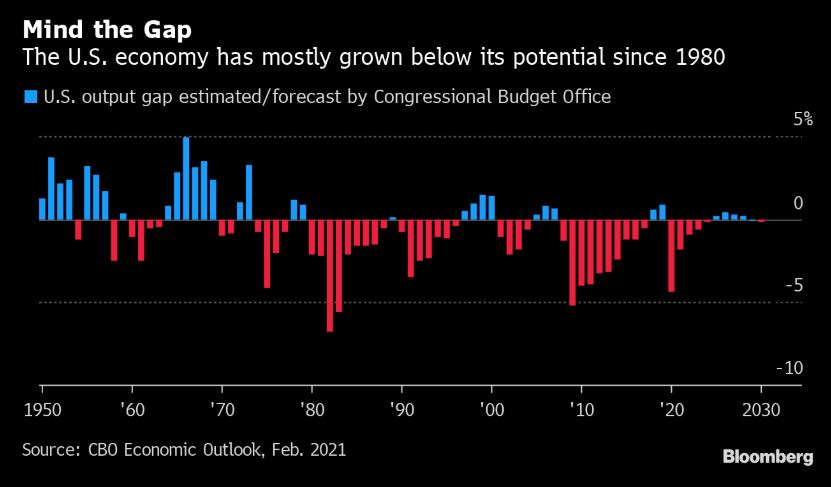

-- Read the latest piece from Bloomberg's Ben Holland, Matt Boesler and Katia Dmitrieva on Biden's bet on run-it-hot economics. Here we have an administration that is eager to add a substantial amount of fiscal stimulus to an economy that's already expected to grow robustly this year and next, with the receding of the virus. Remember back in 2009, Obama was already turning his focus to austerity, and that was in the midst of a much worse slump after a much smaller fiscal stimulus. -- Meanwhile, the Federal Reserve has a new framework that's much more friendly to run-it-hot economics. Whereas previously, the Fed attempted to slowly pre-empt inflation by tapping the brakes at the point where its models said inflation would pick up. Its new strategy aims to actually see sustained firming in headline inflation measures. -- Typically speaking, we expect to come out of downturns with household balance sheets totally wrecked, causing an overhang on the economy for years to come. At least that was the case coming out of the Great Financial Crisis. This time around, we're coming out of a crisis with household savings in relatively good shape (in aggregate) and a booming housing market (and a booming stock market). -- There are other changes happening in the debate. There's a much greater appreciation for the power of direct checks, as opposed to "stimulus" projects that can take a long time to filter out into the economy.  -- Meanwhile, the politics have totally changed. Democrats saw what happened when they presided over a weak recovery in 2009 and 2010, as they proceeded to get clobbered by Tea Party Republicans. As this piece from Mario Parker and Nancy Cook makes clear today, it's the left's go-big approach that's winning the political argument in D.C. -- And the intellectual climate has changed. The old-school deficit hawks are almost silent this time around. There are some critics of the size of the stimulus, for sure. Larry Summers is one. But mostly the argument revolves around whether the real economy can absorb so much spending, and whether that will be inflationary. This is, in a sense, a debate happening on MMT terms. (MMTers argue that the constraint on spending isn't the borrowing, but whether inflation will emerge as a result of too much spending.) -- And of course, there are, bottlenecks emerging in the economy to watch. There's a chip shortage for one thing. Shipping costs are soaring. Oil prices have been on the rise. Housing is very scarce. How the Fed navigates measured rises in the price of various categories will be one of the main stories of 2021. The key thing is that since the 1980s, the economy has run persistently below the CBO's estimate of full potential, with only a few quarters above it. Throughout this time we've seen a steady slide in yields, and an economy characterized by slow growth and low inflation. Nothing is certain, but there's a possibility that between the solid state of existing private-sector balance sheets, a Fed willing to let things run hot and an administration that's eager to spend more that we break out of this rut in a way that we haven't seen in a long time. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment