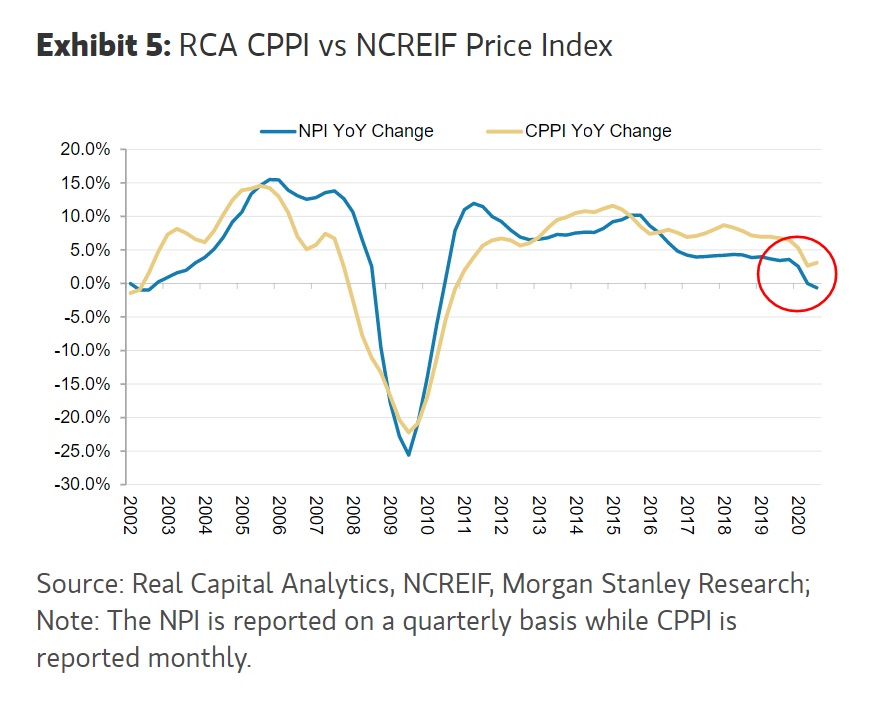

| Democrats to open Trump impeachment. Why China won Trump's trade war. Bitcoin fuels bubble talk. The Democratic-controlled House introduced a resolution to impeach President Donald Trump for a second time on Monday, setting up a vote this week unless Vice President Mike Pence uses his constitutional authority to remove the president. Meanwhile, several major U.S. corporations are punishing Republicans in Congress who voted last week against certifying President-elect Joe Biden's victory, by cutting off campaign contributions to them after a violent pro-Trump mob stormed the Capitol. A larger number of companies — from Wall Street to Silicon Valley — are enacting broader steps by suspending all political contributions at the federal or state level. U.S. President Donald Trump famously tweeted that "trade wars are good, and easy to win" in 2018 as he began to impose tariffs on about $360 billion of imports from China. Turns out he was wrong on both counts. Here's why China won Trump's own trade war — and got Americans to foot the bill in the process. Asian stocks looked set for a muted start Tuesday after U.S. stocks fell for the first time in five sessions with equity prices near all-time highs. The dollar strengthened against all its major peers. Futures pointed lower in Japan, where markets reopen after a holiday, and Hong Kong. The S&P 500 was led lower by the real estate and consumer discretionary sectors, while energy companies were the biggest gainers. Ten-year Treasury yields climbed to almost 1.15%, the highest level since March. Commodities were broadly lower on the back of the stronger dollar, with West Texas Intermediate oil trading near $52 a barrel. While not quite the same, comparing Bitcoin to other high-momentum assets of the past shows how heated its rally has become — and why it's vulnerable to swoons like Monday's. Last week, Bitcoin managed to trade 179% above its average price over the past 200 days, three times as high as the Nasdaq 100 ever got during the heyday of the dot-com bubble. Bank of America strategists say Bitcoin's rally is one thing, along with recent trends in the IPO and SPAC markets, that makes investor behavior look speculative at the moment. It "blows the doors off prior bubbles," they wrote. Meanwhile, the U.K.'s financial watchdog has a stark warning for consumers looking to plow into crypto: be ready to lose everything. U.S. stocks are the most expensive since the dot-com bubble, but strategists at Goldman Sachs's $575 billion wealth management division have cast aside valuation worries as the S&P 500 soars to records. It's all justified in a world of rock-bottom interest rates, and where U.S. profit growth is faster than just about anywhere. They expect the S&P 500 to post a return of about 8% this year on earnings growth of about 26%, which is slightly above consensus. Meanwhile in China, stocks fell the most in three weeks, led by consumer shares and commodity producers, amid concern valuations were stretched and as metal prices slumped. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayHow many people would have expected that after a global pandemic that shut down vast swathes of the U.S. economy, a sharp market sell-off, and unprecedented political chaos, that prices for U.S. commercial property would be this resilient? The Commercial Property Price Index from Real Capital Analytics, which is based on actual transactions in the market, was about 2.1% higher at the end of the third quarter of 2020 than at year-end 2019. While that figure does conceal variation in performance — apartment buildings are doing a lot better than hotels, shops and offices, for instance — it's still striking.  CPPI vs NCREIF Price Index. Bloomberg So why are prices so resilient, and on this measure, even rising? Richard Hill at Morgan Stanley has an idea. He points out that prices based on appraisals, as opposed to actual deals, look a bit different, with the NCREIF Property Index 1.6% lower in the period described above. The discrepancy shows us that things actually look pretty good in commercial real estate so long as property owners can avoid having to sell in the current cycle. It's one of those instances where kicking the can down the road is so far working out. Property owners don't want to sell at cheap discounts, and buyers don't want to snap up properties unless they're extremely cheap. As long as the stand-off holds and lenders don't demand all their money back, commercial property prices can stay unexpectedly strong. You can follow Tracy Alloway on Twitter at @tracyalloway. All Things Wall Street and Finance

Join the many Matt Levine subscribers and sign up for the Bloomberg Opinion columnist's daily newsletter here. Trust us, your inbox will thank you for it. |

Post a Comment