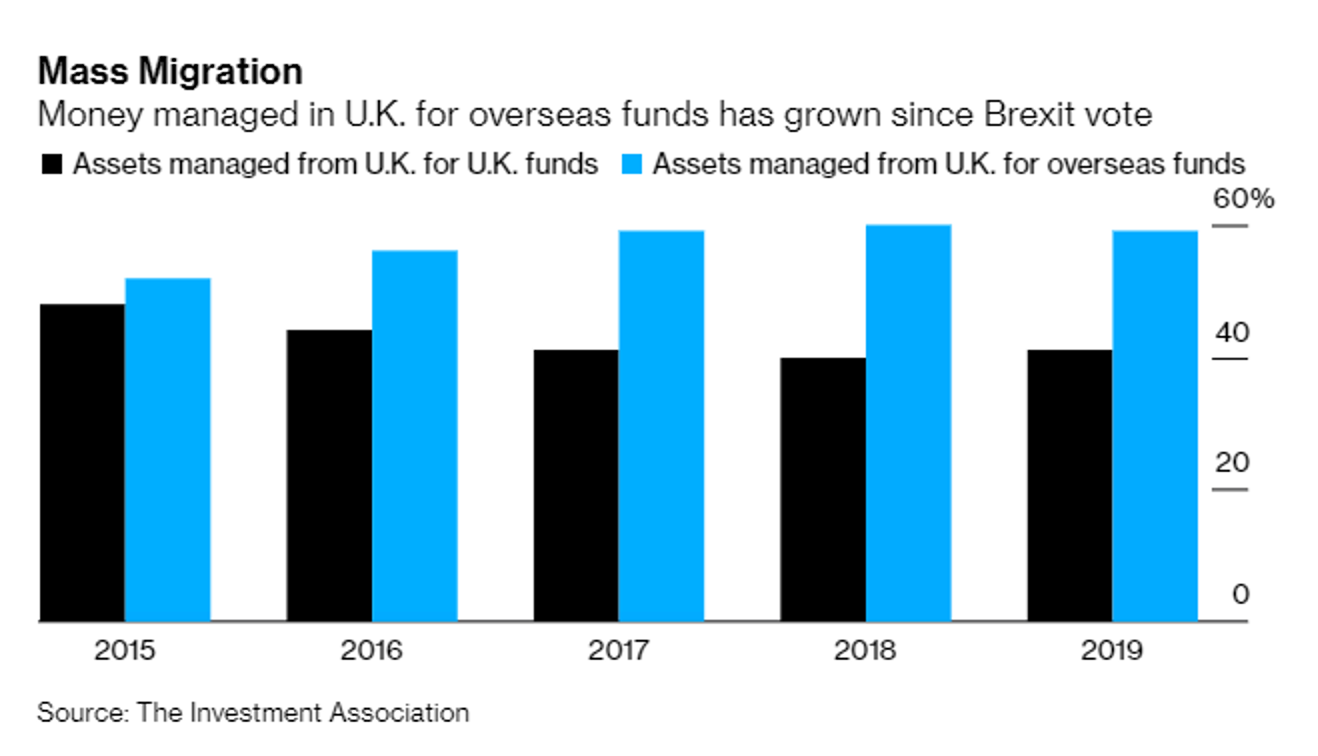

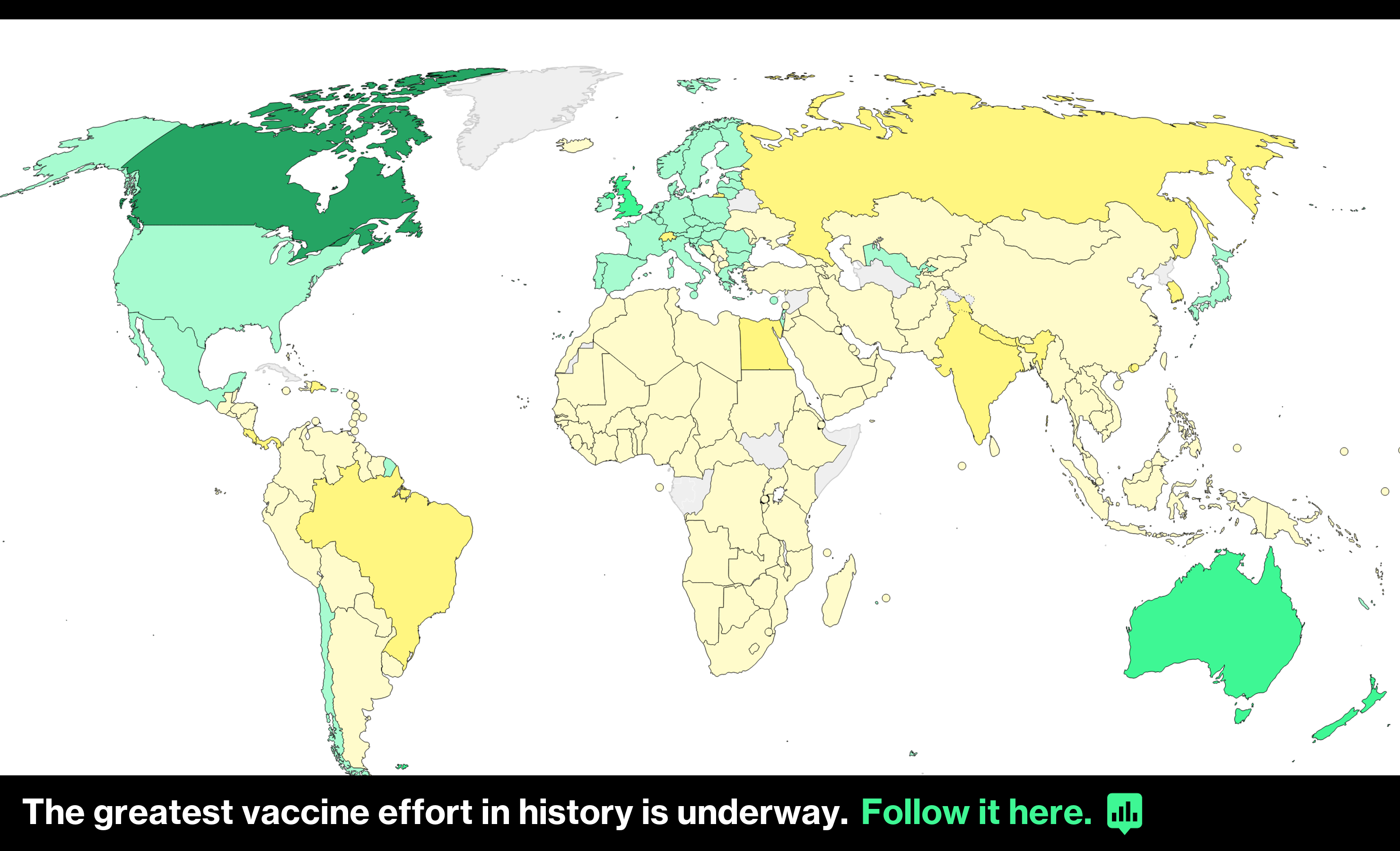

| What's happening? The consequences of Brexit are starting to play out in the City of London – and in some more unexpected places. The rules for London's financial services firms may still be uncertain after Brexit, but one result is already clear: a steady stream of people and business leaving Europe's financial capital. First it was stock-trading, now fund managers. They are concerned about a Brussels-shaped threat to $2 trillion of business. As Lucca de Paoli and Silla Brush report, the EU is considering tightening the rules on delegation, meaning the management of some assets could be forced out of London.  Skyscrapers in City of London, U.K., on Monday, Jan. 4, 2021. Photographer: Jason Alden/Bloomberg Thousands of traders and salespeople have already moved out of London since the 2016 referendum. But the next wave is likely to include the high-flyers who advise on strategy, mergers and the raising of capital, according to more than a dozen officials at global institutions. Goldman Sachs Group Inc., for one, is moving senior London investment bankers to the continent. The problem, as Eyk Henning and Jan-Henrik Förster report, is that U.K. bankers can no longer directly pitch transactions to EU corporate clients. They need a chaperone, a colleague within the EU to initiate contact. And one European regulator has already warned firms against trying to game the system. The backdrop to all this is the negotiation between the EU and U.K. over regulatory equivalence. Unless the EU determines that Britain's rules are as strict as its own, U.K. firms won't be able to offer their services directly to clients in the bloc. The problem for London is that equivalence is entirely in Brussels' gift – and it's hard to see what incentive EU member states, which have long lusted after a slice of London's business, have to grant it soon. If anything, there's an incentive for them to prolong the uncertainty and lure business away.  Elsewhere, Brexit is starting to have some more unexpected effects on the economy. Alberto Nardelli reported this week on how art dealers shifted works out of Britain ahead of the new year to avoid potential import duties in future. Meanwhile, Scottish fishermen have taken to landing their catches in Denmark because of delays in getting them through the U.K. border. Fishing is a small industry but, with elections due in Scotland later this year, it is one with an outsized political impact. One outcome the government has avoided so far is an apocalyptic queue of trucks across Kent, as happened before Christmas. That's because drivers haven't been making it as far as the border. Instead they've been stuck in depots and at factory gates because they can't find officials to process their customs paperwork. As Joe Mayes and Lizzy Burden report, the shortage of customs agents has throttled trade and threatens to hamper any long-term rebound. Faced with all this disruption, it is worth asking what U.K. Prime Minister Boris Johnson will do with his new-found freedom outside the EU. If the Financial Times is right, his government plans to rip up workers' rights and scrap the 48-hour working week. Business Secretary Kwasi Kwarteng quickly denied parts of the report – but his department is still considering changes to help support businesses and growth. Even if the details are disputed, they will be a strong indicator of Britain's future direction of travel. — Edward Evans Beyond Brexit Click here for the latest on the global coronavirus vaccine rollout. Sign up here for our coronavirus newsletter, and subscribe to our podcast. Watch Bloomberg Quicktake, our new streaming news service with a global view and an informed take. Want to keep up with Brexit?You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share the Brexit Bulletin: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. Like getting the Brexit Bulletin? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. |

Post a Comment