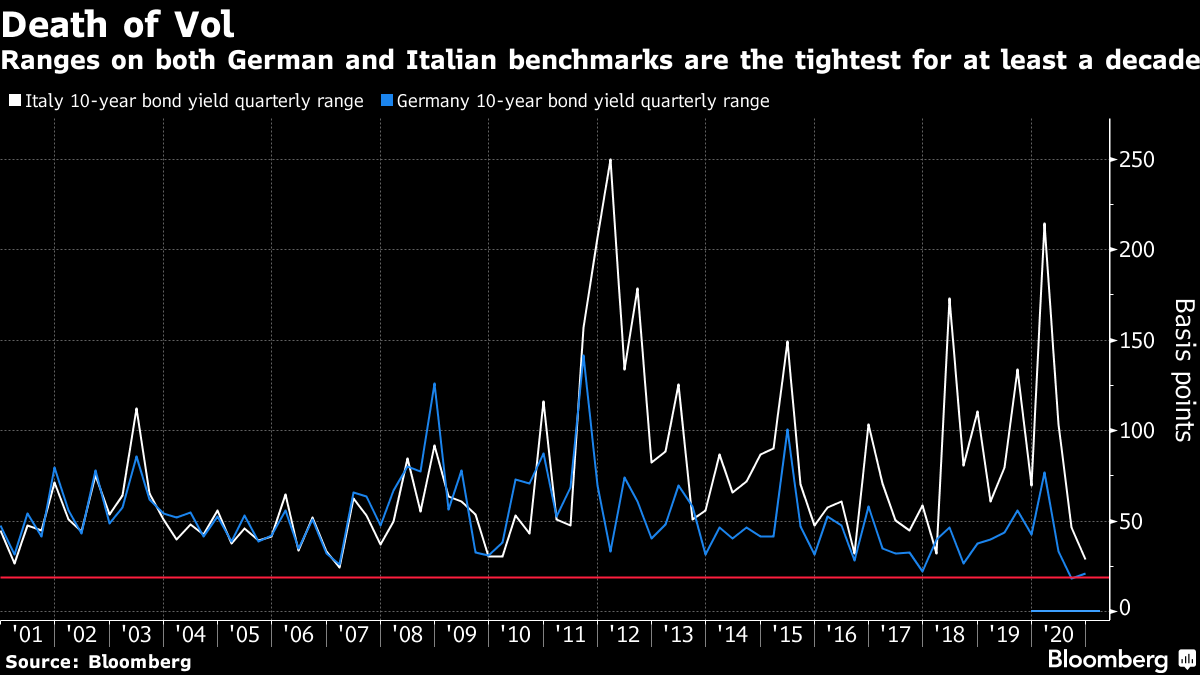

| Welcome to The Weekly Fix, the newsletter that thinks perhaps it was not pavlova the Europeans served, but Eton Mess, which may have been intended as a sentimental offering. Fine distinction. -- Emily Barrett, Asia FX/rates editor. ECB's Air of MysteryThe European bond market is all but dead. The latest action from the European Central Bank -- which has extended its pandemic bond buying program and added another 500 billion euros ($607 billion) -- is another nail in the coffin. Even before Thursday's decision, investors were feeling muscled out of the market. Volumes in bund futures have slumped more than 60% since the ECB started buying bonds and yield ranges have collapsed across the region, our Brussels reporter John Ainger wrote this week in his study of a trader's nightmare. The ECB will own roughly two-fifths of each of its two largest sovereign markets, Germany and Italy, by the end of next year, according to Bloomberg Intelligence.

European markets did have just enough vim Thursday to register disappointment at the central bank's additional commitment, in particular the optimistic caveat that it "need not be used in full." The euro strengthened, Bund yields twitched, and Spanish 10-year yields, which were closing in on zero just hours before, edged as much as 5 basis points higher. The market reaction is probably a reflection of the ECB's "flexible" approach to purchases, to keep financial conditions in check where needed, Barclays strategists including Cagdas Aksu point out. In their view, that whiff of ambiguity should help boost term premium, pushing longer end rates higher and steepening curves in a controlled way. Sound familiar? "Even if there is no explicit yield curve control, we think the current policy backdrop is not far from it indirectly. In fact, we find the pace guidance from the press conference as somewhat similar to BoJ guidance." That analogy actually underpins Barclays support for a steeper curve in Europe, as the Bank of Japan's gradual tapering of purchases to maintain the 10-year around zero actually allowed the long end of the curve to lift, and "has contributed to steepening at times." It's still tough to imagine. Spain was able to sell its first debt at a yield below zero this week, with investors effectively paying the government to take their money for 10 years. Italy and Greece are now among the last remaining euro zone members with yield curves above zero, and the global swamp of negative-yielding debt this week sprawled beyond $18 trillion. Even Australian bank bills saw yields drop sub-zero. And that's despite a teeming primary market. Syndicates have had a stellar year raising the cheapest debt on record, pumping out more than 1.7 trillion euros ($2.1 trillion) of bonds.  At least the path ahead for the EU's historic fiscal spending effort is looking less thorny. Standouts Hungary and Poland finally overcame their objections to a rule-of-law provision, with a little smoothing from Germany, clearing the way for the $2.2 trillion budget and stimulus package.  Brexit, ActuallyThis is where we pause to reflect on doomed dinners. Not since George H.W. Bush threw up on his Japanese host in 1992 has there been such a wretched repast as the one that transpired between British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen this week. Expectations for this soiree were higher, however, as it was billed as one of the leaders' last chances to avoid the U.K. crashing out of the European Union. Perhaps the menu didn't help. Apparently some wit on the Commission's staff arranged for turbot (fished in U.K. waters) and scallops, followed by pavlova -- an Australian dessert possibly intended to impart the flavor of trade relations to come if no deal is struck. Traders aren't hanging around for the humble pie. They're putting money on surging import costs, exacerbated by a further slump in the pound -- it's already slid about 1% versus the dollar -- driving consumer prices higher. Two-year inflation swaps are at levels last seen more than a year ago.  And traders have pulled forward their expectations for the next rate cut from the Bank of England. Money markets in the U.K. are priced for a 10 basis points cut to zero in August now, instead of by year end as of last week. Some traders are bracing for negative interest rates by early 2022. The Prime Minister is headed for a last, final, ultimate attempt to bridge the gap Sunday, having warned British businesses and the public to prepare for a stalemate on trade, and reversion to World Trade Organization terms. Stay tuned to our Brexit coverage for more excruciating developments. Jamie Dimon's had enoughThe CEO of America's largest bank is tired of willing U.S. government yields higher -- now he's done with the market. A couple of years ago Dimon warned that the 10-year was headed to 6%, then 5%. Now we're sitting just shy of 1%. "I think Treasuries at these rates, I wouldn't touch them with a 10-foot pole," he told a virtual gathering hosted by Goldman Sachs this week. "Unfortunately we are -- we have to," he added. It was the first part of that statement that grabbed everyone's attention. Perhaps a different perspective on this vanishing yield situation is in order (European audience nods knowingly). Ben Emons of Medley Advisors suggests that the smart money should be focused on price. "To be profitable in government securities, investors should not trade on yield, but on price," he wrote this week. That means valuing Treasuries for their capital appreciation potential rather than focusing on their traditional role as sources of liquidity, duration and diversification (who's heard about the death of 60/40?). Duration alone gives buy-and-hold investors plenty to worry about -- interest-rate risk on government bonds is higher than almost ever before, meaning that for each percentage point increase in yield, the price could drop sharply.  One bank that's still out on a limb with Treasuries -- and in a tactical sense given the likely "twists and turns" in the year ahead -- is HSBC. Larry Dwyer says they're "mildly bullish" on the market, putting the 10-year yield at 0.75% at the end of 2021, versus a consensus of 1.15%. He's motivated by the Federal Reserve's new average inflation-targeting strategy, which by HSBC's reckoning, should see the Fed persist with its lower-for-longer guidance through the year and beyond. According to their calculations, if we applied current regime to the past: "The Fed would have tightened only once in the past 22 years... or perhaps not at all. Under and AIT rule, the Fed should be dovish until inflation averages more than 2% for a period of years. In contrast, the consensus forecast implies the Fed is likely to be endorsing future tightening moves next year, or that the bond market will ignore the Fed."

Yet banks can't complain -- they've been storming the market lately to borrow at historically low interest rates. Banks have accounted for around three-quarters of the $32.6 billion of high-quality corporate bonds sold so far this month, Ilya Banares reports (it's been the busiest December since 2016).

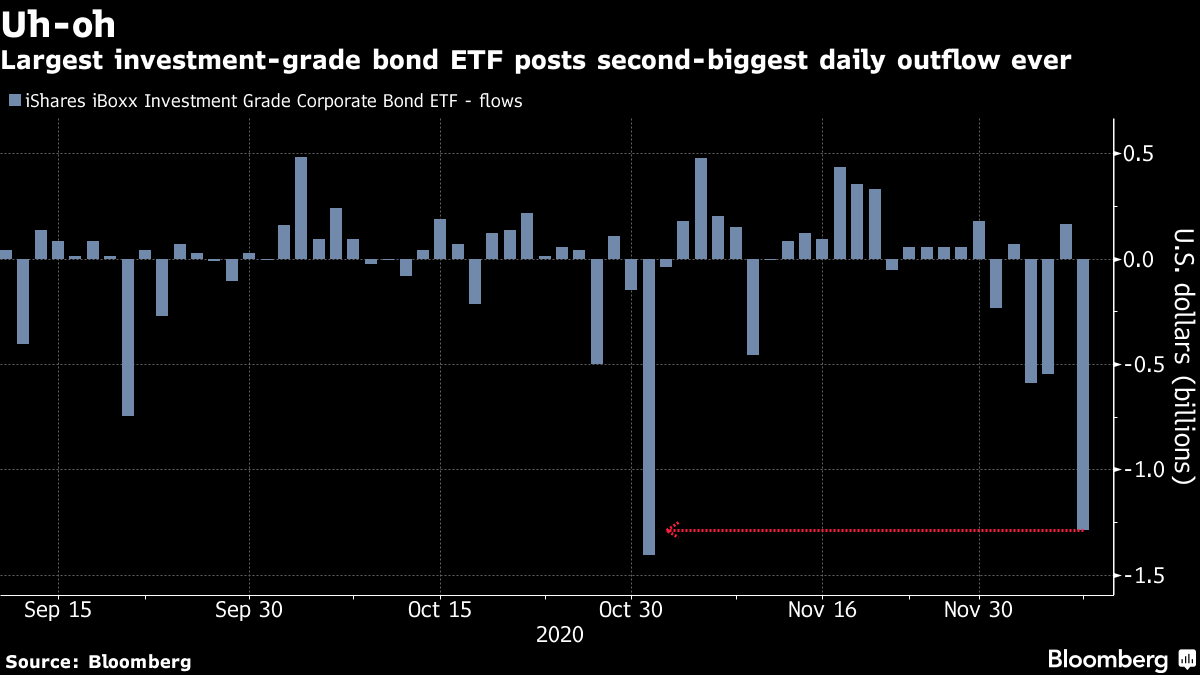

So while JPMorgan may chafe at the hit to its net interest margin, its brethren can at least take some comfort in their ability to lock in the lowest debt-service costs on record. Moreover, it might not be around for so long. For closing on a somber note, here's the near-record daily outflow the largest U.S. corporate bond exchange-traded fund suffered this week:  P.S. It's the Fed meeting next week. We've talked about the dwindling hopes for a skew to longer-dated asset purchases, though most of Wall Street does expect a plan to be aired. Morgan Stanley says the market reaction to the Fed's guidance on quantitative easing is likely to be muted, as long as it doesn't suggest anything sooner than the first half of 2022 for any drop-off in purchases. "The Fed's reinforcement of no hikes in 2023 via the dot plot could push out timing of rate hikes priced in the market, further supporting curve steepening." Just how the market's going to make of the Fed's new, fuzzier charts for its projections, we'll have to wait and see. Bonus PointsSome other infamous feasts. Or, how a flatulent donkey gave us Henri Rousseau. Women are crushing it in the race for a vaccine. Here's Eton Mess. It's broken pavlova, just as tasty. By the way, pavlova is definitely Australian. Prove that it's not. South Korea has the formula to beat Covid's spread Still bored? Make a minimalist Nativity. |

Post a Comment