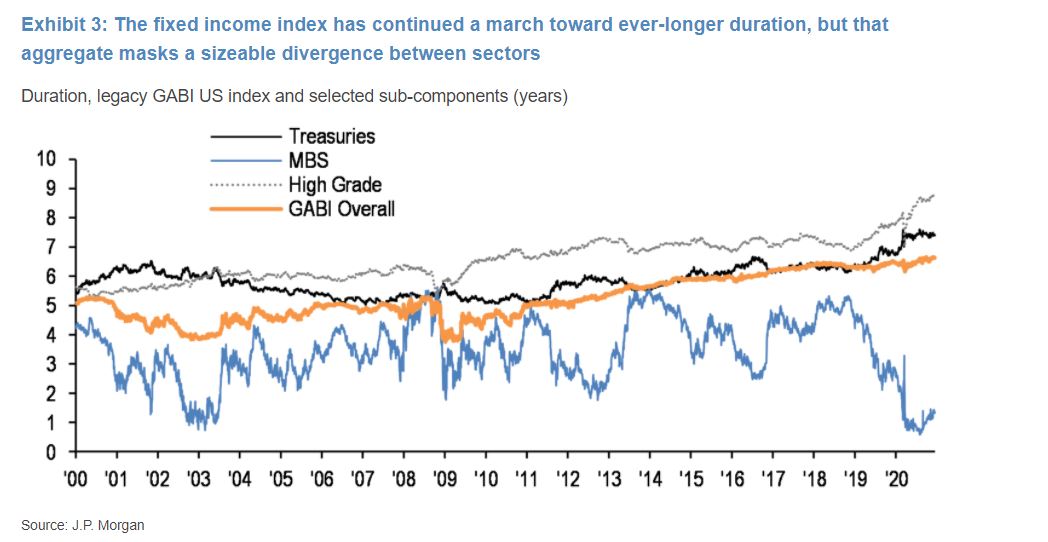

| Virus brings Christmas chaos from London to Sydney. Currencies on edge amid resurgence. Elon Musk is eyeing Bitcoin. The new strain of the coronavirus is "out of control," U.K. Health Secretary Matt Hancock warned, as London went into an emergency lockdown and travel with Europe was banned. On the other side of the world, Sydney's 5 million residents are being encouraged to forgo end-of-year celebrations and anything else that might fan a coronavirus outbreak that's closed state borders and threatens to scupper Christmas festivities. Experts warn vaccines don't mean we'll see the last of Covid. Progress on a U.S. stimulus package curbed appetite for the yen and Swiss franc, while concerns about the U.K.'s worsening virus outbreak and Brexit talks sent the pound lower. Moves were pronounced early Monday across currency markets, with the pound under pressure as "significant differences" remain in trade talks between the U.K. and the European Union. Congressional negotiators in the U.S. reached a compromise that may clear the way for a final agreement on a roughly $900 billion spending plan. Asian stocks may search for direction after U.S. equities dipped on Friday. Australia upgraded its forecast for earnings from mining and energy exports in the 2021 financial year as booming iron ore prices boost the coffers of the world's top producer. Export sales are seen at A$279 billion ($212 billion) in the year to June 30, 2021, up about 9% on the previous forecast in September, the government's Department of Industry, Science, Energy and Resources said in a quarterly update. That's still down from a record A$291 billion in fiscal 2020. Elon Musk inquired about converting "large transactions" of Tesla Inc.'s balance sheet into Bitcoin in a Twitter exchange with Michael Saylor, a prominent booster of the digital currency. In a series of tweets, Saylor, chief executive officer of Microstrategy Inc., encouraged the billionaire to shift U.S. dollars from the electric-car maker to Bitcoin and "do your shareholders a $100 billion favor." Animal spirits are famously running wild across Wall Street, but crunch the numbers and this bull market is even crazier than it seems. Global stocks are now worth around $100 trillion. American companies have raised a record $175 billion in public listings. Some $3 trillion of corporate bonds are trading with negative yields. All the while the virus spreads, the economic cycle stays on life-support and businesses get thrashed by fresh lockdowns. Spurred by endless monetary stimulus and bets on a post-pandemic world, day traders and institutional pros alike are enjoying the easiest financial conditions in history. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayDuration, duration, duration. It's a bit of a fixed-income cliche. Yet as the year draws to a close, it's worth highlighting the bond market's massively increased overall sensitivity to interest rates as measured by duration. JPMorgan points out that the duration of its Global Aggregate Bond Index now stands at 6.6 years — its highest level in over two decades. Duration has gone up as central banks rushed to stimulate their respective economies, forcing another compression in yields on government debt. Meanwhile, companies have also rolled over corporate debt into longer maturities to take advantage of lower borrowing costs, extending duration for another large chunk of the market.  Bloomberg Bloomberg The concern, of course, is that this leaves bonds far more susceptible to a sell-off if interest rates were to sharply rise — or even if the market were to get a whiff of the possibility. Back in 2013, the Federal Reserve spooked investors with a relatively sedate comment that it might slow down its asset purchases if the economy continued to improve. Duration in the bond market was about 5.5 years at that time. With benchmark interest rates once again at zero and the Fed presumably reluctant to go negative, there's an asymmetric risk here. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment