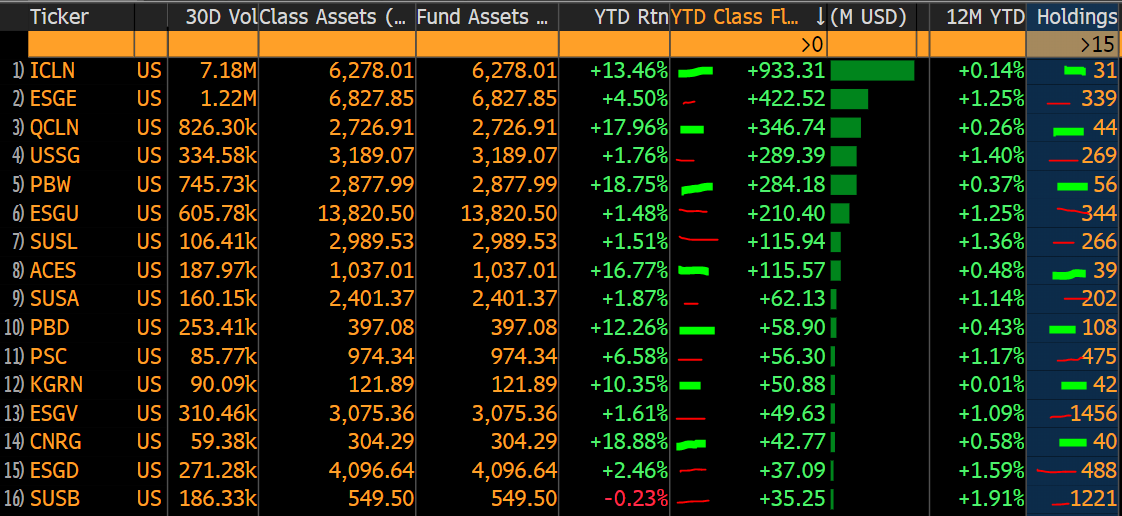

| Trump is impeached for a second time. China's benchmark stocks hit 13-year highs. Alibaba's silence leads to investor concerns. President Donald Trump was impeached by the U.S. House on a single charge of incitement of insurrection for his role in a riot by his supporters that left five dead and the Capitol ransacked. Wednesday's historic 232-197 vote makes Trump the only U.S. president to be impeached twice, a little more than a year since his first. It was supported by all Democrats and 10 Republicans, including Liz Cheney, the third-ranking GOP leader in the House. Amid all the chaos, top U.S. officials abruptly canceled international travel this week out of concern foreign adversaries could exploit a historic political crisis, according to multiple people with the situation. On the impeachment, here's what happens next. Asian shares looked poised for a muted start. Treasuries saw strong demand for a second consecutive day at a government debt sale, helping to send yields down from the highest levels since March. Stock futures were little changed in Japan, Hong Kong and Australia. Technology shares led gains in the U.S., with the Nasdaq 100 outperforming the S&P 500. The dollar edged higher. Elsewhere, oil fell as the stronger dollar and rising refined products supply offset shrinking U.S. crude inventories. Bitcoin gained and gold retreated. The Trump administration declassified the strategy it is using to ensure continued dominance over China. Approved in 2018, it focuses on accelerating India's rise as a counterweight to Beijing and the ability to defend Taiwan against an attack. It was released to show the U.S. commitment to "keeping the Indo-Pacific region free and open long into the future", but China said the report had "sensationalized the 'China threat' theory". The Trump administration's final days are proving as confounding as ever for companies and investors stuck in the middle of increasing tensions between the two countries. Meanwhile, a rare $2,500 book about the U.S. decline is suddenly a must-read in China. As China's equity benchmark trades near the highest level in 13 years and commands the loftiest valuations in five, the country's investors keep throwing money at the same expensive stocks. Take Ganfeng Lithium, which trades at a staggering 127 times projected earnings. Or the unrelenting rally in distillers like Kweichow Moutai, which has pushed an index of consumer staples to near its highest multiple since 2008. An abundance of cash in China's financial system and ultra-low borrowing costs are driving savers to stocks, just as mutual funds invest the record cash they raised last year. Investors are beginning to question whether Alibaba can pull off a jumbo dollar bond in coming weeks, given the uncertainty around co-founder Jack Ma and the Trump administration's possible ban on investments in Chinese securities. The potential sale of as much as $8 billion in offshore debt was planned for as early as this week, however a marketing memorandum hasn't yet been received by prospective investors, according to people familiar with the matter. Reports of a potential U.S. investment ban this week also prompted spreads on some of Alibaba's dollar notes to hit their widest in six months. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayOne of the frustrating things about 2020 for professional investment managers is that even though stocks rallied hard, many of them underperformed. If you weren't exposed to some of the companies that posted outsized gains, your fund probably suffered. You might have had good reason to sit those stocks out, believing the coronavirus pandemic had messed with demand or that valuations were too high, or whatever. But that decision probably turned out to be a painful one in an environment where asset prices are driven by inflows rather than fundamentals. I've called this the "flows before pros" phenomenon before, and it's probably the most important thing in markets right now.  ETFs screened for diversification by New River Investments: green bars suggest more concentration, red bars are more diversified. Bloomberg New River Investments give a good example of this at work. They screened a bunch of thematic ETFs for ESG and other green themes, and looked at performance versus concentration. The ETFs that were the least diversified appear to have greatly outperformed the more diversified funds in recent months — suggesting per New River that "very likely there's something going on with inflows moving the names." Some of the best-performing ETFs have big positions to Plug Power, a meme stock that's up more than 100% so far this year. In an environment driven by flows rather than fundamentals, traditional investing concepts like diversification and valuation become far less important. You can follow Tracy Alloway on Twitter at @tracyalloway. All Things Wall Street and Finance

Join the many Matt Levine subscribers and sign up for the Bloomberg Opinion columnist's daily newsletter here. Trust us, your inbox will thank you for it. |

Post a Comment