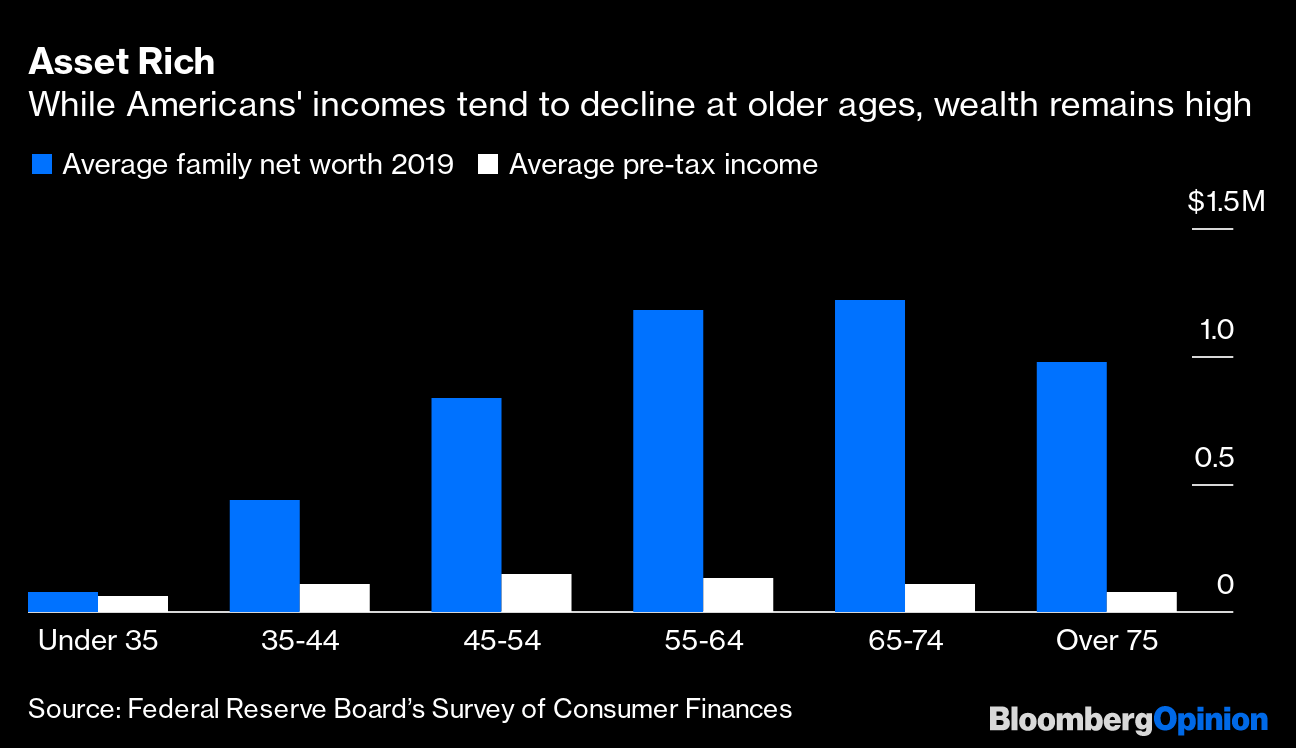

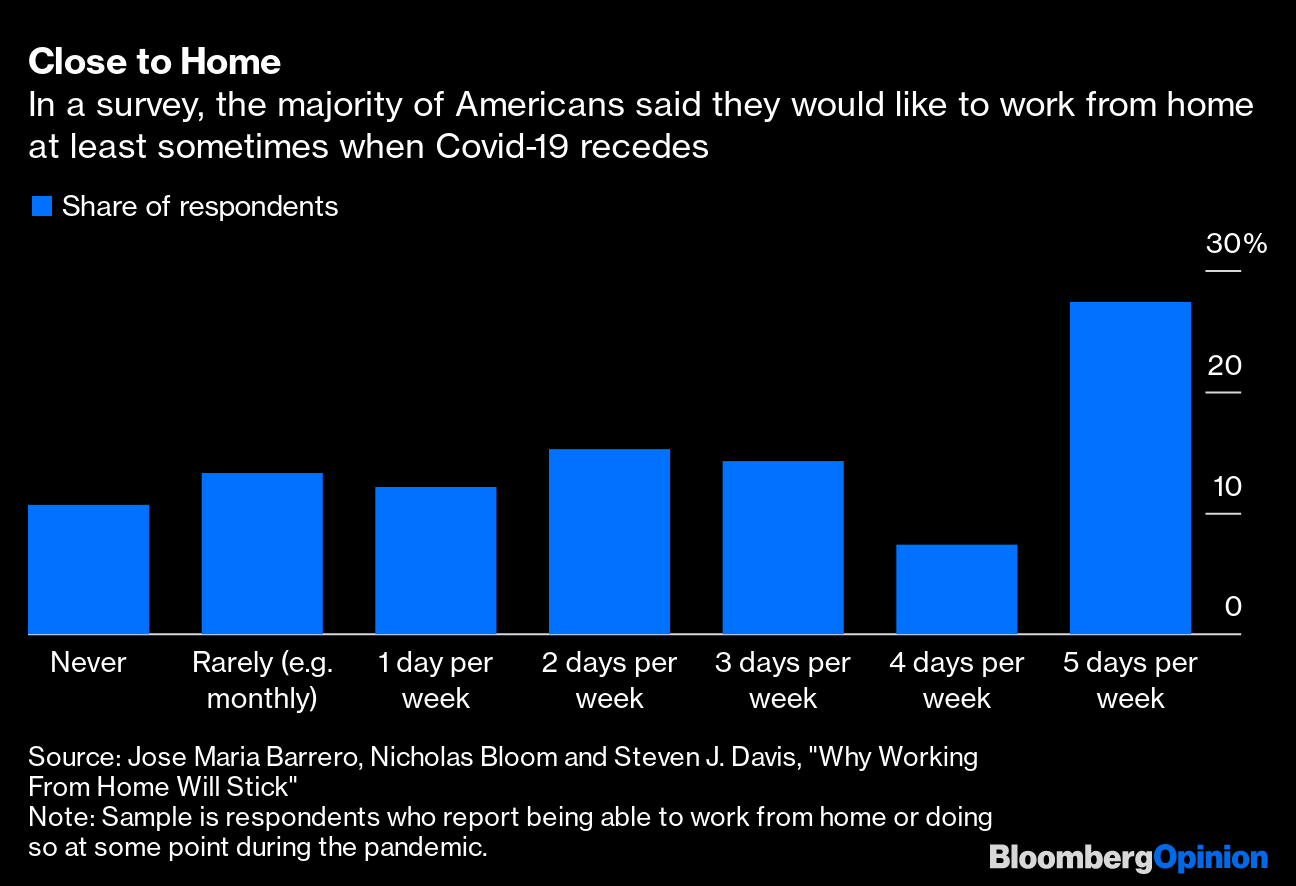

| This is Bloomberg Opinion Today, a media-industrial complex of Bloomberg Opinion's opinions. Sign up here. Today's AgendaDon't Fear the GameStopThe media-industrial complex, of which this newsletter is a cog, has spent more energy, pixels and ink on the GameStonk saga this week than on the many Covid variants creeping into the U.S. to ruin our year. That seems wrong. And yet write about it we must, at least once more, if only to tell everybody to chill out about it already. Somebody on Twitter had this very good idea:  This won't happen, probably, sadly. Unless and until it does, a gang of redditors buying up call options on GameStop and other beaten-down stocks is not a threat to the financial system, writes Bloomberg's editorial board. Does it make a mockery of the efficient markets theory? Yes. Will some people lose their shirts? Also yes. But regulators should think very carefully about what they plan to do about it. Almost none of this is apparently illegal, and many of the participating redditors fully expect to end up shirtless. Some even hope to meme about it. There was bipartisan outrage yesterday when Robinhood and other trading platforms basically said, "Sorry, folks, park's closed. Moose out front should have told ya," and clamped down on all the GameStonk fun. But this was less about playing nanny than it was about making sure these brokers had adequate collateral to clear this flood of risky trades, as Matt Levine explains. There was no Deep State plot to protect hedge funds, probably, sadly. And, contra Conor Sen yesterday, Nir Kaissar argues trying to protect these traders from themselves by restricting their ability to trade would be misguided. Losing shirts is how investors learn. And anyway the motley Reddit crew seems for the moment to be at least as sophisticated as the hedge funds being carried out on their shields. At the same time, making it even harder for short sellers to short is also a bad move, notes Joe Nocera. Shorts are seldom popular, but they can be investors' first line of defense against shady companies. If you want a reason to worry about this situation, because who doesn't enjoy a good worry, you have to look beyond its details to the bigger picture, as John Authers does. Because this saga incorporates many tensions in our society at once: the war between elites and not-elites, the war between the generations, festering anger over the financial crisis, and many more. Where does all this conflict energy go when our attention turns elsewhere? Further GameStonk Reading: Another Successful Infrastructure MonthPresident Joe Biden got elected by being extremely not Donald Trump, but on some big policy issues the two can be weirdly compatible. Trade is where they seem to agree the most, and not in a good way, warns Bloomberg's editorial board. Biden may end Trump's ruinous trade war, but he has embraced his predecessor's commitment to making the U.S. government buy stuff made in America. He's doubled down, in fact, promising stricter rules and enforcement of this buy-stuff mandate. Such protectionism won't help taxpayers or the economy. And boosting the economy is one of Biden's biggest jobs, to which end he has proposed a massive stimulus package that includes a proposal for a national minimum wage of $15. Tyler Cowen takes issue with this bit, as many conservatives have, and suggests a better progressive idea is direct annual payments to families. What should definitely not happen, though, is ditching the stimulus effort just because stocks are at all-time highs. As Karl Smith writes, stocks are at all-time highs partly because they expect stimulus. You see the issue here. Presidential Popularity Isn't What It Used to BeOne consistent feature of Trump's presidency was his deep and abiding unpopularity. Much of that was just Trump being extremely Trump, but some of it is the polarization of our age. Biden is already much more popular and keeps doing popular things, notes Jonathan Bernstein. But he's also less popular than other newly minted presidents of past decades, because there's a small but passionate group that will dislike him no matter what he does. He could single-handedly cure Covid and deliver comically large checks to every household, and some Republicans would still find reasons to hate him for it. This same polarization will likely protect Trump in his impeachment trial, which has some wondering if it's even worth the trouble. Maybe the Senate should just censure him and be done with it. But Ramesh Ponnuru argues a failed impeachment trial and a censure are practically one and the same: Both air his bad deeds and force Republicans to vote their approval of them. Might as well go ahead with impeachment. Telltale Charts Baby boomers are a long-overlooked shopping demographic, but they'll be the first to get vaccinated and start spending more freely, writes Andrea Felsted. Businesses will want to cater to them this year.  This is one of just countless ways the retail landscape will change when we start tiptoeing back into our old working and shopping habits, writes Sarah Halzack. It won't be a return to the full normal of 2019, whatever the heck that was.  Further Reading Johnson & Johnson's Covid vaccine isn't a silver bullet, but it's still a huge help. — Sam Fazeli Jair Bolsonaro's Covid response has been a disaster, but he plays the political game well enough to survive. — Mac Margolis Vladimir Putin's Davos appearance showed he's worried about unrest in his country. — Clara Ferreira Marques Chevron's weird 2020 is a glimpse of oil's new normal. — Liam Denning ICYMICovid variants are causing a surge in Israel despite its vaccination success. New York City will reopen indoor dining on Feb. 14. Apple TV+ is producing a WeWork TV series. KickersArea rock looks like Cookie Monster inside. (h/t Mike Smedley) Area man volunteers to be infected with 50 parasitic worms for a year. Hobbyists beat pros in creating new board games. Investigators may have solved the Dyatlov Pass Incident. Note: Please send cookies and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment