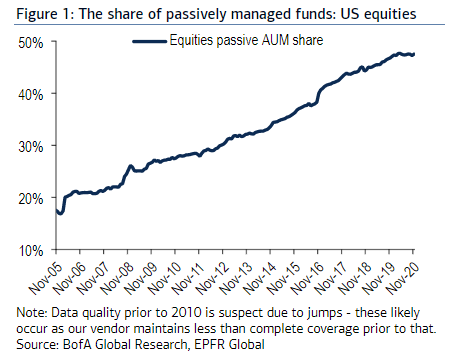

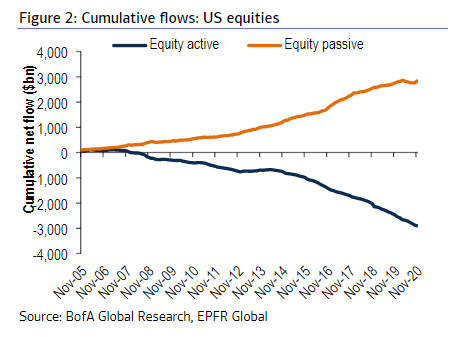

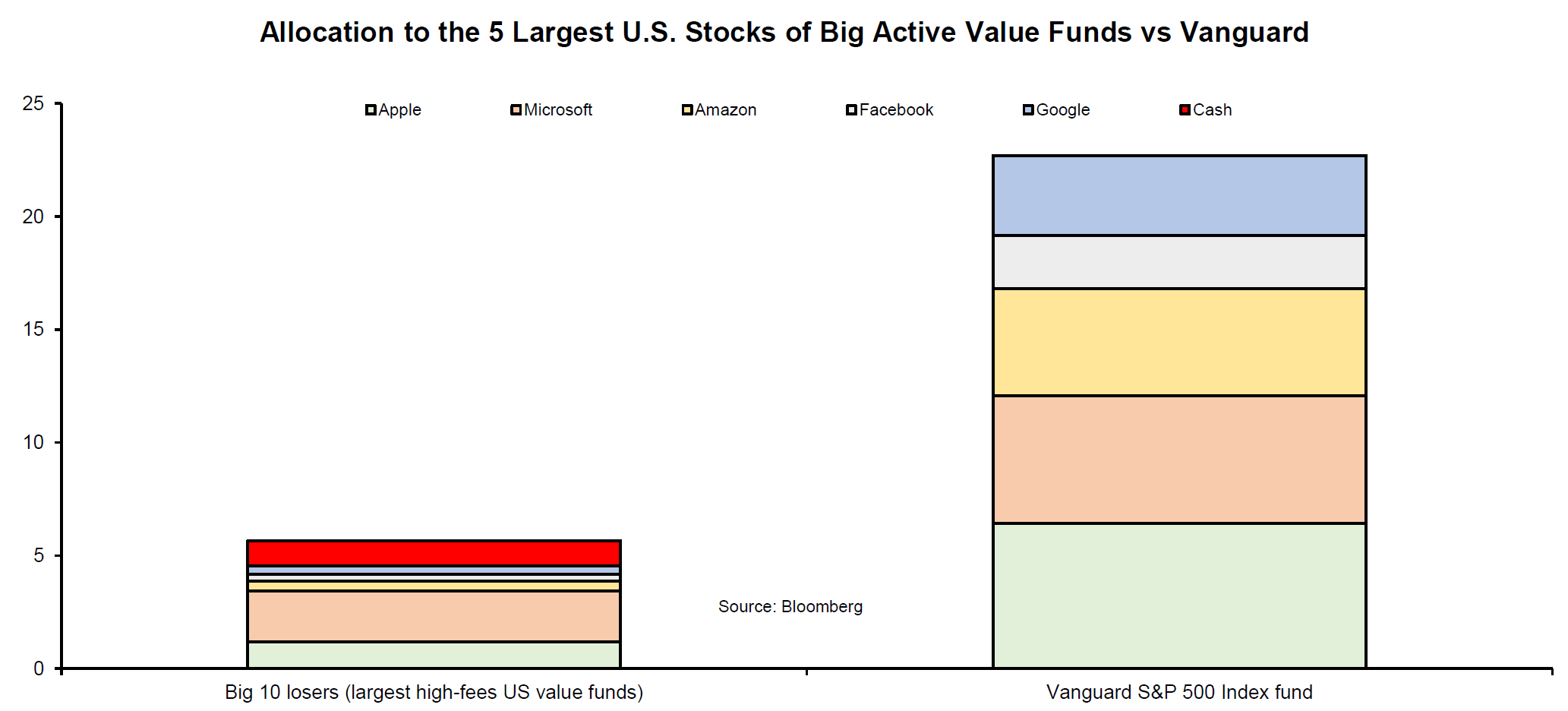

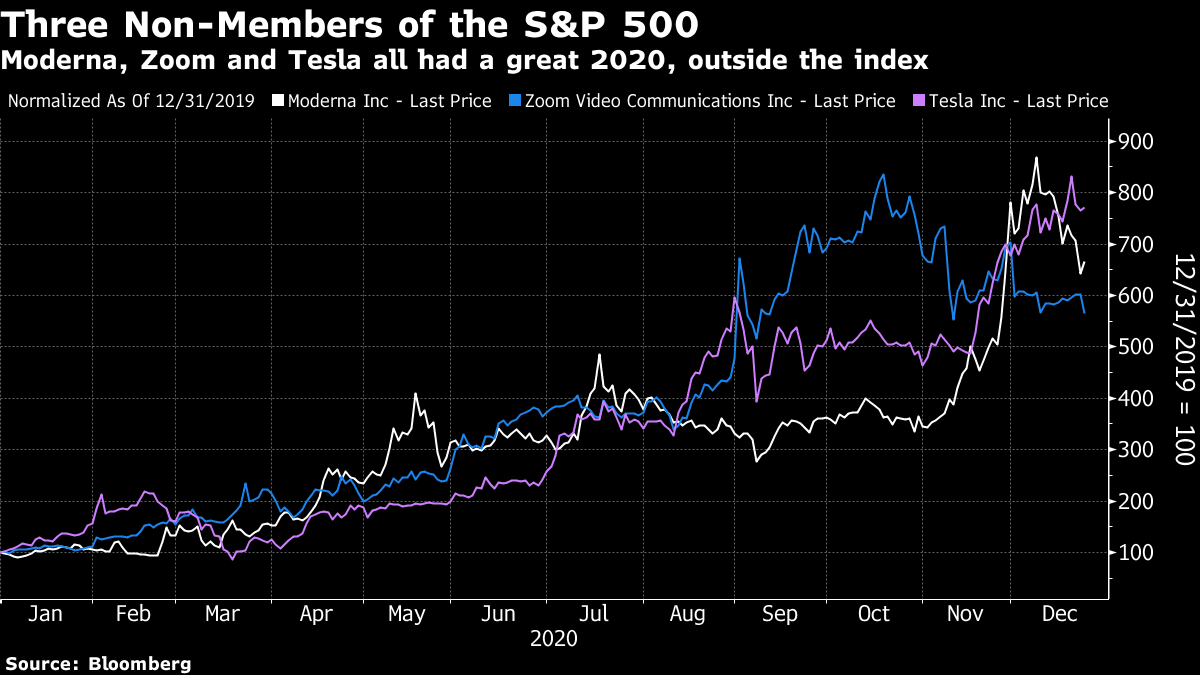

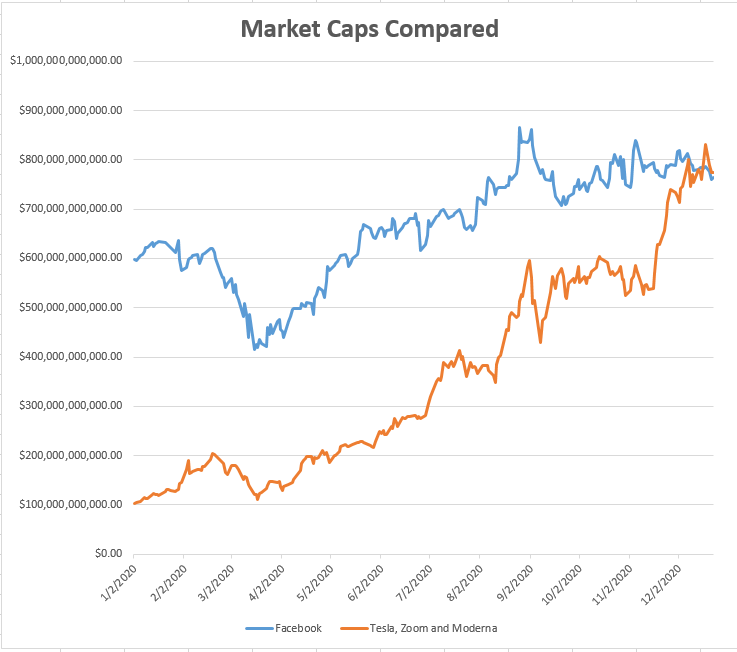

2020: When the Index Beat the IndexIt's nearly over. This miserable year has produced plenty of winners and losers. And passive fund managers are very surprisingly among the non-winners. With a good year, passive funds might have accounted for more than 50% of U.S. equity funds this year. But they stalled. As this chart from BofA Global Research shows, using data from EPFR Global, this has been the first year in more than a decade when passive funds failed to make further inroads:  Looking at cumulative flows since 2005, a similar picture emerges. After years of a dramatic shift from active to passive funds, money continued to leave active managers, but seems to have gone somewhere else:  This wasn't because active funds had a particularly good year. Many are skewed toward value, which inflicted disasters on them in 2020. According to BofA, 36% of large-cap U.S. equity funds were ahead of the Russell 1000 for the year by the end of November — an average year, but nothing more. The great dominance of the biggest internet platform stocks made life impossibly difficult for many. The following chart, from Vincent Deluard of Stonex Group Inc., compares the allocation to the "Big Five" tech stocks (Apple Inc., Microsoft Corp., Amazon.com Inc., Google parent Alphabet Inc. and Facebook Inc.) in Vanguard's S&P 500 index-tracking fund and in the 10 largest U.S. active value funds. It's surprising in these circumstances that active funds did not lag by more:  But this was also a tough year for the biggest and most-tracked index, the S&P 500. It went through almost the entire year without three stocks that might compete for the title of "company of 2020" — Zoom Video Communications Inc., which took over the way we meet with each other, Moderna Inc., which came up with a vaccine against Covid-19, and Tesla Inc., which kept us rapt all year. Tesla joined the benchmark last week and the other two are still not included in the S&P 500, whose managers have a high degree of discretion. This is how they did this year:  Put differently, Tesla, Moderna and Zoom had a joint market cap of almost exactly $100 billion on Jan. 1. They now have a combined market value of just under $800 billion. They were a half trillion dollars smaller than Facebook at the beginning of the year. They are now a bit bigger (the graph is one I drew myself using data compiled by Bloomberg):  Lacking Tesla (and the others) became a problem. Normally, the S&P 500 is carefully managed to exclude stocks that are unduly volatile and speculative. Tesla was shut out until this month because of its difficulty in showing an ability to turn a profit, for example. Usually, this helps the S&P 500 do better than the Russell indexes, which are based solely on market cap with no further discretion. That wasn't the case this year, though. The S&P 500 lagged both the mega-cap Russell Top 50, and also the Russell 1000:  All of this might demonstrate that every investment involves some kind of active decision, and that nothing is truly "passive." The fact that the epochal switch from active to passive has halted this year (if not reversed) might reflect a growing understanding of this, along with some pain for the huge funds tied to the S&P 500. And the performance of Tesla, as active managers queued up to "front-run" the passive funds who would be obliged to buy the electric vehicle manufacturer as soon as S&P added it to the club, shows that no index can grow to be as influential as the S&P is now without moving the market it is tracking, rather than reflecting it. Hindsight ForetoldEven if putting money into an S&P 500 tracker wasn't as great an investment as usual, it still earned a tidy return. The fact is, it was scarily easy to make money in 2020. Humankind was confronted with a once-in-a-century pandemic, the world went through its worst coordinated recession in decades, and yet you could reap investment profits — a lot of them — if you only grasped a few simple principles about the way the world has come to work. That's the inescapable conclusion from my annual festive exercise to look at the trades that an imaginary hedge fund called Hindsight Capital LLC would have made at the beginning of the year, armed with the knowledge of what was going to happen. We'll publish a special Points of Return next week to reveal Hindsight's trades for 2020. But I don't think I'm stealing any thunder if I reveal that you could have made yourself very rich indeed if you saw the pandemic coming and deployed your assets appropriately. I always torture readers (and myself) by explaining why these trades should have been obvious a year ago. This year, you essentially only needed to grasp two things: - China and the rest of Asia would deal with Covid-19 far better than the West. This isn't because authoritarianism is great (Turkey and Russia had bad records dealing with the virus, for example), but because Asian nations have experience dealing with pandemics, as well as a Confucian tradition of being prepared to trust the authority of government officials and surrender some liberty. In the West — with trust in governments and other institutions already at historic lows, and a libertarian tradition that sets the bar for governmental intervention much higher — it was obvious the virus would be harder to combat.

- The West would respond to the crisis by printing money, and a lot of it. That's what happened in the last crisis, the one before that, and the one before that. The main lesson the central banks learned from the global financial system's near-death experience in 2008 was to act much more quickly and drastically this time. As a result, investors could safely bet that there would be no mass bankruptcies, and no stock market collapse.

Armed with these two insights, our brilliantly foresighted hedge fund managers could easily predict that newly created money would find its way to wherever it could make the most profit – just as money to bail out Long-Term Capital Management in 1998 went into dot-com stocks, and successive waves of cheap money went into U.S. mortgages, and then into emerging markets. Therefore, investors needed only to borrow money at virtually zero rates, and pile into investments linked to China, and to the few monopoly internet platform groups that dominate the virtual economy. The implosion of the OPEC oil cartel, making life even easier for China and other oil importers, helped juice this up further. The greater and more worrying question concerns 2020 Hindsight from 10 or 20 years into the future. The pandemic has not turned around or changed any trends in markets or the economy. Rather, it intensified the dynamics that have dominated economic life since the turn of the century: It has deepened inequality through the "K-shaped" recovery, stoked conflict between generations and between countries, and pumped asset prices to levels that seem untenable. What will happen next? And will future generations marvel at our inability to see it coming? Survival TipsThank you for your suggestions for the final survival tips of the year. We can all congratulate ourselves for having reached this far, and celebrate survival over the coming holidays. Where there's life there's hope, and it's worth celebrating. There are a few nice specific recommendations. If you're feeling claustrophobic, you could take a virtual walking tour of New York, as offered by the architecture critic of the New York Times. They're a fun introduction to my adopted hometown. But I do have a problem with the omission of my own neighborhood of Upper Manhattan, home to the sole surviving endemic forest on Manhattan in Inwood Hill Park; the Metropolitan's museum of medieval art at The Cloisters — product of a robber baron touring Europe and bringing back ancient monasteries and chapels brick by brick; and what is surely the greatest concentration of former Major League Baseball stadiums anywhere. In a walk of little more than half an hour, you can go to: the New York Presbyterian Hospital, built on the site of the Yankees' original field (they were known as the Highlanders then, because it was the highest spot in Manhattan); the Polo Grounds, long-time home of the old New York Giants and host to some great moments (only a staircase remains and the stadium is now a housing project); before crossing the Macombs Dam Bridge past the playing field that now stands on the site of the old Yankee Stadium (the House That Ruth Built), which staged more memorable moments than just about any other ballpark anywhere (including even the "greatest game ever played" in football), and reach the new Yankee Stadium, which I find rather soulless compared to the old one, but which has staged some moments I've really enjoyed. For some positivity, it was Steven Sondheim's 90th birthday this year, and there was an online celebration. Try Raul Esparza singing "Take Me to the World." For even greater positivity, long pre-dating 2020, try Louis Armstrong and Danny Kaye singing "When the Saints Go Marching In." If you find Louis Armstrong as genial entertainer a little grating, you can purge the palate by listening to "West End Blues" or "Basin Street Blues" from the era in the 1920s when he was reinventing music. For some Christmas fare, try this fantastic Saturday Night Live skit featuring a motivational speech to Santa's elves by Alec Baldwin. (You'll also see a youthful Amy Poehler, Seth Meyers and Rachel Dratch). If you don't get the reference, Baldwin is sending up his own motivational speech from "Glengarry Glen Ross "twenty years earlier. Always Be Closing. Those were some of the recommendations I received today. My most popular recommendation of the year, as far as I could gather from the feedback, was to relax by listening to Bill Withers as an aid to getting through Election Day. Start the day with "Lovely Day" and you'll be fine. And as a general item of advice, it would be a great idea to use Zoom, or one of its video-conferencing rivals, or even a telephone this holiday season, and talk to people. A video conference might actually end up including people you wouldn't otherwise have seen, and take away a lot of the stress and pressure that comes with arranging holiday events in person. It's not going to be a great holiday season, but if we curl up with good books, good music and good TV, and talk to some people we care about, we'll be fine. Thanks for your company in 2020. It has been a strange privilege to be writing a regular e-mail to so many people this year, but a privilege nonetheless. Watch out for Hindsight Capital next week, and I'll be back in your inbox in the new year. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment