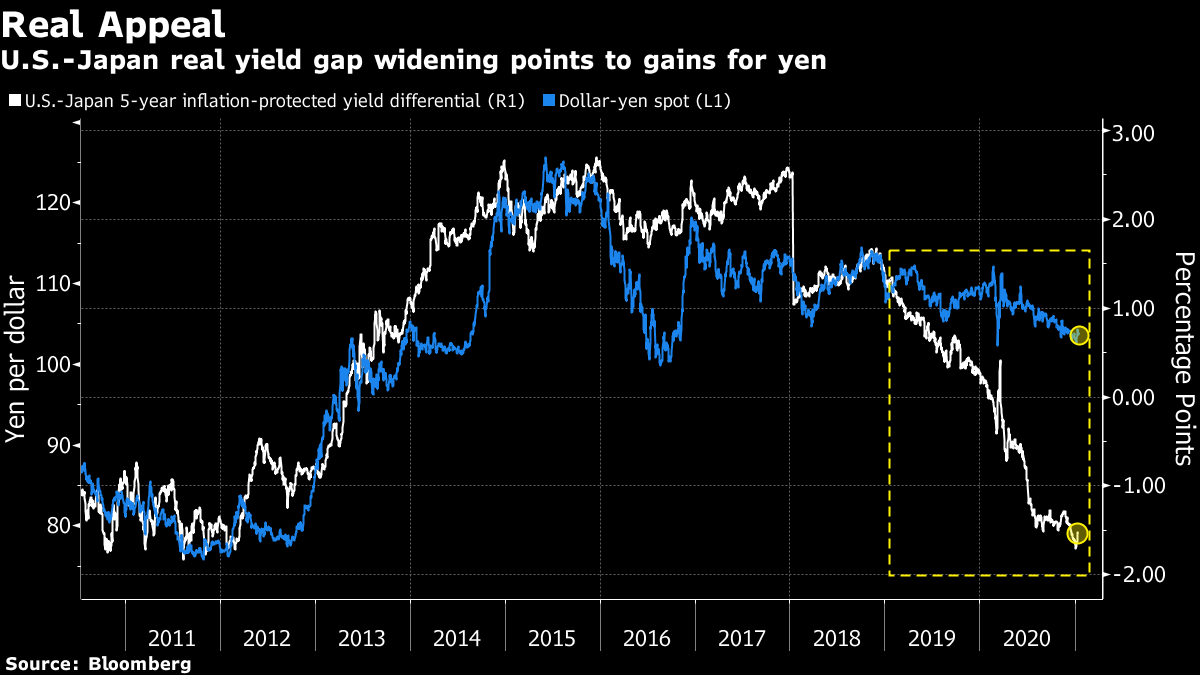

| Good morning. Economic optimism, new German party leader and Alexey Navalny's detainment. Here's what's moving markets. China's ExpansionThere are fresh economic hopes for China after gross domestic product jumped 6.5% in the final quarter, topping forecasts and pre-pandemic growth rates. The data also meant the Chinese economy was the only major one to avoid contraction in 2020. Meanwhile, for the U.S., Goldman Sachs Group economists raised their growth forecasts for this year and beyond, citing President-elect Joe Biden's spending plans. Elsewhere, the dollar may have been boosted this morning by a Wall Street Journal report that Treasury Secretary nominee Janet Yellen is to affirm a commitment to market-determined exchange rates. Here is what's coming up for the economy this week. Laschet's WinGermany's Christian Democratic Union party elected Armin Laschet as leader, opting for the candidate who most resembles outgoing chancellor, Angela Merkel, in policy and style. Laschet's win is being viewed as good news for those who favour greater European Union integration and engagement with China and Russia. Merkel is due to step down after elections in September, but here's why Laschet still might not be the next chancellor. Earnings AheadEuropean equity futures are lower ahead of a week that sees earnings season pick up pace. The main focus is forward looking guidance, with analysts predicting a sharp rebound in profits this year following an eye-watering plunge in 2020. After a jump of about 20% for the Stoxx 600 index since the end of October, valuations may be set up for disappointment. That said, most commentators see the rally as still having some way to go. Utility Repsol and miner Rio Tinto report today. Navalny HeldThere was weekend drama in Russia as police detained opposition leader Alexey Navalny, an outspoken critic of President Vladimir Putin, as he arrived in Moscow after being treated in Germany for poisoning. The 44-year-old's capture at passport control was shown on a live video feed on his YouTube channel. "This is my home," he told reporters shortly before he was detained. "I'm not scared of anything." The U.S. condemned Russia's decision and called for Navalny's immediate and unconditional release, echoing similar demands from the European Union. Here's a reminder of why Moscow views Navalny as a threat. Coming Up…There's plenty of deal news to digest: Carrefour shares may be in focus after the grocer and Alimentation Couche-Tard ended merger talks, while private equity firms are prepared to make an offer for utility Suez, Bloomberg reports. Meanwhile, Total agreed to buy a stake in Adani Green Energy for $2.5 billion. Watch U.K. homebuilders, too, after Rightmove data showed house prices slipped. For the global technology sector, the Trump administration notified several Huawei suppliers that it's revoking their licenses to work with the Chinese company, Reuters reports. Elsewhere, it's a busy week for sovereign bond auctions, while euro area finance ministers are due to discuss the pandemic. In Italy, traders are eying Tuesday's key senate vote. Finally, note that there are U.S. markets closures for the Martin Luther King Jr. holiday. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningYen bulls will have been watching the recent revival of the U.S. reflation trade with great interest. As inflation expectations push higher stateside, they are languishing in Japan, helping to push the country's real yield advantage over the U.S. to its widest in nine years. That increases the relative attractiveness of Japan's bonds and the yen, and could boost the latter. The spread between 5-year inflation-protected bond yields in the two countries has shown a close relationship in the past with the dollar-yen and suggests the greenback has further to fall against its Japanese counterpart, following its 5% decline in 2020. Consumer price growth in Japan excluding fresh food -- a measure closely watched by the country's central bank -- has been negative or zero since April. Expectations for future inflation -- derived from 5-year breakeven rates -- sit at minus 0.1%, compared to 2.1% and rising in the U.S., as investors bet further stimulus under President-elect Joe Biden will help reflate the American economy. Strategists have been lining up with calls in recent months for the yen to make a decent attempt at breaking the closely-watched barrier of 100 per dollar. If the real yield trends continue, it will have every chance of doing so.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment