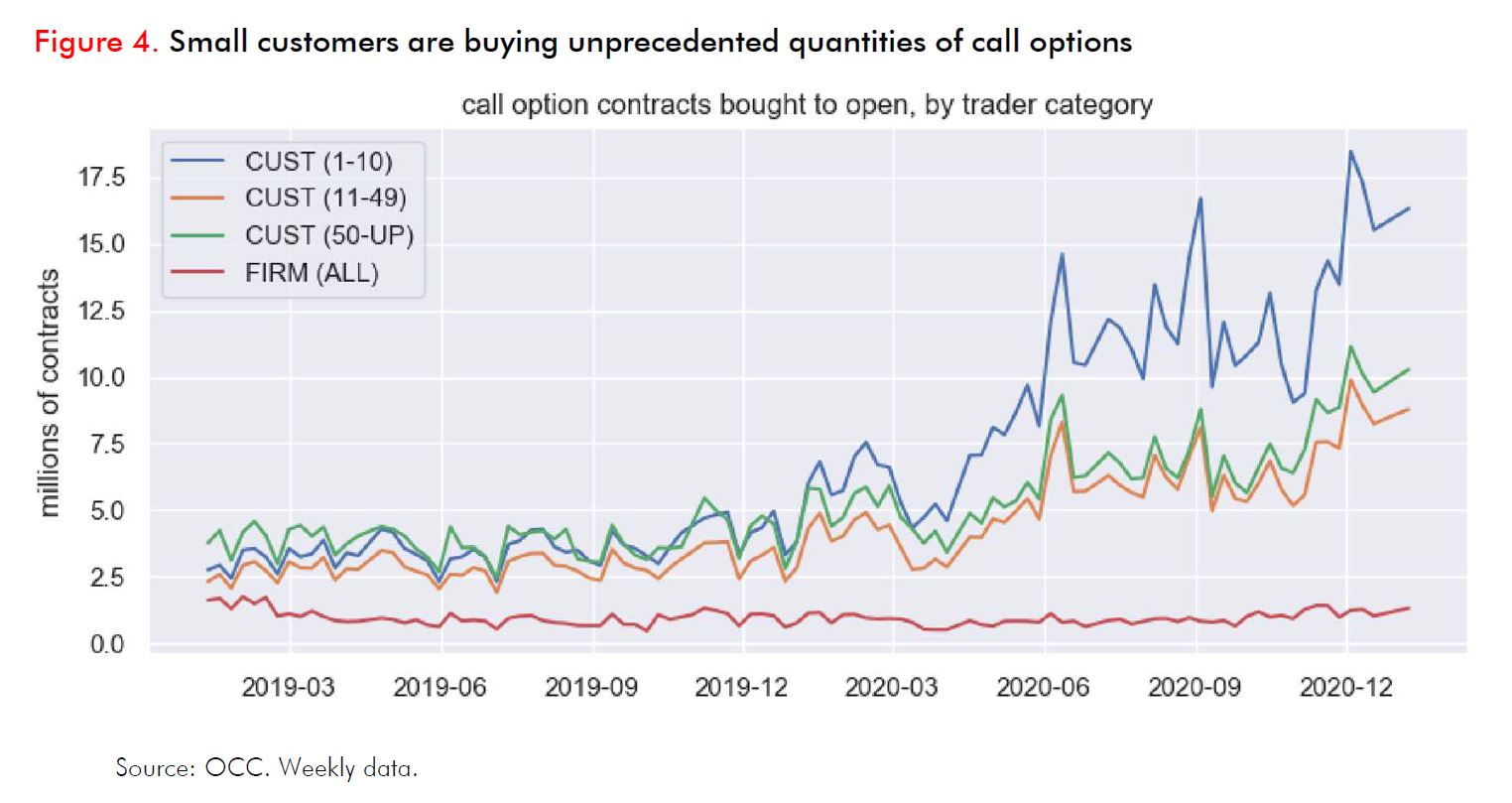

| Janet Yellen signals a hard China stance under Biden. A hedge fund leaves Hong Kong. Goldman says buy any dip. Janet Yellen said the U.S. is prepared to take on China's "abusive" trade and economic practices, signaling that President-elect Joe Biden's administration will aim to continue some of Donald Trump's hard-line policies toward Beijing. China "is undercutting American companies by dumping products, erecting trade barriers and giving illegal subsidies to corporations," Yellen, Biden's intended nominee for Treasury secretary, said. Secretary of State Michael Pompeo added to tensions by labelling China's crackdown on Uighurs a "genocide". Meanwhile in a rare gesture of goodwill toward his successor, Trump said in his farewell address that he wished Biden's administration success; Senate Republican leader Mitch McConnell said the mob that stormed the Capitol was "provoked by the president"; and Biden is planning an immigration overhaul on his first day in the job. Asian stocks looked set for a muted start Wednesday after their U.S. peers rebounded from Friday's selloff and traders parsed the latest earnings reports. The dollar retreated. Futures edged higher in Japan and Australia, though dipped in Hong Kong, which saw strong gains Tuesday. U.S. stocks rose, led by tech shares and small caps. Treasuries were steady, with the yield on 10-year notes around 1.1%. Crude oil advanced and gold was little changed. Netflix surged in after-hours trading as it added more customers than expected. Activist investor Elliott Management plans to close its office in Hong Kong, and move its remaining staff there to offices in London and Tokyo, according to a person familiar with the matter. The New York-based hedge fund, run by billionaire Paul Singer, has been winding down its operations there, and had fewer than 20 employees left in the city on January 1, the person said. The shift began in early 2018 when the firm's then-head of Hong Kong, James Smith, moved to London and began running its Asian operations from the U.K. Smith left the firm the following year. Elliott, which was founded by Singer in 1977, had more than $45 billion in assets under management at the end of 2020. While the risk of a correction in stocks is increasing, stimulus measures and the event-driven nature of the economic crisis make a bear market unlikely, strategists at Goldman Sachs said, recommending using any dips to buy equities. Instead of fearing bear territory, they said in a note that the market is in the early stages of a bull phase following an "explosive" valuations-led rebound in stocks that tends to start in recession and marks the start of a new cycle. Global equities have surged more than 70% since a coronavirus-induced selloff in March last year, reaching a record earlier this month on bets of a vaccine-fueled economic bounce and expanding U.S. stimulus. Wealthy investors rushed to offload stock in Alibaba after China began an investigation into alleged monopolistic practices at billionaire Jack Ma's internet giant, according to Citigroup's private bank. "A large number" of the bank's ultra-rich clients cut or exited their holdings in China's largest e-commerce firm after reports of the probe emerged, the bank said in a report Tuesday. China's stock market previously attracted significant inflows from the firm's wealthiest customers in the second-half of the year, according to the report. China's central bank said last week that Ant Group is working on a timetable to overhaul its business while ensuring operations continue. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in today"Buy the Dip" as a market mantra came about after years of successive interventions by the Federal Reserve. When risk assets shuddered in the face of bad economic news, the central bank would reiterate its commitment to backstopping the economy — and soon enough, stocks would be on their way up again. Buy the Dip (or its ruder acronym "BTFD") was born. In 2020, Buy the Dip arguably went into overdrive as stuck-at-home day traders joined big institutional investors in this cyclical behavior. Retail traders have been buying call options like never before, effectively betting that markets will keep going up and up. You can see that happening in the chart below, courtesy of Benn Eifert at QVR Advisors. Investors trading fewer than 10 lots of options have increased their average contract volumes by a factor of five to six since early 2019 — a much bigger leap in activity than that seen at larger firms in the same period.  Bloomberg Bloomberg This jump in call options in 2020 is the Buy the Dip strategy gone into overdrive, since people aren't even waiting for the dip to actually happen. In some respects its also the commingling of the Fed backstop with a market technicality: as investors buy more options, dealers are forced to hedge by buying the underlying stock, which forces stocks up further and encourages more call-buying. The truly extraordinary aspects of the whole dynamic are its speed and robustness. Whenever the market has fallen in 2020, this risk-taking behavior has snapped back almost immediately. As Eifert points out: "March, June and October all saw sharp pullbacks in this flow. However, each time it snapped back stronger than before." It's not just Buy the Dip now, it's Buy the Dip². You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment