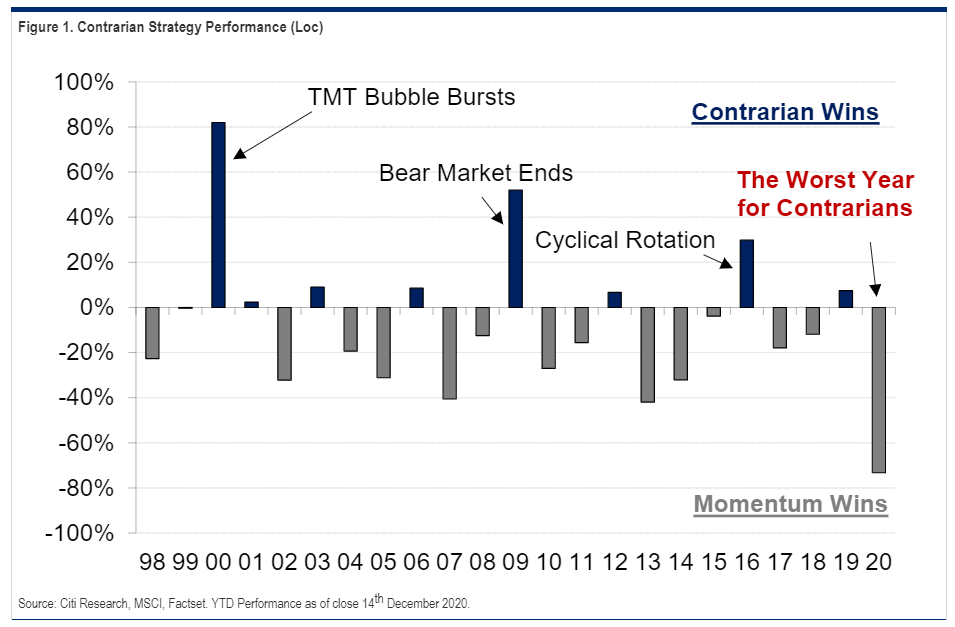

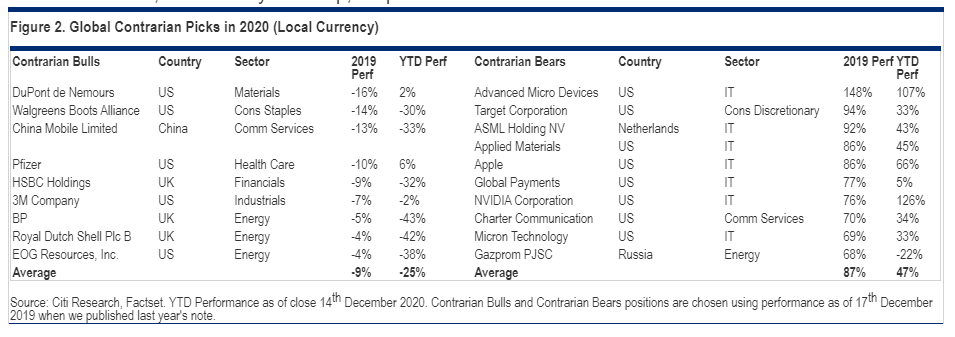

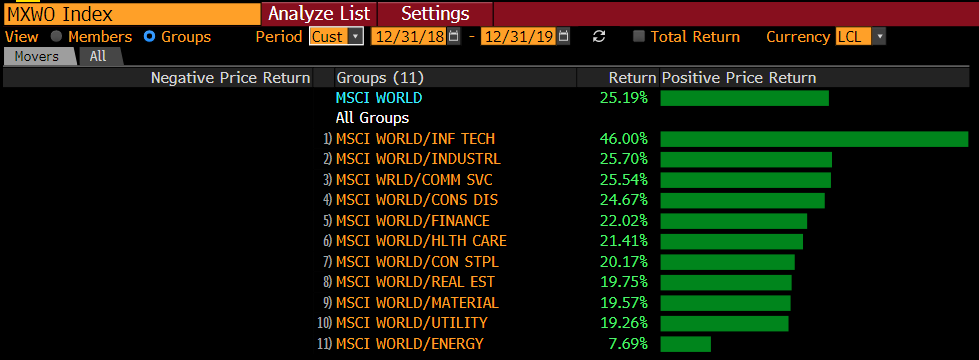

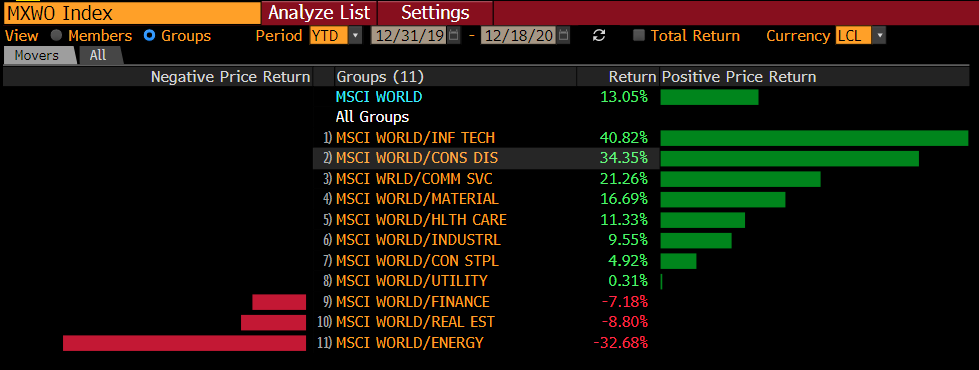

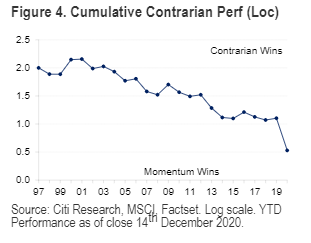

On the ContraryContrarian trades are where the big money is. Investors who hold their nerve and are greedy when everyone else is fearful, and vice versa, can make huge bucks. The nature of the market, and its tendency to overshoot, more or less guarantees this. But while the market is unquestionably inclined to go to unjustified extremes and overshoot, the problem for a contrarian strategy is that most of the time the market by and large gets it right. This means that a strategy of mechanically betting against the market's most extreme positions tends not to work — even though it occasionally works spectacularly. And 2020 turns out to have been a terrible year for contrarians. This might seem strange, as virtually all 12 months were dominated by a novel coronavirus that scarcely anyone outside China had heard of at the year's beginning. But the virus did not turn things around — it merely added speed to trends that were already in place. For evidence, I will refer to the annual exercise conducted by Rob Buckland, chief global equity strategist for Citigroup Inc. in London. He refers to it as the "Christmas lunch hedge fund" — the strategy that would result if stocks were picked over a boozy Christmas lunch in which traders get ever more outrageous in their attempts to shock their colleagues with predictions of which stocks will do best next year. To track such a contrarian strategy, Buckland regularly takes the top and bottom 10 performing stocks each year, and looks at how reversing them would have fared the next year — going "long" the 10 worst performers, and "short" the 10 best. This year was the worst on record:  This was mainly because oil companies had a bad year in 2019, so contrarians would have bet on them to bounce back — a trade that went disastrously wrong. Meanwhile, contrarians also placed a short on technology stocks, which has become almost an annual occurrence. Again, it didn't work out:  The virus proved to be a capricious guide to market returns. Last year's bottom 10 among the 250 largest stocks in MSCI's all-world index, which Buckland used for the exercise, included two stocks that might have seemed certain to do well out of the pandemic. And yet Pfizer Inc., which won the race to produce the first approved vaccine against Covid-19, lagged the market with a gain of only 6%, while Walgreens Boots Alliance Inc., a huge chain of pharmacies, logged a serious loss. Judged by sectors, the very different years of 2019 and 2020 look close to identical when it comes to relative sectoral performance. This terminal screen shot shows how the 11 main industrial sectors performed in 2019, according to MSCI.  And this is the same league table for 2020 so far. Technology again leads, and energy still lags:  In terms of the critical information for sectoral allocation, the two years were not so different. When growth is perceived to be scarce, as was the case both this year and last, investors will pay more for the few stocks they think can provide it — led by the big internet names. Meanwhile, weak global demand was bad for oil majors, and created growing difficulties for the cohesion of the OPEC oil cartel, which came to a head this year. Anyone who placed a long energy/short technology trade among stocks in the S&P 500 Index would as a result have been seriously aggrieved:  Two important messages arise out of the experience. The first is that momentum is such a strong force in markets that on balance it counteracts contrarianism. The winners do continue to win while the laggards keep lagging. To quote Buckland: While we all like to think of ourselves as contrarians, the simple point is that this strategy doesn't work. You might not be very interesting company, but you would win the Christmas lunch competition more often by making momentum calls. The big payout years for contrarians, like 2000 when the Tech bubble burst, are not enough to make up for the more frequent years when they lose. And in some years (like 2020), they can lose really big. If we look at cumulative performance, the global Contrarian Stock-Picking strategy would be down 97% since 1997. The Christmas lunch hedge fund would have been shut down many years ago.

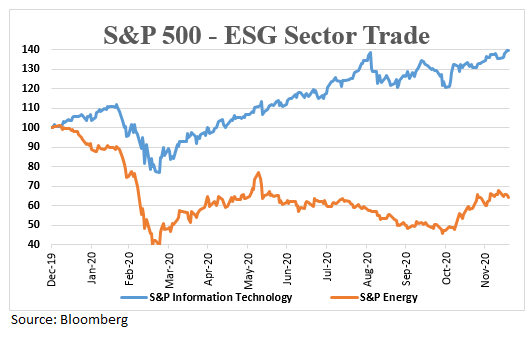

This is his chart on how the contrarian stock-picking strategy would have done since 1997:  The takeaway? We should be on the lookout for great contrarian trades, because they can make a lot of money; but we should not seek out contrarianism for the sake of it, as that is a recipe to lose money. A second point concerns the world that is being created by successive years of out-performance by tech and under-performance by oil majors. These trends tend to overlap with the aims of "ESG" (environmental, social and governance) investing, which is currently very popular. Investing in companies with relatively light carbon footprints will generally also lead to portfolios with lots of tech and no oil companies. As Dec Mullarkey, managing director of SLC Management, put it to me in an e-mail, a strategy of going long on the S&P Information Technology Index (+39.8%) while shorting the S&P 500 Energy Index (-35.7%) has done very well so far this year. "This trade, at modest levels, is embedded in most ESG mandates. And this could persist well into 2021 as value buyers seem tepid on fossil fuels while ESG continues to grow its asset base."  This raises the issue that many people being drawn into ESG at present are, whether or not they realize it, chasing the great recent returns that come with being long technology and short oil. Their commitment to the cause may yet be put to the test. And there is a deeper issue of whether ESG investing gets the results we want. Investing in less pollution-causing companies also tends to involve investing in less labor-intensive companies. This implies that ESG dollars may, at the margin, be going toward creating an economy with ever fewer jobs. The momentum in the stock market is only speeding this development along. One final point of concern is that the contrarians should still be right a little more often than they have been in the last decade. The following chart shows the performance of the MSCI World Momentum index relative to its plain-vanilla World index, going back 25 years. Significant pullbacks used to occur quite often — as after the tech boom, and again after the global financial crisis. But momentum has not suffered a drawdown of even as much as 10% compared to the market since 2008:  Markets have grown more institutionalized over the years, with index funds mechanically designed to accept current prices, and not make any contrarian moves. Central banks are also much more concerned to maintain momentum, and to thwart the contrarians, than they used to be. Betting that these trends would fail this year would, it turns out, have lost you a lot of money. People will be understandably reluctant to make a contrarian bet again. At some point the contrarians will be proved right. When that happens, the embedded returns of so many years of successful momentum could make for a lot of room below — and the boozy contrarian at Rob Buckland's Christmas party will at last have something to be smug about. What a Relief Truly binary outcomes are rare, but Sunday's Capitol Hill deal to agree to further Covid-19 relief appeared to be close to it. The details of exactly what emerged from the congressional sausage-making machine have always mattered quite a lot less to markets than the mere fact that there should be some extension of relief. The good news, for financial markets, is that this binary question had a positive outcome. The agreement means $900 billion will be flowing toward areas of need in the U.S. economy. That substantially reduces the risk of a "W"-shaped recession, just as some macro data was beginning to turn downwards again, and also helps reduce the risk of resumed credit events in the new year. The less exciting news is that prices have been predicated for a while on the notion that some deal will have to be reached — and this deal is still an unappetizing mess. As of the time of writing, there is still no legislative text, and there has still been no vote. The details won't be enough to rub out the good feeling engendered by almost a trillion dollars. But they could yet temper enthusiasm once they become available at the beginning of a short trading week. Initial reactions were muted, with a slight fall in S&P 500 futures in Asian trading, despite the extremely positive news from Friday night that banks will be allowed to resume share buybacks. The dollar gained a bit, suggesting a rise in risk aversion. The last great stumbling block to a deal was the attempt by Republican Senator Pat Toomey to insert language to limit the Federal Reserve's future ability to adopt the sort of emergency lending programs it put in place this year as part of Covid relief efforts. That has been watered down. There is ample room for people to disagree on whether the Fed should retain as much independence to set policy as it currently enjoys, but there is no question that markets prefer a Fed with continuing freedom of action. The exact compromise wording on this topic could be critically important. Win Thin, global head of foreign currencies at Brown Brothers & Harriman & Co., put it as follows: The revised language in the compromise reportedly prohibits the Fed from creating exact copies of the emergency lending programs as those from the CARES Act. All those programs will shut down as of year-end and the $429 billion in unspent funds will be redirected to other programs in the new $900 billion bill. Republicans reportedly believe the language will prevent the Fed from pursuing new emergency lending programs on its own without Congressional permission and appropriations. However, the Democrats reportedly believe that the language still gives the incoming Biden administration leeway to introduce new emergency programs in conjunction with the Fed if needed. We hope we never have to find out who's right here.

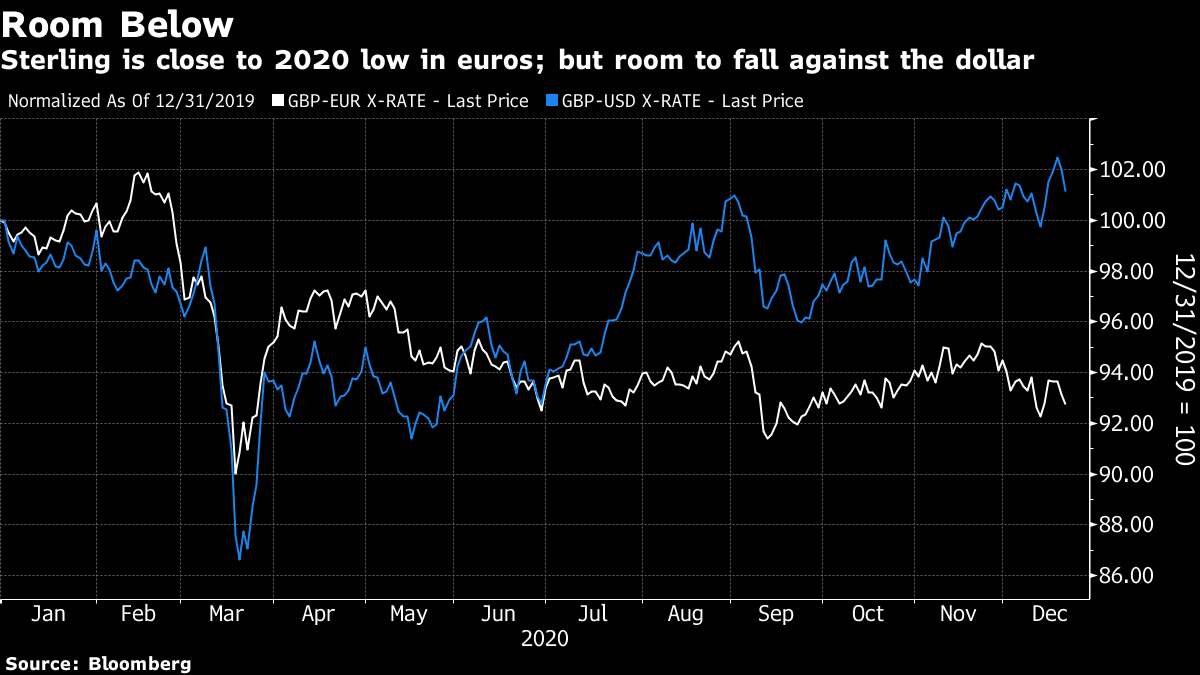

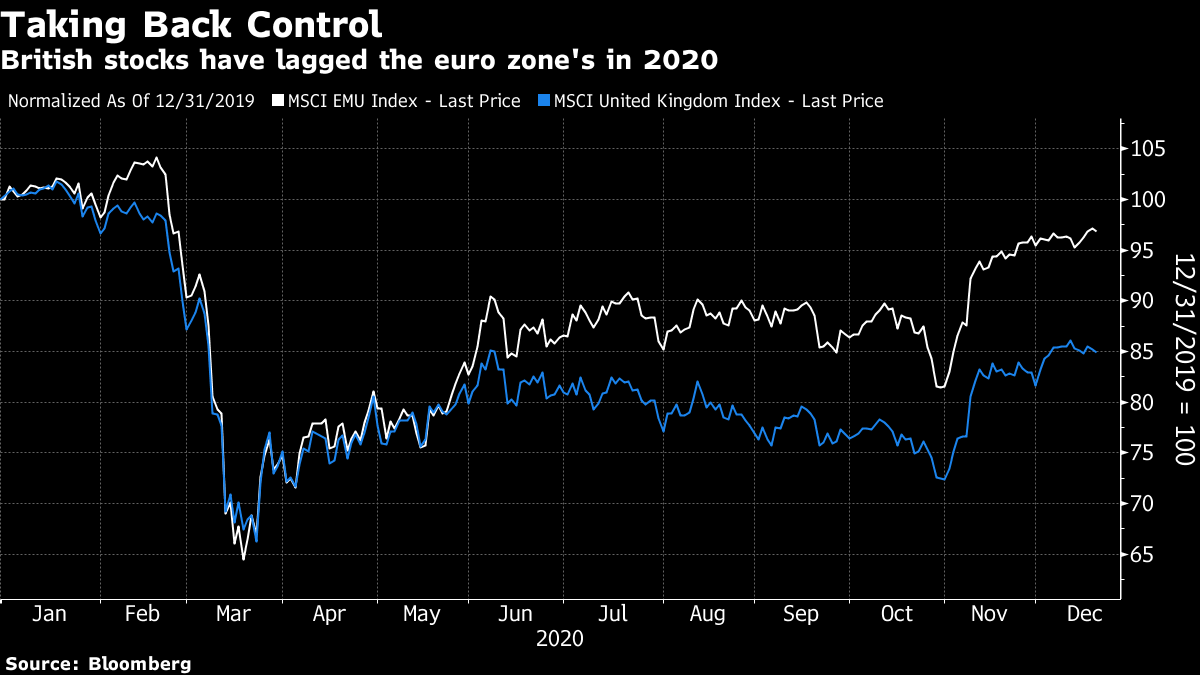

As it stands, the deal may provide an excuse to enter the market for those in need of one. But the growing worries about Covid-19 emanating from Europe, and the need to close out books before the end of the year, will be inhibiting factors. I hope to write more about this once there is some substantive detail to analyze. No Relief: Another Missed Brexit DeadlineCongress reached its deadline (sort of ) to agree to a deal over Covid-19 fiscal relief, but the talks to finalize a new post-Brexit trade treaty between the U.K. and the European Union didn't make it. Deliberations will continue Monday after the two sides remained unable to bridge their differences over the weekend, missing another crucial deadline and increasing the risk of Britain leaving the single market at month-end without a new treaty in place. Fisheries continue to present a critical obstacle. It may not matter that much in the short term. Over the weekend, Britain's government announced that a new and much more infectious variant of the Covid-19 virus was "out of control," and reversed its previous attempts not to call off Christmas by instituting new and extremely tight restrictions on travel. This dropped the government into serious political trouble at home, infuriating many senior Conservative MPs. Several European countries have barred travelers from Britain. France even barred British freight. Without an agreement, Britain would trade with its nearest neighbors on the same terms as it trades with Australia. The fears were that a no-deal Brexit would lead to a sharp increase in red tape at the border and hence to serious delays and bottlenecks. That now seems unavoidable — thanks alone to the virus. A sudden change to much skinnier trade rules could make an inevitable mess far worse. In the light of all this, it is not surprising that the pound fell at the first opportunity traders had to sell it after the weekend break. Against the dollar, it has a lot of room to fall. But that is largely a factor of the weak dollar; against the euro, it is not far off the low it hit during the worst of the Covid scare in March:  As for the stock market, both the doubts over Brexit and the country's bad handling of the pandemic have taken a toll. The U.K. shows up as a strikingly cheap market on many metrics. Again, the scope for further damage, judging by a comparison between British and euro-zone stocks, is limited:  If there is any comfort for the U.K. in what looks certain to be a miserable Christmas, then, it is that much bad news is already in the price. Although very few can have been expecting quite this much bad news all at once. Survival TipsReportedly Boris Johnson is so keen on trading with his continental neighbors on the same terms with which Britain trades with Australia that he has taken to singing "Tie Me Kangaroo Down, Sport" in Downing Street. Last week, I suggested some better Australian songs for him to sing; readers have since complained that I didn't choose the best ones, and at the current rate of progress Boris may need a bigger Australian tune library in future. So here are some more — including one sung by a group of English football hooligans, to get into the authentic Brexit spirit. Some might profess to be thunderstruck by the continuing failure to find a deal, but Boris truly, madly deeply believes in what he's doing. Many on both sides seem to have a physical difficulty in reaching a sensible compromise. The air supply is running short. And now that I've thought of the image of Boris psyching himself up for Brexit negotiations by air-guitaring to AC/DC, I can't get it out of my head. Whatever happens, Brexit continues to shake Britain to its foundations. Ultimately, the fact remains that Britain and the EU will continue to be neighbors — they need to be there for one another, so that good neighbors can become good friends. Have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment