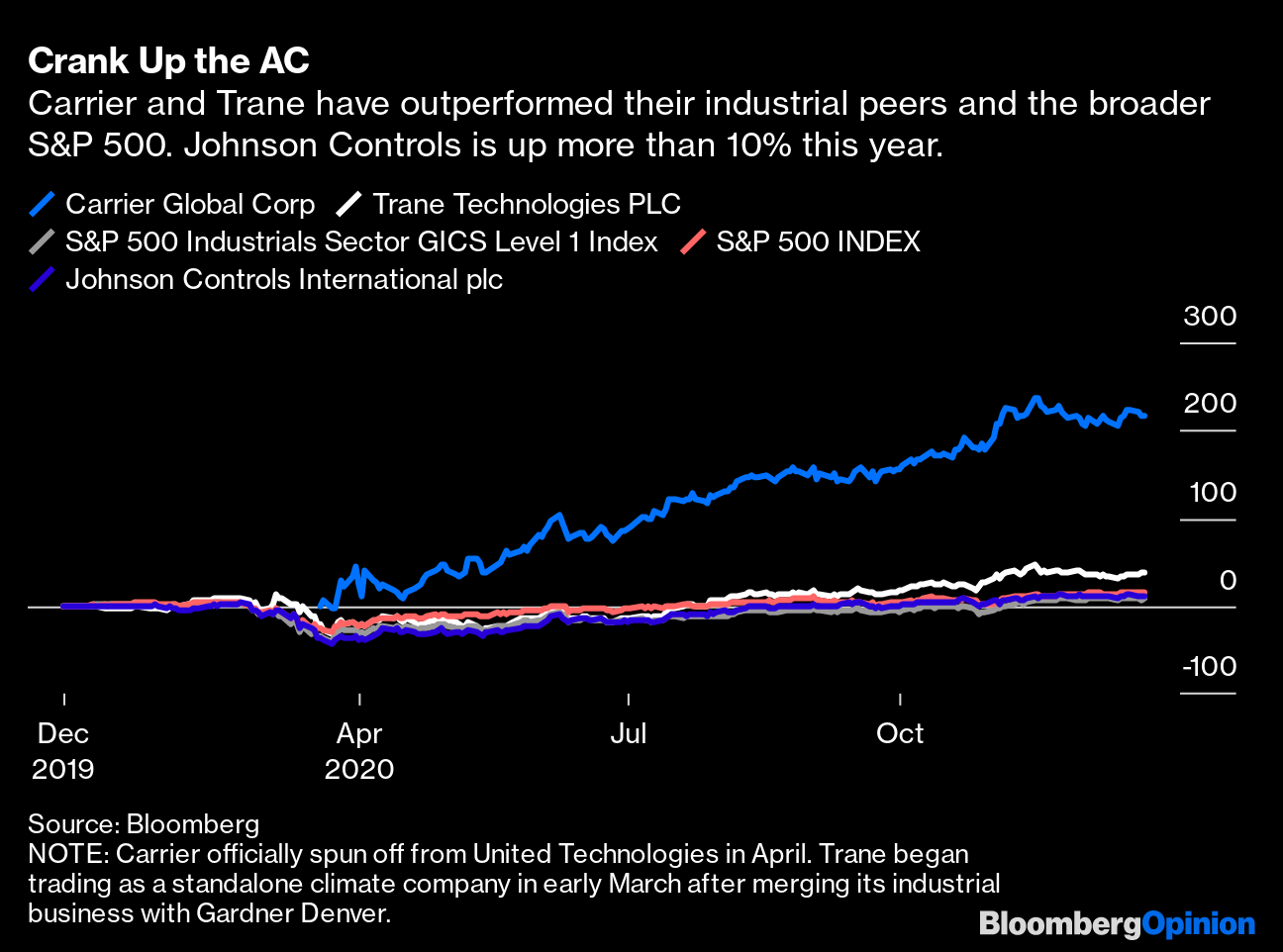

| This is Bloomberg Opinion Today, a stocking stuffed with Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Hot Business of Freezing and Cleaning AirThe need for super-cold freezers to store Covid-19 vaccines and ventilation systems to keep the disease from spreading indoors helped Carrier Global Corp. and Trane Technologies Plc, which make both, easily outpace both their industrial peers and the stock market as a whole in 2020.  The boost in freezer demand may be short-lived and the responses makeshift — Trane's Thermo King division has been repurposing "SuperFreezers" designed to keep fish fresh for vaccine use. But Brooke Sutherland talked to executives at Carrier, Trane and ventilation-systems maker Johnson Controls International Plc who think the new appreciation of indoor air movement brought on by the pandemic could boost business for years to come. Air filtration and purification are in great demand, while Johnson Controls has been talking to universities about designing pandemic-proof dormitories where each room can be transformed into a pressurized isolation chamber with the flip of a switch. Boris Did BrexitThe Brexit deal announced this morning has made Boris Johnson the most consequential British prime minister since Margaret Thatcher, concludes Therese Raphael. What exactly these consequences will be remains the big question. The agreement keeps the U.K. closely tied to continental Europe, albeit with lots of new hoops to jump through for expats, students, exporters and many others. The battle lines over Europe within the U.K. may not so much disappear as be redrawn.

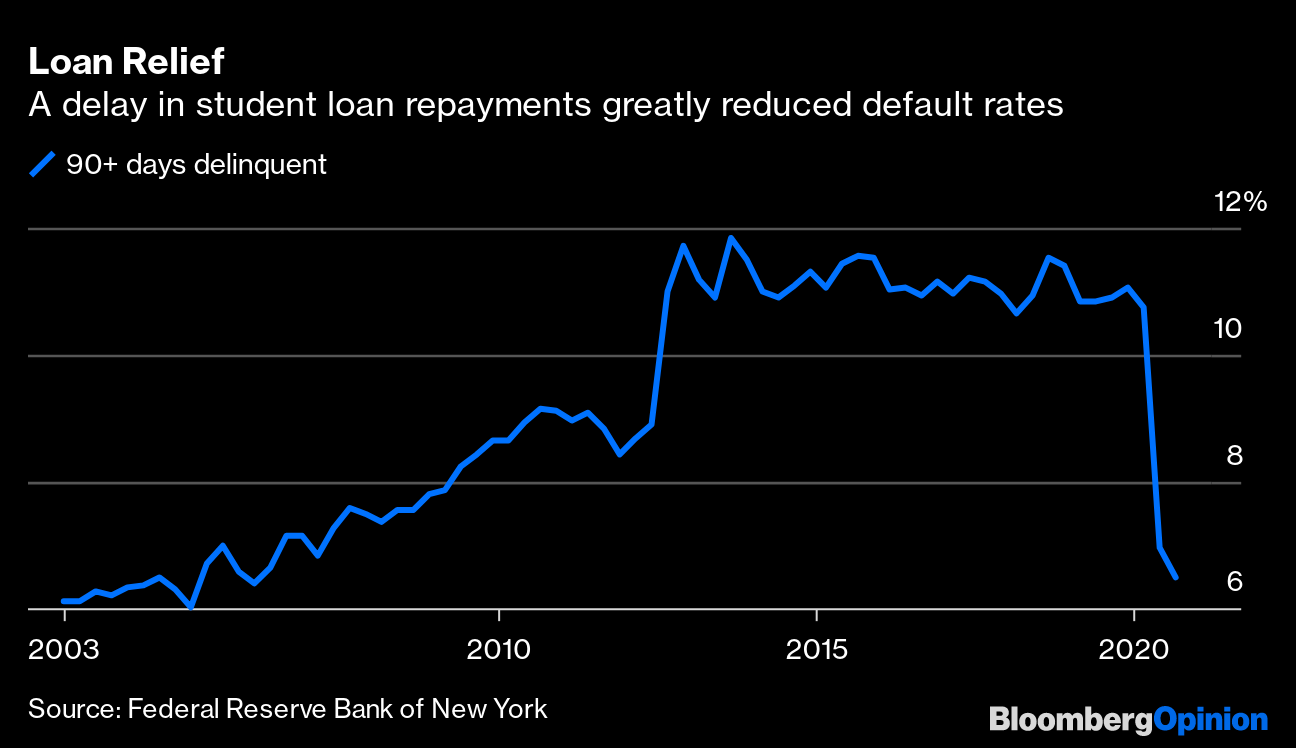

In the meantime, the deal is great news for U.K. stocks in 2021, writes Marcus Ashworth, who was already arguing earlier in the day that markets have infinite reasons to be cheerful. Tech Giants Probably Can't Top ThisThe strange stay-at-home economy spawned by the pandemic delivered big profits to Amazon.com Inc., Apple Inc., Facebook Inc. and Alphabet Inc., and their stock prices outpaced the profits as the onetime upstarts became perceived as safe havens amid global turmoil. Tae Kim doesn't think they can count on any of that holding up in 2021.  The biggest challenge facing the monopolies and near-monopolies of the tech world is that, well, they're monopolies and near-monopolies. European authorities, who have had big American tech companies in their sights for a while, appear likely to heighten their scrutiny in the coming year, while in the U.S. a new bipartisan consensus is forming in favor of tougher antitrust enforcement. Even the Chinese government, which Tim Culpan says paved the way for the creation of homegrown tech monopolies by keeping out overseas competitors, is now investigating alleged monopolistic practices at Alibaba Group Holding Ltd. Science ProgressedIt wasn't just the record-quick development of highly effective vaccines against Covid-19, although that was pretty amazing. Tyler Cowen offers a rundown of these and other 2020 scientific and technological advances that ought to make us hopeful about the future. In medicine, a malaria vaccine is in the final stages of testing and a universal flu vaccine seems ever likelier. In transportation, there were advances in rockets, supersonic planes and electric vehicles. A year of working from home and meeting on Zoom brought productivity gains as well as occasional aggravation. Meanwhile, new artificial-intelligence technology allowed for the creation of human-like writing of great depth and complexity, not unlike this newsletter. Telltale ChartsA congressionally mandated freeze on student-loan repayments has spared Americans a lot of financial distress this year. But Claudia Sahm argues that forgiving and forgetting student debt isn't as good a solution as making sure that the degrees students get actually lead to better-paying jobs.  The Gini index, a measure of inequality that isn't very sensitive to what happens at the ends of the income distribution, has been steady for the past couple of decades but rose sharply in the 1980s and early 1990s, reflecting the upper middle class pulling away from the lower middle class and staying there. Amid continuing windfalls for the very rich, this middle-class inequality hasn't gotten as much attention lately, Noah Smith writes, but it may be having a corrosive long-term effect on American society and politics.  Further ReadingIt's time to tell Trump enough is enough. — Bloomberg's editorial board Consumers are itching to buy things other than sweatpants and furniture. — Andrea Felsted Iraq's economy is a big mess, and it may get worse. — Bobby Ghosh The Egyptian military is looking for investors to help it make more macaroni. — Timothy Kaldas A look at life in Taiwan, where things are pretty much normal. — Tim Culpan A great year for stocks was less great for S&P 500 index funds. — John Authers ICYMIYes, Virginia, there is a Brexit deal. The $2,000 checks aren't dead yet. U.S. mortgage rates hit another record low. How pharma came through on vaccines. KickersOctopuses sometimes punch fish that are pursuing the same prey. BMW plans to pester out-of-warranty U.K. drivers with smart billboards. These aren't the worst of times in America's Christmas city. A collection of Santa-adjacent folk demons driving sweet cars. Note: Please send sashimi-filled SuperFreezers and complaints to Justin Fox at justinfox@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment