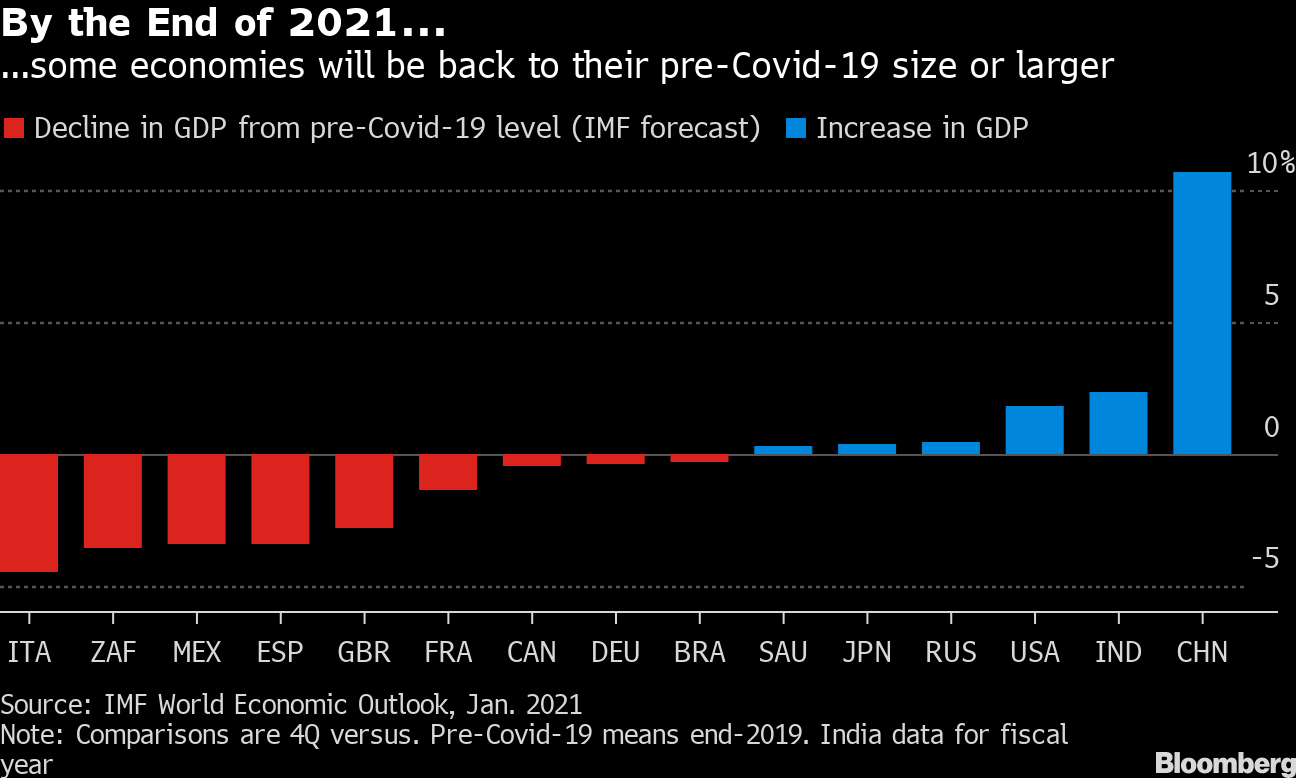

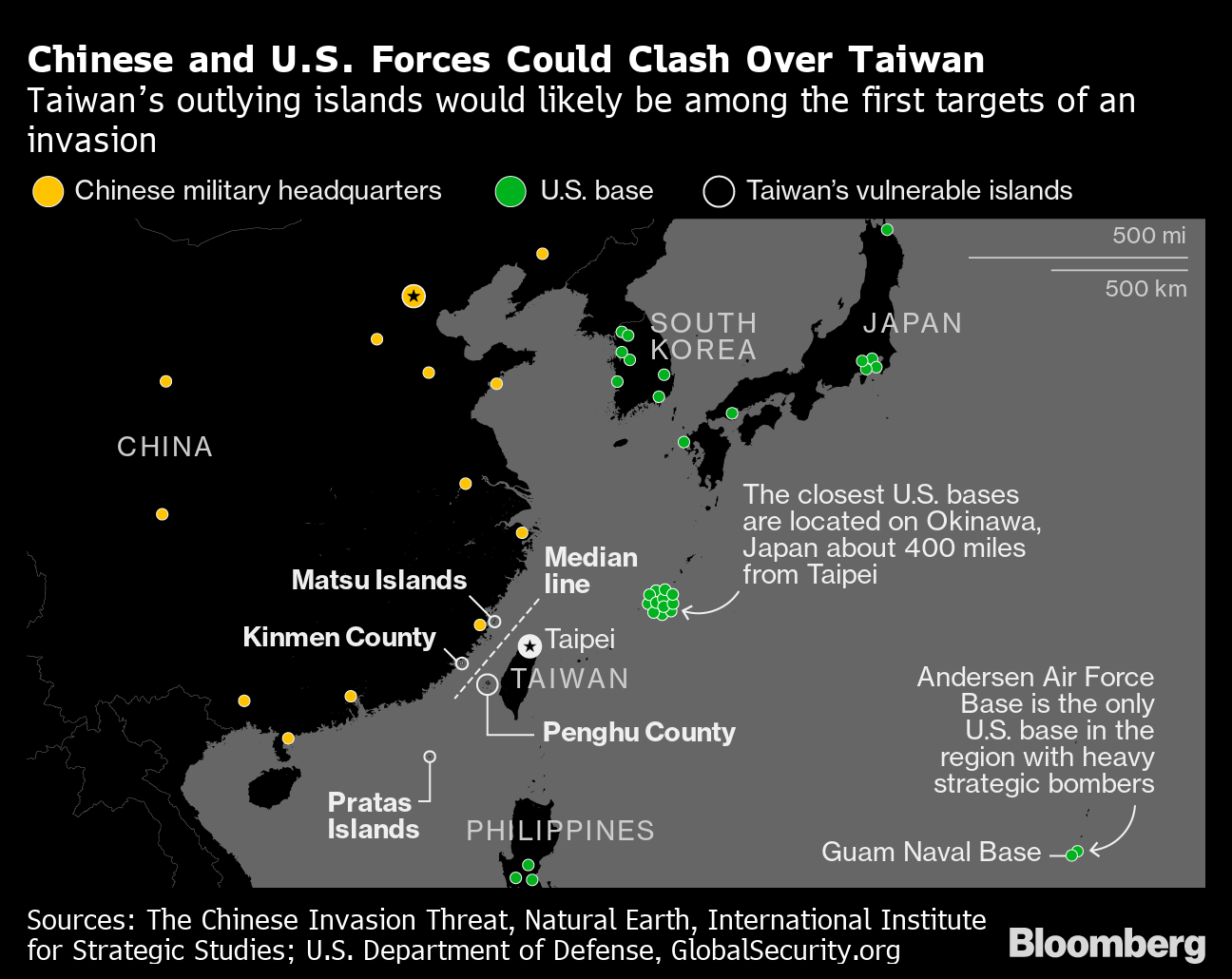

| Chinese markets endured a notable jolt this week, albeit a far cry from what unfolded in America. While regulators in Washington were grappling with the feverish surge in shares of GameStop, policy makers in Beijing were struggling with how to tip toe away from emergency settings without jolting markets. Economic activity has come roaring back after China was able to largely contain the coronavirus within its borders. Not only was it the sole major economy to see expansion in 2020, but China is forecast to grow more than 8% this year.  With recovery underway, the central bank has signaled that it's thinking about exiting some of the stimulus measures put in place to counter the effects of Covid-19. That's left Chinese financial markets on edge. The concern is that done too quickly, draining the money injected into the financial system during the crisis will spark a sharp drop in asset prices. It was a worry that played out dramatically this week. It began with comments by Ma Jun, an adviser to the People's Bank of China, who told a symposium that Beijing needed to consider the risk of bubbles in the equity and property markets when thinking about the future direction of policy. His comments, reported by local media Tuesday, triggered worries the withdrawal of stimulus could come sooner than expected. Compounding the situation was the PBOC's decision that same day to pull money from the financial system by not rolling over loans it had extended previously to banks. The result was a selloff. China's benchmark stock index saw its biggest one-day decline in almost four months. In Hong Kong, where a flood of money from the mainland had fueled a recent rally, shares fell by the most in eight months. Authorities tried to allay concerns. PBOC Governor Yi Gang, speaking on a previously scheduled panel a few hours later, pledged not to "prematurely" exit stimulus. The next morning's Securities Times, one of China's most prominent state-owned financial dallies, argued on its front page that there was no need to worry. It appeared to work, at least partly. Stocks on the mainland eked out a small gain on Wednesday, while in Hong Kong they slid by just a third of a percent. But the central bank also drained money once more on Wednesday, which contributed to a spike in the interest rates Chinese banks charge one another for overnight loans. If markets were unsure about the PBOC's intentions then, they appeared to make up their minds Thursday after authorities pulled money from the financial system for a third consecutive day. Stocks on the mainland and in Hong Kong plunged. The cost to borrow money overnight for financial institutions shot up even more, with traders saying that banks had become unwilling to offer large loans to each other. The PBOC appeared to give some ground Friday, injecting funds instead of draining cash. Even still, China is almost certainly headed toward some exit of stimulus. Not doing so would risk a slew of economic ills. The questions, of course, are when and how quickly. Feeling Them OutMore than a dozen Chinese military aircraft flew into the Taiwan Strait last weekend, not a week into Joe Biden's presidency. Beijing's aim? The new American administration should understand that China's claims of sovereignty over the island are a red line the U.S. must not cross. That's according to Yongwook Ryu, an assistant professor of East Asian international relations at National University of Singapore, who added more signal-sending is likely as the two sides try to feel each other out.  Signals were indeed sent. In addressing the World Economic Forum by video this week, President Xi Jinping called for "ideological prejudice" to be abandoned and warned that no country should force its system onto others. That echoes Beijing's long-held position in its negotiations with Washington that American expectations cannot be for a wholesale change of the Chinese system. Biden, meanwhile, affirmed the U.S.'s commitment to defend uninhabited islands that have been a source of tensions between Beijing and Tokyo during a call with Japanese Prime Minister Yoshihide Suga. Newly confirmed Secretary of State Antony Blinken likewise reiterated American alliances in calls with his counterparts from the Philippines, Australia and Thailand. The U.S. has long expressed to China that America sees itself as a Pacific power and that Beijing's expectations cannot be for Washington to withdraw its forces. The boundaries appear to be getting drawn quickly and clearly. TikTok MoneyLooking only at ByteDance's financials, it'd be easy to miss how tumultuous a year 2020 was for the Beijing-based owner of the TikTok video app. It was revealed this week that the company's operating profit jumped to about $7 billion last year from less than $4 billion in 2019. Revenue surged to $35 billion, quadruple what it was in 2018. While those numbers underline how big a phenomenon TikTok has become, they also belie the challenges ahead. Chief among those is former U.S. President Donald Trump's as-yet-unresolved bid to ban the app in America, an effort that is now up to Biden to either continue or stop. India, meanwhile, has shown no sign of rescinding its own ban on TikTok imposed in mid-2020. That led TikTok this week to announce that it's reducing its workforce in India. But at least money won't be a worry, especially with ByteDance exploring an initial public offering for some of its businesses in Hong Kong. The enthusiasm with which investors have taken to the IPO of smaller rival Kuaishou Technology would suggest ByteDance's sale will prompt a similarly favorable reception. Zero ToleranceChina's campaign to neutralize the coronavirus within its borders has been unique in Beijing's willingness to deploy resources and powers that wouldn't be viable or even countenanced in many other countries. A year ago, the decision to lock down the city of Wuhan shocked the world, though since then the practice has spread across the globe. China has also been alone in its insistence on testing imports of frozen food, arguing such shipments may be contaminated and infect those who handle the freight. The measures are so strict and China is such a large market for food that the impact is rippling across the global shipping industry. What's more, Beijing's zero-tolerance strategy for dealing with the coronavirus has seen China employ more-invasive testing measures that other countries have not. Residents in some northern regions, for example, have been asked to undergo anal swabs recently as authorities try to root out a recent outbreak. But for all the criticism this strategy has engendered, it is hard to argue with the results.  Disinfection of a market in the Daxing district of Beijing on Jan. 21. Photographer: NOEL CELIS/AFP What We're ReadingAnd finally, a few other things that caught our attention: |

Post a Comment