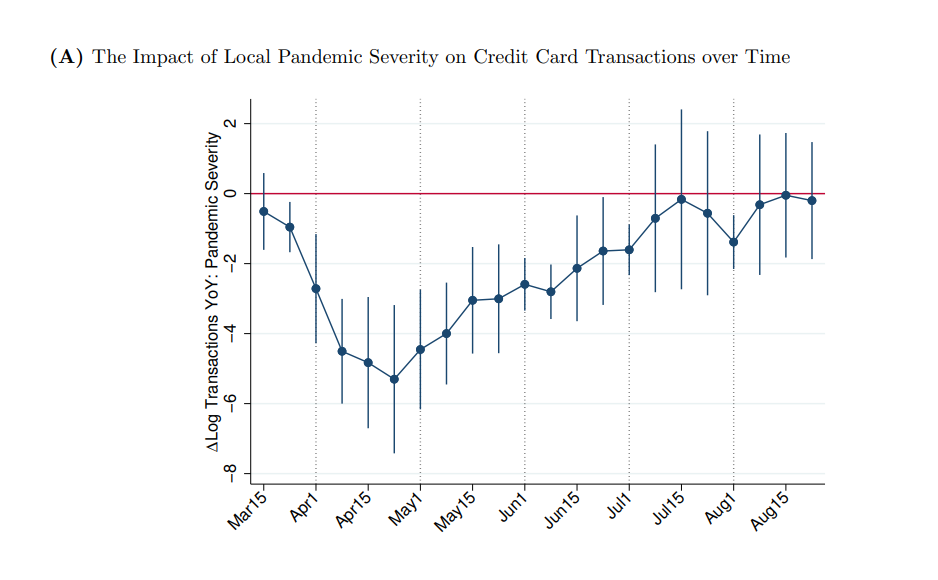

| Ant Group reaches a deal with Chinese regulators. Food prices are rising in China. And the Robinhood saga reveals the hidden costs of zero-fee trading. Ant Group and Chinese regulators have agreed on a restructuring plan that will turn Jack Ma's fintech giant into a financial holding company, making it subject to capital requirements similar to those for banks. The plan calls for putting all of Ant's businesses into the holding company, including its technology offerings in areas such as blockchain and food delivery, people familiar with the matter said. One of Ant's early proposals to regulators had envisioned putting only financial operations into the new structure. Last week, China's central bank chief said the IPO that never was could be resumed if Ant irons out its problems. Asian stocks looked set to retreat Thursday after a decline in technology and retail shares weighed on U.S. benchmarks as earnings continued to roll in. Treasuries fell and the dollar was little changed. Futures slipped in Japan, Hong Kong and Australia. The S&P 500 pared earlier gains to close barely in the green following its biggest two-day rally in almost three months, while the Nasdaq 100 finished lower. Oil climbed as OPEC+ said it will keep pushing to quickly clear the surplus left behind by the pandemic. A widely watched segment of the Treasury yield curve reached its steepest level in almost five years. Dealmakers across Asia are busy fielding calls from company founders who are considering selling up as the Covid-19 pandemic has upended how global business is done. After riding the region's rise over the past decades, family firms that dominate the economic landscape are also looking for bigger partners, help to modernize management teams and aid with succession planning. Recent deals include a CVC Capital Partners-led privatization of Hong Kong fashion chain I.T Ltd. as well as a takeover by TPG and Northstar Group of a unit of Singapore-based food company Japfa. A spike in food prices in China is being put down to a resurgence of the coronavirus, which the country thought it had contained, and a much chillier-than-usual winter. The combination of events is raising food costs and nudging up inflation just as households demand heaving tables for the new year festivities. Logistical constraints because of travel restrictions to control the spread of the virus are hindering the transport of fruit and vegetables, and pork prices are up to their September highs thanks to a logjam at ports affecting the supply. Many hedge fund stock-pickers who rang up benchmark-beating returns in 2020 expect to repeat that feat for a second straight year. They're betting that rock-bottom interest rates, government stimulus and vaccine rollouts will push stocks higher, and they see irrational exuberance from retail investors creating a target-rich environment on the short side, after stocks like GameStop and AMC Entertainment rocketed to heights that quickly proved to be unsustainable. Meanwhile, some hedge fund heavyweights are looking beyond the U.S. to extend their hot streak. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayOne of the big questions in economics right now is what will happen to consumer spending once the Covid-19 pandemic is over. On the one hand, you could see a scenario where spending takes a while to normalize, with people so scarred from the experience and the economic hit it entailed, that they decide to save more money for a long time to come. On the other hand, people might be so tired of being stuck at home that as soon as the virus goes away they go on a fresh spending bonanza — in particular switching from buying stay-at-home goods like laptops and Nintendo switches to spending more on services. A new Federal Reserve working paper lends some evidence to the second scenario. It looks at detailed U.S. credit card data to examine the impact of the coronavirus crisis on consumer credit. Among a bunch of interesting findings, one stands out. The paper talks about strong evidence of " pandemic fatigue," in which people spend more on their credit cards the longer lockdowns and other containment efforts go on. According to the paper, "a one-standard deviation cross-sectional increase in local pandemic severity is associated with a 5.8 percentage point reduction in credit card transactions in April but only with a 1.9 percentage point reduction in July." In other words, people cut their spending by a smaller amount the longer the pandemic raged.  Bloomberg Bloomberg There's other evidence of pandemic fatigue too. If you look at U.S. mobility data — or the frequency of people going to stores and restaurants and things like that — you can see that it had returned to pre-pandemic levels by July. If people are so tired of being afraid of the virus and limited by pandemic-related restrictions there's a possibility that a mass vaccine rollout will unleash all that cooped-up energy in a flurry of new consumer spending. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment