A Day of DramaI sit down to write this at the end of a day of historic political drama in the U.S. Friends in New York feel as shocked by today's events as they were by 9/11 — and having also lived through that, I tend to agree. In Congress, politicians drew parallels not only to 9/11 but to Pearl Harbor, and to the burning of the Capitol by the British army during the War of 1812. The bloodshed and death toll this time weren't remotely comparable to any of these events, but beyond that, those comparisons seem perfectly reasonable. Meanwhile, it was also a dramatic day on the markets. These two things have almost nothing to do with each other. I am not alone in finding it hard to muster enthusiasm for offering up market analysis. It seems inappropriate somehow. The staff of High Frequency Economics, a consultancy producing daily commentary that I often cite in this newsletter, opted not to publish any market analysis for their subscribers tonight. This was the first time they had done so since 9/11, and they explained why with a beautiful piece of prose that I will quote at length: This is not a time to remain quiet and hope for the best. It is incumbent upon every person who believes in democracy and the rule of law to make their voices heard in a call for peace and unity, regardless of political party or affiliation. The only way forward is together. We at High Frequency Economics are disgusted by the role of the President of the United States in inciting this riot, and we are saddened that he cannot find the character to stand up in front of the mob he has created, quell the violence and send everyone home. Responsibility for this outrage rests securely on his shoulders. He has lied, using the sanctity of his office to convince those with less power, income and resources than he to do his bidding. The handful of people breaking the law and resorting to violence represent only the slimmest fraction of Trump voters. The majority of Republicans, Democrats and independents condemn the actions of these rogue insurrectionists. Even so, to our readers around the world, we are embarrassed. We know that the United States can do better than the images that are displayed in the news. This is a time for reflection, not market data or economic trends. However, to bring this back to our own remit -- the economy and the markets -- we expect this episode can and will affect investor sentiment about owning US securities. That said, we believe the United States' institutions are strong enough to survive this insurrection, and that President-elect Biden will peacefully take office on January 20. However, we still have to get through the next 14 days before that happens. How smooth the process will be remains to be seen. Perhaps today's events will motivate members of both parties -- centrist, leftist and right-wing -- to come together. That will play a large part in how policy will be implemented over the next four years.

I applaud them for their first two paragraphs, with which I agree wholeheartedly. Today's scenes were painful. Are they right about the impact this could have on markets and sentiment? Despite the immense impact on people across the country, my best guess is that markets will shrug this off as easily as they shrugged off the demonstrations (many of which turned violent) that followed the police killing of George Floyd during the summer. Capital markets have a long history of being unbothered by political street violence. This was true even of the horrors of 1968 (a good year for the stock market). Generally, markets have confidence in underlying institutions and believe that riots will have little or no practical economic effect. Even this time, it looks as though U.S. institutions will hold — albeit after an almighty scare — and markets are allocating money accordingly. Another reason, as the team at High Frequency Economics points out, is that the Trump presidency has only two weeks to run. Judging by the fevered speculation of the last few hours, there is a real chance that there will be an attempt to invoke the 25th Amendment, and remove Trump from office on the grounds that he is no longer fit to occupy it. This would be an extraordinary event, and the greatest constitutional crisis at least since Watergate. But the prospect of a fortnight of Mike Pence as caretaker president doesn't appear to scare the markets. After that, there is now certainty that the nation will have two years of unified moderate Democratic government. That will have its pluses and minuses, but it isn't too scary. Such calculations might explain the ice-blooded judgments made in trading Wednesday. The day started with the news that Georgia had handed the Senate to the Democrats. Ostensibly a problem for markets, it was greeted by a fall in volatility, and a rally for the S&P 500. This was textbook: Uncertainty had been resolved.

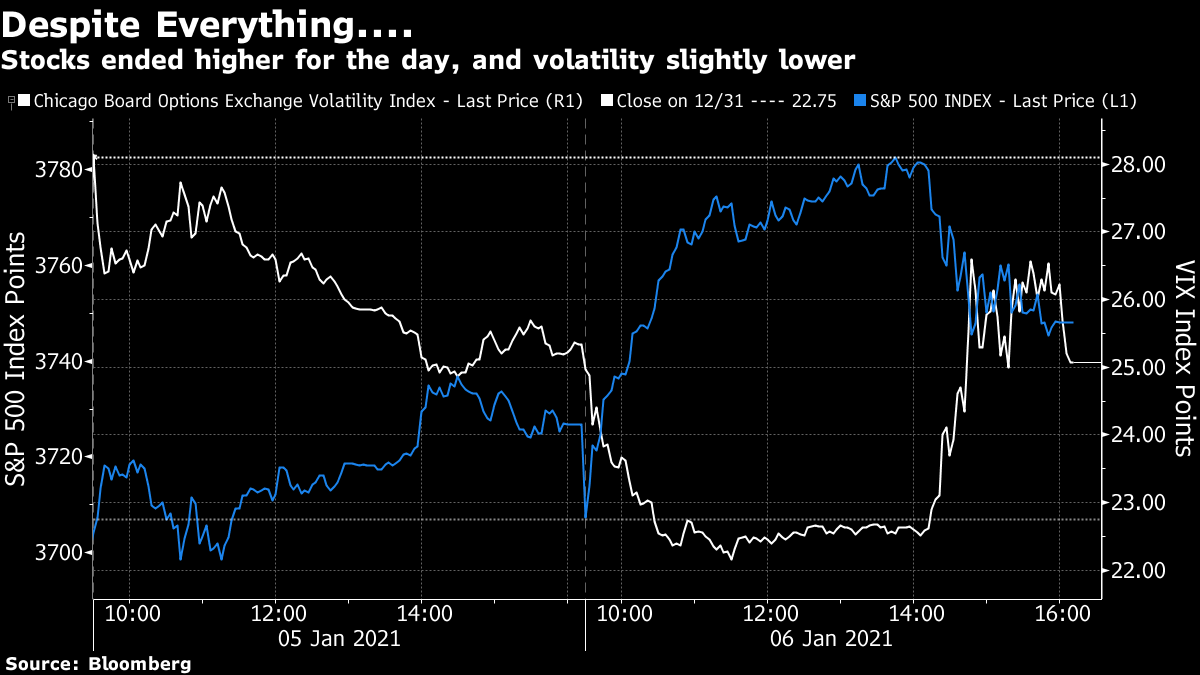

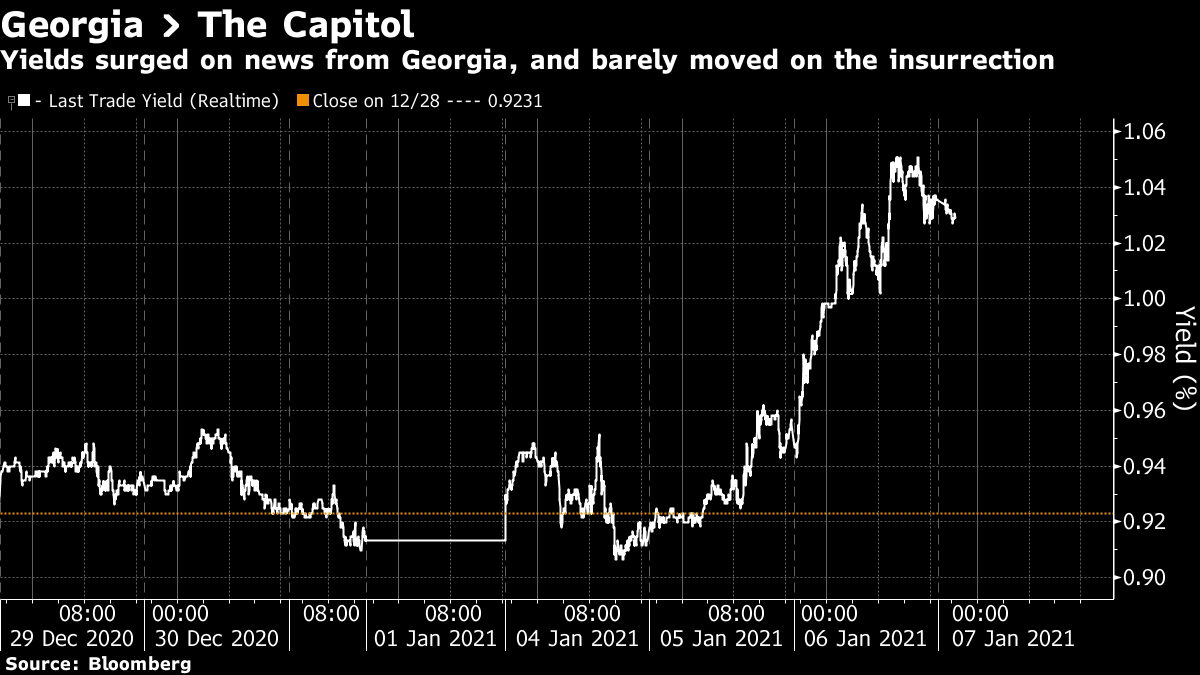

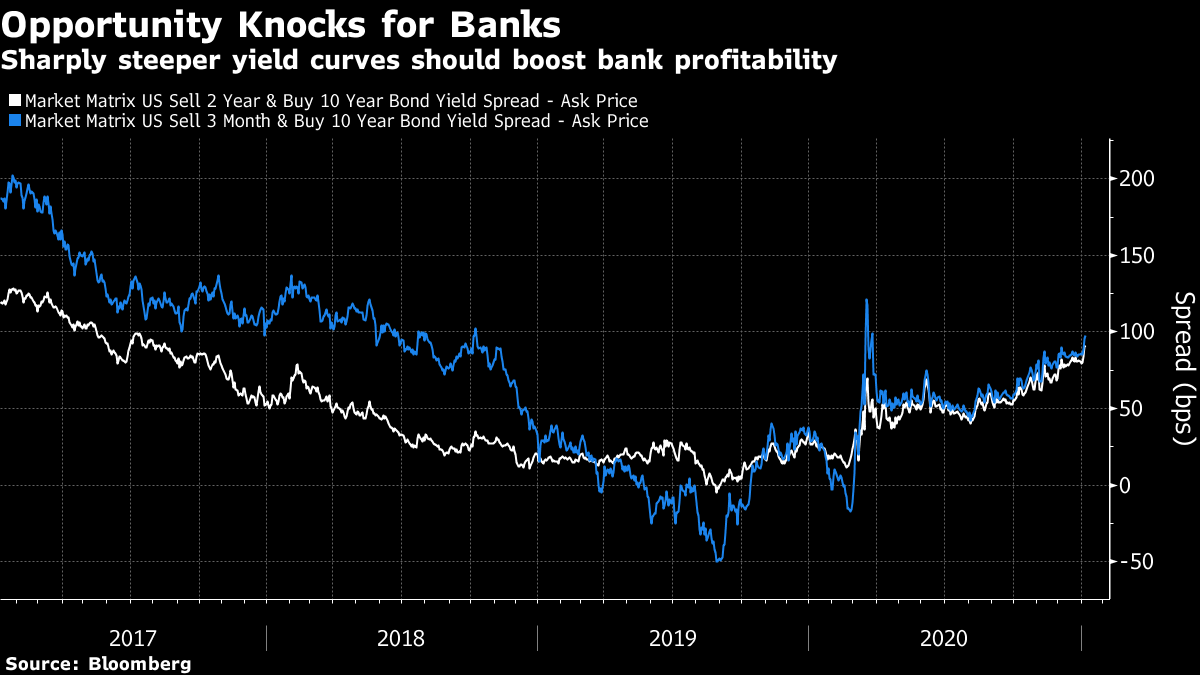

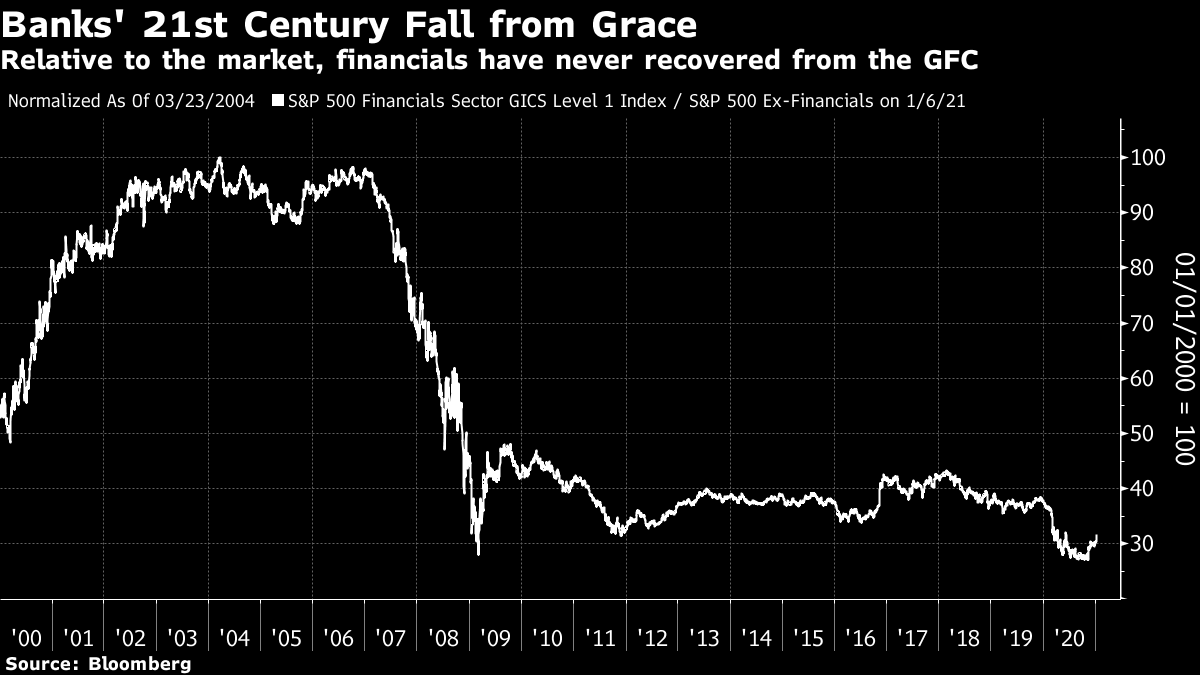

The invasion of the Capitol took place with almost two hours of trading left. As the chart shows, it prompted a sharp rise in the VIX volatility index, and a tumble for the S&P 500. But by the close, volatility was back to the level at which it had started the day, and the stock market had held on to some of its gains:  By far the greatest impact of the Georgia election results was felt in the bond market. A Democratic Senate is perceived as putting upward pressure on yields. And indeed, yields rose throughout election night, breached the 1% level and kept rising. A shocker like an armed invasion of the Capitol might have been expected to send investors rushing for the haven of bonds, and it did — but as the chart shows, this was only enough to bring the 10-year yield down by a bit more than one basis point. The shock value of the insurrection was tiny compared with the prospect of more expansive fiscal policy:  As the evening has continued, with a number of Republican senators backing down from their intent to vote not to certify the election results, the chances of a major constitutional set-to seem to have receded. A two-week Pence presidency would eliminate much uncertainty. And so the calculation seems to be in that the insurrection can be safely ignored. These are all risks that can be measured, at least to some extent, and if these are the judgments being made by investors they are probably correct. But there is a dangerous tendency to dismiss risks that can't be quantified. These events could have a dreadful if unquantifiable effect on U.S. "soft power." The big outstanding risk is that a significant current, numbering in the millions, continues to believe that Trump was denied by a fraudulent conspiracy, and is prepared to resort to further displays of resistance. I have no idea how to quantify that risk, but it exists. Should it come to pass, it would have a serious impact on the U.S. and the world — and, in passing, on the markets. Taking It to the BankSomewhat anti-climactically, let us now turn to the drama in the markets. Most dramatic was the recovery for banks. They have been deeply out of favor for a long time. But the stocks of big U.S. financial companies have been on a tear since Pfizer Inc.'s "Vaccine Day" in early November. With a day of massive outperformance Wednesday, they have now outperformed the rest of the S&P 500 by more than 30% in three months, and have made back all their lost ground, in relative terms, since last March. They still have to regain their losses from the first few weeks of the Covid-19 shock, but it is still quite a revival:  This wasn't just an American phenomenon. Banks in the rest of the world haven't lagged their local markets quite so badly, because they don't have FANG stocks to compete against. But they've trailed badly, and enjoyed a big recovery Wednesday:  Why would President Biden with Democrats in the ascendancy in both houses of Congress be such great news for banks? Because of the yield curve. Banks classically make a lot of their money from the gap in interest rates at which they borrow and lend. The steeper the yield curve, then, the greater the opportunity to make money. And curves have sharply steepened in response to hopes that the government will now start splashing money around, borrowing more and pushing up longer rates. This is true of the gap between both three-month bills and two-year bonds and the benchmark 10-year bond:  But this argument can only be taken so far. As Chris Davis, the veteran expert in financials who runs the Davis Financial Fund, points out, it would be just as easy to turn the Georgia results into an excuse to sell. President Biden with a unified Congress is likely to be much more unkind to Wall Street, and to beef up consumer protection once more in a move that will be unwelcome for retail banks. In any case, a steeper yield curve is less important to their profitability than it used to be. That might in turn imply that the Democrats' capture of the Senate was more of a convenient excuse to start buying banks than a reason to do so. The last such excuse came with the 2016 presidential election, when bank valuations (as measured, as is standard for the sector, by price-book multiples), last enjoyed a surge. Hopes of expansive fiscal policy then were dashed, but this time hope is rising once more. U.S. banks are once more trading above their book value:  Is there a valid bullish case to be made for them? Davis made a good attempt. They have done undue penance for the disasters of 2008, and this has gone unrecognized. In 2010, they accounted for 15% of the S&P's earnings, he says; by 2019 that reached 24%. Despite this, their share of the total market cap of the S&P slid from 18% to 12% over the period. Some but not all of this can be accounted for by the rise of the FANGs. This is how the S&P 500 Financials index has performed compared to the rest of the index in this century:  There is plenty of room for them to recover. Last year, Davis points out, the banks further had to deal with onerous (but probably correct) requirements from regulators that they beef up reserves to guard against the widely anticipated risk of a wave of bankruptcies. This major credit event didn't happen, but the extra reserves still ate into banks' profitability. They also showed themselves able to deal with the sudden drying up of liquidity early in the year. And, Davis says, they still managed to be profitable even with a flat and briefly inverted yield curve. On Davis's argument, trust in banks was so low (for good reasons after the disastrously irresponsible lending that sparked the crisis) that they needed to show they could weather a crisis and a recession before trust could be regained — much as Big Tech underwent a decade of penance after the bubble burst in 2000, before rallying again after the Great Recession. It's just possible that banks have finally done enough to win back trust, in which case there is a long way for them to go. They aren't as dramatic or as important as the horrifying events on Capitol Hill, but it's worth taking a look at the banks. Survival TipsOne of the good things about the lockdowns of the last 10 months is that I've got to know a lot more about my kids' taste in music. (I wrote that without my tongue in cheek, almost.) So, I tried listening to Evermore by Taylor Swift, one of two albums she produced while locked in, which I was assured was really good. And I have to report that it is, indeed, really good. Try listening to No body, no crime, or even the whole album. It reminds of Edie Brickell or Suzanne Vega. More soothing than watching cable news in the last couple of days. |

Post a Comment