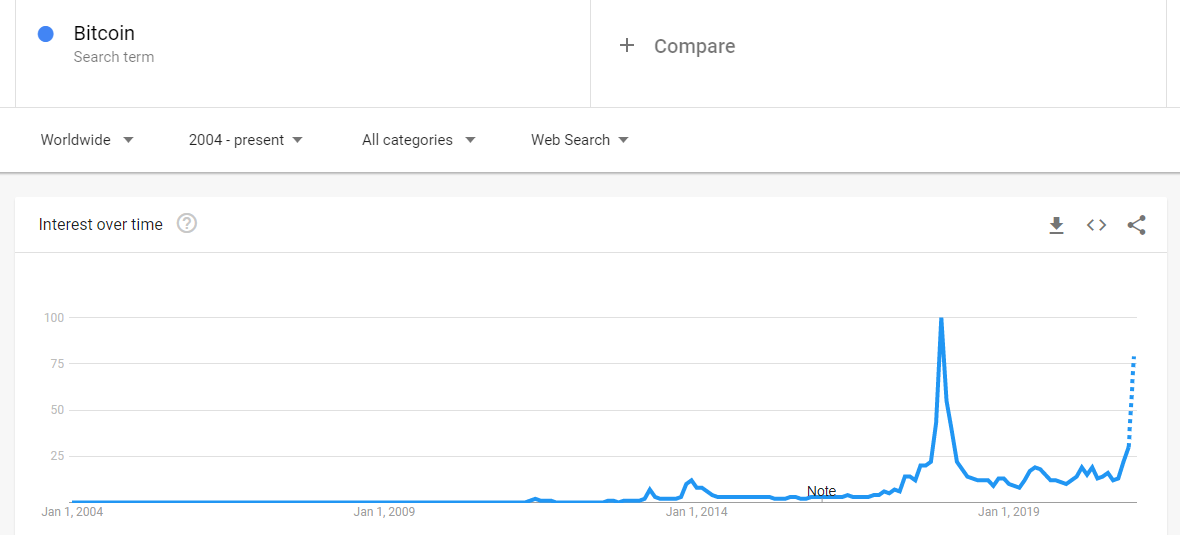

| Biden asks for $1.9 trillion in stimulus. The U.S. blacklists a major Chinese oil company. China's economy is roaring back to life. President-elect Joe Biden will ask Congress for $1.9 trillion to fund immediate relief for the pandemic-wracked U.S., in the face of a split Senate and a deteriorating economy. The proposal will be the first phase of a two-part strategy, with a broader program in subsequent weeks focused on longer-term goals such as infrastructure and climate change. Here are the key items in his stimulus plan. Meanwhile, a day after the House impeached President Donald Trump for a second time, there is still little clarity on when his trial would take place or what form it would take. That has major implications for President-elect Joe Biden, who is set to be sworn-in six days from now. The trial is giving Trump a fresh headache too: he's having trouble finding a legal team willing to defend him. The Trump administration announced that it's blacklisting Chinese smartphone maker Xiaomi for its links to the military, and China's third-biggest oil company China National Offshore Oil Corp., over drilling in disputed South China Sea waters. The announcement comes as part of a Trump administration push against Beijing during its final days in office, and follows a decision to blacklist more than 60 other Chinese companies in December, prompting China to threaten countermeasures. "CNOOC acts as a bully for the People's Liberation Army to intimidate China's neighbors, and the Chinese military continues to benefit from government civil-military fusion policies for malign purposes," Commerce Secretary Wilbur Ross said in a statement. China's economic ascent is accelerating barely a year after its first coronavirus lockdowns. The world's second-largest economy is set on Monday to report GDP increased 2.1% in 2020, the only major economy to have avoided a contraction, according to a Bloomberg survey of economists. After withstanding President Donald Trump's trade war, China is looking to domestic consumption to power its next phase of growth, and is deepening ties within Asia and Europe: In November, fifteen Asian countries including China signed the Regional Comprehensive Economic Partnership pact, and in December, the EU agreed to a comprehensive investment deal with China. U.S. equity futures edged higher and Treasury contracts were steady as investors scrutinized President-elect Joe Biden's $1.9 trillion Covid-19 relief plan. Asian stocks looked set for a muted start. S&P 500 futures nudged up after the benchmark surrendered gains late in the session to end modestly lower. Technology, communication services and consumer discretionary sectors were the biggest losers. After the market closed, the details of Biden's proposal were released, including a wave of new spending, more direct payments to households, an expansion of jobless benefits and an enlargement of vaccinations and virus-testing programs. Futures were flat in Hong Kong and Japan, while Australian shares opened higher. Treasury yields rose in the Thursday session and the dollar weakened. Asia's financial markets are showing signs of froth as investment pours into nations that have so far contained the coronavirus better than their Western counterparts. South Korea's Kospi stock index is among the best performers worldwide in 2021, China's equity benchmark is near a record and Japan's Nikkei 225 index has scaled a new peak in dollar terms. An Asian currency gauge is on one of its longest winning streaks in more than two decades. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayBig news in markets this week was Bitcoin's steep plunge. Is it a sign that the bubble is bursting or just the usual crypto volatility? Bitcoin, as we've discussed before, isn't a traditional asset in the sense that you can look up its price-to-earnings ratio or something like that to gauge whether it's overvalued. Its value lies almost entirely in a network effect: the more people get excited about it, the better. And so, the chart below might be of utmost importance for Bitcoin bulls. It shows Google Trends data for "Bitcoin," — the volume of search requests for the term. There's not a lot of historical data to parse, but if you're looking for a rough gauge of interest, then this is it. On this basis, enthusiasm for Bitcoin has yet to reach its 2017 highs, even as the price goes parabolic. That suggests a lot more money could, in theory, still pour into it.  Bloomberg Bloomberg You can follow Tracy Alloway on Twitter at @tracyalloway. All Things Wall Street and Finance

Join the many Matt Levine subscribers and sign up for the Bloomberg Opinion columnist's daily newsletter here. Trust us, your inbox will thank you for it. |

Post a Comment