| Stimulus efforts progress amid party rancor, claims data due, and regulators gather to discuss retail mania. Checks While President Joe Biden isn't willing to move on the size of the $1,400 stimulus checks to individuals in his $1.9 trillion package, congressional Democrats are weighing whether to reduce the earnings threshold above which the payments are phased out. With the White House still hoping to garner some Republican support for the measures to boost the economy, GOP lawmakers are involved in internal power struggles between moderate and Trump-supporting wings of the party. The Senate will also take up the final passage of the budget resolution today, the debate on which was opened in a party-line vote on Tuesday. Claims The driving force behind the stimulus package is obviously the damage done to the U.S. economy by the pandemic. Recent data suggests a recovery is starting, with the nascent trend getting a health check at 8:30 a.m. Eastern Time when latest weekly jobless claims figures are published. Economists surveyed by Bloomberg expect a drop to a still-elevated 830,000. The January payrolls report is out tomorrow, with expectations for 100,000 new positions to be added. Consumer protection Today's meeting of regulators overseen by Treasury Secretary Janet Yellen to discuss the recent market volatility driven by retail investors is seen as a test on how the new administration will deal with consumer and investor protection issues. While the U.S. Securities and Exchange Commission is already probing social media and online message boards for signs of collusion and lawmakers in Washington have moved to hold hearings on the issue, there is little to suggest that today's meeting will lead to any concrete action. Shares in GameStop Corp., which have been the poster child for the recent volatility, are slightly higher in premarket trading this morning. Markets mixedThis week's move higher in global equities is running out of steam a little today, as corporate earnings rolled in and the dollar rose. Overnight the MSCI Asia Pacific Index slipped 0.6% while Japan's Topix index closed 0.3% lower. In Europe, the Stoxx 600 Index was 0.1% higher at 5:50 a.m. in mixed trading as investors digested a raft of company results. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 1.137%, oil rose and gold dropped. Coming up...U.S. December factory and durable goods orders are at 10:00 a.m. Dallas Fed President Robert Kaplan and San Francisco Fed President Mary Daly speak later. It is a mammoth day for earnings, with Ford Motor Co., Snap Inc., Merck & co. Inc., Gilead Sciences Inc., Clorox Co., Philip Morris International Inc., T-Mobile US Inc. and Pinterest Inc. among the many, many companies reporting. The Bank of England's rate decision at 7:00 a.m. is expected to hold policy unchanged. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningOn the latest episode of the Odd Lots podcast, Tracy Alloway and I talked to Jeff Currie, the head of commodities research at Goldman Sachs. And I think it's one of the most important and out-of-consensus macro conversations I've had in a long time. His view is that we're heading into a new commodities bull-market supercycle, reminiscent of the 1970s. He argues that President Biden's policy priorities will contribute to a boom in oil prices, and other industrial commodities.

His basic argument has a few parts. One key element is the nature of green stimulus. While moves to electrify and decarbonize the economy will, in the long run, reduce the commodity-intensity of economic growth, these benefits are felt on the back end after years of capital expenditures. In the short run, faster growth and investment will naturally increase demand for commodities by delivering a jolt to growth and consumption. What's more, because of environmental reasons, and the potential lack of long-term demand for, say, oil, these price increases won't be met with increased investment in new production/mining/exploration etc. the way they might normally in a price boom. Again, if you think the long-term future is an economy less dependent on hydrocarbons, why invest now, even if prices are moving higher? Currie also notes that Biden has a lot of discretion about taxes on drilling on federal lands and that he can institute a stealth carbon tax, lifting the global price of oil in a bid to make clean energy (wind, solar etc.) even more cost-competitive.  Finally, the bigger macro backdrop is that he sees the 2010s as having been similar to the 1960s, a decade characterized by strife on multiple fronts. Hence the potential repeat of the 1970s, when inequality fell broadly before the start of the Volcker/Reagan era a decade later. The other big aspect of his view is economic redistribution. It's well understood by now that lower-income households have a higher propensity to consume, rather than save, their marginal dollars. So, direct checks, and other forms of wealth redistribution under Biden, will grow the economy faster than, say, the Trump tax cuts. But furthermore, says Currie, the consumption of lower-income households is more commodity-intensive than the consumption of higher-income households. Hence wealth redistribution gives you a double jolt: more growth, and more commodity-intensive growth specifically. More broadly, we're coming off a decade-long commodity bear market, marked by declining investment in the space, and as it is we're already seeing deficits emerge in various industrial commodities at a time when governments around the world are stimulating their economies to get out of the pandemic.

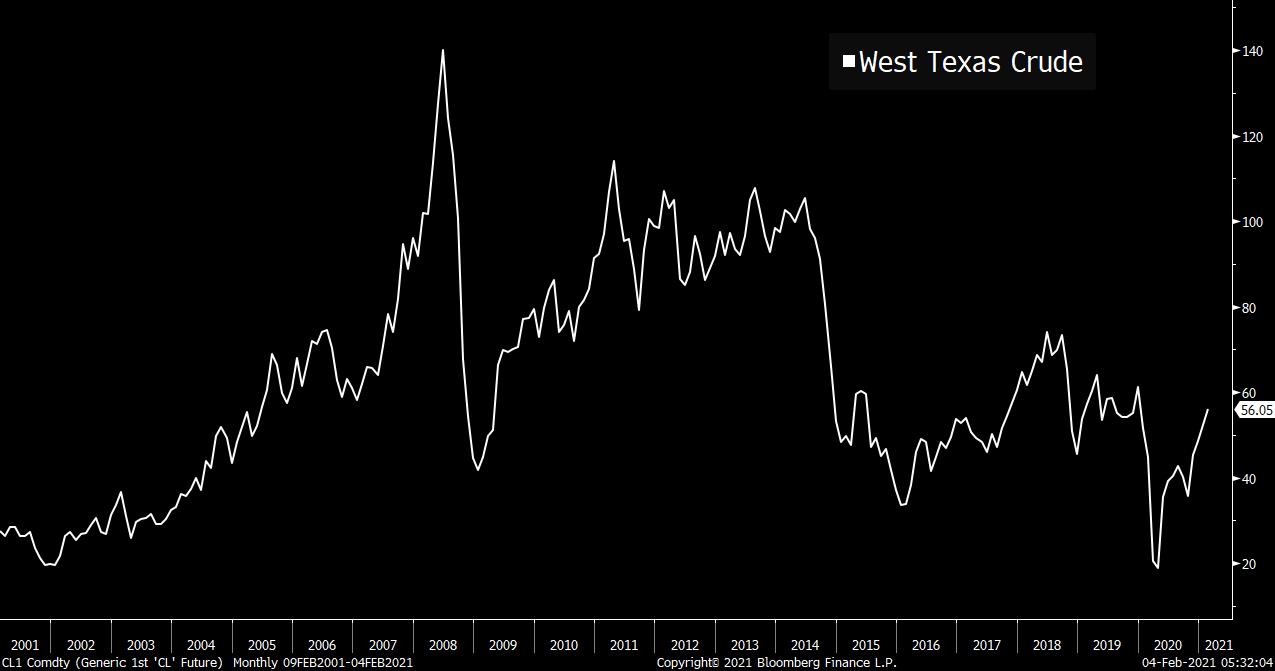

The macro implications of Currie's view, that commodities will run a lot further for a lot longer, are intriguing. Oil's been on a tear lately. A barrel of West Texas Crude was below $36 at the end of October. This morning it's above $56. There are signs that the economy is in much better shape this winter than had been anticipated. If the reopening does produce the much-expected economic boom, and you get stimulus, and you get any post-stimulus economic regime change, and you see a sustained commodities boom, we could be looking at a macro picture that's unfamiliar to those who've become accustomed to a decade of slow growth and lowflation.

Check out the episode on iTunes here. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment