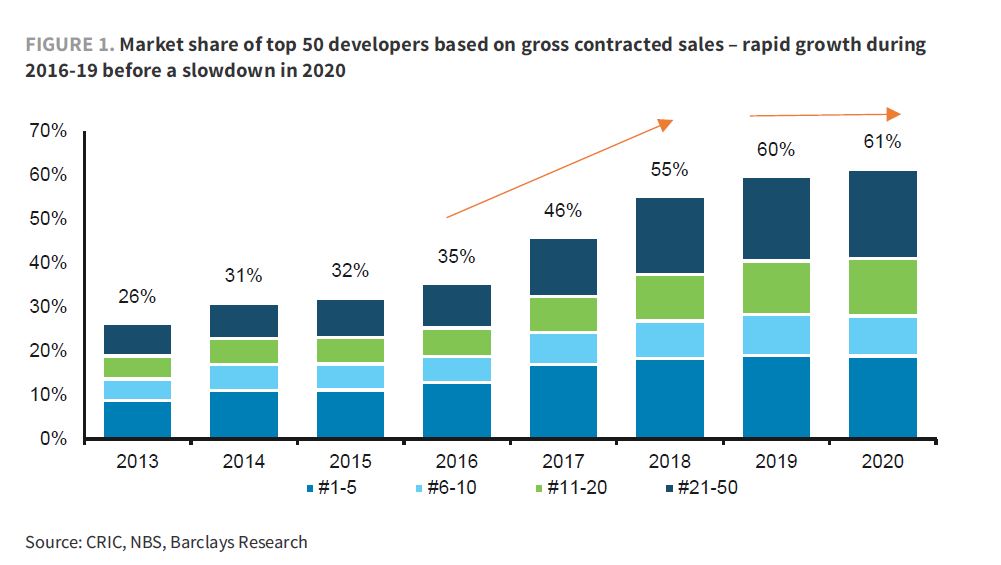

| Facebook restricts the sharing of news in Australia. China stocks are primed to hit record highs. U.S. power crisis worsens. Facebook has started restricting the sharing of news on its service in Australia, defying a controversial proposed law that would require technology companies to pay publishers when their articles are posted by users. Facebook's decision blocks those in Australia from sharing news stories and stops users globally from sharing articles from Australian publishers. The ban constitutes the strongest action yet in response to the proposed legislation, which would force Facebook and Google to pay publishers for the value their articles generate on the digital platforms. News outlets have argued they should be fairly compensated for their journalism, as the two web giants capture much of the advertising market. Asian stocks looked set for a muted open after a mixed session from their U.S. peers as investors weighed strong retail sales against concerns about inflation. Treasury yields retreated from a one-year high. Futures were little changed in Japan and dipped in Australia and Hong Kong. The S&P 500 Index finished little changed, while the Nasdaq slipped as stocks seen as most sensitive to higher inflation retreated. The dollar rallied against most major peers. Elsewhere, oil rose for a third session and Bitcoing jumped past $52,000. Chinese markets are set to extend their rally and are primed for all-time highs when they open for the first time after the Lunar New Year break. The CSI 300 Index is within 70 points of its 2007 closing peak, and there are promising omens for it to break through that barrier. Chinese stocks listed in Hong Kong have gained 3.5% since onshore markets last traded, while the offshore yuan has been steady after hitting its strongest level versus the greenback in 32 months this week. The crisis that has knocked out power for days to millions of homes and businesses in Texas and across the central U.S. is getting worse, and the economic fallout is cascading. The outages and cold are wreaking havoc on oil and gas. Crude output has plunged by 4 million barrels a day — the most ever — according to traders and industry executives with direct knowledge of the operations. And gas production has plummeted to the lowest level since 2017, with prices soaring. With the outages expanding beyond Texas to neighboring power systems, as many as 2.8 million customers across three states are now without electricity, according to PowerOutage.US Federal Reserve officials in January expected it would be "some time" before conditions to scale back massive bond purchases were met, leaving open the question of whether any tapering could start before 2022. The account reinforced the dovish message from Fed Chair Jerome Powell, who said last week that the U.S. is "very far from a strong labor market whose benefits are broadly shared." While some regional Fed presidents have raised the possibility of paring bond purchases later in 2021 if the economy performed better than expected, Powell has called such talk premature. Still, it's only a question of time before the discussion resumes - and that might not be a bad thing. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayRed, orange, yellow, green. Put 'em all together and what do you have? The answer is China's new methodology for evaluating and classifying property developers. Authorities back in September began a trial run for a new system of grading the country's real estate companies. Whereas firms had previously been judged on size, sales growth, geography and the "implicit" support of their stakeholders, they would now be examined on the basis of debt-related factors like leverage, gearing and liquidity (a.k.a. "The Three Lines" test). According to new estimates from Barclays, a quarter of Chinese property developers that would have been classified as "core" under the previous rules, would fail the Three Lines Test if the new rules were implemented immediately.  Market share of top 50 Chinese property developers. Bloomberg The irony is that previous curbs on property developers meant to cool the sector and discourage the accumulation of further debt, may actually have ended up making the biggest players even bigger by giving them yet another funding advantage over smaller players. As Barclays points out, "tightening measures meant to curb excesses in the property market actually ended up driving this race for scale, because leading developers were seen to have better access to credit and mortgage arrangements, and enhanced opportunities to increase their land banks and engage in M&A." The combined market share of the top 50 developers increased from 35% in 2016 to 60% in 2019. This new and colorful evaluation system is meant to unwind some of the froth accumulated by the largest developers. It's one to keep an eye on. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment