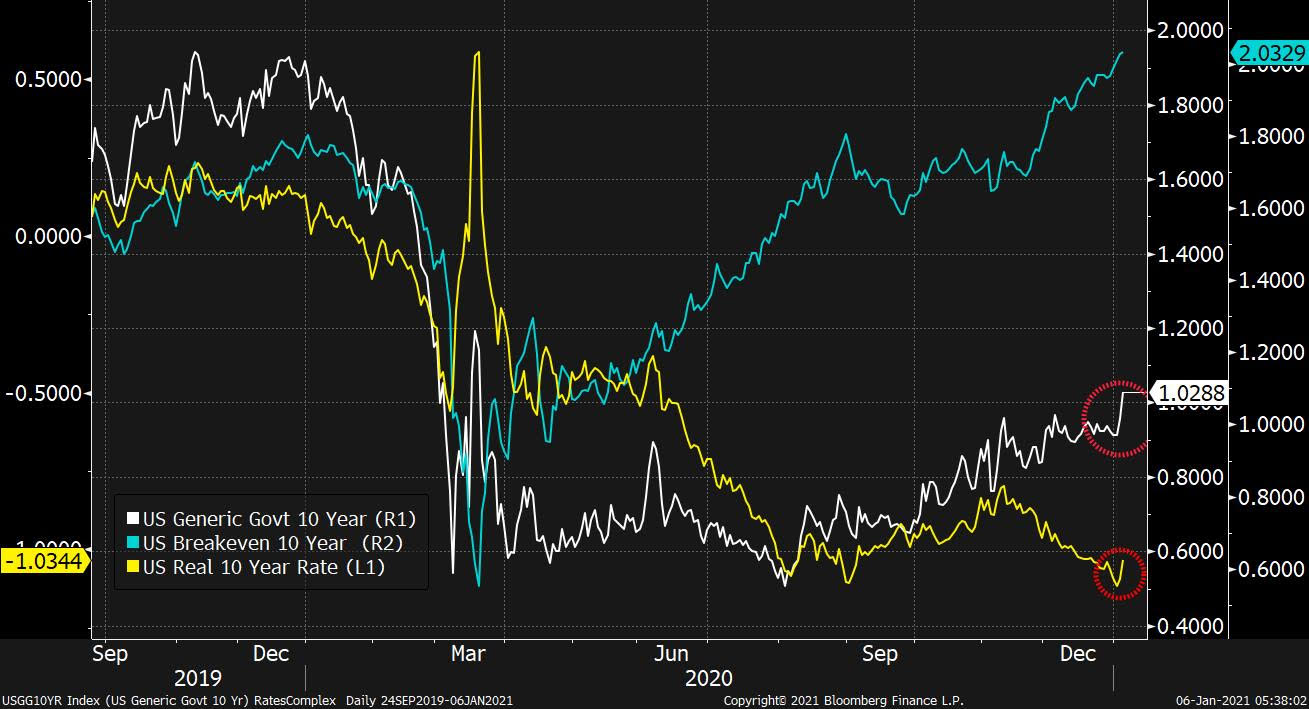

| Democrat control of the Senate in the balance, Treasury yields climb, and more grim Covid news. Tight Democrat Raphael Warnock won the first of two Senate runoff elections declared in Georgia, while Jon Ossoff holds a very slim lead over Republican Senator David Perdue in the other race where counting continues. The narrow margin of victory either way in that contest will almost certainly spark legal challenges and recounts. Should Democrats win both seats, the party will control the White House, the Senate and the House, giving President-elect Joe Biden more freedom to implement his policy agenda. 1%It is that policy agenda that is foremost in investors' minds this morning as they try to price in Biden's policies. The yield on 10-year Treasuries rose above 1% for the first time since March as a Democrat sweep is seen to pave the way for more spending. There were also signs in the bond market that investors see more inflation coming, with the spread between five- and 30-year bond yields hitting the highest level since November 2016. A gauge of the dollar fell to near the lowest since 2018. One in 30The scale of the Covid crisis in the U.K. was laid bare yesterday when the government released data showing one person in every 50 in England has the virus, while one in 30 in London is infected. The new strain of the virus has pushed the country's health service close to breaking point, with things expected to worsen in the coming weeks. Governments across the world are under pressure to speed up vaccine programs. In the U.S., the South is once again seeing a rapid rise in cases, with more than 45% of Covid tests coming back positive in Alabama in the past two weeks. Equities mixed While the Georgia election is dominating the bond market today, there are some significant moves in equities too. Overnight, the MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed 0.2% higher. In Europe, the Stoxx 600 Index had gained 0.9% by 5:50 a.m. Eastern Time with banks surging and energy stocks adding to gains in the wake of Saudi Arabia's decision to cut oil production. While S&P 500 futures pointed to a small drop at the open, the biggest moves were in Nasdaq futures, which were under pressure as investors worried about Democrat polices towards large tech companies. Oil traded at over $50 a barrel and gold added to recent gains. Coming up...ADP employment change data for December is at 8:15 a.m., Services and Composite PMIs are at 9:45 a.m. and November Factory and Durable Goods Orders are at 10:00 a.m. Crude oil inventories data is at 10:30 a.m. The minutes from the December Fed meeting are published at 2:00 p.m. The biggest event of the day will be in Washington where Congress meets to certify the results of November's election, with scores of Republican lawmakers set to challenge the count. President Donald Trump is also trying to put pressure on Vice President Mike Pence to reject some electors. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningWe're still waiting on results from one of the two Georgia races from last night, but at the moment it appears Democrats have a strong chance of taking control of the Senate, giving Biden a chance to enact at least some of his policy agenda. So we're seeing some interesting market moves this morning that are worth breaking down. First let's look at rates. Here's a chart that I've been tracking for awhile that shows the yield on the U.S. 10-year (white line), implied breakeven inflation rates (teal line) and real 10-year yields (yellow line). You can see the spike in 10-year yields, as investors expect greater stimulus coming and eventually some sort of Federal Reserve response. Another way to think about it therefore is that the timing of the first Fed rate hike (whenever that is) just got pulled forward a little bit, bringing up both nominal and real yields.  Turning to equity markets, there's a pretty interesting divergence going on across different sectors. The easiest way to see that is to compare the QQQ ETF (which tracks the tech-dominated Nasdaq 100) versus ETFs that track oil and financials.

What you can see clearly is that the tech ETF (white line) is tanking relative to where it closed yesterday, while the other two are surging.  It's not instantly intuitive that a big Democratic night would favor oil companies and banks. But the story here is that more stimulus is assumed to equal more growth, which is all else equal beneficial for companies whose fortunes are highly tied to the fate of the economy and interest rates. Meanwhile, tech has been a quasi safe haven during this long period of weakness. And if we were to break out of that, then perhaps investors won't be as interested in paying huge multiples on estimated earnings. Hence the fall.

Bottom line: If the Democrats hold on and win the Senate, the market's initial assessment is more stimulus, an eventual Fed response, and a more favorable outlook for value sectors, as opposed to high-flying tech.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment