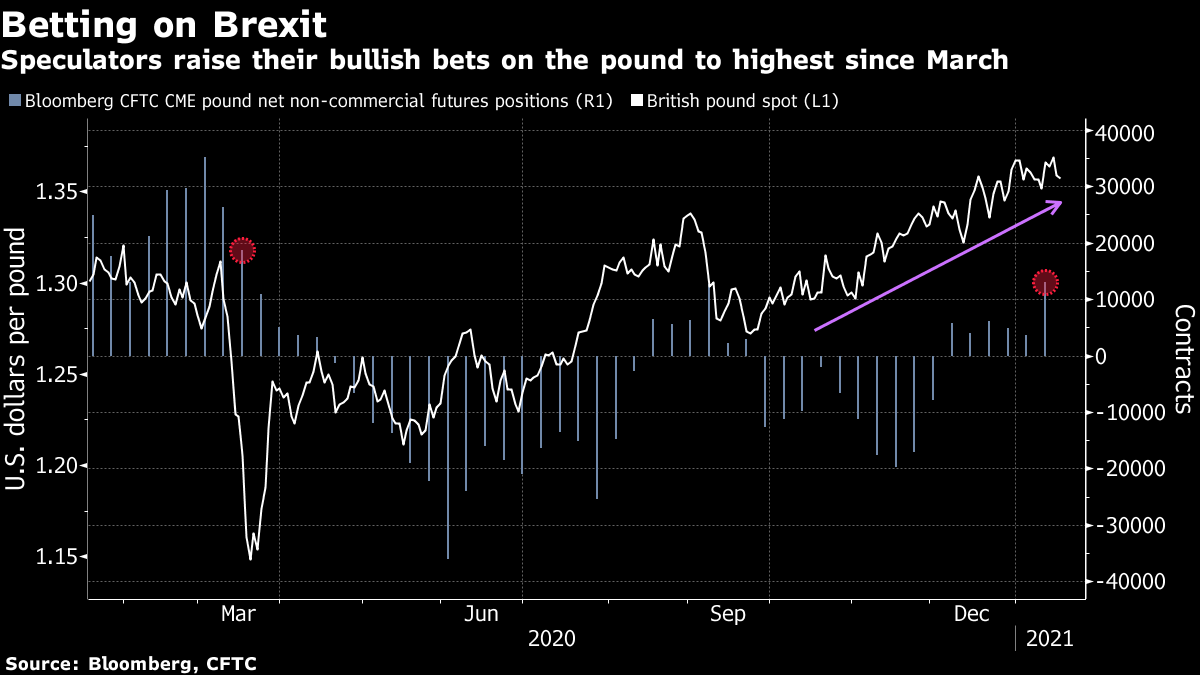

| Good morning. Trump's goodbye, Italy confidence vote, Janet Yellen hearing. Here's what's moving markets. Trump's FarewellIt's U.S. President Donald Trump's last full day in the job. His approval rating has dropped to a low point of a presidency that already had the weakest average of any of his predecessors since the Gallup poll began, though views remain highly polarized. Despite speculation, officials don't expect Trump to give himself, nor those closest to him, preemptive pardons, Bloomberg reports. There's a bizarre detail, though, with clemency potentially in the works for rapper Lil Wayne. Meanwhile, with Trump set to skip Joe Biden's inauguration tomorrow, his supporters have been invited to a separate event outside of Washington. Here's what could be next for Citizen Trump. Conte Clears HurdleGiuseppe Conte's ambition to continue as Italy's prime minister faces a crucial test later with a confidence vote in the senate, after he won a similar vote in the lower house of parliament late yesterday. A narrow victory in the senate would allow the premier to stay in power, even if his support fell short of an outright majority. A defeat would force him to offer his resignation to President Sergio Mattarella. The test of strength in the upper house comes in the wake of the defection of Italy Alive, a minor coalition party headed by ex-premier Matteo Renzi. Yellen HearingThe dollar edges lower ahead of Janet Yellen's confirmation hearing for the U.S. Treasury Secretary position before a Senate committee today, as the former Federal Reserve boss bids to become the first woman in the role. Lawmakers will also likely vet Biden's spending package and expected foreign exchange policy. The EU, meanwhile, is due to unveil its plan to strengthen the international role of the euro. European stock futures are higher after shares managed small gains Monday amid a focus on earnings to come. Gold is steady ahead of Yellen, and keep an eye on Bitcoin as strategists look for the digital coin to get back to $40,000. Different SpeedsThe European Union is to urge member states to set a goal of inoculating at least 70% of the bloc's population from Covid-19 by the summer. The union combined with Britain and the U.S. have, so far, given citizens about 24 million doses -- more than half of the shots administered globally. However, vast numbers of countries have yet to begin their campaigns, raising concerns around breeding more dangerous versions of the illness. Meanwhile, authorities in Norway say there's no evidence of a direct link between the recent string of deaths among elderly people and the vaccine they received. For travel, Biden's incoming administration rejected a move by Trump to rescind coronavirus-related bans for non-American citizens arriving from the EU, the U.K. and Brazil. Coming Up…In corporate earnings, engineer Alstom provides an update from this region, while U.S. banks Goldman Sachs and Bank of America are also scheduled. In data, we'll get a reading of the German ZEW economic survey. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningSterling traders are clearly not stuck in customs in Kent. Despite stories of red tape and mountains of paperwork choking cross-border U.K. trade, FX players look to have put concerns about Brexit behind them and are backing the pound to push higher this year. Net long speculative positions in the British currency have risen to their highest since March, according to the latest Commodity Futures Trading Commission data. Investors have warmed to U.K. assets since the country left the European Union at the end of 2020, bolstered by the Brexit trade deal and Britain's rapid Covid-19 vaccination drive. The FTSE 100 is up almost twice as much as the Stoxx 600 this year. The pound is sitting solidly mid-table among its G-10 peers over the past three months, up about 5% against the dollar. A paring back of rate cut bets could help momentum in the short-term. But much will depend on the U.K. benefiting from its vaccine headstart and avoiding any setbacks that delay the economy's reopening.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment