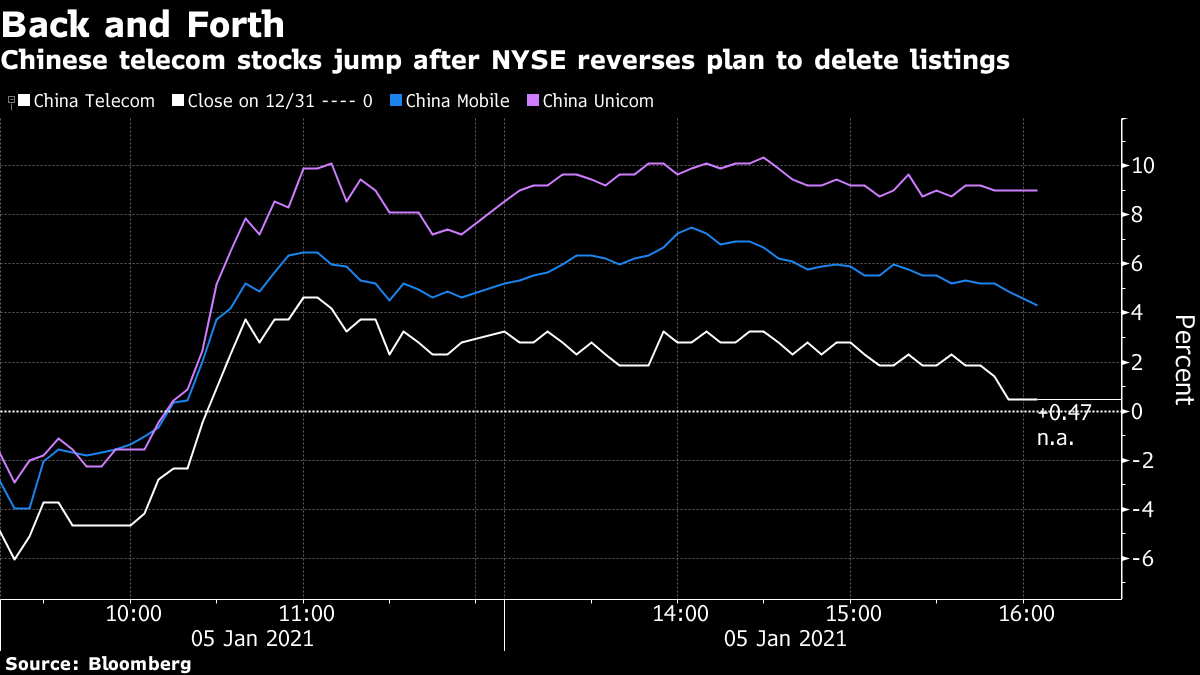

| NYSE says it won't delist Chinese shares...then changes its mind (again). Markets await Georgia races outcome. China hands down death sentence for bribery. The New York Stock Exchange is reconsidering its decision to halt the delisting of three major Chinese telecommunications firms after Treasury Secretary Steven Mnuchin told the Big Board he opposed its shock announcement to grant the companies a reprieve, said three people familiar with the matter. NYSE's announcement that it wouldn't remove China Mobile, China Telecom and China Unicom Hong Kong after all, caught some officials at the White House, Treasury and State departments off guard. It also sowed confusion among the regulators who had helped craft the order signed by President Donald Trump in November that requires American investors to unload Chinese businesses deemed as posing a threat to U.S. national security. Saudi Arabia surprised the oil market with a large reduction in its output for February and March, carrying a greater burden of OPEC+ cuts while other producers hold steady or make small increases. The kingdom will make an extra cut of 1 million barrels a day, said Saudi Energy Minister Prince Abdulaziz bin Salman. That more than offsets the combined 75,000 barrel-a-day increase Russia and Kazakhstan will be allowed to make in each of those months. The rest of the group will hold output steady. Asian stocks looked set to follow their U.S. peers with modest gains Wednesday as traders awaited the outcome of key elections in Georgia that could have implications for President-elect Joe Biden's agenda. Treasuries dropped and oil rallied on the OPEC+ deal. Futures pointed higher in Japan and Hong Kong, though were little changed in Australia. In a session marked by thin trading volume, the S&P 500 rebounded after suffering its worst start to a year since 2016. Treasury yields climbed — with a key curve measure reaching its steepest level in four years — as markets become more comfortable with the idea of Democrats taking control of both chambers of Congress, which would imply the possibility of a more generous stimulus package. The dollar tumbled to the lowest since February 2018 against its major peers. Oil surged past $50 a barrel for the first time since February. China has sentenced to death the former chairman of China Huarong Asset Management Co., Lai Xiaomin, on charges of malfeasance, one of the most severe sentences to stem from President Xi Jinping's anti-corruption drive. He was found guilty of receiving 1.79 billion yuan ($277 million) in bribes between 2008 and 2018, according to the court of Tianjin City. The move underscores the ruling Communist Party's increasingly tough stance on corruption among government cadres and corporate executives, which has seen more than 1.5 million government officials punished. U.S. intelligence agencies and the FBI said a major hack of the federal government and some corporations was likely undertaken by Russia — contradicting President Trump's efforts to suggest China might be responsible — and "will require a sustained and dedicated effort to remediate." The Federal Bureau of Investigation is still focused on identifying victims, collecting and analyzing evidence and sharing information about the sophisticated hack, according to a joint statement on Tuesday from the FBI, National Security Agency, Office of the Director of National Intelligence and the Cybersecurity and Infrastructure Security Agency. The cyber-attacks are ongoing, according to the agencies. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayWhat is going on? Anyone waking up this morning will probably be surprised to see the latest news regarding the delisting of three Chinese telecoms companies in the U.S. After announcing last week that it planned to delist the companies to comply with U.S. Treasury rules imposed by the Trump administration, the New York Stock Exchange backtracked on Tuesday to say it wouldn't go through with the delisting following "further consultation with relevant regulatory authorities." Then, later that day, we learned that the NYSE might go through with it after all, with Bloomberg reporting that Treasury Secretary Steve Mnuchin told the exchange that he opposed the surprise u-turn that granted the companies a reprieve.  The remarkable back-and-forth will clearly be of interest to anyone who sold (or bought) ADRs off the back of the NYSE announcements. It also plays straight into the hands of Chinese regulators who now have a perfect example of the unruliness and unreliability of U.S. capital markets. U.S. politicians have long criticized China's financial markets and business environment as unpredictably beholden to the Communist Party, with requirements likely to change or be reinterpreted at any time. This "rule by law" of the Party, is much more uncertain than the "rule of law" that tends to be the norm in the West, as Elizabeth Chen, a researcher at the Jamestown Foundation, recently put it. Now, China officials can counter that characterization with an incredible example of U.S. "rule by law" of their own. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment