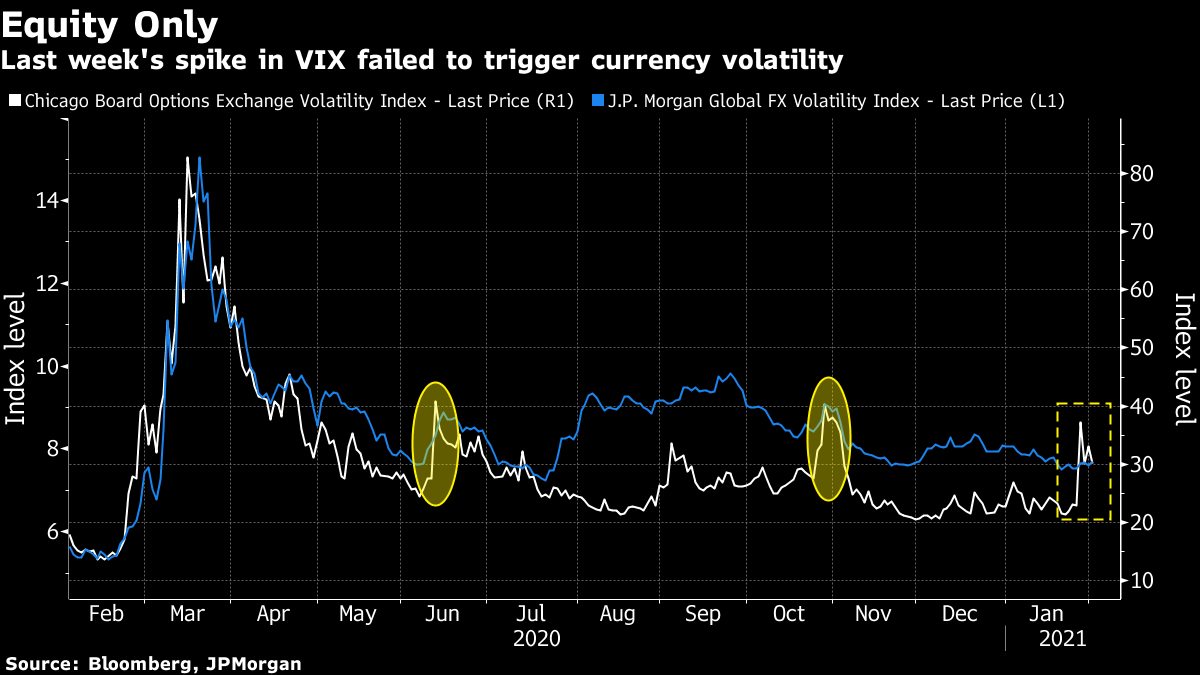

| Good morning. Silver moves to the center of the Reddit storm, fallout from the EU's vaccine strategy continues and Joe Biden still intends to push for big stimulus. Here's what's moving markets. Silver and BiotechsThe new target for retail investors is seemingly silver, which came fully into view on Monday and which appears to have lost some momentum heading into Tuesday. This as debates rage over who exactly is behind the spike in prices to 2013 highs, though it seems to fit the anti-establishment hallmarks of previous day-trader targets. Doing the same with other commodities, as some Reddit investors have suggested, may prove a tougher task. The stocks at the center of the Reddit frenzy, video-game retailer GameStop and cinema chain AMC continued to be volatile, albeit in a narrower range, and there is evidence to suggest that the short squeeze on those names is sinking as bears cover their bets. What's the next target for the retail army? It could be heavily-shorted biotechs. Vaccine BlameThe fallout from European Union's U-turn over vaccine export controls continues, with European Commission President Ursula von der Leyen trying to deflect blame to one of her deputies, trade chief Valdis Dombrovskis. Ireland said it retains confidence in von der Leyen after the turmoil. Johnson & Johnson, meanwhile, will ship some Covid-19 vaccines ordered by the EU to the U.S. for the final stage of production, raising fears about more delays to the rollout. Chancellor Angela Merkel, meanwhile, pledged a vaccine for all Germans by September, with the caveat that this depends on drugmakers meeting their delivery commitments. Big StimulusPresident Joe Biden intends to continue pushing for a large pandemic relief package even if he has to bypass Senate Republicans to get it passed, following a "very productive" meeting on stimulus options on Monday. Among the sticking points is the size of stimulus checks, an issue which is even causing some concern within the White House. On the foreign policy front, Biden warned the U.S. may reinstate sanctions on Myanmar following a military coup in the Southeast Asian nation. The seizure of power provides an early test of Biden's efforts to counter the appeal of China's authoritarian governing model in the region. China's top diplomat called for ties to be restored with the U.S., but warned that interfering in internal affairs is a "red line." The U.S. is also being pushed by the EU for a suspension of tariffs on metals and aircraft. Big OilBP and Exxon Mobil will get the earnings season underway for global oil majors on Tuesday at a delicate time for the industry, as companies try to balance a move toward greener energy while continuing to maximize returns from their fossil fuel assets. The results are expected to show the worst is over for the industry after a rough 2020 and that higher crude prices will translate into increased cash flows. Oil prices rose on Monday too, caught up in a stock rally and optimism on the demand outlook, and have held those gains on Tuesday. Both of the majors have been in focus in recent days too. Over the weekend, it was reported Exxon and U.S. peer Chevron had held talks last year over a potential merger, while BP's program to divest assets continues apace. Coming Up…European and U.S. stock-futures are trending firmly higher heading into Tuesday following the rally on Monday, with Asian stocks having gained on stimulus hopes, vaccination progress and receding concerns about the volatile retail trading picture. European GDP data will be closely watched, as will the latest house price figures for the U.K. On the earnings front, in addition to BP, we'll get numbers from power generation group Siemens Energy, Danish industrial enzymes producer Novozymes and sportscar maker Ferrari. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningYou don't need to scour Reddit to beat the market. An equal-weighted basket of 20 U.S. stocks that showed the biggest drop in retail investor activity in January -- as per quantitative strategists at UBS Group AG -- has still managed to outperform the S&P 500 Index on a year-to-date basis, according to calculations by Bloomberg. The gauge of so-called "forgotten stocks" is up about 1.5% this year, suggesting bullish investor sentiment remains intact outside the pockets of the market most affected by the recent retail trading frenzy. A quick look at other asset classes also suggests broader risk sentiment remains undisturbed by the retail-driven wobbles in stocks. Gauges of volatility in currencies and bonds failed to push higher amid the equity price swings. That could still change -- signs of froth in risk assets haven't gone away -- but for the moment traders in other markets remain unperturbed by the Reddit revolution.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment