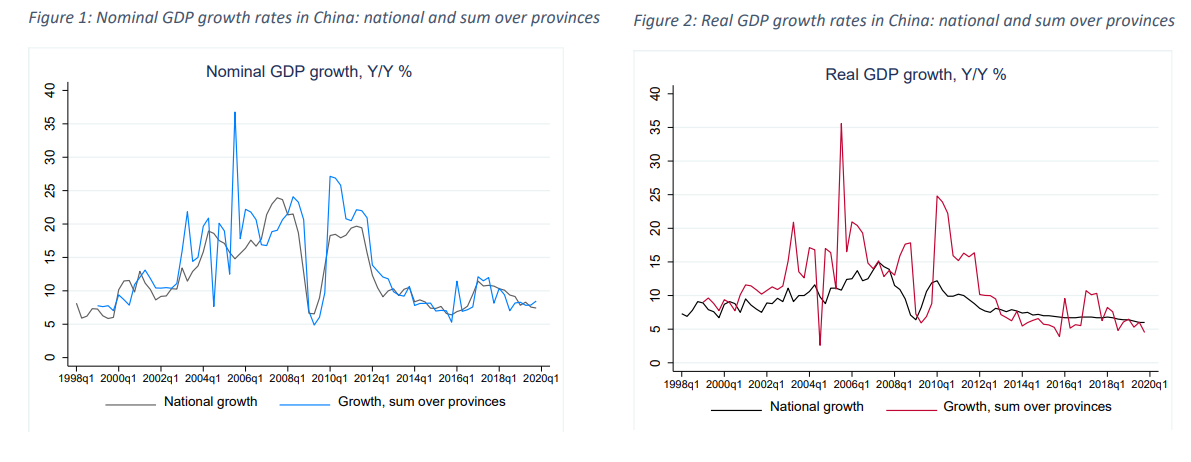

| Biden signals sanctions against Myanmar. Australia to name and shame underperforming pension funds. Elon Musk boosts Bitcoin again. President Joe Biden said the U.S. could reinstate sanctions on Myanmar if the Southeast Asian country's military doesn't "immediately relinquish the power they have seized" and release activists and officials. The military takeover could prove to be an early test case of the Biden administration's vow to defend democracy "wherever it is under attack," as the president's statement said. If carried out, the policy would represent an abrupt shift from the Trump administration, which often muted traditional criticism of authoritarian governments. Here's how Aung San Suu Kyi's election win triggered the military takeover. Australia's government wants to force pension funds that don't meet key after-fee investment return milestones to write to their customers and set out their failure in plain language. Additionally, they would have to point savers to a government-curated list of firms that are doing a better job. The new measures, which are being introduced to parliament this week, are part of a push to overhaul the world's fourth-largest pension system and try and prevent disengaged consumers from getting stuck with sub-par operators. A government inquiry two years ago found more than a quarter of funds were persistently under-performing. Asian stocks looked set to open higher Tuesday after U.S. shares had their biggest rally in about 10 weeks, as concerns eased that the recent onslaught of speculative buying will derail the equity bull market. The dollar climbed. Futures rose in Japan and Australia. In a broad-based advance led by technology and retail companies, the S&P 500 Index rebounded from last week's selloff as the Nasdaq 100 jumped 2.5%. Elsewhere, Treasuries were steady. Oil surged. Some of Goldman Sachs Group's most in-demand traders were confronted with a surprising rider before collecting their rewards for 2020. The firm asked staff in its portfolio-trading group to sign a six-month non-compete clause to get bonuses for the breakout year, making it harder for them to defect to rivals, according to people with knowledge of the matter. While a non-compete of that length is normal for more senior ranks, it's often half that or less for more junior levels. Pockets of inflation are flickering across some parts of Asia and fading in others, impacting central banks' scope to further support economies in a region that's leading the recovery from the Covid-19 pandemic. From sharp rises in food prices to government stimulus measures that are driving up consumption, central banks are mulling over the possibility of having less room to ease. Australia has adjusted its inflation framework to allow the economy to run a little hotter, while Korea's central bank governor warned against excessive borrowing that has spurred a rally in the country's stock and property markets. Here's a look across the region. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayWe interrupt your retail trading coverage to take a brief detour to the land of Chinese economic statistics. A new paper from the Bank for International Settlements uses China's provincial data to create an aggregate estimate of nominal and real GDP. The thinking here is that provincial data is more removed from the centralized control of the National Bureau of Statistics, which might make it a better gauge of China's true economic growth. Sure enough, comparing provincial data with the official GDP numbers shows a discrepancy, at least in the case of real GDP. The provincial data for this is a lot more volatile than the official real GDP number, especially after China doubled its real GDP target back in 2012.  Bloomberg Bloomberg Critics of China's GDP statistics will no doubt seize on that disparity as proof that China is smoothing its statistics. But the paper actually shows something much more interesting for anyone seeking structural weakness in the world's second-biggest economy. The provincial data — which the authors give the catchy name of "The 31 Provinces China Business Cycle Indicator," or 31P-CBCI — also suggests that the engines of China's economic growth shifted gears sometime around 2010. Growth used to be driven by investment and productivity gains, but in recent years government spending, credit and house prices have become much more important. The natural question, as the BIS authors note, "is whether such determinants can sustain growth persistently?" The full paper is well worth a read. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment