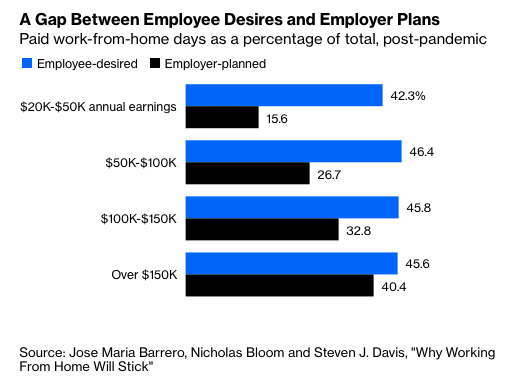

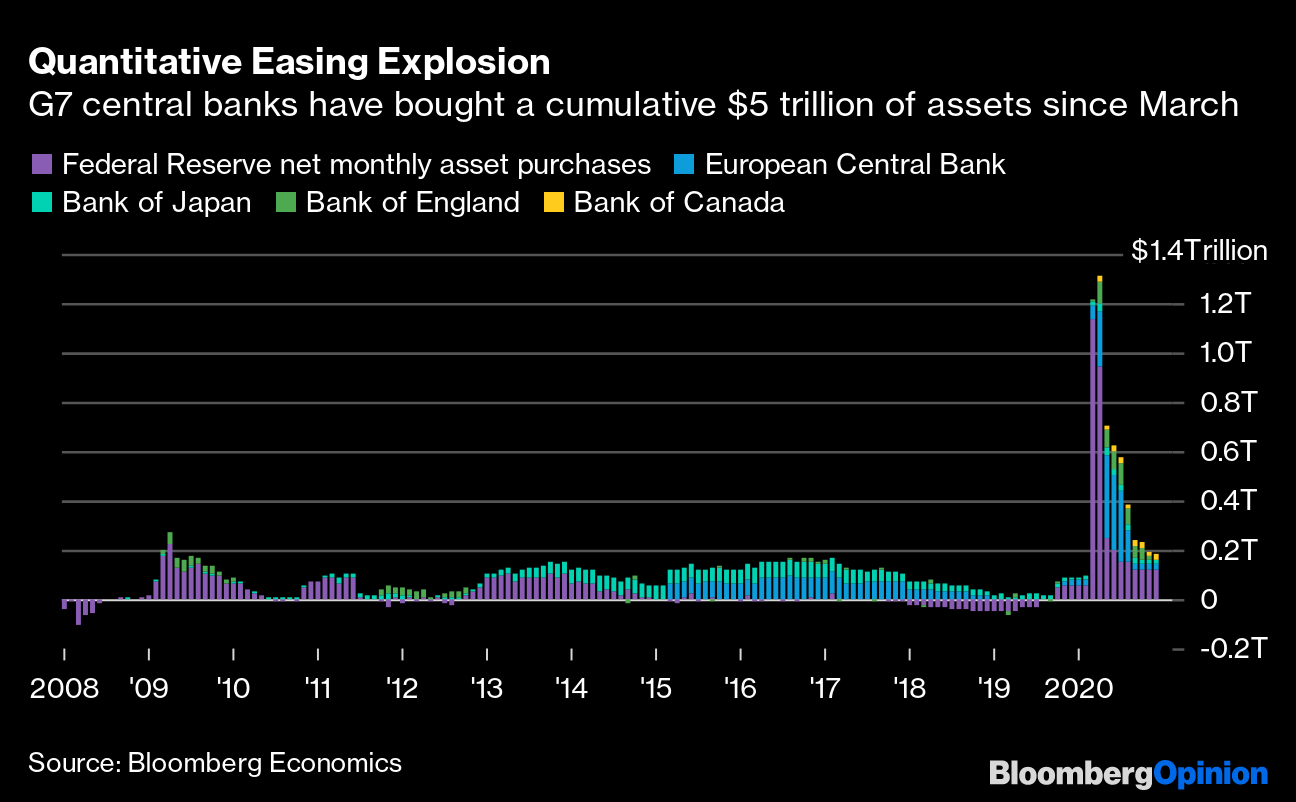

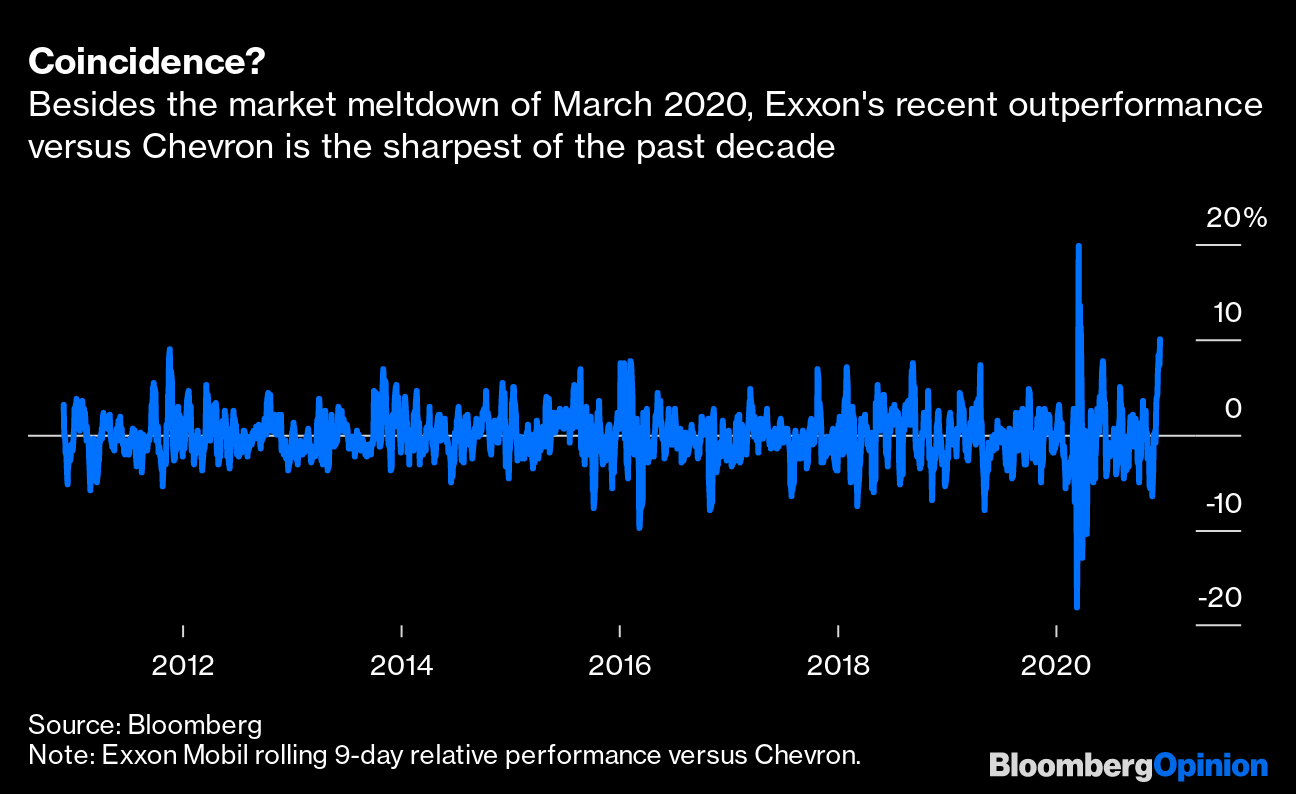

| This is Bloomberg Opinion Today, a WFH schedule of Bloomberg Opinion's opinions. Sign up here. Today's AgendaLet's Make Sabbaticals the New NormalEarly in the pandemic a video went around thanking the coronavirus for reminding us what's really important. It felt glib and insensitive then and really feels that way now, after 1.65 million people have died. But there's no denying the disease has brought new perspective, sort of the way jumping from an airplane with an iffy parachute can really refocus the mind. One of the biggest paradigm shifts has been in how we think about work-life balance. This has a whole new meaning when most of us are either working where we live or risking our lives for work. Citigroup apparently had this in mind when it decided to start offering its longtime bankers three-month sabbaticals or one-month breaks to do charity work. The new policy could be a challenge for the bank when everybody wants to take advantage at once, Elisa Martinuzzi notes. After all, when this nightmare is over, we'll all need a vacation. But that's a risk worth taking to establish a healthy work culture. Hopefully other companies will follow Citi's example. Most of the bank's employees have had the luxury of working from home through this pandemic, which is safer but also not exactly the day-spa visit some employers once thought. It turns out you can get real work done from home, while avoiding the soul-crushing commute. And when kids go back to school, WFH productivity levels may go through the roof. So employees will want to do it more, and employers will be more willing to allow it. The conflict, Justin Fox warns, will come in that DMZ between worker hopes and boss demands. Some things never change.  Further Pandemic-Exit Reading: How many dang vaccines do we really need? A lot, actually. — Sam Fazeli Congress Delivers Half a LoafWe've been banging on the dinner table, demanding more fiscal stimulus, for months. Fed Chairman Jerome Powell has been right there with us, including after yesterday's policy meeting, when, as Brian Chappatta notes, Powell stood pat and again strongly suggested Congress is sleeping on the job. Now it looks like we might finally get some of what we're demanding — but not nearly enough. The relief package being kicked around Congress right now, if it passes, won't be enough for many workers and businesses, warn Tim O'Brien and Nir Kaissar. It will leave out much-needed state and local government aid entirely. And it certainly won't address the underlying economic problems that made the last recovery so slow and uneven. That recovery contributed to a societal meltdown. What will the next one bring? Time to start banging the table again. Further Pandemic Economy Reading: Inconvenience is a far bigger post-pandemic economic threat than inflation. — Tyler Cowen What's at Stake in GeorgiaNow that Republican Party leaders have finally started abandoning President Donald Trump to rant alone about the election, more attention is turning to next month's Georgia Senate runoffs. These are kind of important, after all, determining control of the Senate and the boundaries within which President-elect Joe Biden can roam. Democrats need both seats, and few forecasters give them much chance. But John Authers warns markets aren't taking the possibility seriously enough. On the one hand, full Democratic control of government could open the door to more of that fiscal stimulus we keep banging on about. On the other, it could also lead to regulations big businesses won't like — although any Democratic majority will be wafer-thin, keeping more extreme measures on ice. One big upside of Democratic Senate control is that it would let Biden re-stock the government with enough employees to make it function adequately, Jonathan Bernstein notes. Mitch McConnell might let Biden's top cabinet picks through, but he could shut the door after that, and Biden needs a response plan. Does he pull a Trump and install a bunch of "acting" officials? Rally a centrist revolt? As we've been reminded lately, having a functioning government is kind of useful. Telltale ChartsDespite the near-term economic gloom, there are about $5 trillion reasons to expect stocks will just keep rising in 2021, write Mark Gilbert and Marcus Ashworth.  Exxon stock is suddenly trouncing Chevron, and it may have a small activist to thank, writes Liam Denning.  Further ReadingThe U.S. has curbed other countries' ability to shelter taxes and launder money, but then started doing that lucrative dirty work itself. — Bloomberg's editorial board The Supreme Court could finally end the exploitation of college athletes. It probably won't. — Joe Nocera Vietnam is learning the downside of being a trade-war winner: getting booked for currency manipulation. — Dan Moss Italians have warmed up to the Germans this year, an encouraging sign for EU unity. — Ferdinando Giugliano China is getting really good at changing the weather. What could possibly et cetera? — Adam Minter How to deal with family members seeking cash. — Kimberly Seals Allers ICYMIHackers accessed the networks of agencies watching the nuclear stockpile. They also hit at least three states. Amazon workers are struggling to get by. Employers are cutting pay for remote workers who move to cheaper places. KickersWorld's ugliest orchid discovered. (h/t Mike Smedley) Hungry bees can trick plants into flowering early. (h/t Uffe Galsgaard) Scientists find a link between sleep cycles and Alzheimer's. The mystery of Navy "UFO patents" deepens. The ultimate best books of 2020 list. Note: Please send orchids and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment