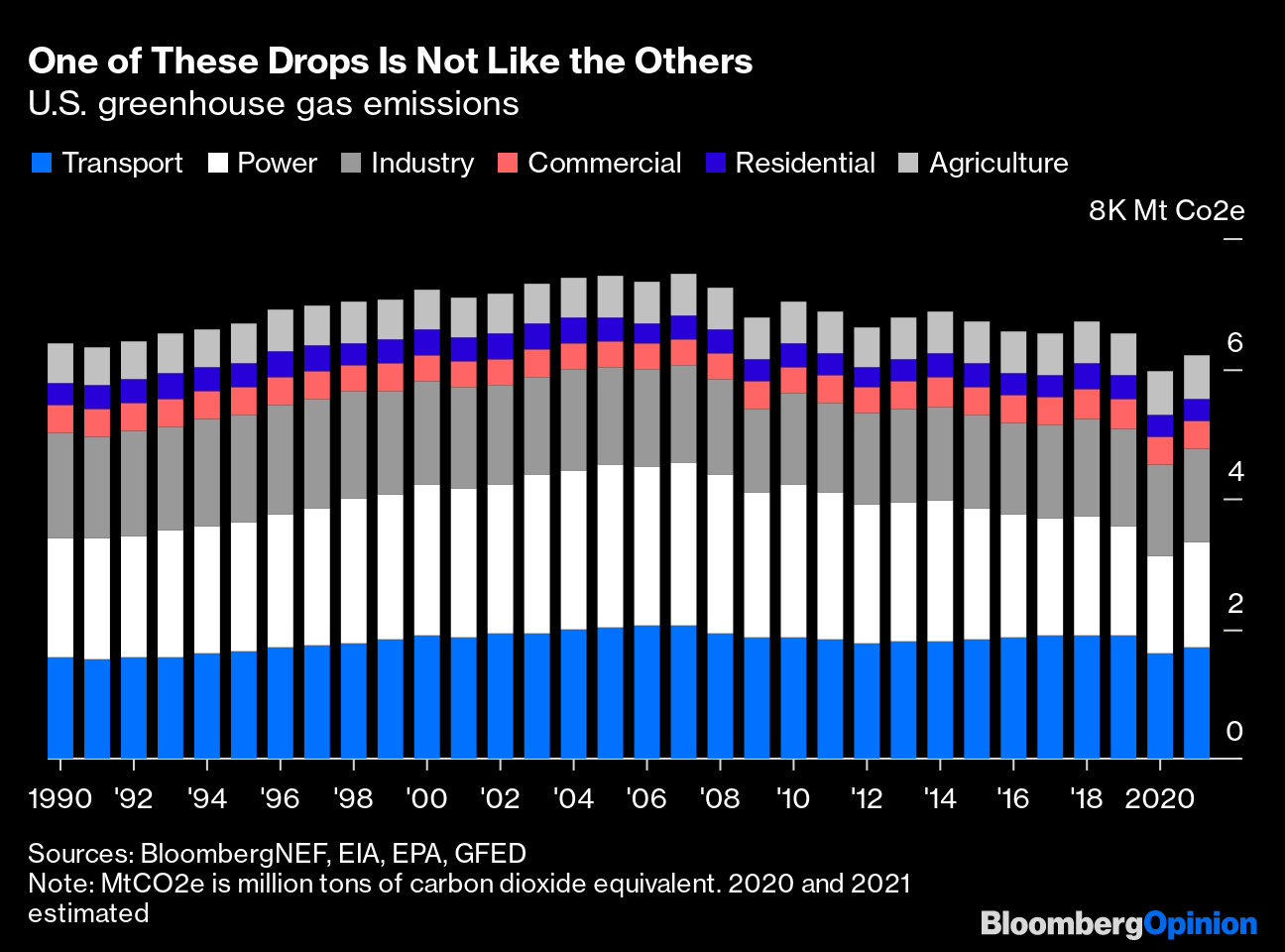

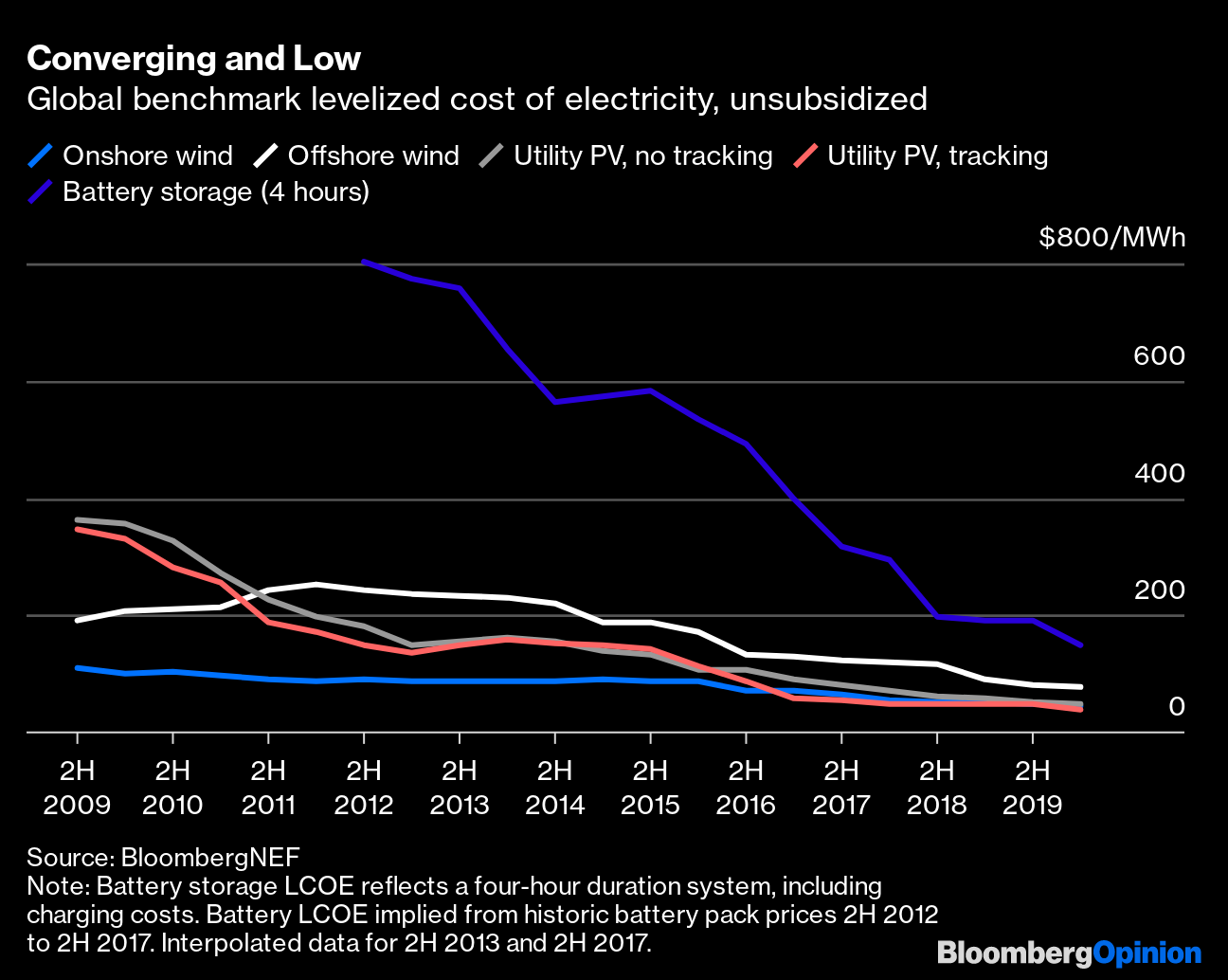

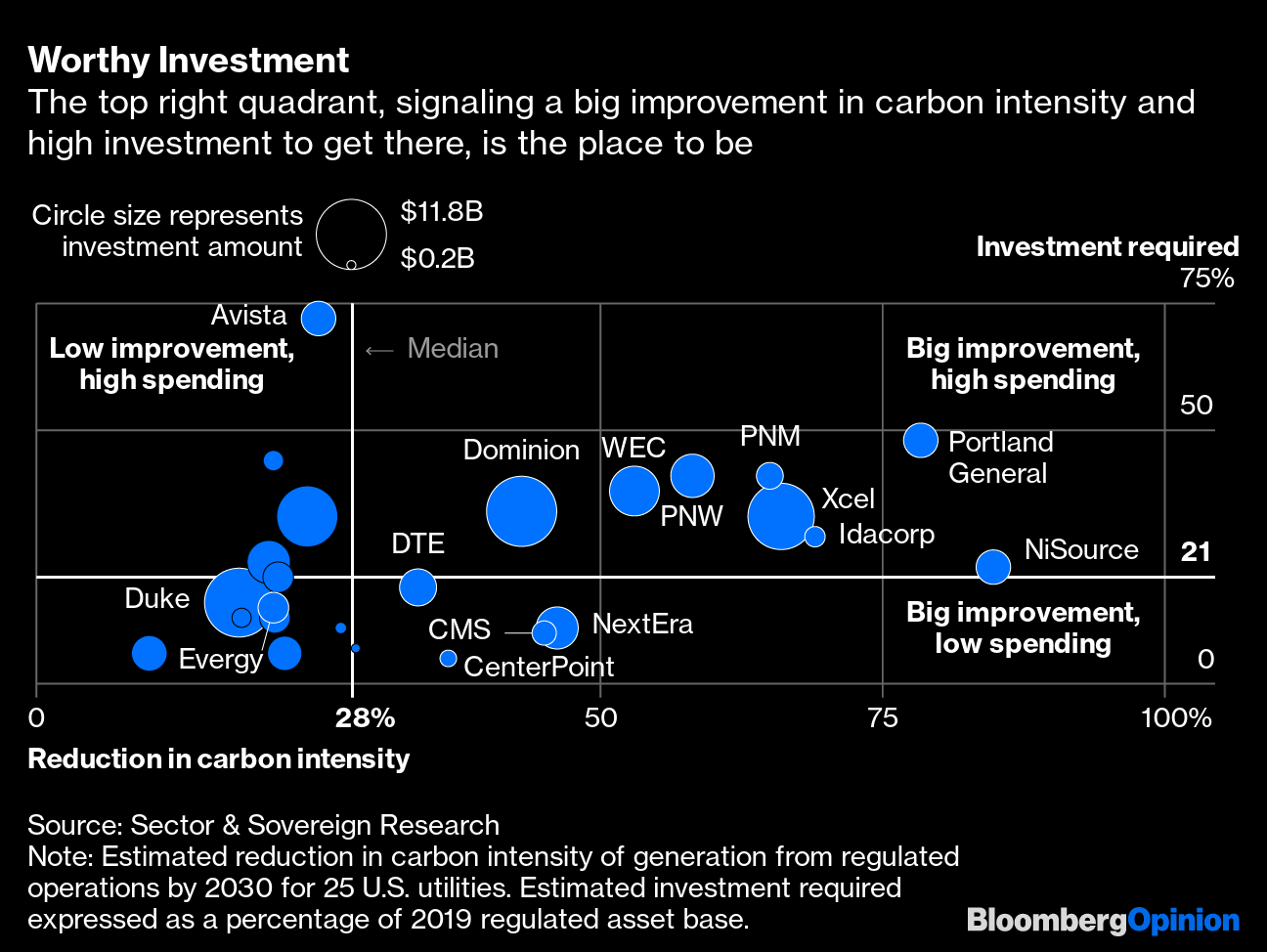

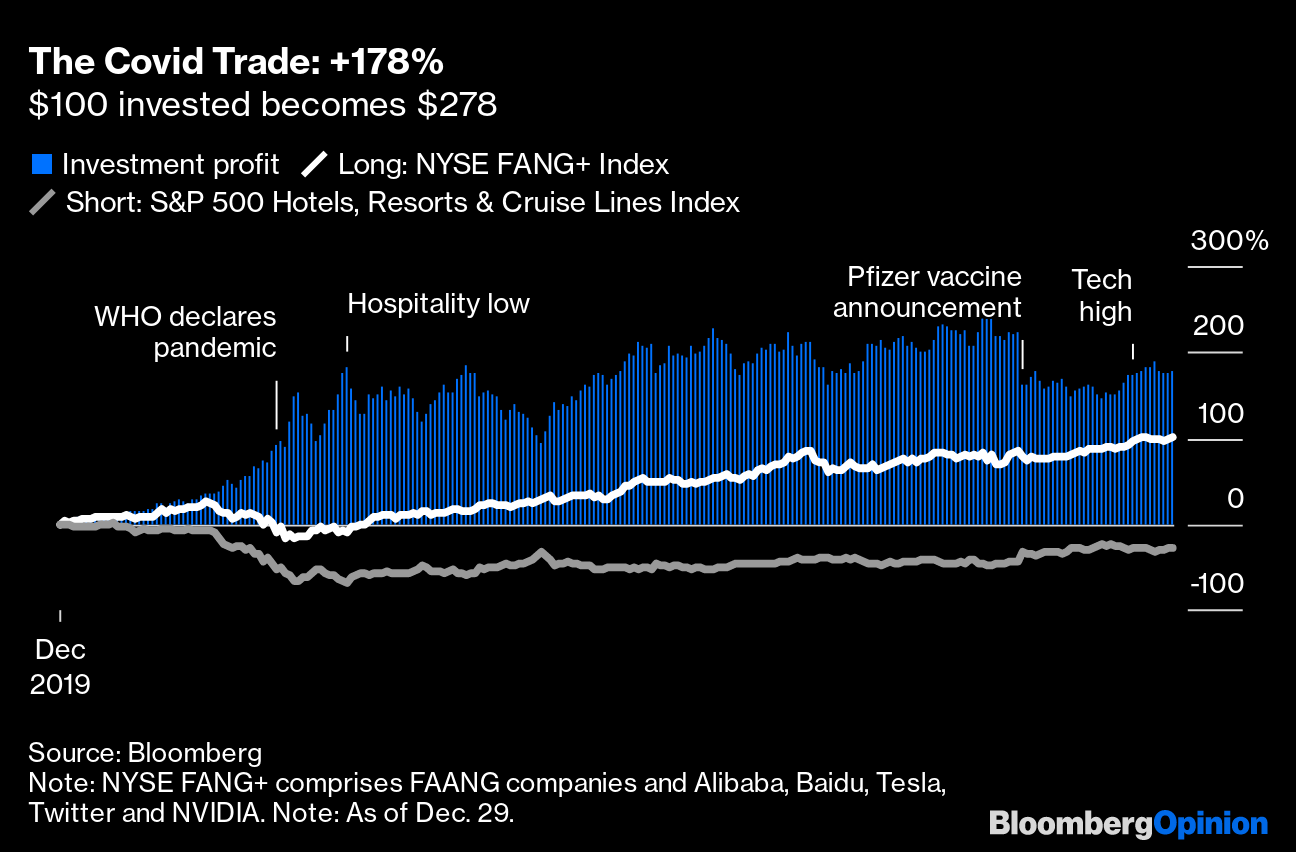

| This is Bloomberg Opinion Today, an ESG portfolio of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe Greening YearFor decades, one of the main roadblocks to doing anything significant about global warming has been fear that the economic damage of truly curbing carbon emissions would be too painful to bear. This year, Covid-19 finally forced the issue. Shutting down vast swaths of the global economy to fight the pandemic had the silver lining of also keeping a whole bunch of carbon from spewing into the atmosphere, notes Nathaniel Bullard. See, for example, the dramatic dip in U.S. emissions to their lowest level since 1983:  Observant readers of this newsletter — and really, is there any other kind? — will observe that emissions also fell in several other years besides this annus horribilis, and that the trend in emissions has been lower since 2007. Like so many other things in this pandemic — e-commerce, working from home, realizing child care is important — the coronavirus has merely accelerated trends already in place. Renewable costs just keep falling, while demand for electric cars and aversion to fossil fuels keeps rising:  Nathaniel has eight other charts that tell the whole story, and you can see them all here. Hand-in-hand with this greening trend is one toward investors being more sensitive to environmental, social and governance issues. It may seem counterintuitive, but Liam Denning points out that one of the best ESG investments you can make these days is a dirty utility trying to mend its ways.  Green energy may be getting cheaper, but overhauling the dirtier stuff costs money. You can help future generations, while boosting your own wallet and sense of personal fulfillment, by posting the capital. Even in this pandemic, there are still some win-win situations. How to Stimulus GoodThe economy will need help at least until vaccines have been widely distributed, so it's a good thing President Donald Trump finally agreed to sign a new relief bill, despite threatening to hold it up over a complaint its $600 stimulus checks are too small. Democrats agree with Trump that $2,000 is a better number. Senate Republicans, at least the ones in charge, disagree. Bloomberg's editorial board argues the total relief package is too small, but bigger stimulus checks will just use up limited resources (the government can't borrow infinity dollars, one presumes) that could be better spent on more targeted relief. One way to focus the next bill could be with measures that help women, who have suffered more than men in this recession, as Elisa Martinuzzi notes. Some other governments around the world figured this out and specifically tried to help working mothers. The latest U.S. bill dedicates $10 billion to child care, but that should only be a downpayment for the next round of relief. There's a risk that a bunch of stimulus, along with pent-up demand and vaccines, could boost the economy so much that we get an inflation scare next year, warns Tim Duy. But there's still way too much slack in the economy for any short-term price jump to make the Fed clamp the flow of credit too soon. China's MistakesIt's a little hard to call China a coronavirus winner, exactly, considering the whole nightmare appears to have originated there and was poorly handled at first, leading to profound suffering. On the other hand, China did quickly get a grip on its own outbreak, and its economy has rebounded smartly. It's still making a few big mistakes, though, writes Shuli Ren. It's aiming stimulus at the wrong audience, it's scaring off investors by punishing mouthy billionaires, and it's not handling defaults at state-owned enterprises well. China risks undermining its own success story, such as it is, in the process. Further China Reading: The EU is wrong to rush into an investment pact with China. — Andreas Kluth Telltale ChartsThe best trades are always obvious in hindsight, but this year they were almost easy to spot in real time, writes John Authers. Shorting hospitality and going long the FAANGs may have involved the least amount of brainpower.  Further ReadingBenjamin Netanyahu faces a real electoral challenge, this time from within his own party. — Zev Chafets If Texas really wants to be the next Silicon Valley, it should ban noncompete agreements. — Noah Smith You've got questions about the new Astra vaccine. Sam Fazeli has answers. It's time to talk to your parents about estate planning; here are some tips to make it less awful. — Erin Lowry ICYMICovid vaccinations are happening too slowly. Refrigeration problems aren't helping. Locked-down cruise-ship crew members have been dying by suicide. KickersWhere has all the bucatini gone? (h/t Alistair Lowe) Emotional headlines affect our brains, regardless of source. How they shot the mirror scene in "Contact." How to eat your Christmas tree. Note: Please send bucatini and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment