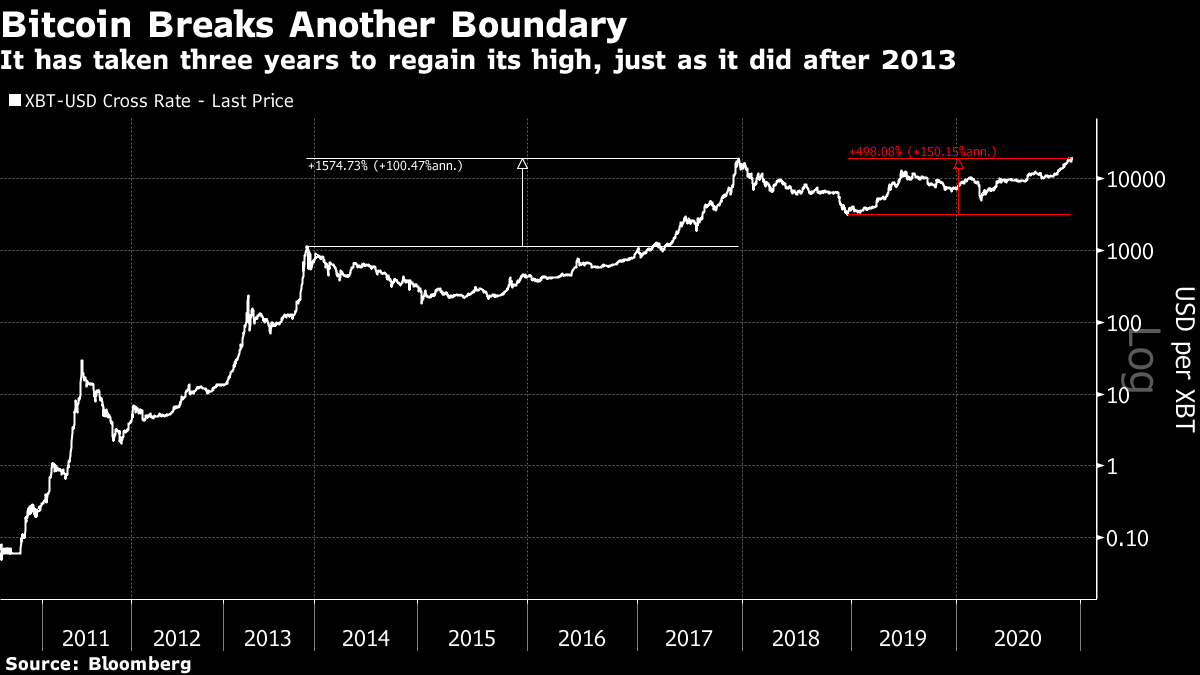

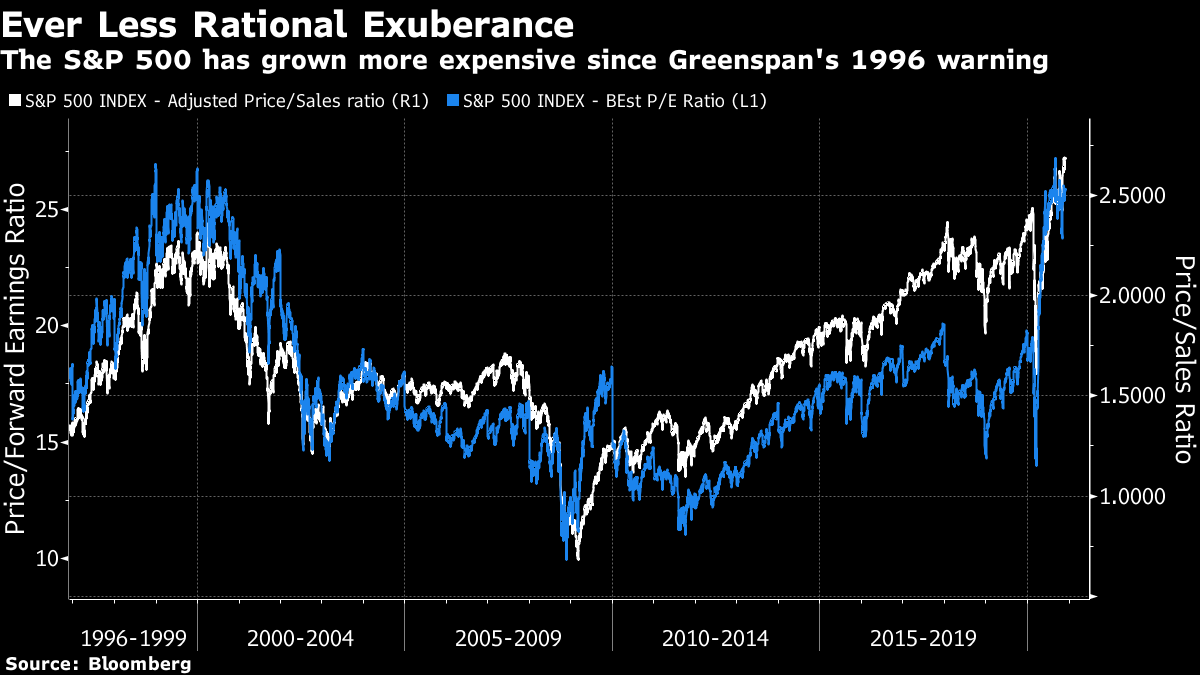

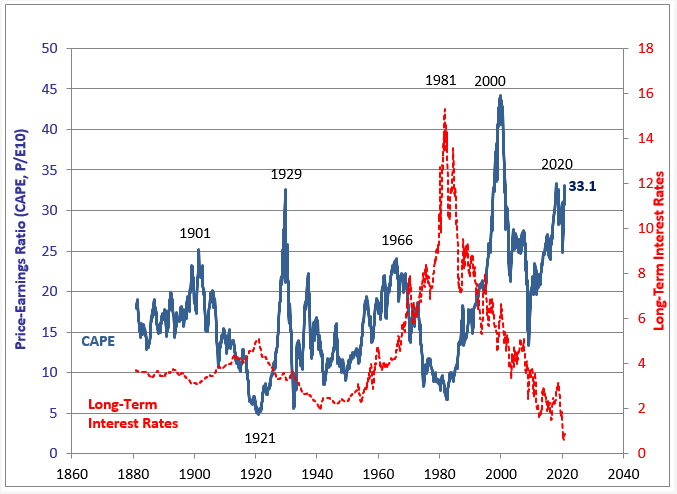

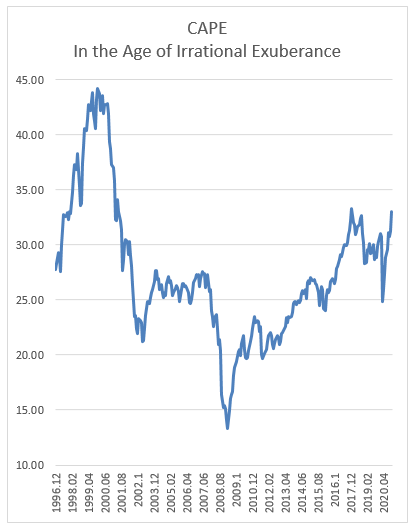

Landmark MondayThere is no particular reason why we should care about records and round numbers in the markets. They just play to human heuristics; mental shortcuts. But we plainly do care about them, so here is a roundup of a landmark-strewn passage of trade. Bitcoin The first and best-known cryptocurrency set a record high Monday, and came close to topping $20,000 for the first time. It is three years since its last peak, in December 2017, which followed a frantic binge of speculation. After the previous big spike, in late 2013, it also took about three years for the cryptocurrency to make a new high. Amid ridiculous volatility, some patterns are emerging. Bitcoin continues to make money for those with the gall and timing to take advantage. Buy at its 2013 peak and sell at the 2017 peak, and you would have compounded at more than 100% per year. The same is true if you had bought at its recent low in 2018:  Back in 2017, I enjoyed writing a long essay on the similarities between bitcoin and tulip bulbs. Tulips, I averred, are at least rather pretty. But the great Dutch tulipmania collapsed in a heap and never returned. The bitcoin phenomenon is plainly different as it keeps coming back for more, between tulip-like doses of excess. Following 2013, much money was poured into ways to use the new technology, and new tokens and cryptocurrencies arrived on the scene. Many were more or less blatant scams. But there was a sense, rather like the laser in an earlier generation, of a solution in search of a problem; now, people are finding problems to solve with it. Bitcoin is used more, and should gain in value from network effects. It continues to have appeal for anyone who wants to bet that central banks will debase fiat currencies. And some big institutions, desperate for anything that might produce a return in current conditions, are beginning to dabble in it. The problems with it remain: Bitcoin has no intrinsic value, and governments may fight hard to keep their monopoly over issuing currency. But for the time being bitcoin is showing some signs of growing maturity as an asset class — and it has endured far longer now than the average tulip. Remember, Remember November As many have pointed out, the month just passed was a stellar one for stock markets. The following chart shows the S&P 500 and FTSE's index for the rest of the world, both rebased to 100 at the end of October. Both gained more than 10%.  Double figure returns for a month are rare. They happened in April this year, during the post-Covid rebound, but never in the rebound from the global financial crisis. There was a double-figure month in October 2011, as the market recovered from the shock of the U.S. Treasury downgrade; another in December 1991 (investors were excited about what was predicted to be a speedy recovery from the recession of that year, which had come with Operation Desert Storm, and were also relieved that the Soviet Union was about to wind itself up without bloodshed); and in January 1987 (Black Monday lay ahead). Such months used to be more common, and I found three during the early years of the Reagan bull market: August and October 1982, and August 1984. November was actually more impressive outside the U.S. Dredging through the terminal, November seems to have been the best calendar month on record for the FTSE's rest of the world index, and for the MSCI EAFE index, which covers the developed world outside the U.S. and gained 15.4% in dollar terms. That's a heck of a lot for one calendar month. How much does it matter? There is no particular reason for markets to overlap with the dictates of the calendar. As the chart shows, November's remarkable performance owes much to the coincidence that a selloff ended on the last day of October. The S&P 500's level compared to its previous peak in September is nothing like as exciting. Valuation This week will also see an anniversary. Alan Greenspan made his famous warning about "irrational exuberance" in the stock market on Dec. 5, 1996. The intervening 24 years have flown by. This prompts some more worrying signals about today. The former Federal Reserve chairman was famously right about the irrationality, but got his timing badly wrong. The bull market would rage on, and form a bubble, for three more years after that speech (in part because Greenspan lost his zeal for puncturing the excess). The following chart shows the price-sales and price-forward earnings multiples (as calculated by Bloomberg) for the S&P 500, starting at the point of his speech. Both rose far further in the next three years, before spending the better part of a decade below their level of December 1996 once the internet bubble had burst. Now, thoroughly alarmingly, the P/E ratio is almost as high as it was at the dot-com peak, while the sales multiple is at a record. This is at a point where vaccines have still not been cleared for use, and the Covid pandemic continues to subject most of us in the Western world to lifestyles that cramp economic activity.  With only one exception, it's hard to see any justification to pay more for stocks now than in December 1996 (when all appeared set fair for years into the future). The exception is important. Bond yields are far lower than they were back then. Yale University professor Robert Shiller literally wrote the book on irrational exuberance. His bestseller of that name included a methodology for valuing stock markets using his cyclically adjusted price-earnings ratio, or CAPE. This takes a multiple of average earnings over the previous 10 years, and thus corrects for the market's tendency to take account of the economic cycle, with lower P/Es when earnings are expected to fall and higher ones when they are expected to rise. Shiller continues to update his measure of the S&P's CAPE, but he always publishes it on a chart that also shows long-term interest rates. This is the latest update, compiled at the close of trading immediately before Thanksgiving:  Stock valuations are slightly higher than they were on the eve of the Great Crash of 1929, which is a landmark devoutly not to be wished. Since the dot-com bubble burst, valuations have only once been higher than they are now, and that was in January 2018, immediately before a nasty correction. This is what the CAPE looks like since Greenspan's speech:  On the bright side, rates are considerably lower than they have ever been at any point in the 140 years that Shiller tracked for his research. Plainly, borrowing costs so low mean that future earnings should be discounted at a lower rate, and corporate valuations should be higher. But how much higher? Running the numbers from Shiller's spreadsheet, I found that the average CAPE over history has been 17.1, barely half the current 33.1. The average 10-year yield has been 4.52% (the late 1970s and early 1980s were a huge exception to the historical norm), whereas it is now at 0.88%. Conceivably, low rates justify earnings multiples at this level, but it isn't pleasant to think about what would happen to share prices if bond yields ever made a significant and sustained rise. The market corrections of 2013 (during the Taper Tantrum) and of early and late 2018 were all driven by the fear of rising rates ahead. Current U.S. stock market valuations may not be irrationally exuberant, then, but they take a lot of good news for granted, and they also assume a complaisant bond market. Up to a Point, Lord Copper Finally, another landmark sees the price of copper reach its highest level in seven years. Most intriguingly, this has been combined with a dive in the price of gold, which has suffered a 13% correction over the last two months. Put those together and you have a startling rise in the copper/gold ratio, a classic sign of optimism about economic growth:  November's rise, at a point when much of the world economy still languishes, is if anything even more extraordinary than the advance in the stock market. It doesn't owe anything to the vagaries of the calendar. However, it is only four years since the copper/gold ratio last had a month this good. And November 2016 was also a U.S. presidential election month. In both cases, the narratives around the election (to borrow another concept from Shiller), were swiftly turned into reasons for optimism. Back in 2016, the story was that an incoming President Trump would be good for growth, cutting tax, deregulating and priming the pump with infrastructure investment. This would at last jolt the world out of years driven solely by monetary policy. This November, the story is that an incoming President Biden will be good for growth, rebuilding trade, priming the pump with infrastructure investment, and using his Treasury secretary, the mightily respected Janet Yellen, to help rebuild the U.S. labor market. True, the vaccine is also a major factor this time. But it is striking that a fundamental indicator, driven by demand for very different metals, seems to have been sparked into life equally by both the victory and the defeat of Donald Trump. Survival TipsAs the winter nights close in, there will be more time for streaming video. If you hunger for high culture, note that New York's Metropolitan Opera is livestreaming an opera every night this week. Each will be available for 23 hours. Tuesday's offering will be Verdi's Aida, in a production I once saw. My strongest memory is of the Egyptian parade that crossed the stage, including live camels. For glorious operatic treatment, it should be hard to beat. Treats ahead for the week include Carmen, and Puccini's Tosca, featuring Pavarotti. It might be worth making an event out of it, and pretending you're in an opera house, not your living room. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment