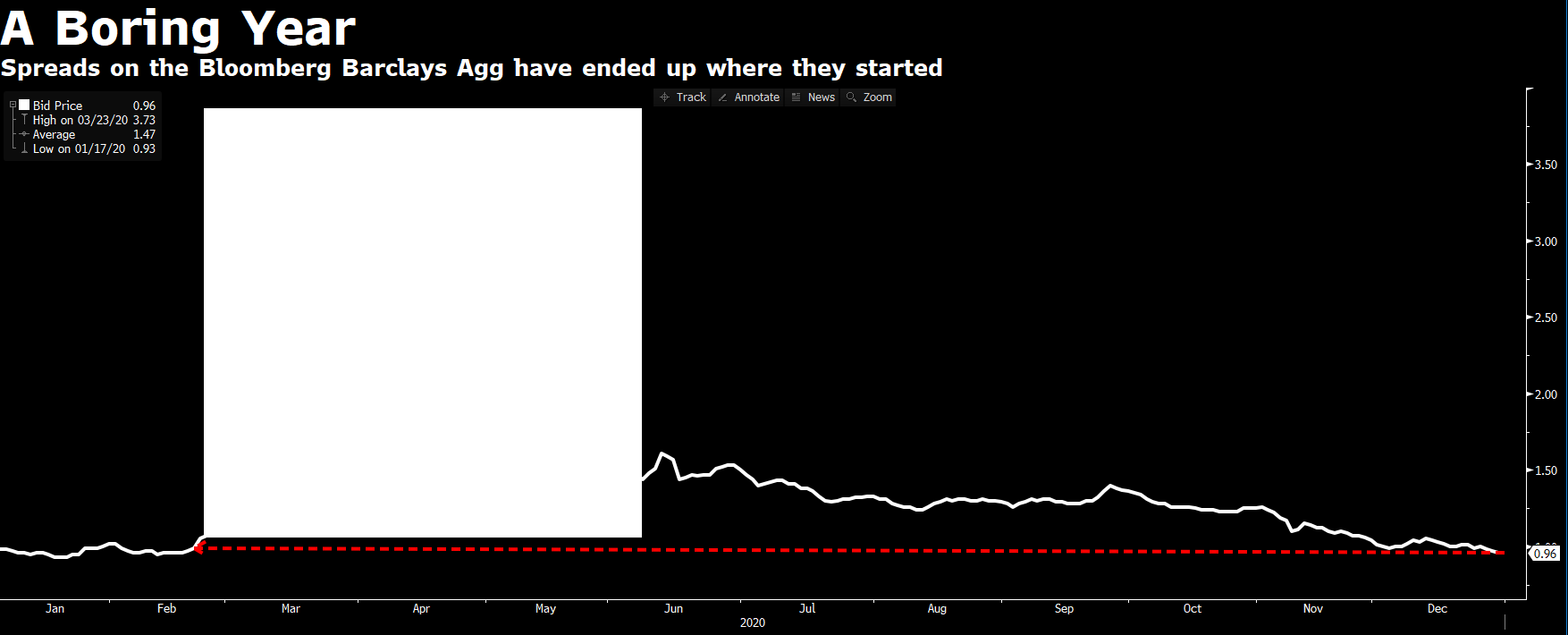

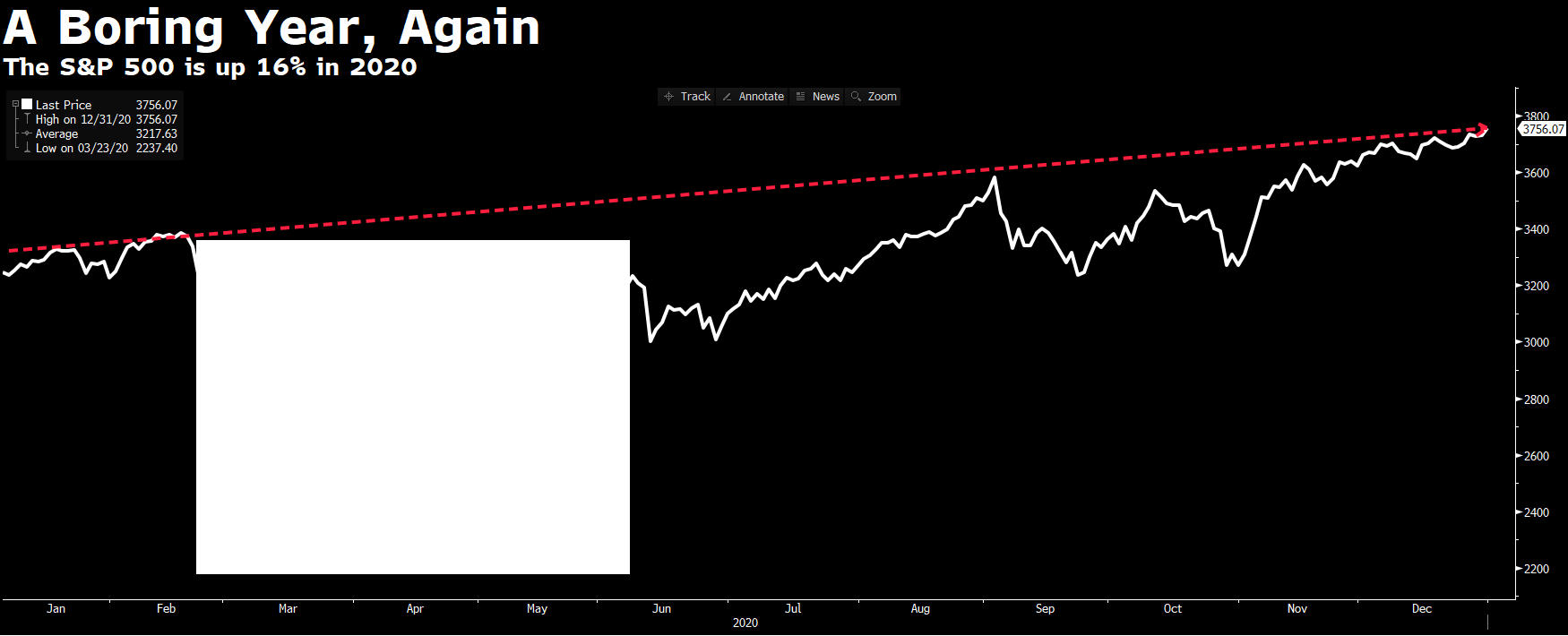

| Bitcoin swallows another milestone in unstoppable rally. The U.S. eyes delisting of more Chinese companies. Stocks start 2021 at record amid bubble red flags. Bitcoin, the world's largest cryptocurrency, topped $34,000 just weeks after passing another major milestone. The currency gained as much as 9.8% to $34,792.48, before slipping back. It advanced almost 50% in December, when it breached $20,000 for the first time. The currency "will be on the road to $50,000 probably in the first quarter of 2021," said Antoni Trenchev, managing partner and co-founder of Nexo in London, which bills itself as the world's biggest crypto lender. Chinese oil majors may be next in line for delisting in the U.S. after the New York Stock Exchange said last week it would remove the Asian nation's three biggest telecom companies to comply with a U.S. executive order that imposed restrictions on companies identified as affiliated with the Chinese military. China's largest offshore oil producer CNOOC. could be most at risk as it's on the Pentagon's list of companies it says are owned or controlled by Chinese military, according to Bloomberg Intelligence analyst Henik Fung. PetroChina and China Petroleum and Chemical Corp. may also be under threat as the energy sector is crucial to China's military, he said. Stocks are set to enter the new year at a record high when the first day of trading for 2021 kicks off in Asia Monday. The S&P 500 Index and Dow Jones Industrial Average closed at all-time highs on Dec. 31. Most markets around the world were shut on Jan. 1. The dollar opened mixed against its G-10 peers as trading started in Sydney. The pound dipped as the U.K. faces a tighter lockdown to stem the march of the coronavirus. OPEC warned of risks to the oil market from the resurgent pandemic, a day before the group and its allies meet to consider another increase in production. The IPO market is manic. Stocks haven't been this expensive since the dot-com era. The Nasdaq 100 has doubled in two years, leaving its valuation bloated — all while volatility remains stubbornly high. It's a setup that's left investors sitting on fat returns from 2020, a year that defied easy explanation. It's also one that has a growing cohort of experts warning about a bubble. Knowing when market rallies turn from logical to excessive is always tough. But history offers clues, and a raft of current market conditions meet criteria that would likely be found on a bubble checklist. Australia is moving to boost ties with small island nations off its eastern coastline, pushing back against China's growing influence in the Pacific Ocean as the virus outbreak hinders travel. Prime Minister Scott Morrison's government has promised to supply its neighbors with Covid-19 vaccines in 2021 as part of a A$500 million ($386 million) package aimed at achieving "full immunization coverage" in the region. It also recently signed a "landmark" deal with Fiji, one of the region's most populous nations, to allow military deployments and exercises in each other's jurisdiction. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayIf you were to suddenly wake up in 2021, having missed the majority of 2020, and you looked at several benchmark indexes, you would probably conclude that you hadn't missed very much at all. Spreads on the Bloomberg Barclays U.S. Aggregate Bond Index have largely retraced their Covid-19 moves, ending the year at around 96 basis points.  Spreads on the Bloomberg Barclays U.S. Aggregate Bond Index. Bloomberg  The S&P 500 in 2020. Bloomberg Meanwhile, the S&P 500 finished up 16%. In fact, as one derivatives trader on Twitter put it, if you blocked out the worst of the year's volatility, 2020 looks like a completely reasonable — even boring — year for risk assets. It's a tongue-in-cheek point of course, but it also highlights that one of the more unusual things to have taken place in 2020 might just be the apparent compression of an entire market cycle into fewer than 12 months. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment