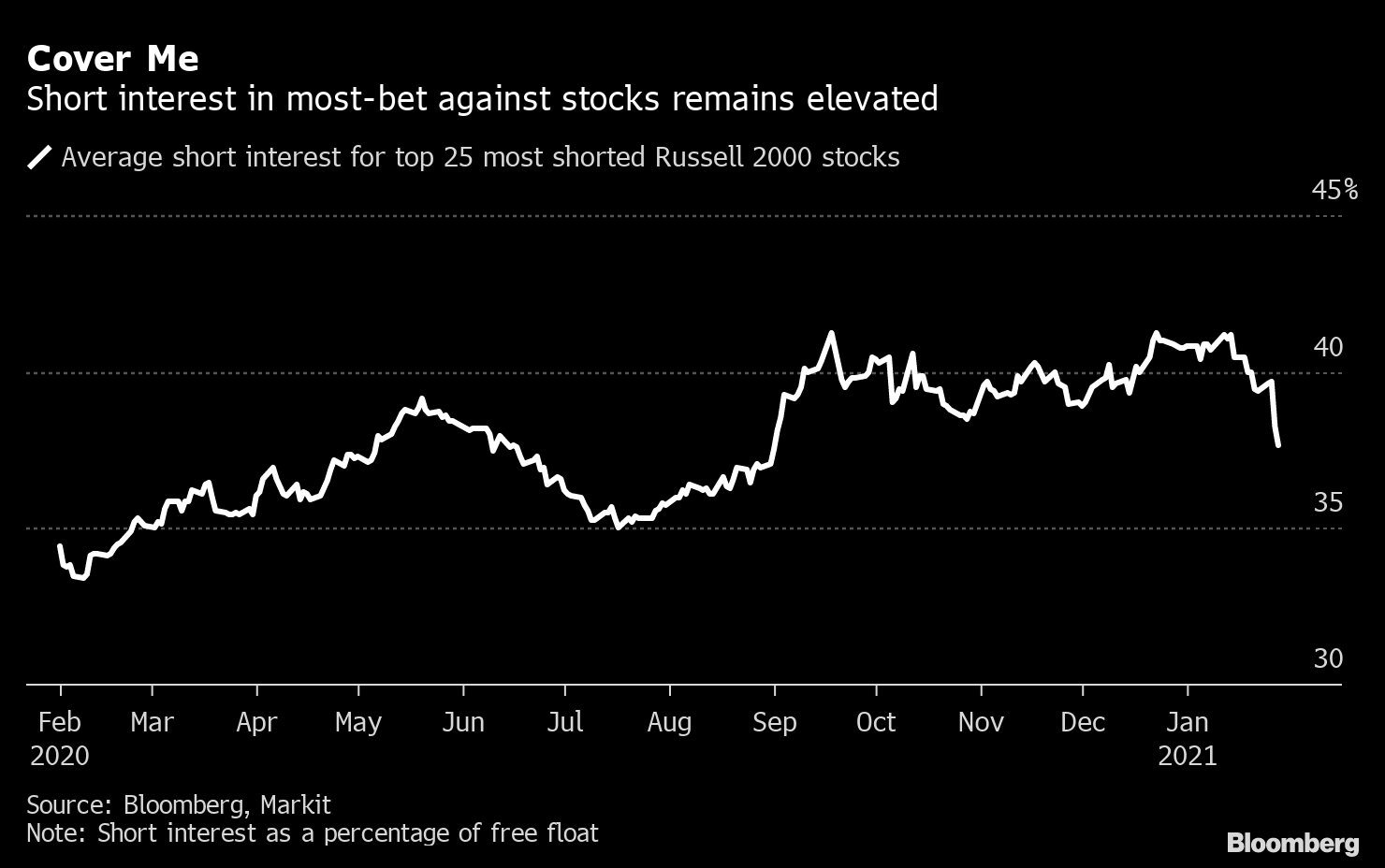

| Good morning. Reddit traders dominate the narrative, Europe's vaccine supply worries and a new U.S. stimulus proposal. Here's what's moving markets. Reddit MarketThe ascent of GameStop shares dominated last week's stock market narrative but there are few signs that volatility linked to such retail trading heralds a market-wide contagion. The Reddit-fueled surge in these equities is, however, providing those companies with a lifeline they could scarcely have imagined. Some, like American Airlines and cinema operator AMC, have the chance to sell new shares. For the hedge funds suffering against the tide of Reddit traders, their risk models made them more vulnerable to the sharp market moves. No-fee brokers like Robinhood at the center of the retail buying are now in the unenviable position of telling clients they sometimes cannot buy whatever they want. Vaccine BattleThe week is likely to see further fallout from the European Union's now-reversed plan to impose vaccine restrictions on shots shipped from the bloc. The move sparked condemnation for its impact on the Irish border, from the World Health Organization and from pharmaceutical companies and the EU is now taking steps to bolster its pandemic preparedness in the future. Drugmaker AstraZeneca said it will deliver an additional 9 million doses to the EU in the first quarter to help get the inoculation drive on track. The U.K. government said its vaccine supply is secure and it will continue the rollout at the pace intended, after the spat had raised concerns about supplies from within the EU and raised the specter of damaging vaccine nationalism. Stimulus ProposalsA group of 10 Republican Senators have written to President Joe Biden with an alternative proposal on Covid-19 economic stimulus that they claim will win bipartisan support. The plan is expected to be significantly smaller than what Biden has called for. Biden's presidency began at a sprint with a series of executive actions designed to erase Donald Trump's legacy, but he is already starting to feel the limits of his power, running into hurdles on vaccine production and familiar roadblocks in Congress. This week, Biden will also get the first full look at the health of the labor market he has inherited, with a still-elevated unemployment rate expected on Friday. Protests and CoalitionsTwo political situations to keep a close eye on this week. In Russia, more than 4,000 people were arrested in the second straight week of protests against President Vladimir Putin on Sunday, including the wife of jailed opposition leader Alexey Navalny. The demonstrations came after Putin's confidence rating fell to the lowest since the country's Public Opinion Foundation started asking that question in 2013. Meanwhile, talks on building support for a new coalition in Italy are to continue after failing to reach an agreement over the weekend, with demands from former premier Matteo Renzi for a new finance minister to be appointed. Coming Up…European and U.S. stock-futures are trending higher, in line with gains in Asia, but the attention is likely to be a spike for silver, now a favorite of the Reddit crowd. Updates on manufacturing activity across Europe and the U.K. are top of the economic agenda on Monday, while the earnings calendar is led by the likes of medical equipment group Siemens Healthineers, low-cost airline Ryanair and U.K. stockbroker Hargreaves Lansdown, one of the companies which saw a spike in demand as retail traders piled into the market last week. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWith greed and fear having driven markets for much of the last year, it was a relief of sorts to see something more mundane behind last week's "turmoil" -- prudence. Behind the headlines of vengeful legions of retail traders taking on a besieged hedge fund army, the skirmishes do little to impact the global financial battlefield. As Barclays strategists led by Maneesh Deshpande noted, the most-heavily shorted companies targeted by day traders this year had bearish wagers amounting to less than 0.001% of the $43 trillion stock market. In fact even within that cohort, the short-covering was incredibly concentrated. The average level of short interest in the 25 most-bet-against members of the Russell 2000 Index fell just three percentage points to 38% as of Thursday, from 41% at the beginning of the year, according to data compiled by Bloomberg. The level of bearish bets -- which is calculated as a percentage of free float -- is still higher than the 34% it was a year ago. But perhaps because of the headlines -- hedge funds in trouble -- it was prudent for global investors to take some risk off the table. Valuations are elevated, stocks have had a great run and as mentioned in these pages in recent weeks, technical alarm bells were ringing in some sections of the market. Those conditions still exist, so it's still an open question whether last week's prudent derisking will be rewarded.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment