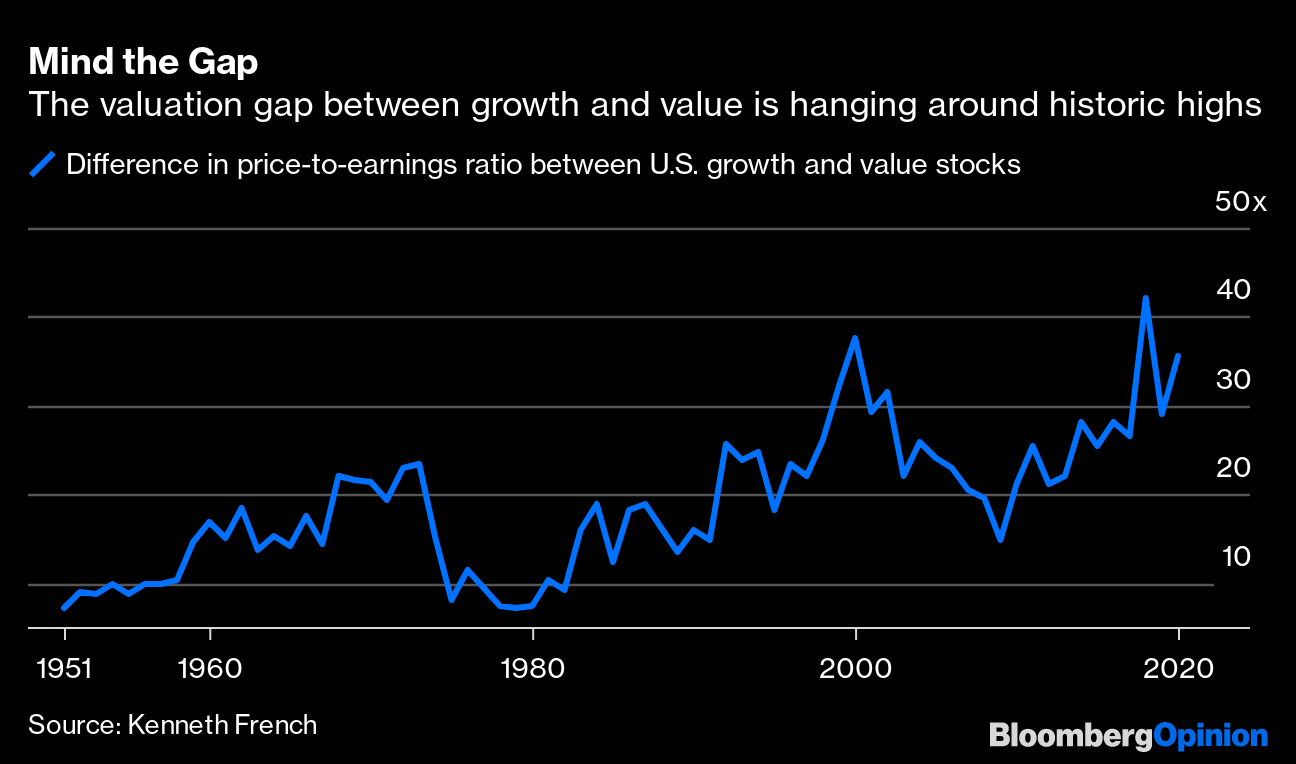

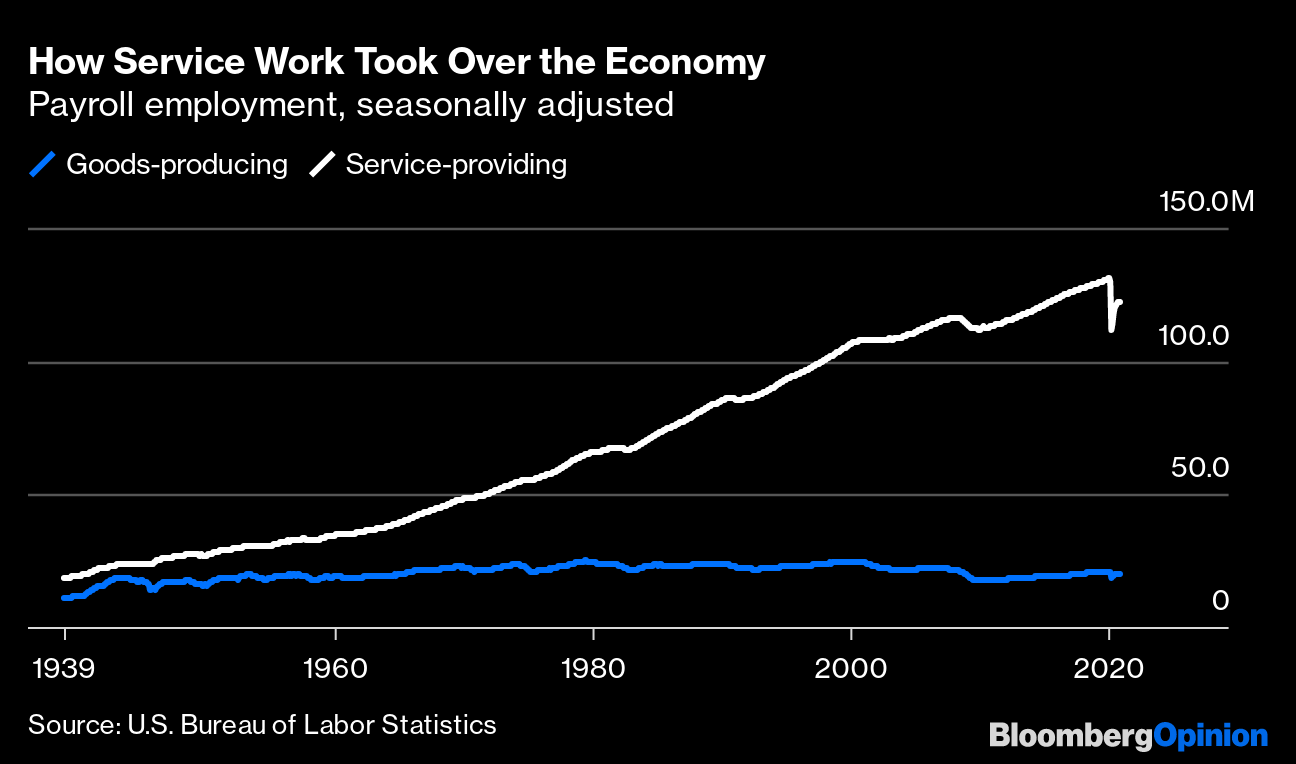

| This is Bloomberg Opinion Today, a trust circle of Bloomberg Opinion's opinions. Sign up here. Today's AgendaTrump's Circle of Trust Shrinking RapidlyPresident Donald Trump's friends are abandoning him in the closing moments of his presidency, and with a history-making second impeachment looming, which is sort of like if the Titanic's captain had tried to quit just before it sank. Maybe we'd all be better off if these people had ditched Trump earlier, but they can still do some good. Maybe most notably, Representative Liz Cheney, of the Wyoming Cheneys, broke with her party and vowed to impeach Trump in paint-peeling terms. It's a big risk for her, not unlike the one Newt Gingrich took when he shivved President George H.W. Bush over tax cuts, writes Robert George. That ended up working out well for Gingrich. It may not do the same for Cheney. For the past four years, Corporate America has been quicker to oppose Trump in word and deed. Maybe being relentlessly tweet-bullied hardened its resolve. But last week's storming of the Capitol hastened business's slow breakup with the GOP. The National Association of Manufacturers called for Trump's ouster. And led by the Chamber of Commerce, several companies have cut off donations to GOP politicians who backed Trump's election-fraud lies. Hallmark even asked for some of its money back! Hallmark! One industry dragging its feet on backstabbing the GOP is Big Oil. It has few friends left in this hard, rapidly warming world, Liam Denning writes, so it's reluctant to betray its nearest and dearest supporters. But Joe Manchin is just standing right there like Duckie, waiting to be Big Oil's rebound boyfriend. Even Mitch McConnell is reportedly happy to see Trump impeached, though not quite happy enough to hurry up his trial. He could still whip Republican votes even as the minority leader in the new Senate, and Clive Crook wonders if he'll do to Trump what Sir Geoffrey Howe did to Margaret Thatcher in 1990: End her era. That McConnell has soured on Trump shows just how much damage he has done to the nation and to his party, Tim O'Brien writes. Trump does seem vaguely aware he must behave better to avoid real consequences; today he asked supporters not to storm any more capitols if they could avoid it. But no matter the outcome, you can bet he'll make sure the blame for his problems falls where it belongs: on his so-called friends. What Biden Should and Shouldn't DoWe're now less than a week from President-elect Joe Biden taking office, believe it or not. He'll be greeted by two blazing emergencies that should consume all his efforts for a while: the pandemic and its associated recession. With a Democratic Congress, Biden has precious political capital to get stuff done, but Noah Smith implores him not to make the mistake President Barack Obama did and get sidetracked in less urgent, and less popular, projects such as reforming health care. Biden will also have to act quickly to repair America's relationship with the rest of the world, which has been badly damaged by the way Trump treats so-called friends. Bloomberg's editorial board has some advice for Biden on getting off to a quick, smart start. These include easy fixes, such as ending Trump's hopeless trade war and rejoining key international pacts, along with trickier ones, such as confronting, you know, [waves hand at China] China. Further Biden-Agenda Reading: The military sees climate change as a national security threat and should like Biden's seriousness about it. — James Stavridis It's Almost Inflation O'ClockWe haven't seen inflation around these here parts in a long, long time. This will probably be the year it returns, writes Michael R. Strain, as supply-constrained businesses try to meet an upwelling of demand from a freshly vaccinated America. What we don't know is whether it will actually heat up so much that it scares the Fed into pulling back stimulus early. That would be very bad for stock prices, obviously, especially if we're entering a period of generally rising commodity prices, writes John Authers. But for better or worse, labor-driven inflation still seems to be a distant threat, given how bad the labor market is. Further Inflation Reading: Telltale ChartsThe answer to the mystery of why value stocks have lagged growth stocks for so long is probably simple, writes Nir Kaissar: These things go in cycles. Sometimes value just has bad years/decades, but afterward it beats growth handily. This may be one of those times.  Manufacturing has thrived in this recession, which is not how recessions usually go, notes Justin Fox. Meanwhile, the service sector has been decimated, affecting women and certain regions most. But America's economy is still a service-sector economy, for better or worse.  Further ReadingGeorgia is more like Virginia than North Carolina: getting bluer and bluer. — Conor Sen China must stop stonewalling on Covid's origins, to help science and its own reputation. — Adam Minter Remote work makes every team more disjointed and disloyal, including the fraudulent ones. — Matt Levine 2021 will probably be pretty wild, too. — Tyler Cowen ICYMIWhy bother impeaching Trump now? Bitcoin isn't like any other bubble. How long will China and Tesla be BFFs? KickersScientists transfer memories from one snail to another. Also, snails have memories. (h/t Alistair Lowe) New world's oldest animal drawing just dropped. (h/t Mike Smedley) America could be on the brink of several Ireland moments, which is not good. You cannot stop sea shanty TikTok. You can't even hope to contain it. You shouldn't even try. Just let it happen. Note: Please send memories and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment