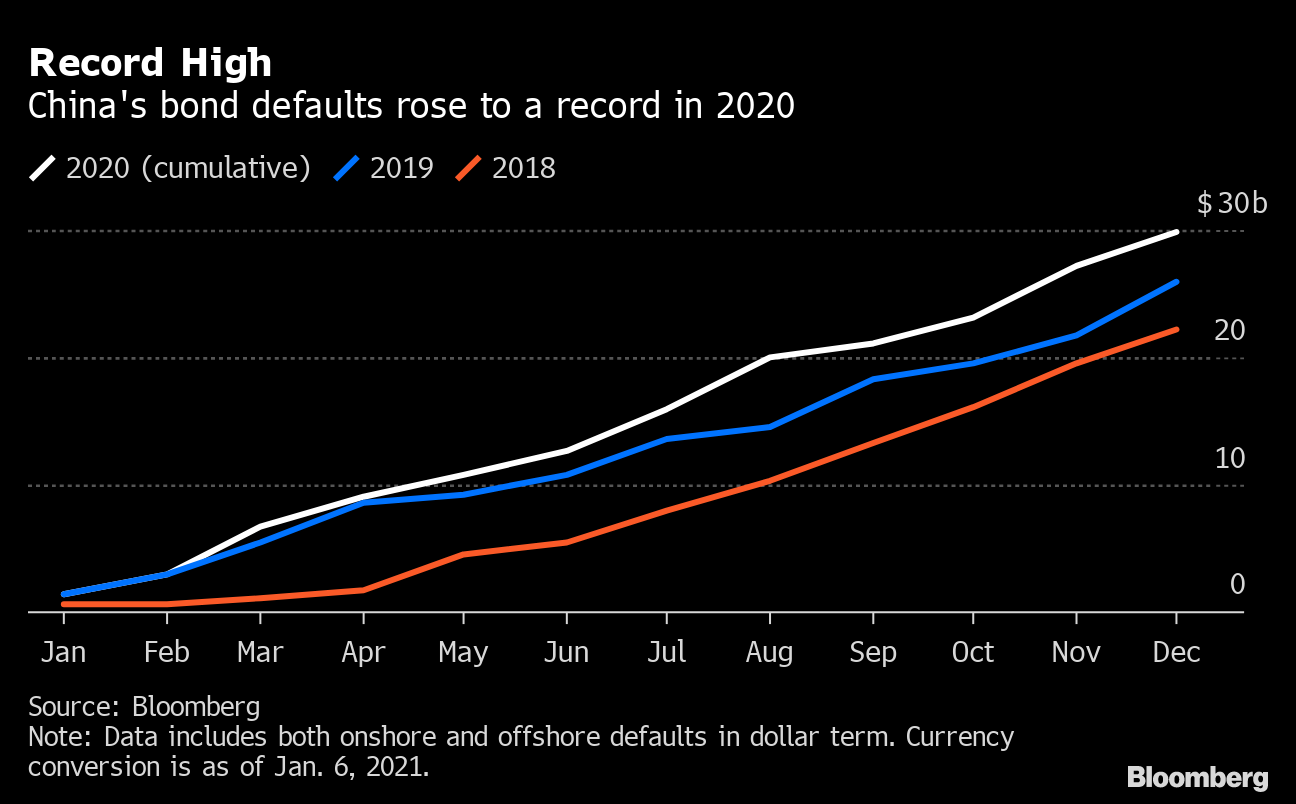

| Donald Trump will have left the White House by this time next week, but his trade war with China will be sticking around. While the countries did sign a phase-one trade deal a year ago, the limited scope of that pact has left hundreds of billions of dollars of commerce still subject to tariffs. And as the events of this past week can attest, removing those remaining levies appears ever more difficult. One additional challenge that's arisen in the waning days of Trump's administration is his ban on U.S. investments in companies Washington deems to have links to China's military. When that executive order came into effect this week, it became the most-substantial step yet toward a financial decoupling between the countries. Firms such as BlackRock and Vanguard were forced to sell their holdings in sanctioned Chinese companies. Goldman Sachs, Morgan Stanley and JPMorgan announced that they'd delist 500 structured products in Hong Kong. These are new fissures that will need to be addressed. Just as notable has been a recent surge in demand in China for an out-of-print book titled "America Against America." Some copies have begun appearing on an online marketplace for antiques priced at $2,500.  "America Against America" for sale at Kungfuzi, an online marketplace for antiques. Among the reasons for the book's popularity is that its author, Wang Huning, is now a member of the seven-man Politburo Standing Committee, China's most-powerful decision-making body. Written during an academic visit to the U.S. in 1988, Wang predicts in it that fissures in American society will sap its competitiveness. It's an argument that's attracting more attention in Beijing after last week's chaos at the U.S. Capitol. As explained by Wang Wen, executive dean of Renmin University's Chongyang Institute for Financial Studies, the concern for China is that instability in negotiating partners means a greater risk agreements will be broken. This week also highlighted another reason why Beijing may be in no rush to jumpstart trade negotiations: Things in China are going well. The coronavirus is largely under control and the economy is growing, two things that cannot be said for much of the West. Indeed when President Xi Jinping delivered a speech to provincial leaders this week, he was notably upbeat. Xi argued that China's challenges were outnumbered by the opportunities ahead. "The world is undergoing profound changes unseen in a century, but time and the situation are in our favor," he said. When Joe Biden takes office as president next week, he'll be confronted with a bilateral relationship that is more splintered than ever and a China that is more confident in its resolve. That augurs poorly for a quick end to the trade war. Surging ShipmentsChina's exports have been booming as of late despite American tariffs. But it's not because those levies have had no effect. Prior to the pandemic, they had weighed noticeably on the country's outbound shipments. What's happened instead is that the impact of the tariffs has been overwhelmed by new waves of infections in the U.S. and Europe. Surging case counts have not only fueled demand for personal protective gear and stay-at-home electronics, they've also forced many factories in those countries to close. That's meant an ever larger portion of orders are being filled by Chinese manufacturers. One place where this shift has become most prominent is in shipping rates. Containers that once cost $2,000 to send across the Pacific are now being quoted as high as $13,000 for service before the Lunar New Year in mid-February.  Virus OutbreaksWhile China has been largely successful at containing the spread of Covid-19, this winter has not been without its challenges. Indeed, this week saw the country's first death from the coronavirus since April. An outbreak of cases in the province of Hebei, which surrounds Beijing, has also prompted authorities there to impose lockdowns on three cities, including the provincial capital Shijiazhuang that's home to 11 million people. Cars and people have been banned from leaving those jurisdictions, and mass testing has been rolled out for their entire populations. During this most recent outbreak, Hebei has identified about 1,000 infections in total when combining both symptomatic and asymptomatic cases. That's not a large number compared with countries such as the U.S., U.K. or Japan, though it would be hard to tell from Beijing's response. But if China's over-the-top reactions have proven to be anything it's effective. Debt WoesLast year proved to be another record year for defaults in China, with about $30 billion of bonds not being paid in a timely fashion. That new high in delinquencies, however, is unlikely to last past this year. That's because as China's economy recovers from the pain of the pandemic, policy makers in Beijing have made it clear that they intend, albeit slowly, to start tightening the flow of money. Indeed, data released this week showed that credit growth moderated in December, suggesting that any increase in liquidity has already peaked. With cash harder to come by, 2021 will prove quite challenging for companies with big repayments looming and not the financial resources to pay.  What We're ReadingAnd finally, a few other things that caught our attention: |

Post a Comment