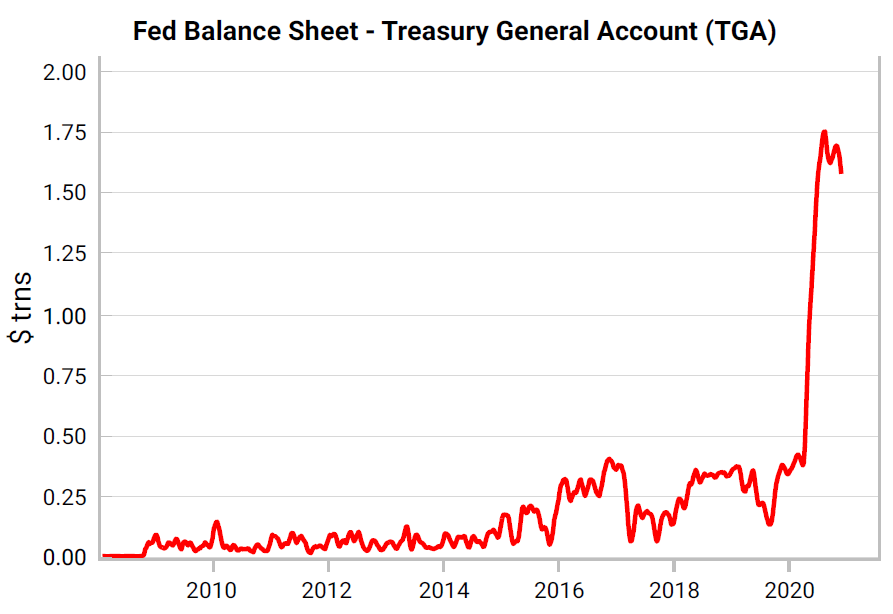

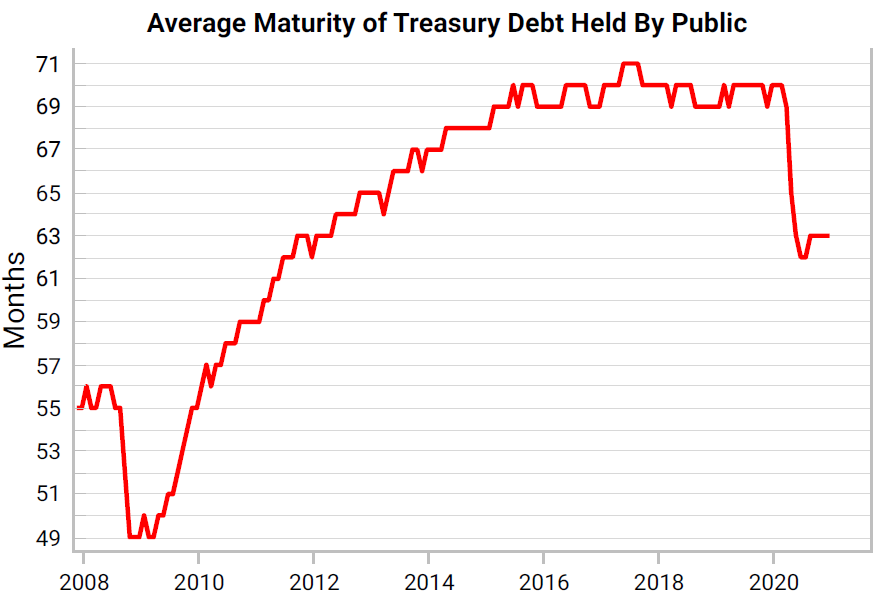

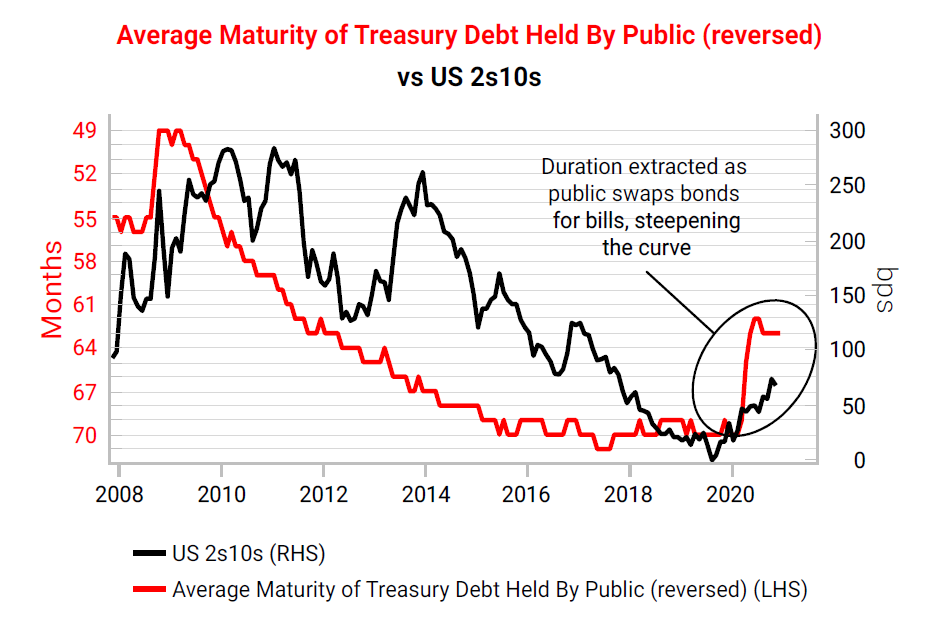

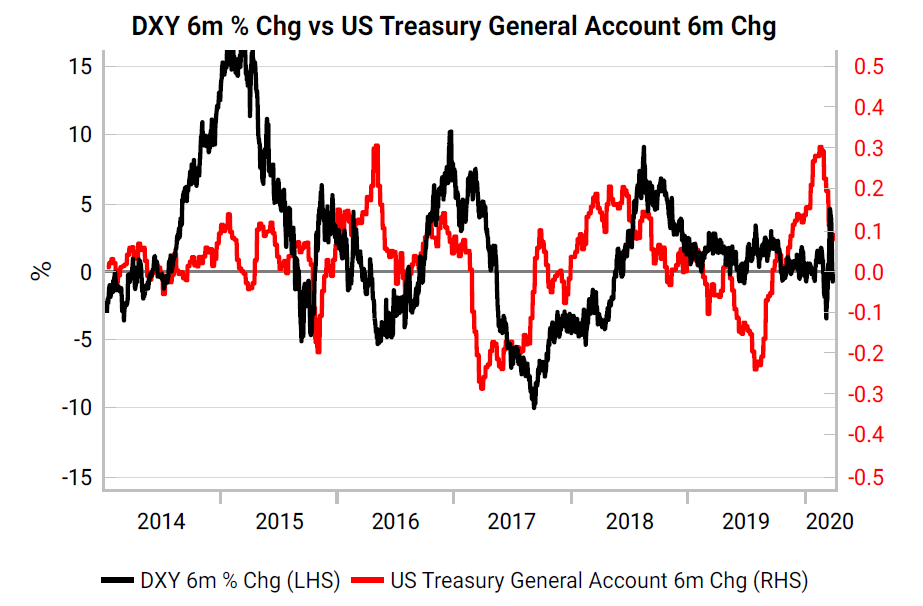

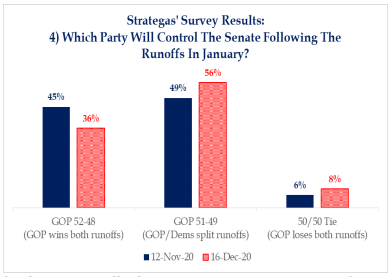

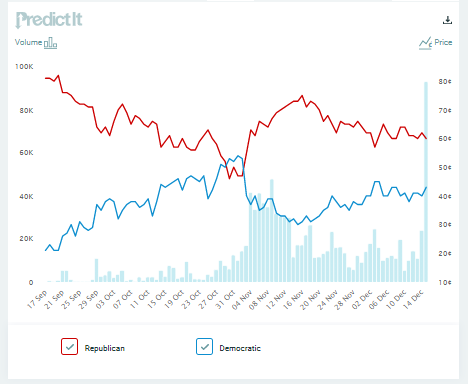

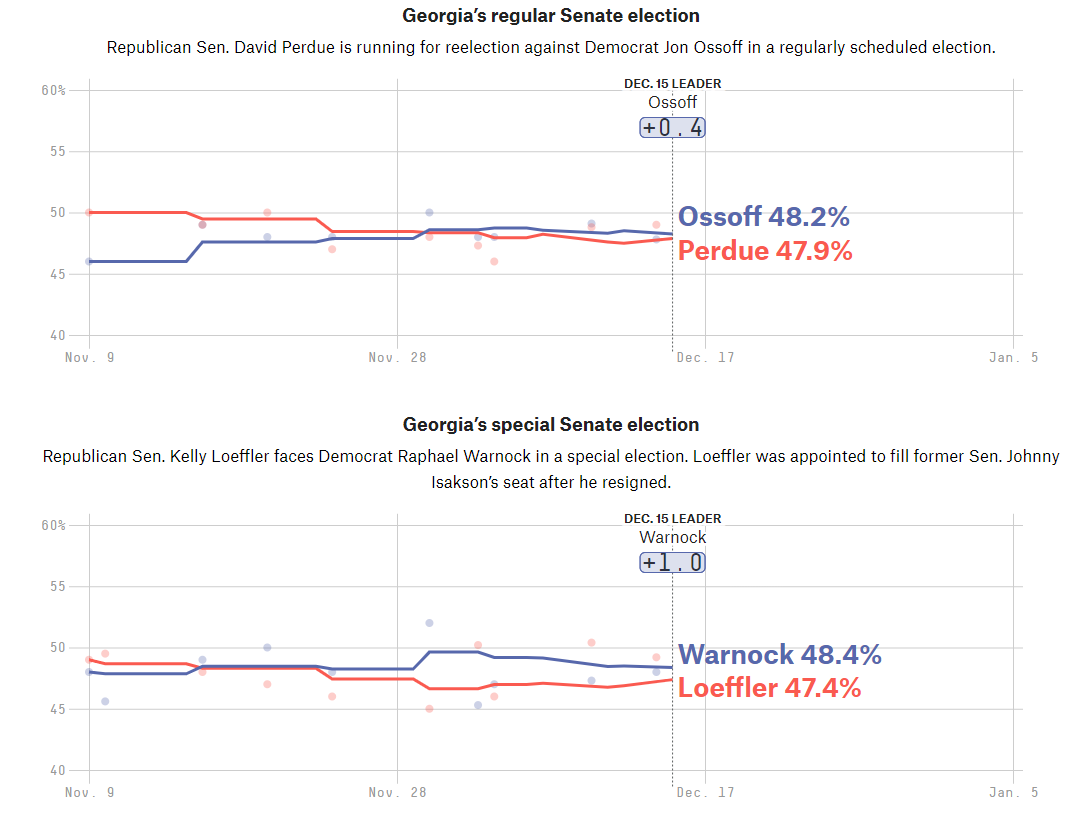

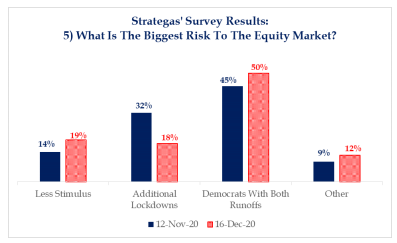

Flattening to DeceiveIn monetary policy, the year ended not with a WAM but a whimper. Jerome Powell did about as little as anyone had thought he could get away with, eschewing new purchases or strict quantitative targets for merely qualitative (in other words, squishy) guidance. Instead of any clear metrics on future asset purchases, Powell and his colleagues unanimously signed up to a statement that they would continue until "substantial" further progress has been made toward the twin goals of price stability and full employment. They are free to define "substantial" however they wish. In practice, to borrow a footballing analogy from my colleague Brian Chappatta, the Fed has punted. After immense monetary stimulus this year, the ball is now with elected politicians. That seems entirely prudent. The market reaction was appropriately muted, with a quiet improvement for equities while the dollar took another leg down. That is a good combination for the Fed, as it is obviously tied (rightly or wrongly) to keeping asset prices afloat, and will find it easier to reignite inflation if the dollar weakens. The job of managing a transition away from the huge stimulus thrown at markets and the economy this year still threatens to be treacherous. One bizarrely technical issue might help over the next year. The Treasury department will need to draw down its enormous account at the Fed. This is how how the Treasury General Account, or TGA, a deposit that appears as a liability on the Fed balance sheet, has moved since the global financial crisis:  The chart is from Simon White of Variant Perception Ltd. in London, who kindly took me through the counterintuitive effects that this massive rainy day fund could have on markets and financial policy. The money in this account doesn't increase either the Fed's balance sheet, or any of the "M" numbers measuring the monetary base. It was built up by the Treasury to give it some leeway ahead of the next clash of heads with Congress over the debt limit. Then it became much bigger, as the chart shows, as the Treasury tried effectively to pre-fund a Covid-19 stimulus. It did this by issuing more short-term bills. At the same time, the Fed was busily buying back bonds of generally longer maturities as part of its QE efforts. Those from whom the Fed bought were left with cash that they then used to buy the short-term bills the Treasury was offering. These funding logistics may explain a sharp fall in the average maturity of the Treasury debt held by the public this year:  While this move is neutral as far as the monetary base is concerned, it has an important effect on the dynamics of the bond market, and hence on financial conditions. All else equal, shortening the average maturity of debt held by institutions will mean more money pouring into shorter-term bonds; therefore it should also mean a steeper yield curve, as this will lead to shorter bond yields falling more than those on longer-term securities. As this chart shows, the direction of the average maturity of Treasury debt appears identical to the direction of the yield curve. The sudden switch to a shorter average duration this year coincided neatly with a sudden curve steepening:  All other things equal (which they won't be, but still), we should expect the opposite to happen during 2021; the Treasury will wind down the account, which it can do easily by allowing the bills to expire. That will entail paying money to institutions that now need to find something to do with it. The chances are that the bulk of that money will go toward buying longer-dated bonds. Other things equal, yields on longer bonds will come down by more, and the yield curve will flatten. The Fed might well want to control the yield curve next year. The TGA will probably provide a tailwind that will help it to avoid explicit yield curve targeting, or adopting an overt target for the weighted average maturity, or WAM, of assets on its balance sheet. Especially with Janet Yellen in charge of the Treasury, the chances look good that the Fed will have some coordinated help from fiscal policymakers. If the TGA acts against the consensus when it comes to the yield curve, it may help the consensus when it comes to the dollar. The relationship isn't strong, but in recent years declines in the TGA have overlapped with a weak dollar, while rises have coincided with a strong currency. A sustained decline in the TGA in 2021, leading to a flatter yield curve, would probably help bring down the dollar.  If there's an impasse over the debt limit as expected in July, then the TGA will more or less have to be drawn down significantly. There is a "but," though. Next year will start with two special senatorial elections in Georgia. If the Democrats win both seats, the Senate will be split 50-50, giving Vice President Kamala Harris the casting vote. That could mean the debt limit would remain suspended, giving Yellen the freedom to spend money on fiscal expansion, rather than draw down her account at the Fed. That would be a big change. Few people are talking about the fact that control of the Senate is still to be decided. Investors seem confident that the Republicans will retain control. To do so, they only need to win one of the two seats at stake in Georgia, both of which they currently hold. According to a survey of investors by Strategas Research Partners in New York, 92% think the Republicans will hold on, barely changed from 94% in the week after the presidential election:  Arguments in favor of the Republicans include that the Democrats haven't won a Georgia Senate seat since 1996, and that David Perdue, their sitting senator, only failed to win the 50% needed to avoid a run-off by a tiny margin in November. Georgia is a conservative place. But the Predictit market, which is now beginning to generate significant volume, puts Perdue's chances much lower. This is how his odds have moved over the last 90 days:  Perdue's probability spiked to almost 100% when it appeared that he had topped 50% in the election. Now he has a 62% shot. Meanwhile, the other "special" election, caused by the retirement through ill health of former senator Johnny Isakson, pits Republican businesswoman Kelly Loeffler, who was appointed by the governor, against Democrat Raphael Warnock, who is Black, and who has the distinction of preaching from the pulpit once used by Martin Luther King in Atlanta. Loeffler has always been seen as more vulnerable than Perdue, and her chances are currently put at about 60%.  The two races will be highly correlated. If the Democrats win one seat, the chances are pretty good that they will win both. That is reflected in the odds Predictit puts on Democrats winning control of the Senate: 34%. Plainly, the Republicans are likely to prevail, but there is a big gap between the 8% assumption that Strategas finds investors are making and the 34% shot perceived by bettors on prediction markets. As for the polls, frayed though their record is of late, they fared better in Georgia than in many other states. They suggested that Biden would win narrowly, and he did. So it would be dangerous to ignore them altogether. The latest, by Fox5 and InsiderAdvantage, show Perdue and Loeffler both leading by only one percentage point, according to RealClearPolitics. The running aggregate polls by FiveThirtyEight also show a one-point advantage, but to the two Democrats.  Add to this the dissension within Republican ranks, with some loyalists saying they will refuse to vote because they believe the presidential election to have been rigged, and the frenetic but highly organized attempts by Democrats to get out their vote, and it is easily conceivable that the Republicans will lose. Market strategists in the Strategas survey think a Democratic Senate would be a more alarming development than failed stimulus negotiations or additional lockdowns:  Would the consequences really be that stark? There are several very moderate Democrats in the Senate, so the chance of pushing a radical agenda of the kind advocated by Senator Bernie Sanders would still be close to zero. For most policy, there isn't a truly binary outcome. The exception, as pointed out by Beacon Policy Advisors, lies in control over committees, nominations and floor votes. These include agencies such as the Federal Communications Commission and Federal Trade Commission, which are deadlocked along party lines and where Senate control would enable the Democrats to push forward their agenda on policies such as internet subsidies, net neutrality, and the antitrust case against Facebook Inc. And with great marshalling of political resources, there would be an opportunity to reverse some Trump tax cuts, and spend some money. If Biden does all that, then 2021 could go more with a bang than a whimper. And a lot about such esoterica as the yield curve would need to be reconsidered. It's a difficult path and is still likely to be cut off next month. But it would make sense if Georgia were much closer to top of mind. Survival TipsHappy birthday Ludwig van Beethoven. The great composer was born 250 years ago in 1770. The best guess from the surviving records is that his birthday was Dec. 16. For a long time I felt ambivalent about Beethoven. The music is powerful and touched with genius, but many works seemed to me to have a thread of anger. Particularly as he aged and lost his hearing, there were more repeated loud chords, which I used to attach to the notion of a man banging the wall in frustration. Beyond that, there was suspicion about his muscular political ideas, such as his initial dedication of the Eroica Symphony to Napoleon Bonaparte. I've grown out of those suspicions. It's not just that much of Beethoven's music is lyrical and beautiful, it's that it has universality. For some reason, Beethoven is funny, as comedians from Victor Borge to Jimmy Fallon have shown. He became the unlikely hero of a cartoon in my childhood. All around the world, people respond to him. I understood that most powerfully after I started performing in the choir for the Ninth Symphony, back in my 20s with the Philharmonia Chorus (who, before my time, made some of the greatest Beethoven recordings ever). At one point, on a tour with the conductor Carlo Maria Giulini we sang it six times in seven nights, in five different countries. The audiences in Amsterdam and Copenhagen, with a history of war and occupation by the Germans in living memory, responded if anything with even greater excitement (and joy) than the audiences in Luxembourg City, Lucerne, or even Munich. I recommend listening to the whole thing and not just starting with the Ode to Joy – all the first three movements are exciting, as I got to learn while sitting in a tuxedo under hot lights while my throat dried out, night after night. The final movement, with its twists and turns and drama, also repays repeated listening. Getting to know the work from the inside and performing it was one of the greatest privileges of my life. The Ode to Joy itself is universal. Just witness the hold it has on Japan, where every year at Christmastime it is sung by a choir of 10,000, or hear it converted into Yiddish. And for the many British people who now dislike it because it was co-opted as the anthem of the EU; please get over it. It transcends politics. All of which is a long way of saying thank you and happy birthday to Ludwig van Beethoven. Enjoy the links. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment